Herstatt Bank

This presentation highlightes the reason of collapse of Herstatt Bank and describes Herstatt Risk Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising.

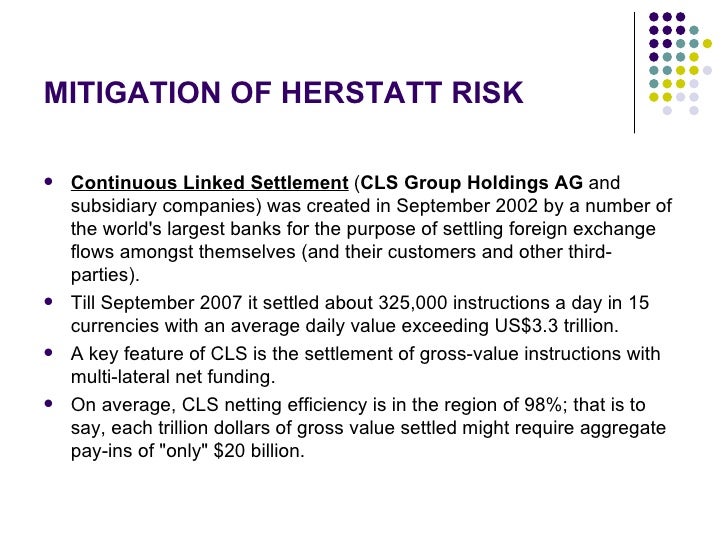

Herstatt bank. Herstatt’s main correspondent bank was Chase Manhattan Bank in New York, which was caught with about $6m of transfers due to customers on account of Herstatt 38 As soon as Chase heard that Herstatt was suspended, they froze payments out of the account (with about $156m in it), but continued to accept incoming transfers In Cologne on 17 December about 3000 creditors of Herstatt appeared. The creators of the new agency (to be known as CLS Bank) have been haunted by a 27yearold ghost In 1974 a small bank in Germany, Bankhaus Herstatt, was closed in the middle of the day by regulators The bank was insolvent and it left the dollars that it owed on its foreignexchange deals unpaid There was a panic as banks rushed to freeze their. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt.

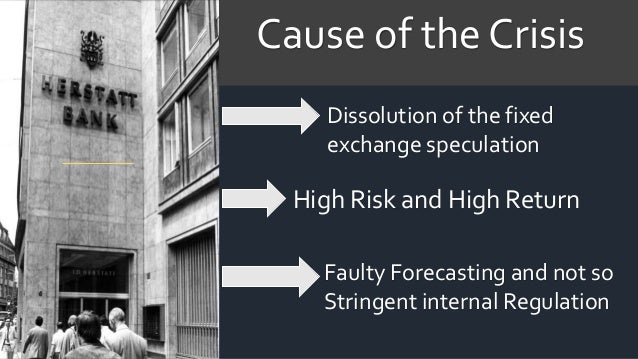

In 1974, the Herstatt Bank in Germany collapsed after making a series of wrong moves on the foreign exchange markets, ending up with DM470 million in losses (worth the equivalent of nearly USD 1. Menu The term comes from an actual situation that occurred in the 1970s when Germany’s Herstatt Bank failed to pay what it owed in a forex transaction after the other side had met its obligations Quicker. Herstatt’s main correspondent bank was Chase Manhattan Bank in New York, which was caught with about $6m of transfers due to customers on account of Herstatt 38 As soon as Chase heard that Herstatt was suspended, they froze payments out of the account (with about $156m in it), but continued to accept incoming transfers In Cologne on 17 December about 3000 creditors of Herstatt appeared.

In 1974, the Herstatt Bank in Germany collapsed after making a series of wrong moves on the foreign exchange markets, ending up with DM470 million in losses (worth the equivalent of nearly USD 1 billion today) This forced Herstatt into insolvency before it could settle accounts with counterparty banks, putting client funds at risk The. Essay on value of games and sports for class 10 case bank study Herstatt pdf english class research paper topics engl 102 fiction essay how to cite my own essay mla Proofread essay job, essay on my achievements example of essay writing with thesis statement. How Herstatt Bank’s Failure Highlighted FX Risk In International Payments This sort of FX risk is known as “Herstatt risk,” after a German bank whose failure in 1974 nearly caused meltdown of the international FX settlement system At 330 pm local time on June 26, 1974, German regulators closed Bankhaus Herstatt.

Herstatt Bank has a special place in bank failure lore, triggering a debacle that resulted in a new international regulation German regulators seized the ailing Herstatt and forced it to liquidate on June 26, 1974 The same day, other banks had released Deutsch Mark payments to Herstatt, which was supposed to exchange those payments for US dollars that would then be sent to New York. The risk that the other party in a transaction may not fulfill the terms of the contrac Dictionary !. The time zone difference meant that the banks sending the money never received their US dollars, on June 26, 1974, German regulators forced the bank into liquidation 11th October 13 The world has seen failure of banks and corporates due to creative accounting strategies such as Repo105 in case of Lehman Brothers, transferring accumulated losses.

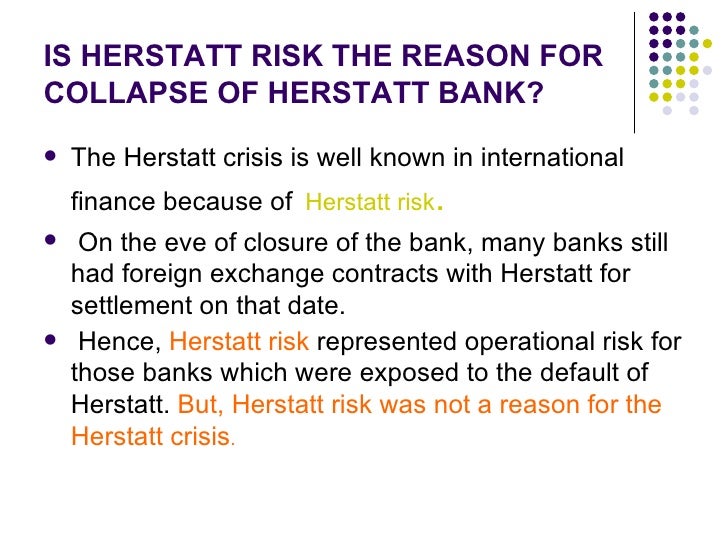

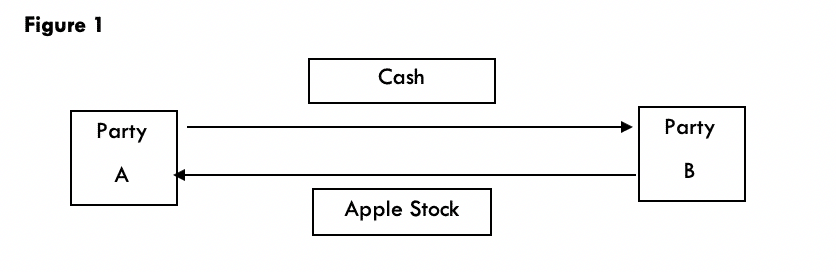

Herstatt was a small German bank that was involved in many foreign exchange transactions when it failed Settlement risk in largevalue payment systems credit/systemic risk has come to be known as Herstatt risk International settlements a new source of systemic risk?. Several of Herstatt’s counterparties had irrevocably paid Deutsche Marks to the bank that day through the German payments system, with the expectation of receiving USdollar funds through Herstatt’s correspondent bank in New York later that day. CrossCurrency Settlement Risk Crosscurrency settlement risk is a type of settlement risk in which a party involved in a foreign exchange transaction remits the currency it has sold but does not.

Herstatt was a small German bank that was involved in many foreign exchange transactions when it failed Settlement risk in largevalue payment systems credit/systemic risk has come to be known as Herstatt risk International settlements a new source of systemic risk?. Listen to the audio pronunciation of Herstatt Bank on pronouncekiwi Sign in to disable ALL ads Thank you for helping build the largest language community on the internet pronouncekiwi How To. Pronunciation of Herstatt with 1 audio pronunciation and more for Herstatt.

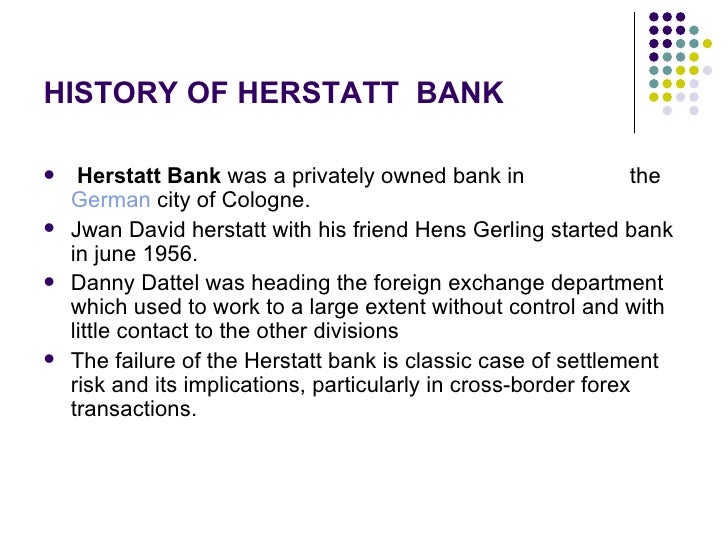

David Herstatt and Hans Gerling started Herstatt in June 1956 the end of 1973 the bank was the 35th largest bank of Germani s asset was 7 DM () Dattel was heading the foreign exchange department which use to work to a large extent without control and with little contact the other divisions. Ben Norman In June of 1974, a small German bank, Herstatt Bank, failed While the bank itself was not large, its failure became synonymous with fx settlement risk, and its lessons served as the impetus for work over the subsequent three decades to implement realtime settlement systems now used the world over. Herstatt bank Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising If you continue browsing the site, you agree to the use of cookies on this website.

Why settlement risk is known as Herstatt risk?. MILAN, Italy, June 28—The failure of West Germany's biggest private bank, Bankhaus I D Herstatt of Cologne, has dealt another blow at confidence in the monetary world and has caused a general. Menu The term comes from an actual situation that occurred in the 1970s when Germany’s Herstatt Bank failed to pay what it owed in a forex transaction after the other side had met its obligations Quicker.

Iwan David Herstatt with his friend Hans Gerling started Herstatt bank in June 1956 By the end of 1973 the bank had an asset of 7 DM and it was the 35th largest bank of Germany Danny Dattel was heading the foreign exchange department which used to work to a large extent without control and with little contact to the other divisions. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt. Overturning two lower court decisions, the Court said that the London merchant bank, Hill Samuel & Company, could not collect $45 million plus costs in Herstatt‐related losses from the Bundesbank.

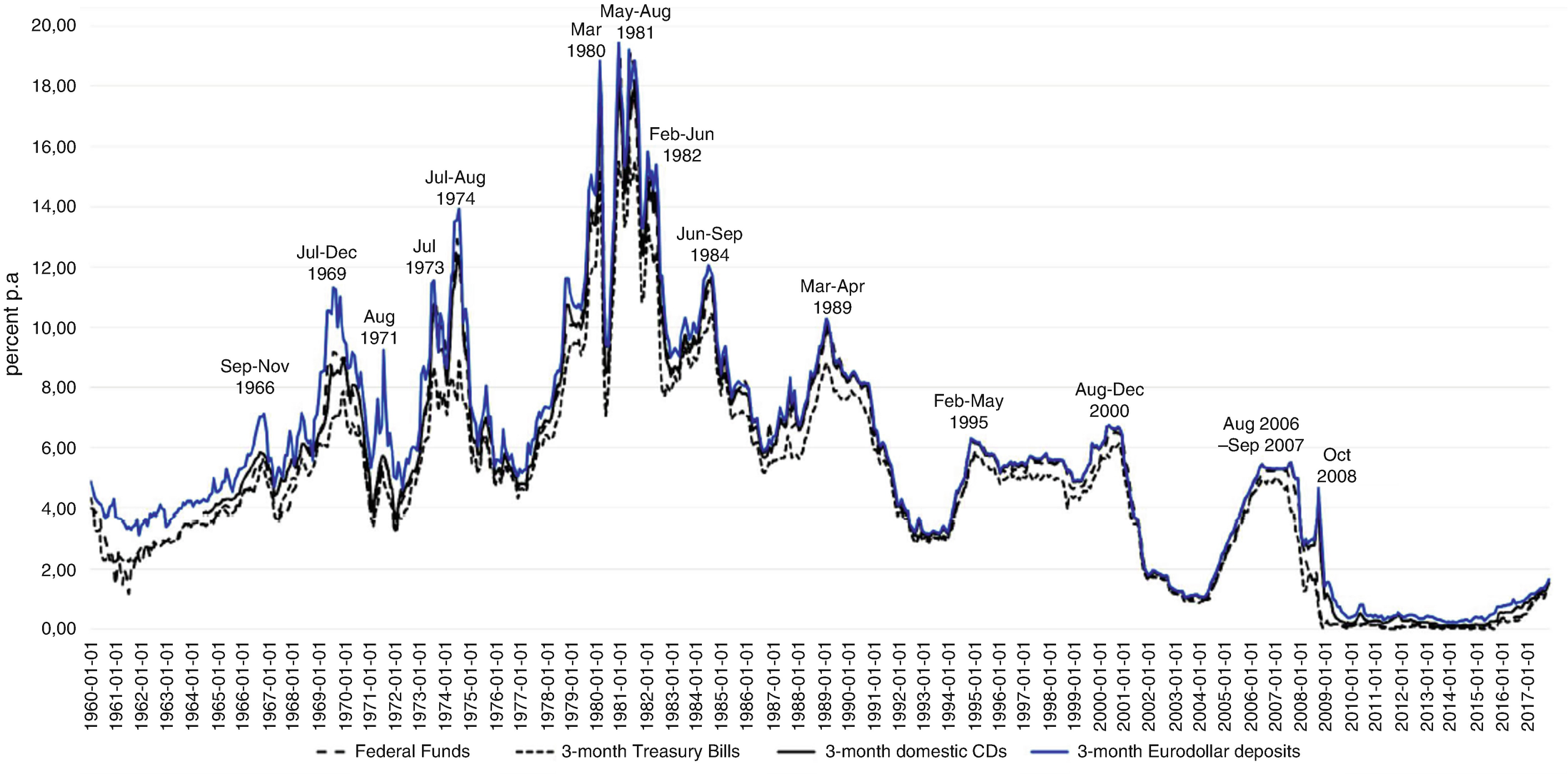

Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt. In 1974, the Herstatt Bank in Germany collapsed after making a series of wrong moves on the foreign exchange markets, ending up with DM470 million in losses (worth the equivalent of nearly USD 1 billion today) This forced Herstatt into insolvency before it could settle accounts with counterparty banks, putting client funds at risk The. The private bank, started by Ivan David Herstatt, had assets of over DM2 billion (approximately $800,000 at the then extant exchange rates) by 1974 and was the 35th largest bank in West Germany During 1973 – 1974 the US dollar experienced significant volatility Bank Herstatt had become by then a substantial player in foreign exchange markets.

This presentation highlightes the reason of collapse of Herstatt Bank and describes Herstatt Risk Slideshare uses cookies to improve functionality and performance, and to provide you with relevant advertising. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt. Bank and its likely effect on relevant risks Herstatt On 26 June 1974, at 1530 CET, the German authorities closed Bankhaus Herstatt, a mediumsized bank that was very active in foreign exchange markets2 On that day, some of Herstatt’s counterparties had irrevocably paid large amounts of Deutsche marks to the bank but not yet received.

How to say Herstatt in English?. Herstatt Bank was a privately owned bank in the German city of CologneIt went bankrupt on 26 June 1974 in a famous incident illustrating settlement risk in international finance On June 26, 1974, German regulators forced the troubled Bank Herstatt into liquidation That day, a number of banks had released payment of Deutsche Marks (DEM) to Herstatt in Frankfurt in exchange for US Dollars. One form of settlement risk is foreign exchange settlement risk or crosscurrency settlement risk, sometimes called Herstatt risk after the German bank that made a famous example of the risk On 26 June 1974, the bank's license was withdrawn by German regulators at the end of the banking day (430pm local time) because of a lack of income and.

David Herstatt and Hans Gerling started Herstatt in June 1956 the end of 1973 the bank was the 35th largest bank of Germani s asset was 7 DM () Dattel was heading the foreign exchange department which use to work to a large extent without control and with little contact the other divisions. What does herstattrisk mean?. In 1974, the Herstatt Bank in Germany collapsed after making a series of wrong moves on the foreign exchange markets, ending up with DM470 million in losses (worth the equivalent of nearly USD 1.

A Little More on What is Herstatt Risk The name is derived from the German Herstatt bank, which shuttered in 1974 for insolvency Basically, the operations of the bank were suspended in the middle of a foreign currency exchange transaction. Collapse of the Herstatt Bank in Germany and creation of the Basel Committee The collapse of this mediumsized bank sparked a deep crisis in the foreign exchange market, on which it was very active The New York interbank market came to a standstill, almost leading to the collapse of a number of other institutions. Those two German banks were Bankhaus ID Herstatt of Cologne and Bass & Herz Bankhaus This was a situation where the failure of Herstatt led to the failure of Bass & Herz and a host of other substantial losses Chase Manhattan Bank was in possession of $156 million in Herstatt deposits.

The Herstatt bank went bankrupt in 1974 which caused quite a scandal in Germany Banker The Herstatt bank went bankrupt in 1974 which caused quite a scandal in Germany Flowers In their memory Plant Memorial Trees Leave a Flower. Herstatt Bank was founded in 1955 by Ivan David Herstatt, with financial assistance from Herbert Quandt, Emil Bührle and Hans Gerling, the head of an insurance company who took a majority share By 1974 the bank had assets of over DM2 billion, making it the 35th largest bank in Germany. On 26 June 1974 a number of banks had released Deutschmarks (the German currency) to the Herstatt Bank in exchange for dollar payments deliverable in New York City Basel IWikipedia This is known as settlement risk, or “Herstatt Risk”, after the German bank, Bankhaus Herstatt, which collapsed in June 1974 leaving many of its FX.

The Collapse of Herstatt Bank When the US took the dollar off the gold standard in the 1970s, it opened the door to currency speculation by investors with little regulatory oversight and, of course, schemes to get rich Herstatt Bank, the 35thlargest bank in Germany, had been betting on the depreciation of the dollar. The creators of the new agency (to be known as CLS Bank) have been haunted by a 27yearold ghost In 1974 a small bank in Germany, Bankhaus Herstatt, was closed in the middle of the day by regulators The bank was insolvent and it left the dollars that it owed on its foreignexchange deals unpaid There was a panic as banks rushed to freeze their. Ben Norman In June of 1974, a small German bank, Herstatt Bank, failed While the bank itself was not large, its failure became synonymous with fx settlement risk, and its lessons served as the impetus for work over the subsequent three decades to implement realtime settlement systems now used the world over.

Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June 1974 in a famous incident illustrating settlement risk in international finance. Those two German banks were Bankhaus ID Herstatt of Cologne and Bass & Herz Bankhaus This was a situation where the failure of Herstatt led to the failure of Bass & Herz and a host of other substantial losses Chase Manhattan Bank was in possession of $156 million in Herstatt deposits.

What happened to Herstatt?To know about NRO accounts please watch https//youtube/VhXpqJOwbH0 To know about N. In 1974, the Herstatt Bank in Germany collapsed after making a series of wrong moves on the foreign exchange markets, ending up with DM470 million in losses (worth the equivalent of nearly USD 1. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of CologneIt went bankrupt on 26 June 1974 in a famous incident illustrating settlement risk in international finance It led to the creation of the Basel Committee on Banking Supervision a committee composed of representatives from central banks and regulatory authorities to help find ways to avoid.

One form of settlement risk is foreign exchange settlement risk or crosscurrency settlement risk, sometimes called Herstatt risk after the German bank that made a famous example of the risk On 26 June 1974, the bank's license was withdrawn by German regulators at the end of the banking day (430pm local time) because of a lack of income and. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of CologneIt went bankrupt on 26 June 1974 in a famous incident illustrating settlement risk in international finance It led to the creation of the Basel Committee on Banking Supervision a committee composed of representatives from central banks and regulatory authorities to help find ways to avoid. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt.

Thirtyseven years ago this month, the failure of a small German bank sent shock waves through the system, costing banks from New York to Singapore some $6 million in lossesThe collapse of Bankhaus Herstatt in Cologne made the front page of the June 27, 1974, issue of American Banker, which we've republished today on our 175 anniversary Flashback site. The risk that the other party in a transaction may not fulfill the terms of the contrac Dictionary !. What does herstattrisk mean?.

Herstatt Bank was a privately owned bank in the German city of CologneIt went bankrupt on 26 June 1974 in a famous incident illustrating settlement risk in international finance On June 26, 1974, German regulators forced the troubled Bank Herstatt into liquidation That day, a number of banks had released payment of Deutsche Marks (DEM) to Herstatt in Frankfurt in exchange for US Dollars. Settlement risk is sometimes called "Herstatt risk," named after the wellknown failure of the German bank Herstatt On June 26, 1974, the bank had taken in its foreigncurrency receipts in Europe. The Herstatt Bank failure is not just a page of distant history Still in 08, the leading German economic newspaper Handelsblatt published an article on the surviving of the Herstatt risk – and in 04, the story was even turned into a theatre play, Ko¨lner Devisen!4.

Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt. Herstatt Bank was founded in 1955 by Ivan David Herstatt, with financial assistance from Herbert Quandt, Emil Bührle and Hans Gerling, the head of an insurance company who took a majority share 2 By 1974 the bank had assets of over DM2 billion, making it the 35th largest bank in Germany.

2

Www Lkouniv Ac In Site Writereaddata Sitecontent rajiv Applied Basel Norms Pdf

Euromoney The Mysterious Private Banks Of Geneva

Herstatt Bank のギャラリー

Herstatt Bank

Appendix I International Bank Lending In 1981 International Capital Markets Developments And Prospects 19

Herstatt Bank Wikipedia

The Failure Of Herstatt Bank

How Rtgs Inadvertently Killed System Liquidity Financial Times

Basel Basel Ii Capital Requirement

Herstatt Settlement Risk The Collapse Of Herstatt Bank

Geldhauser Deutschlands Grosste Bankenkrisen Manager Magazin

Herstatt Bank

Herstatt Bank Wikiwand

Are We At Another Herstatt Risk Moment In The Global Financial System

Tackle Corruption Before Bailing Out Kabul Bank Foreign Policy

Ppt Mbf 705 Legal And Regulatory Aspects Of Banking Supervision Powerpoint Presentation Id

Bankhaus Herstatt By Suzy Zain On Prezi Next

Www Bis Org Publ Qtrpdf R Qt0212f Pdf

Boe Archives Reveal Little Known Lesson From The 1974 Failure Of Herstatt Bank Bank Underground

6bypqifrtsgkzm

Www Ecb Europa Eu Pub Financial Stability Fsr Focus 07 Pdf Ecb Ccda416def Fsrbox0712 19 Pdf

Herstatt Bank Case Study Pdf

Frtb An Overview What Is The Fundamental Review Of The By Costas Andreou Financeexplained Medium

Museenkoeln De Bild Der Woche Ende Eines Gluckspiel

Herstatt Risk Systemic Risk In The Forex Market International Finance

Case Study Bank Herstatt Docx Document

Heinonline Org Hol Cgi Bin Get Pdf Cgi Handle Hein Journals Abaj62 Section 234

5 Herstatt Risk And Collapse Of Herstatt Bank

Herstatt Skandal Devisenzocker Ruinierten Deutschlands Vorzeigebank Welt

Herstatt Bank

Herstatt Risk And Collapse Of Herstatt Bank Foreign Exchange Market Money

Portrat Devisenhandler Der Herstatt Bank Dany Dattel Europeana

International Money Markets Eurocurrencies Springerlink

Herstatt Risk Settlement Risk Youtube

Herstatt Bank

Herstatt Bank Risk

Boe Archives Reveal Little Known Lesson From The 1974 Failure Of Herstatt Bank Bank Underground

What Is The Fx Market Financeexplained

Herstatt Bank

Herstatt Bank

Case Study Bank Herstatt Floating Exchange Rate Foreign Exchange Market

Losses Of Banks In London Due To Herstatt Bankhaus Collapse Usd Million Download Table

Italy S Mysterious Deepening Bank Scandal The New York Times

Western From Yesterdaythe Bankruptcy Of Herstatt Bank Personal Financial

Losses Of Banks In London Due To Herstatt Bankhaus Collapse Usd Million Download Table

Losses Of Banks In London Due To Herstatt Bankhaus Collapse Usd Million Download Table

Http Ccl Yale Edu Sites Default Files Files Macey ppt for friday 9 18 13 Pdf

571e6179 Faaa 4a75 B1df Ecc7e681b5d9 Collapse Of Herstatt Bank Barings Bank Collapse Lehman Brothers Collapse Over The Counter Finance Foreign Exchange Market

W 3kktphg4 Fkm

Years Of Economy Collapse Of The Herstatt Bank In Germany And Creation Of The Basel Committee

Shocking Money Scandals Of The Last Century Gobankingrates

Finanzkrise Als Die Kolner Herstatt Bank Zusammenbrach Bilder Fotos Welt

Bank For International Settlements Wikipedia

Herstatt Risk And Collapse Of Herstatt Bank Foreign Exchange Market Money

Frtb An Overview What Is The Fundamental Review Of The By Costas Andreou Financeexplained Medium

W 3kktphg4 Fkm

Boe Archives Reveal Little Known Lesson From The 1974 Failure Of Herstatt Bank Bank Underground

Herstatt Risk Systemic Risk In The Forex Market International Finance

Herstatt Bank Failure Herstatt Risk Settlement Risk Moneymyntra Herstattcrisis Jaiib Caiib Youtube

Herstatt Bank Scars Remain The New York Times

Herstatt Bank Settlement Risk

Www Tandfonline Com Doi Pdf 10 1080 14

Foreign Exchange The Long Dark Shadow Of Herstatt Finance Economics The Economist

3 Guilty In Herstatt Failure The New York Times

Http Ccl Yale Edu Sites Default Files Files Macey ppt for friday 9 18 13 Pdf

Boe Archives Reveal Little Known Lesson From The 1974 Failure Of Herstatt Bank Bank Underground

Full Article Trust Is Good Control Is Better The 1974 Herstatt Bank Crisis And Its Implications For International Regulatory Reform

25 Biggest Bank Failures In History

Years Of Economy Collapse Of The Herstatt Bank In Germany And Creation Of The Basel Committee

History Bank Underground

Conglomerate Blog Business Law Economics Society

Risk Versus Uncertainty Frank Knight S Brute Facts Of Economic Life Items

Wenn Eine Bank Zumacht Dann Der Vermogensverwalter Portfolio Concept

Herstatt Bank Failure

Iwan Herstatt Herstatt Bank Fotos Imago Images

Dpa Files Creditors Of The Bankrupt Herstatt Bank Are Registered Stock Photo Alamy

A Bank To Rule Them All Exposing The Bank For International Settlements Part Ii Occupy Com

Bretton Woods Bank Herstatt And Fednow Payment System Origins Business Law Blog

2

Herstatt Bank

Settlement Risk And Blockchain Global Financial Markets Institute

Losses Of Banks In London Due To Herstatt Bankhaus Collapse Usd Million Download Table

Herstatt Pleite Ard Verfilmt Kolner Schock Erlebnis Express De

Herstatt Banking Regulation The Long View

Herstatt New Low Observer

Was Wirecard Mit Der Herstatt Pleite Vor 46 Jahren Gemeinsam Hat

Trust Is Good Control Is Better The 1974 Herstatt Bank Crisis And Its Implications For International Regulatory Reform Enlighten Publications

Herstatt Bank Wikivisually

Trust Is Good Control Is Better The 1974 Herstatt Bank Crisis And Its Implications For International Regulatory Reform Emmanuel Mourlon Druol

Herstatt Bank

Sal Oppenheim Wikipedia

Mbf 705 Legal And Regulatory Aspects Of Banking Supervision Osman Bin Saif Session Fourteen Ppt Download

Http Www Seacen Org File File 14 Rp92 Basel chapter 1 Pdf

Serie Finanzskandale 16 Herstatt Bank Die Bruchlandung Der Raumstation Orion Finanzskandale Faz

Risks In Large Value Payment Systems Open Access Journals

What Is Herstatt Risk Reasons For Herstatt Bank Failure What Happens In Herstatt Bank Caiib Youtube

Herstatt Bank Failure

50 Jahre Express Ich Sah Die Geschockten Herstatt Sparer Express De

Failure Of Herstatt Disturbs Banking The New York Times

Herstatt Bank Brief History Of The Bank Essay