Reverse Factoring Definition

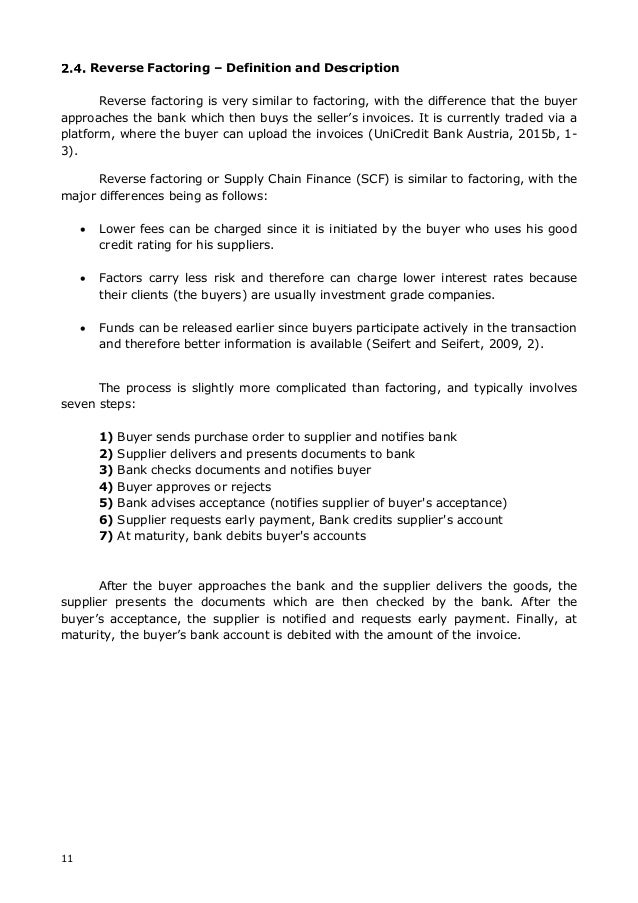

REVERSE FACTORING meaning REVERSE FACTORING definitio.

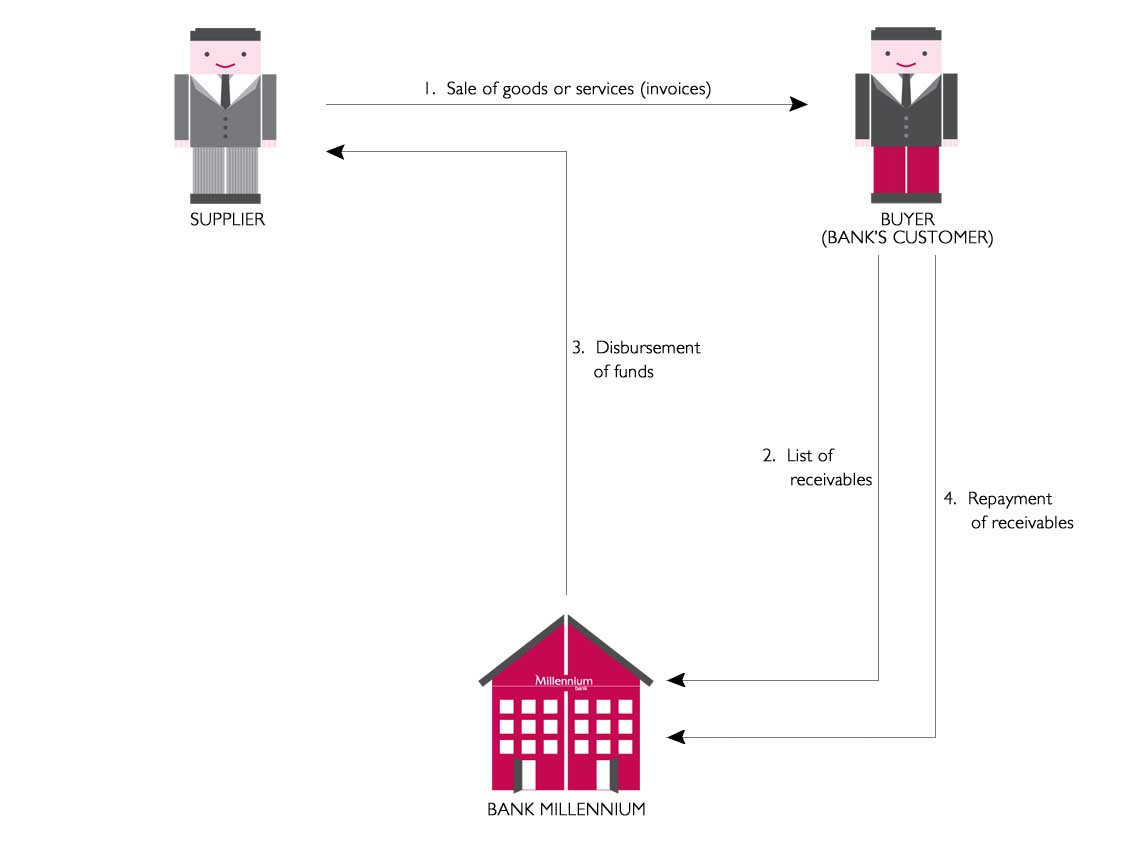

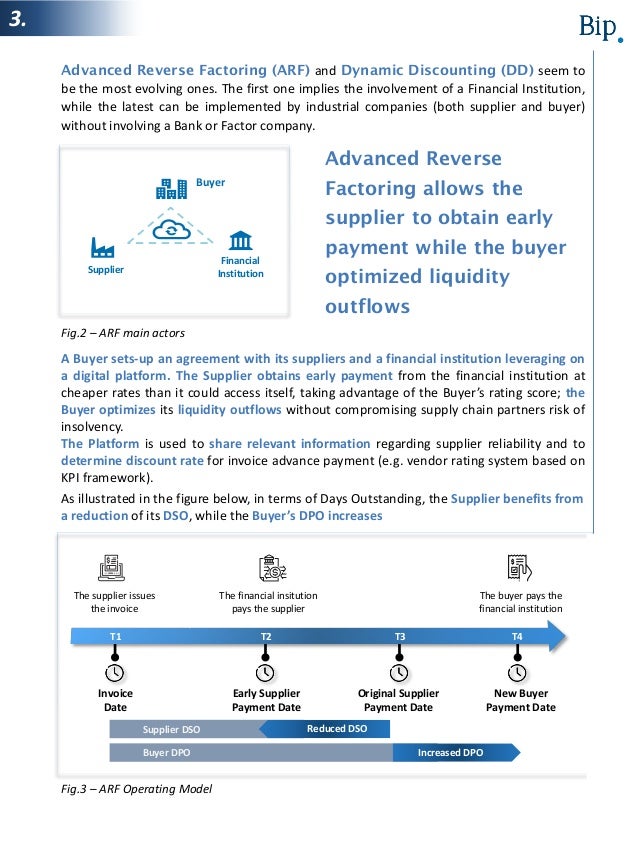

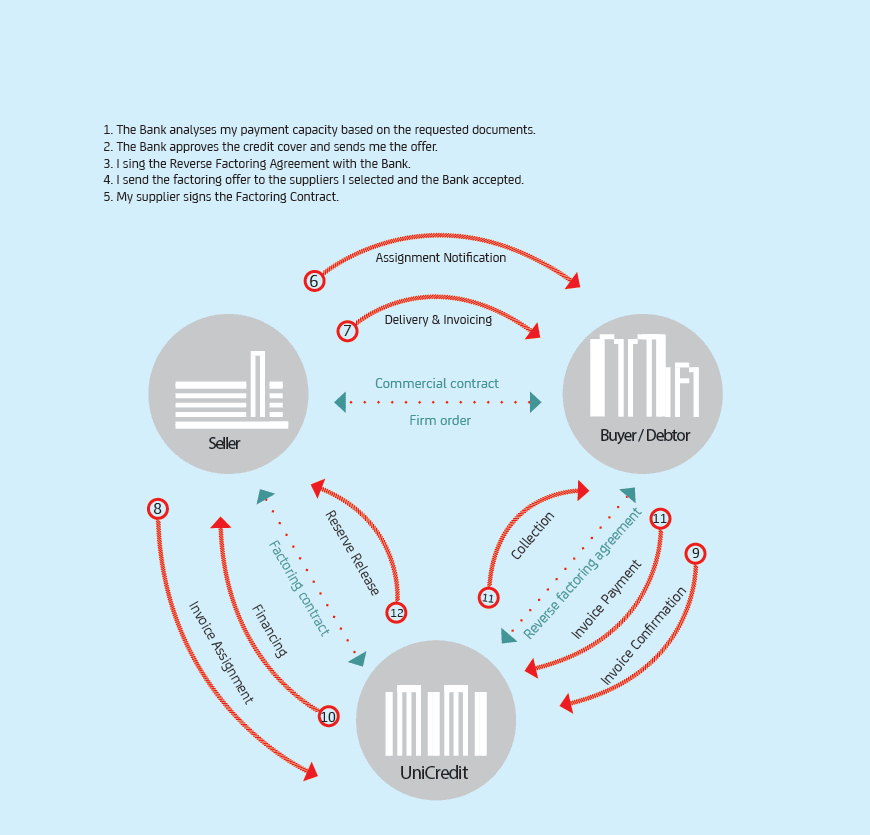

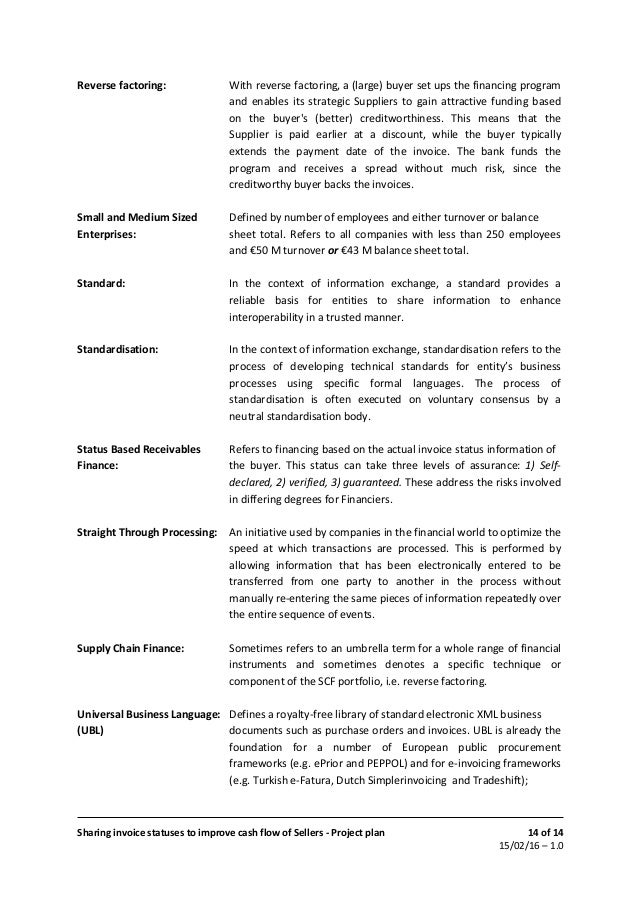

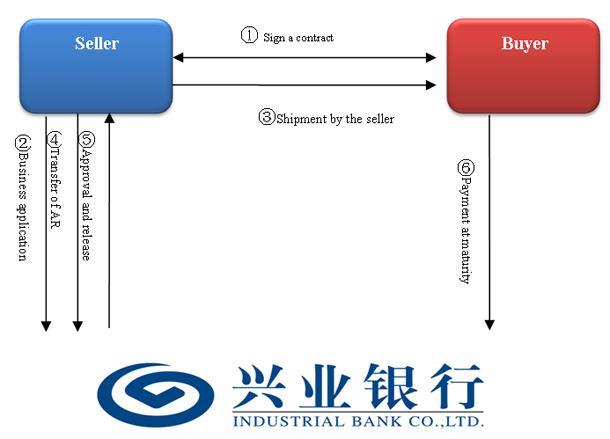

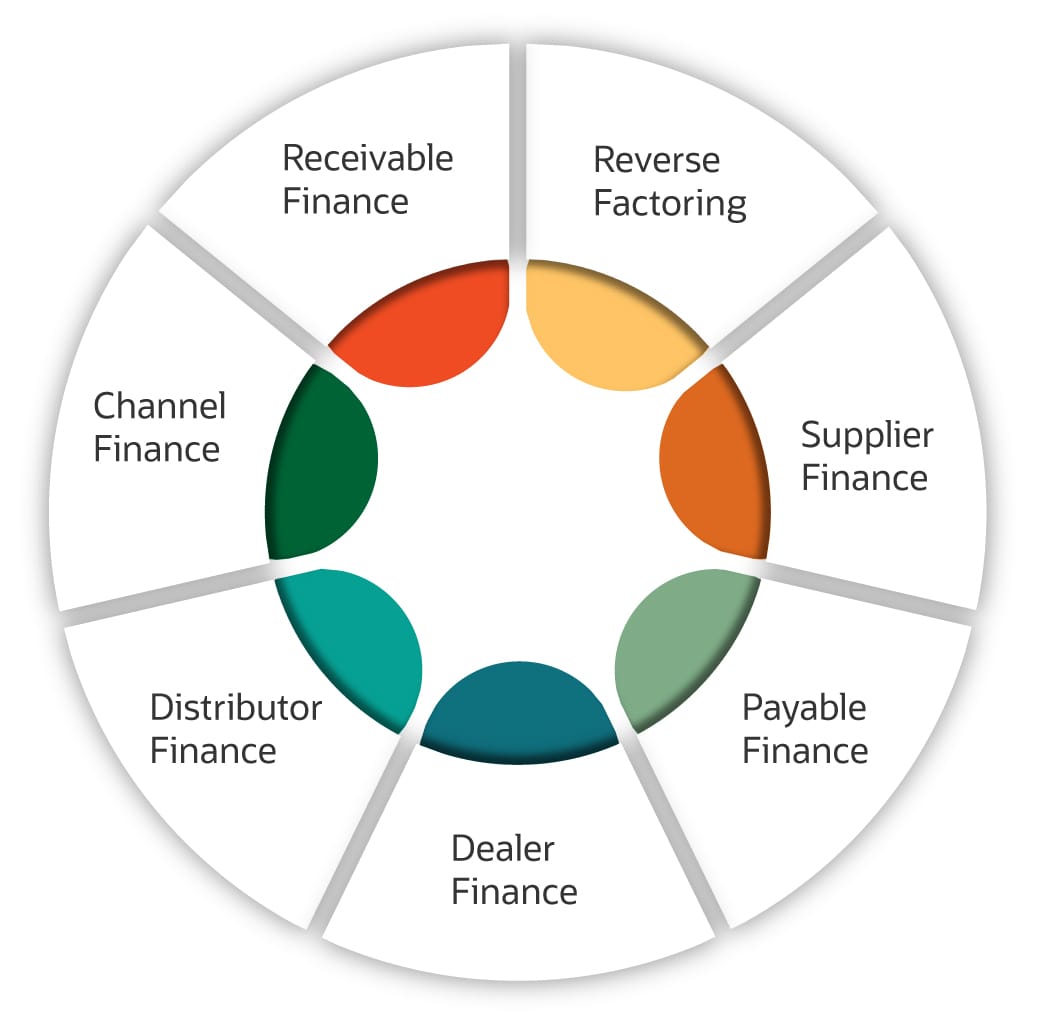

Reverse factoring definition. This is a common process used for speeding up the cash flow cycle and providing risk mitigation for the exporter on 100% of the debts value As the receivables are usually guaranteed by the importer's bank, the forfaiter frees the exporter from the risk of nonpayment by the importer. Reverse factoring versus confirming “Reverse factoring” is a term broadly used to refer to creditor factoring or supplier discounting arrangements In accounting, this practice is referred to as “structured trade payables” Technically, the following three types of arrangements are clubbed together under the reverse factoring term. Reverse factoring is when a company uses a similar sort of informal financing process to pay off its suppliers, rather than to collect unpaid invoices from customers.

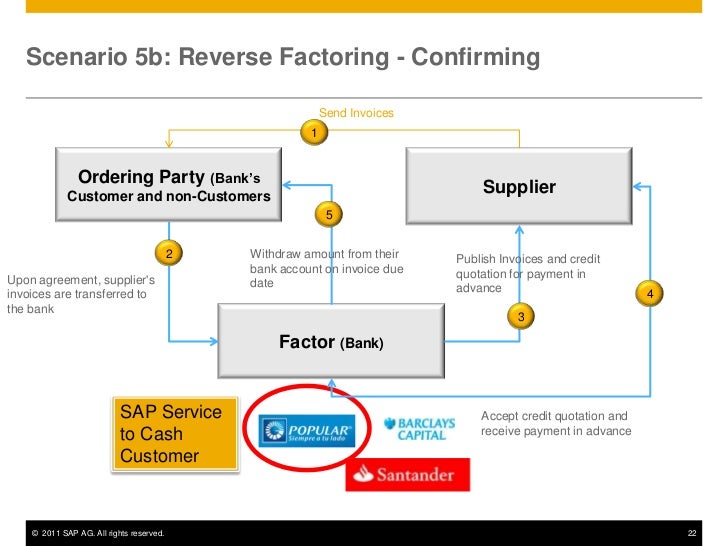

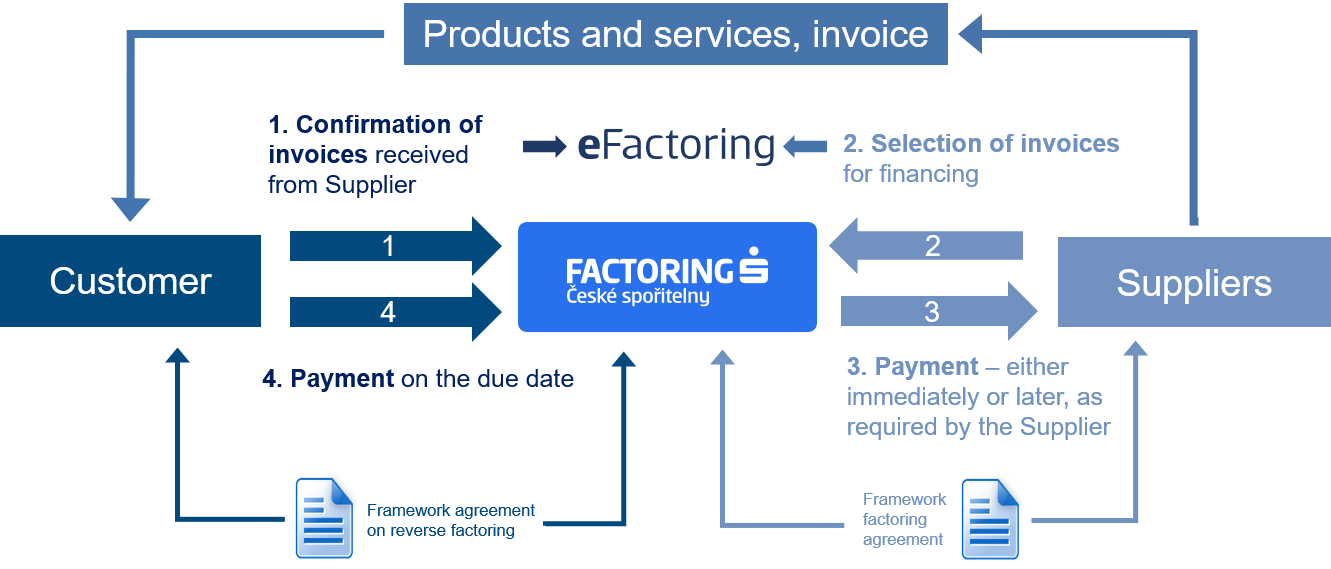

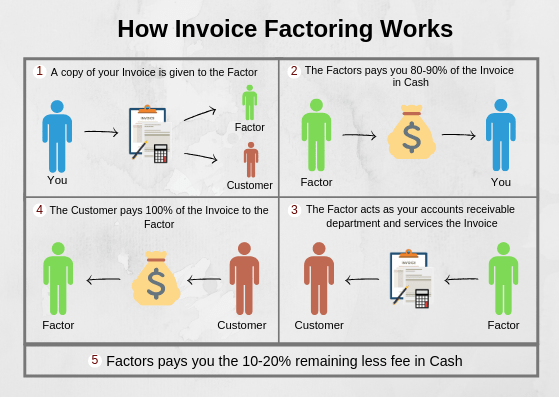

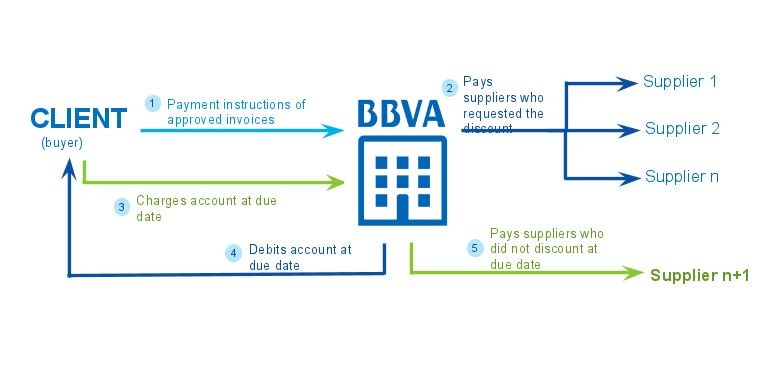

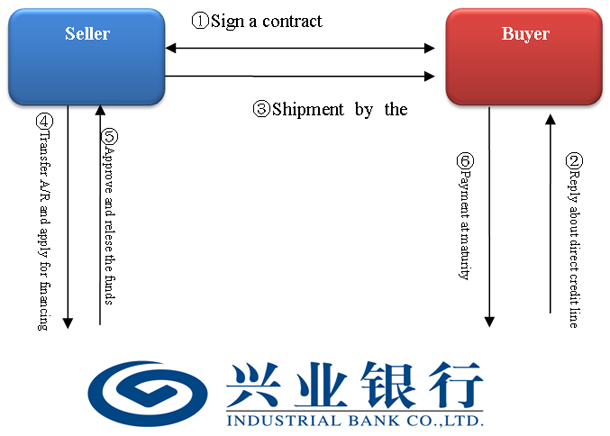

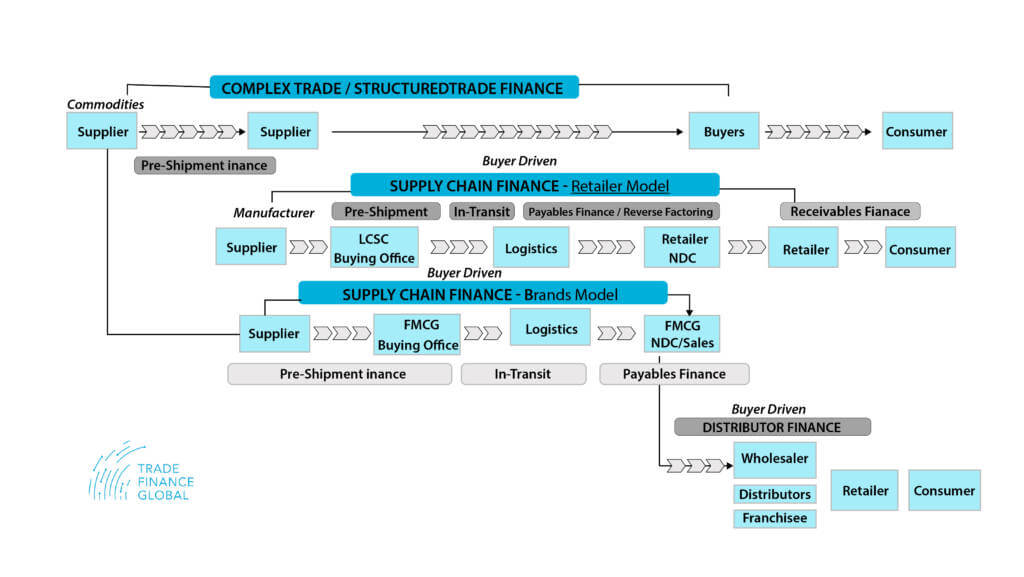

Reverse factoring involves a finance or lending institution—also referred to as a “factor”—which serves as a thirdparty intermediary between a business and their supplier The finance institution or factor agrees to pay the company’s invoices to suppliers at an accelerated rate and collect customer payments for a fee. Http//wwwtheaudiopediacom What is REVERSE FACTORING?. FCI, the global representative body of nearly 400 members for the Open Account Factoring and Receivables Finance Industry together with Demica, the leading independent provider of Working Capital and Finance Solutions, recently signed a legal agreement which allows FCI members to access to the ‘FCI reverse’ PlatformLeveraging Demica’s best in class technology and FCI’s global network.

Definition Factoring implies a financial arrangement between the factor and client, in which the firm (client) gets advances in return for receivables, from a financial institution (factor)It is a financing technique, in which there is an outright selling of trade debts by a firm to a third party, ie factor, at discounted prices. The way Reverse Dictionary works is pretty simple It simply looks through tonnes of dictionary definitions and grabs the ones that most closely match your search query For example, if you type something like "longing for a time in the past", then the engine will return "nostalgia". Definition Refactoring consists of improving the internal structure of an existing program’s source code, while preserving its external behavior The noun “refactoring” refers to one particular behaviorpreserving transformation, such as “Extract Method” or “Introduce Parameter”.

Definition and explanation Factoring accounts receivable means selling receivables (both accounts receivable and notes receivable) to a financial institution at a discount Factoring is a common practice among small companies The institution to whom receivables are sold is known as factor. Reverse factoring involves larger companies agreeing to pay a funder the full value of outstanding supplier invoices The funder immediately pays the supplier what is owed to them, rather than have them wait 3090 days for payment, which are commonly used payment terms. Factor the expression 2x 4yCheck to see that your answer is correct Since each term of the expression has a factor of 2, we can "factor out" a 2 from each term to find that 2x 4y = 2(x 2y)To check that our answer is correct, we multiply the factors we found using the distributive property.

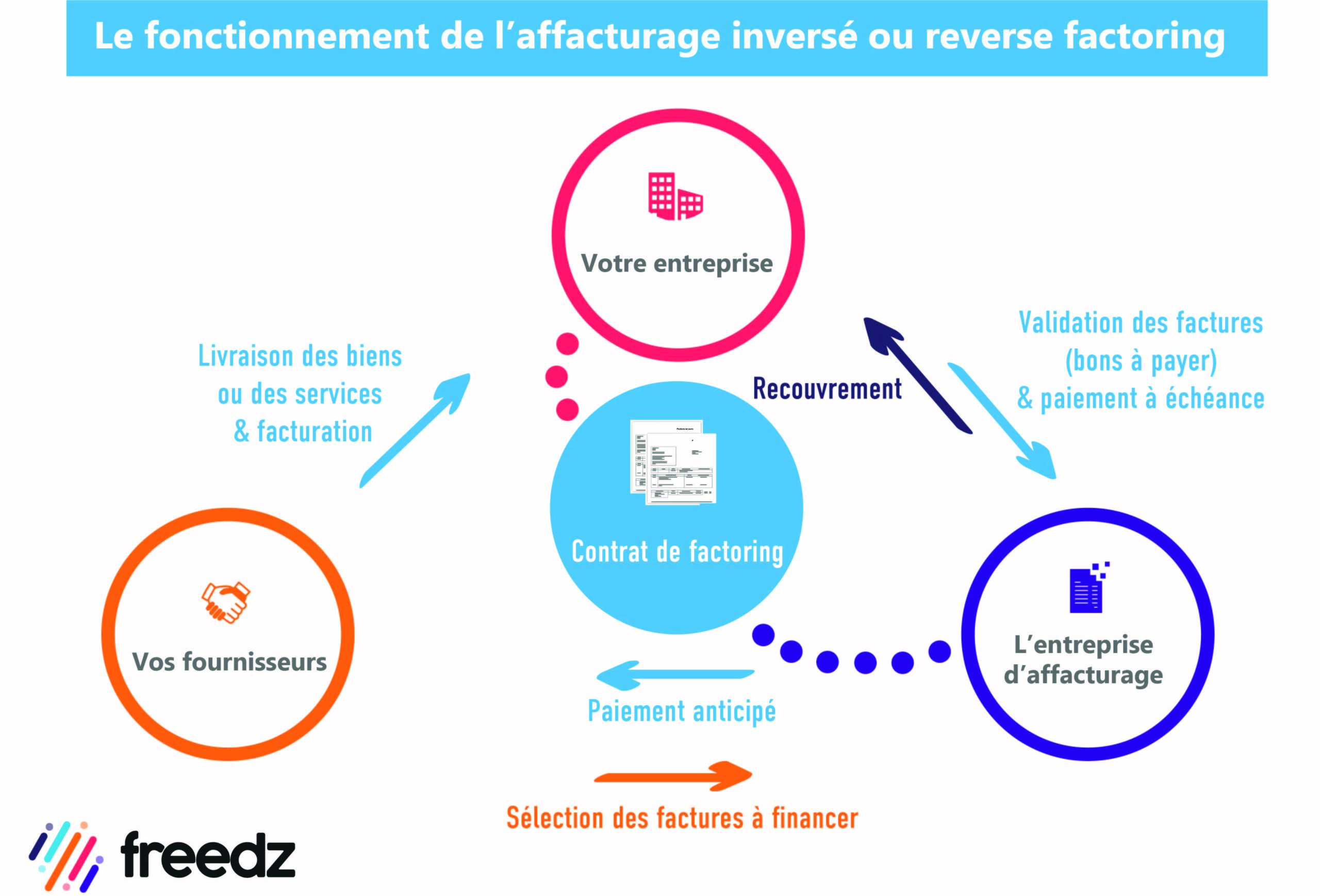

Recourse factoring is the most common and means that your company must buy back any invoices that the factoring company is unable to collect payment on You are ultimately responsible for any nonpayment Nonrecourse factoring means the factoring company assumes most of the risk of nonpayment by your customers. Définition du mot Reverse factoring Le reverse factoring ou affacturage inversé est une solution de financement qui fait intervenir trois acteurs un client, un fournisseur et une société d'affacturage Contrairement à l'affacturage classique, ce n'est pas le fournisseur qui prend l'initiative de cette solution de paiement, mais le client luimême. “Reverse factoring” is a term broadly used to refer to creditor factoring or supplier discounting arrangements In accounting, this practice is referred to as “structured trade payables” Technically, the following three types of arrangements are clubbed together under the reverse factoring term.

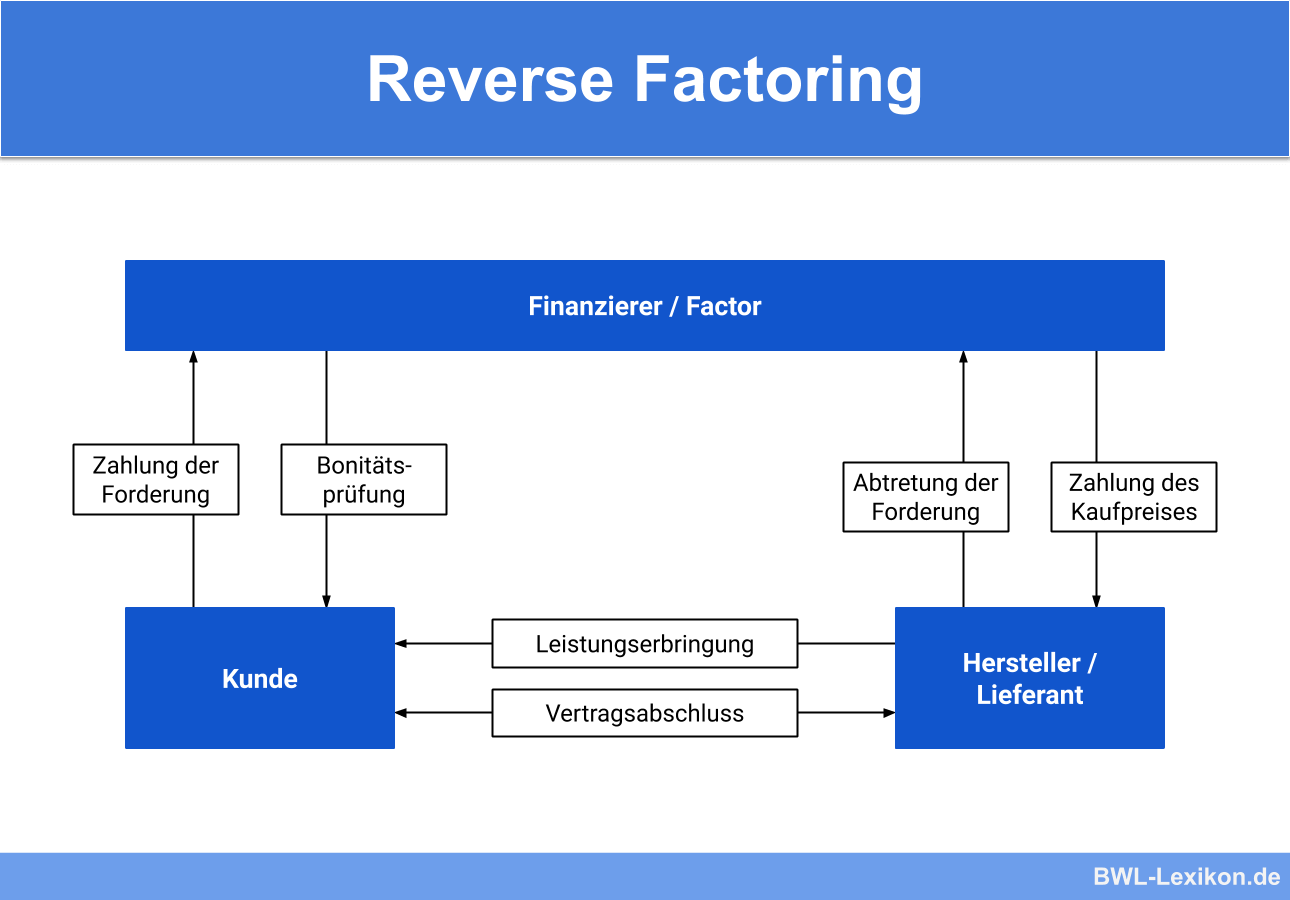

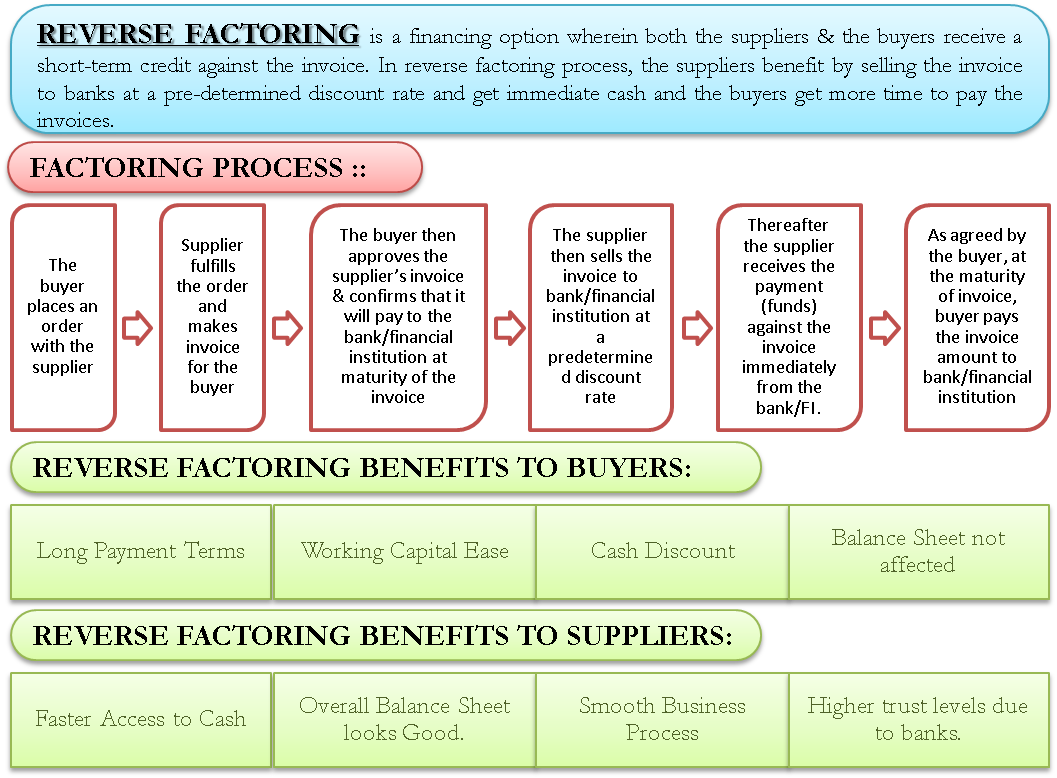

Reverse Factoring Definition Im Gegensatz zum "normalen" Factoring verkauft beim ReverseFactoring nicht ein Unternehmen in seiner Rolle als Lieferant seine Forderungen gegenüber seinen Kunden an ein Factoringinstitut, sondern ein Unternehmen in seiner Rolle als Kunde bzw Abnehmer organisiert ein Factoring für seine (Haupt)Lieferanten Beispiel Ein Stahlproduzent ist Zulieferbetrieb der. Reverse factoring, also known as supply chain financing, is a finance solution initiated usually by a larger company who introduces a smaller one to its invoice finance provider The invoices to the smaller company are then secured against the larger invoices of the bigger company. Factoring is the use of a borrowing entity's accounts receivable as the basis for a financing arrangement with a lender The borrower is willing to accept a factoring arrangement when it needs cash sooner than the payment terms under which its customers are obligated to pay.

It is a measure of a company’s liquidity and its ability to meet shortterm obligations as well as fund operations of the business The ideal position is to that is tied up in accounts receivable and also transfers the default risk associated with the receivables to the factor. In a reversefactoring deal, a third party pays off the company’s suppliers early, and the company pays that financier back at a later date. Factoring of accounts receivable is the practice of transferring the ownership of accounts receivable to a company specialized in receivable collection, in exchange for immediate cash In other words, the company that originally owns the receivables, sells them to another company called “factor” and receives immediate cash.

« Le reverse factoring , un outil de financement des achats court terme rapide – 48h et de gestion du poste client » Le reverse factoring, aussi appelé affacturage inversé, ou affacturage des achats est une technique de financement utilisée par les entreprises fournissant des biens et des services Cette méthode de financement permet au fournisseur de voir ses créances payées. A quantity by which a stated quantity is multiplied or divided, so as to indicate an increase or decrease in a measurement The rate increased by a factor of ten 5. Reverse factoring is also a type of factoring in which the debtor pays the factor funds that are owed by them, and the factor in return pays these funds to the company What is Forfeiting?.

The agencies are now arguing that companies should be forced to identify only the proportion of trade credit covered by reverse factoring or SCF, which would then be counted as a liability That would ignore any proportion covered by traditional factoring Frankly, all trade credit is a liability and should be counted towards the indebtedness. Reverse factoring is at its simplest, where a supplier receives finance in relation to their receivables (money for goods/services delivered) by a process that is started by the ordering company It allows the supplying company to receive better finance terms than it would otherwise be able to receive from a lender. Definition Factoring implies a financial arrangement between the factor and client, in which the firm (client) gets advances in return for receivables, from a financial institution (factor)It is a financing technique, in which there is an outright selling of trade debts by a firm to a third party, ie factor, at discounted prices.

We work together with large corporate buyers to pay their supplier invoices early The supplier benefit from prepaid invoices and accelerated cash flow whils. Factoring (Distributive Property in Reverse). UnFOILing is a method for factoring a trinomial into two binomials When you multiply two binomials together, you use the FOIL method, multiplying the First, then the Outer, then the Inner, and finally the Last terms of the two binomials into a trinomialBut when you need to factor a trinomial, you unFOIL by determining the factor pairs for a and c, the correct signs to place inside the two.

A Muddy Waters report shed light on a fastgrowing but opaque supplychain financing technique known as reverse factoring that has recently come under pressure from accountants, regulators, and. Reverse factoring definition An alternative financing solution where a supplier finances their receivables via a process started by the ordering party, in order to help their suppliers receive more favorable financial terms than they would have otherwise received for operational and other passthru costs incurred in providing services to the. What does REVERSE FACTORING mean?.

Supplier financing also known as reverse factoring is an arrangement in which a financing entity, usually referred to as a factor agrees to pay the supplier of goods or services of an entity, the customer, on short payment terms and at a discount, and the customer paying the factor at a later date. Définition du mot Reverse factoring Le reverse factoring ou affacturage inversé est une solution de financement qui fait intervenir trois acteurs un client, un fournisseur et une société d'affacturage Contrairement à l'affacturage classique, ce n'est pas le fournisseur qui prend l'initiative de cette solution de paiement, mais le client luimême. When the bill is paid, the factor remits the balance, minus a transaction (or factoring) fee Companies that use factoring like it because they get money quickly rather than waiting the usual 30 or.

Forfeiting is very similar to factoring in that receivables are purchased by a forfeiter at a discount, thereby providing security of payment to the business. Factoring is the use of a borrowing entity's accounts receivable as the basis for a financing arrangement with a lender The borrower is willing to accept a factoring arrangement when it needs cash sooner than the payment terms under which its customers are obligated to pay. REVERSE FACTORING meaning REVERSE FACTORING definitio.

Reverse factoring is a shortterm financing solution tailored to fit the needs of suppliers that serve large customers Through the intermediary of a “factor”, suppliers can obtain payment for their invoices before the contract deadline, using a “payment authorization” issued by the customer To implement this type of solution, the supplier and the factoring company sign a factoring contract. Reverse factoring, also known as supply chain finance or supplier finance, is a financial technology solution that mitigates the negative effects of longer payment terms to help buyers and suppliers optimize working capital Linking buyers, suppliers, and financial organizations, reverse factoring improves cash flow, reduces supply chain risk, and provides predictable return on investment for. Factoring is a financial transaction and a type of debtor finance in which a business sells its accounts receivable (ie, invoices) to a third party (called a factor) at a discount A business will sometimes factor its receivable assets to meet its present and immediate cash needs Forfaiting is a factoring arrangement used in international trade finance by exporters who wish to sell their.

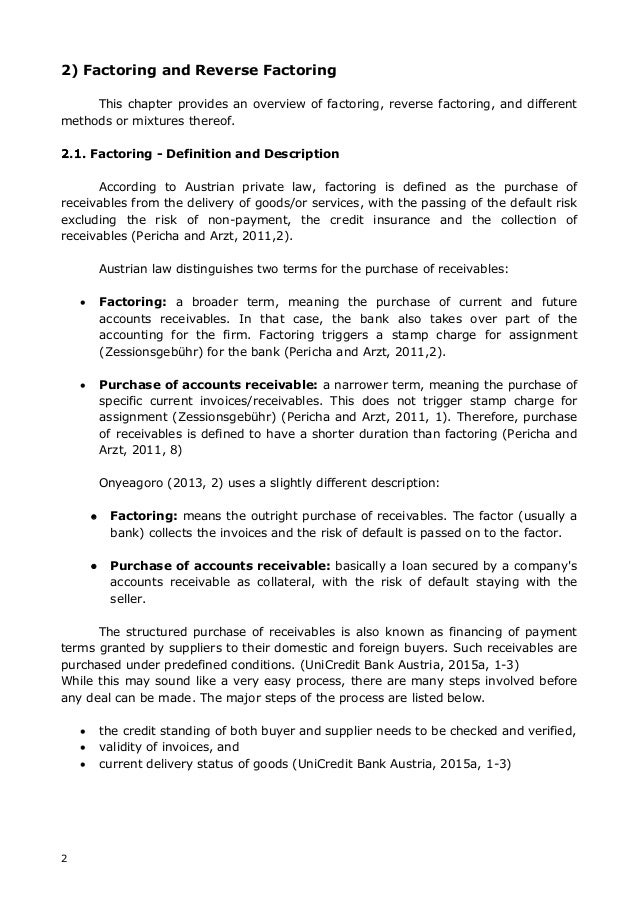

Reverse factoring definition Reverse factoring, also referred to as supply chain finance, is a buyerled financing option where the supplier’s invoice is financed by a bank or financial institution at a discounted rate Because the invoice has been sold, the supplier receives an immediate cash injection and the buyer gets a little more time. Reverse factoring is a financial instrument that allows a business finance company to interject itself between suppliers and businesses it serves The finance company commits to making discount payments to suppliers for its business customer at an accelerated rate. Unlike traditional factoring, where a supplier wants to finance its receivables, supply chain financing (or reverse factoring) is a financing method initiated by the ordering party (the customer) in order to help its suppliers to finance its receivables more easily and at a lower interest rate than what would normally be offered In 11, the reverse factoring market was still very small, accounting for less than 3% of the factoring market.

Refactoring is the process of altering an application’s source code without changing its external behavior The purpose of code refactoring is to improve some of the nonfunctional properties of the code, such as readability, complexity, maintainability and extensibility. Factoring accounts on a non recourse, • Other smaller nonrecourse factors and their clients contractually reverse the presumption They agree that if a purchased ac count does not collect within the agreed period, say, 1 days from. Reverse Factoring or Supply Chain Financing is when a bank or finance company commits to pay a company’s invoices to the suppliers at an accelerated rate in exchange for a discount It is unlike traditional invoice factoring, where a supplier wants to finance his receivables Reverse factoring is a funding solution started by the ordering party to help his supplier finance their receivables easily.

Under factoring there are two parties that is the bank and the company while under securitization there are many investors involved who invest in the securitized asset 3 While factoring is done for short term account receivables ranging from 1 month to 6 months whereas securitization is done for long term receivables of the company. Reverse factoring by definition involves a strong buyer and many smaller, or dependent, suppliers in need of a financing platform that will match the liquidity gap created during a specific credit period The factor provides financing against trade receivables based on the creditworthiness of the buyer and its commitment to provide accurate and. Supplier financing also known as reverse factoring is an arrangement in which a financing entity, usually referred to as a factor agrees to pay the supplier of goods or services of an entity, the customer, on short payment terms and at a discount, and the customer paying the factor at a later date.

Reverse factoring is a type of supplier finance solution that companies can use to offer early payments to their suppliers based on approved invoices. Reverse factoring definition An alternative financing solution where a supplier finances their receivables via a process started by the ordering party, in order to help their suppliers receive more favorable financial terms than they would have otherwise received for operational and other passthru costs incurred in providing services to the ordering party. Factoring definition, the business of purchasing and collecting accounts receivable or of advancing cash on the basis of accounts receivable See more.

What is Reverse Factoring?. BS Confirming (Reverse Factoring) is a supplier payments management service that allows the company to delegate the payments function to Banco Sabadell As the invoices to be paid are endorsed by the client, the bank informs the suppliers that it has instructions to make the payment on the due date, offering them, at the same time, financing without recourse of the said payments. Reverse factoring is a financing option wherein both the suppliers & the buyers receive a shortterm credit against the invoice In reverse factoring process, the suppliers benefit by selling the invoice to banks at a predetermined discount rate and get immediate cash and the buyers get more time to pay the invoices.

Reverse factoring is a traditional approach for modern era’s supply chain finance It is a financing option led by buyer in which both parties ie supplier & buyer receives a shortterm credit against the invoice. Reverse factoring definition An alternative financing solution buzzword where a supplier finances their receivables via a process started by the ordering party, in order to help their suppliers receive more favorable financial terms than they would have otherwise received for operational and other passthru costs incurred in providing services to the ordering party. Also known as supply chain finance or supplier finance, reverse factoring involves a funder advancing payment to its clients’ suppliers at an accelerated rate, giving both parties a number of benefits Reverse factoring differs from traditional factoring in that it is the buyer, not the supplier who initiates the funding.

Debt factoring definition a financial arrangement in which a factoring company takes responsibility for collecting money Learn more. It typically involves the sale of trade receivables (at a discount) to a factoring company in exchange for the rights to cash collected from those receivables Some factoring arrangements transfer substantially all the risk and rewards of the receivables, resulting in an accounting derecognition by the seller, whereas others do not. Reverse factoring by definition involves a strong buyer and many smaller, or dependent, suppliers in need of a financing platform that will match the liquidity gap created during a specific credit period.

If you have a nonrecourse factoring agreement, the factoring company absorbs the loss of nonpayment due to insolvency by the end customer during the factoring period There are some essential details in that definition that are often misunderstood Most nonrecourse agreements only absorb losses if the nonpayment happens due to insolvency. Reverse factoring occurs when a financial institution such as a bank decide to pay the company's invoices to the suppliers in terms of short term credit in exchange for a discount This is a lowercost form of financing which helps in accelerating accounts receivable receipts for suppliers. Supply chain finance, also known as supplier finance or reverse factoring, is a set of solutions that optimizes cash flow by allowing businesses to lengthen their payment terms to their suppliers while providing the option for their large and SME suppliers to get paid early.

Http//wwwtheaudiopediacom What is REVERSE FACTORING?. What does REVERSE FACTORING mean?. Factoring means selling the invoices raised to the customers to a thirdparty who make the payment immediately after reducing a discount Bill Discounting provides immediate operating capital by borrowing against the invoice raised to the customers Both are means to shortterm capital for running operating expenses Factoring and Bill or Invoice Discounting have been long established as.

Reverse factoring is when a finance company, such as a bank, interposes itself between a company and its suppliers and commits to pay the company's invoices to the suppliers at an accelerated rate in exchange for a discount This is a lowercost form of financing that accelerates accounts receivable receipts for suppliers. Reverse factoring, also referred to as supply chain finance, is a buyerled financing option where the supplier’s invoice is financed by a bank or financial institution at a discounted rate Because the invoice has been sold, the supplier receives an immediate cash injection and the buyer gets a little more time to pay the invoice.

Crx Marketplace Crx Markets

Www Emerald Com Insight Content Doi 10 1108 Ijpdlm 08 14 0171 Full Pdf Title Reverse Factoring In The Supply Chain Objectives Antecedents And Implementation Barriers

Www Mdpi Com 1911 8074 12 1 3 Pdf

Reverse Factoring Definition のギャラリー

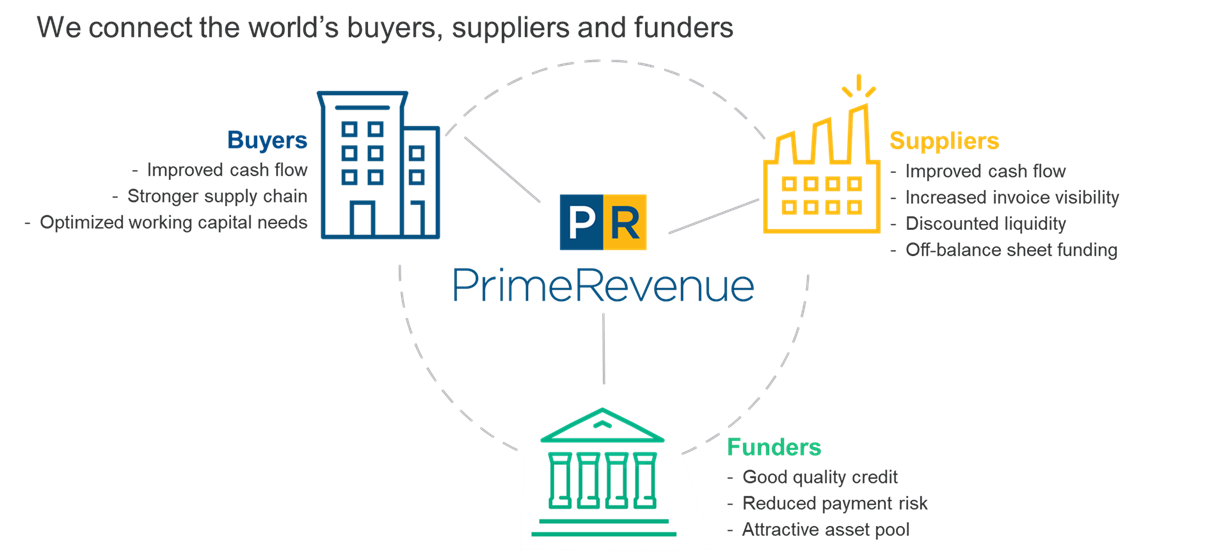

What Is Supply Chain Finance Primerevenue

ru 002 Reverse Factoring Supplier Financing Kpmg Australia

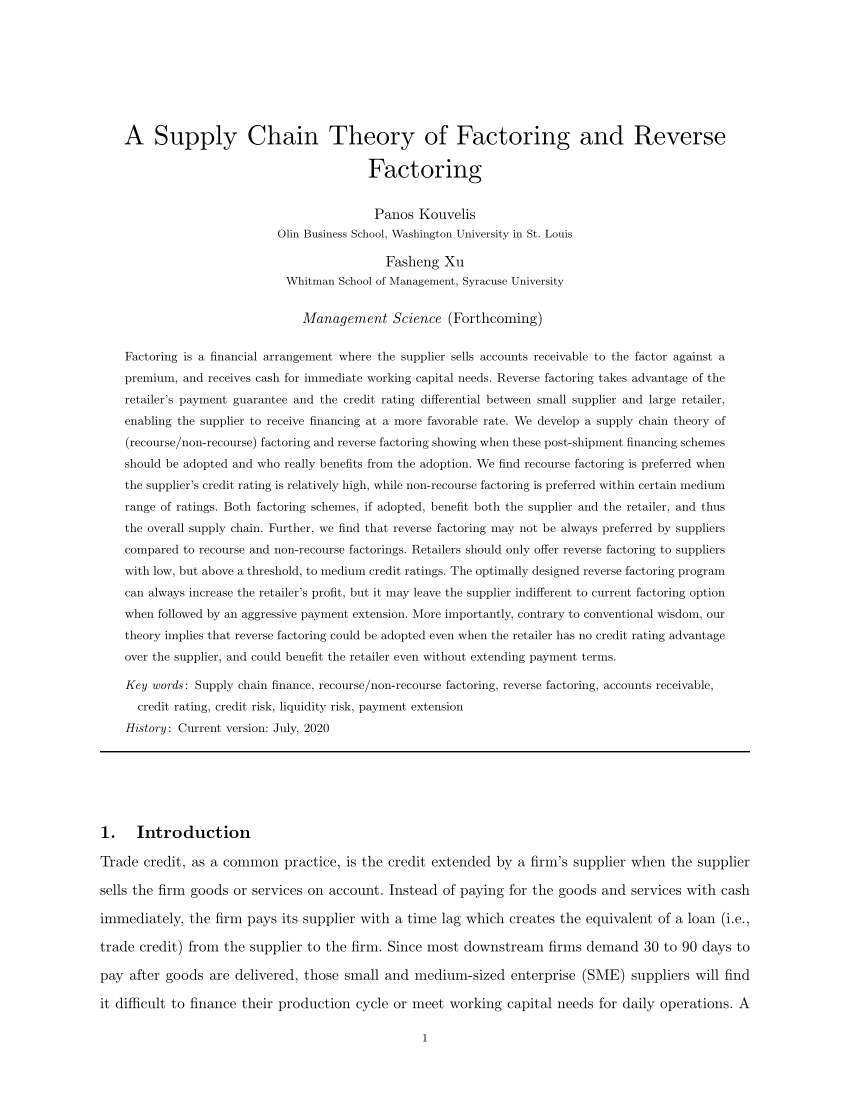

Pdf A Supply Chain Theory Of Factoring And Reverse Factoring

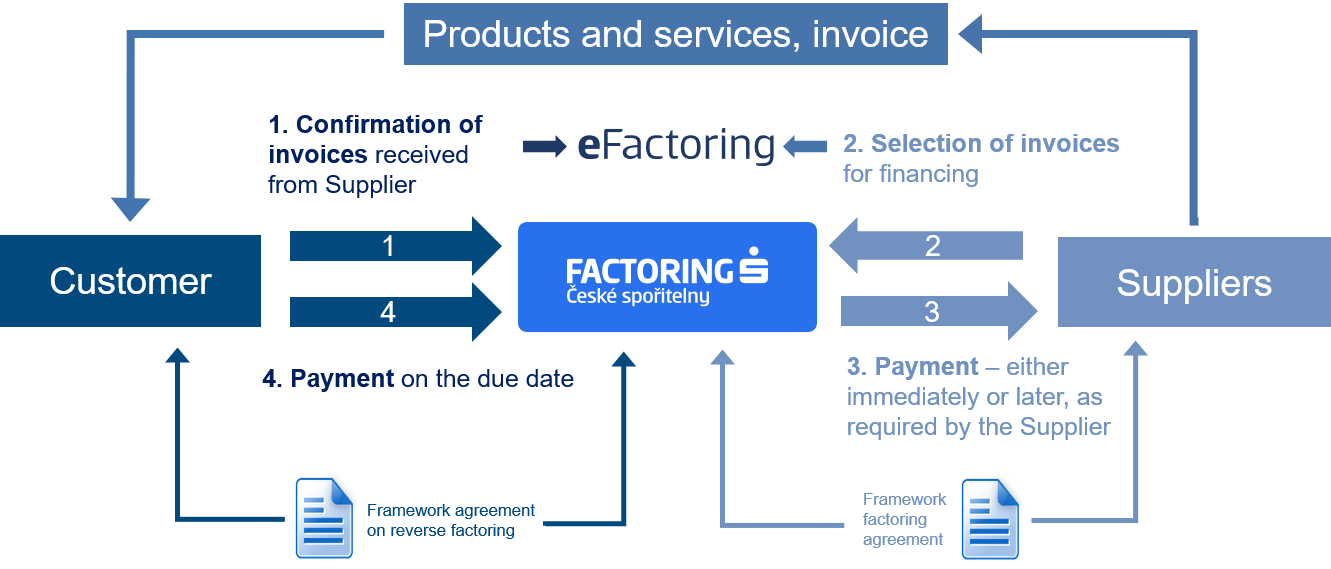

Factoring Ceske Sporitelny Reverse Factoring

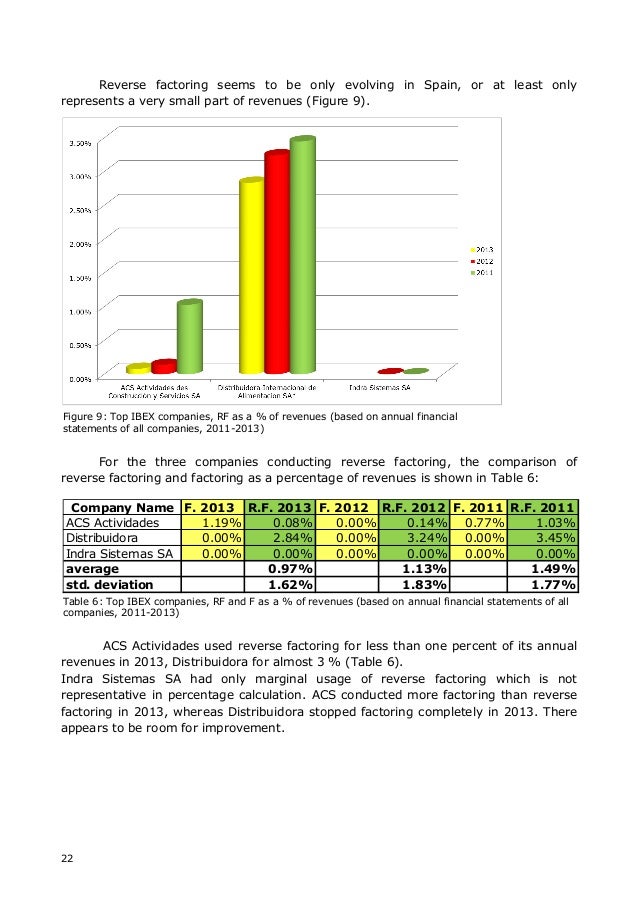

Factoring Opportunities In Spain An Analysis Of Companies In The Ibe

Factoring Opportunities In Spain An Analysis Of Companies In The Ibe

Reverse Factoring A Ticking Time Bomb In Corporate Books

Factoring Bank

Market Adoption Of Reverse Factoring Emerald Insight

Supply Chain Finance Diving Into The Mechanisms Main Benefits And E

Factoring Ceske Sporitelny What Do We Offer

Pure Tue Nl Ws Files 1 Pdf

Factoring Bank

Reverse Factoring Policy And Disclosure Of Amounts Involved Accounts Examples

How To Factor Quadratic Equations Foil In Reverse Video Lesson Transcript Study Com

Difference Between Factoring And Reverse Factoring Wip Funding

Reverse Factoring Policy And Disclosure Of Amounts Involved Accounts Examples

Pdf The Financial Supply Chain Management A New Solution For Supply Chain Resilience

The Reverse Factoring Mechanism Download Scientific Diagram

1

Factoring Opportunities In Spain An Analysis Of Companies In The Ibe

Euf Eu Com Category 4 Brochures Html Download 375

How To Factor Quadratic Equations Foil In Reverse Video Lesson Transcript Study Com

Difference Between Factoring And Supply Chain Finance Financeviewer

Factoring Opportunities In Spain An Analysis Of Companies In The Ibe

Reverse Factoring Definition Process And Benefits

Www Emerald Com Insight Content Doi 10 1108 Ijpdlm 08 14 0171 Full Pdf Title Reverse Factoring In The Supply Chain Objectives Antecedents And Implementation Barriers

The Price Of Reverse Factoring Financing Rates Vs Payment Delays Sciencedirect

Www Aph Gov Au Documentstore Ashx Id 0085a356 Cc13 454b c1 33dc2aa590a4 Subid

Http Www Scfcommunity Org Uploads 1 1 5 8 Moodys Reverse Factoring Sept 19 Published Pdf

How To Factor Quadratic Equations Foil In Reverse Video Lesson Transcript Study Com

Service To Cash Essential Banking V4

Factoring Ceske Sporitelny Reverse Factoring

Www Bsr Org Reports Bsr The Sustainable Supply Chain Finance Opportunity Pdf

Bnp Paribas Factoring Reverse Factoring Youtube

Http Www Kennisdclogistiek Nl System Downloads Attachments 000 000 312 Original Logistiek Nr 4 Supply Chain Pdf

Market Adoption Of Reverse Factoring Emerald Insight

Reverse Factoring Definition Erklarung Beispiele Ubungsfragen

What Is Reverse Factoring Freedz

Www Dinalog Nl Wp Content Uploads 13 07 Projectplan Scf2 0 Pdf

Bilanzierung Reverse Factoring Rodl Partner

Www Asbfeo Gov Au Sites Default Files Documents Asbfeo Scf Position Paper Pdf

Project Plan Status Based Receivables Finance 16

What Is Reverse Factoring Gocardless

Reverse Factoring Definition Vorteile Nordwest Factoring

Reverse Factoring

The Price Of Reverse Factoring Financing Rates Vs Payment Delays Sciencedirect

Reverse Factoring Enters Late Payments Debate Pymnts Com

Www Accaglobal Com Ab111

Background I What Is Buyer Led Supply Chain Finance Springerlink

Welcome To Cib

Difference Between Factoring And Supply Chain Finance Financeviewer

Invoice Factoring Invoice Factoring Offers Short Term By Paolo Medium

The Price Of Reverse Factoring Financing Rates Vs Payment Delays Sciencedirect

What Is Reverse Factoring What Does Reverse Factoring Mean Reverse Factoring Meaning Explanation Youtube

The Reverse Factoring Mechanism Download Scientific Diagram

Cdn Ifrs Org Media Feature Meetings April Ifric Ap03 Supply Chain Financing Pd

1

The Price Of Reverse Factoring Financing Rates Vs Payment Delays Sciencedirect

The Reverse Factoring Mechanism Download Scientific Diagram

Introduction Supply Chain Finance Scf Lecture Ppt Download

Payables Finance Global Supply Chain Finance Forum

Www Aph Gov Au Documentstore Ashx Id 0085a356 Cc13 454b c1 33dc2aa590a4 Subid

Supply Chain Finance Banking Oracle

Online Reverse Factoring Platform Sakchyam Programme

Factoring Opportunities In Spain An Analysis Of Companies In The Ibe

Www Alexandria Unisg Ch 1 Wp29 Blockchain Driven supply chain finance towards a conceptual framework from a buyer perspective Pdf

Factoring Opportunities In Spain An Analysis Of Companies In The Ibe

Www Theseus Fi Bitstream Handle Kleemann Thesis 18 Pdf Sequence 1

Factoring Bank

Welcome To Cib

Leasing And Factoring Pdf Free Download

Iccwbo Org Content Uploads Sites 3 16 11 Scf Techniques Draft Version Pdf

/shutterstock_112522391-5bfc2b9846e0fb0051bde2d3.jpg)

Supply Chain Finance Definition

Factoring Opportunities In Spain An Analysis Of Companies In The Ibe

Dspace Mit Edu Bitstream Handle 1721 1 Mit Pdf Sequence 1 Isallowed Y

Reverse Factoring

Reverse Factoring A Ticking Time Bomb In Corporate Books

What Is Reverse Factoring Primerevenue

Supply Chain Finance Wikipedia

The Price Of Reverse Factoring Financing Rates Vs Payment Delays Sciencedirect

Trade Financial Supply Chain Management 19 Trade Finance Global Treasury Management Hub

Online Reverse Factoring Platform Sakchyam Programme

Reverse Factoring Finance Investing Accounting And Finance Economics Lessons

Chainlink Research Research Supply Chain Finance Networked Platforms Financing Servicessupply Chain Platform Series Part 2c

Reverse Factoring Meaning Examples What Is Reverse Factoring

Q Tbn And9gcsc7yjclwcnkbec1u4 F2hsyeslfr Trt2tsqbuhr4ec7c0d Vz Usqp Cau

How Can Your Business Benefit From Reverse Factoring

C2c Cycle Viewpoints Which Matter

How Can Your Business Benefit From Reverse Factoring

A Beginners Guide To Reverse Factoring

Market Adoption Of Reverse Factoring Emerald Insight

Le Lexique De L Affacturage Bnp Paribas Factor

Www Commerce Gov Sites Default Files Migrated Reports Supplierpayv25 Pdf

Reverse Factoring Definition Process Benefits Limitations Efm

How Can Your Business Benefit From Reverse Factoring

Ias 7 Additional Information Disclosure Of Factoring And Reverse Factoring Effects On Operating Cash Flows Accounts Examples

Supply Chain Finance Definition Example How It Works

Supply Chain Finance Diving Into The Mechanisms Main Benefits And E

Www Emerald Com Insight Content Doi 10 1108 Ijpdlm 08 14 0171 Full Pdf Title Reverse Factoring In The Supply Chain Objectives Antecedents And Implementation Barriers