Dividende Capital Stage

O If dividends are paid from Stage then the holding company will receive the dividend without either Part I or Part IV tax If no dividends are paid from High Income Limited then tax can be deferred indefinitely or until dividends are paid out to you personally as part of your compensation planning The tax system in Canada has rules, such as the Additional Refundable Tax on Aggregate.

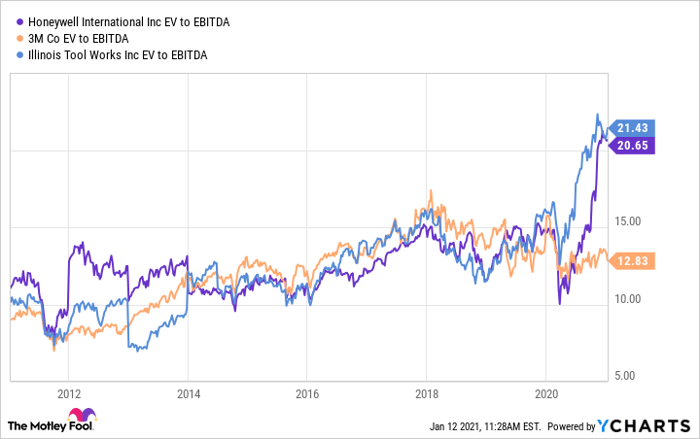

Dividende capital stage. Vodafone and Annaly Capital Management checked off all the boxes when it comes to dividend stocks that are cheap but worth buying right now Image source Getty Images 1. Companies chosen by investors for its regularity of dividend must have a more stringent dividend policy than others It becomes essential for such companies to take effective dividend decisions for maintaining stock prices Stage of Growth Dividend decision must be in line with the stage of the company infancy, growth, maturity & decline. Dividend Assets Capital is a large advisory firm with 566 clients and discretionary assets under management (AUM) of $742,110,956 (Form ADV from 0716) Their last reported 13F filing for Q3 included $4,904,000 in managed 13F securities and a top 10 holdings concentration of 3317%.

Brent Nyitray, CFA 12/10/ Opinion America's education system is in need of dramatic reform. Dividend & Capital Appreciation gives a brief about the meaning of dividend, face value, capital appreciation, dividend yield etc Whenever an investor plans. (RE/TA) are more likely to pay dividends The earned/contributed capital mix is a logical proxy for the lifecycle stage at which a firm currently finds itself because it measures the extent to which the firm is selffinancing or reliant on external capital Firms with low RE/.

Dividend Dividends For some investors, their main aim of investing in stocks is to have regular income from dividends A dividend is a reward a company gives to its shareholders for their loyalty to the company It is the distribution of a portion of the company’s profits to the qualifying stockholders. R – The estimated cost of equity capital 3 MultiPeriod Dividend Discount Model The multiperiod dividend discount model is an extension of the oneperiod dividend discount model wherein an investor expects to hold a stock for multiple. Capital earmarked for dividends does not evaporate if it is retained If provisions prove adequate, shareholders should get their cash eventually Investors today can still take a view on the odds.

The historical dividend information provided is for informational purposes only, and is not intended for trading purposes The historical dividend information is provided by Mergent, a third party service, and Intrado Digital Media, LLC does not maintain or provide information directly to this service. Some venture capital investors (VC investors) use a diversified approach, providing initial investment to companies at different stages in the financing lifecycle (for example, they may invest 25% in startups, 50% in growthstage companies and 25% in laterstage companies). (RE/TA) are more likely to pay dividends The earned/contributed capital mix is a logical proxy for the lifecycle stage at which a firm currently finds itself because it measures the extent to which the firm is selffinancing or reliant on external capital Firms with low RE/.

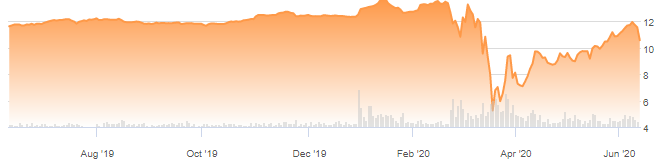

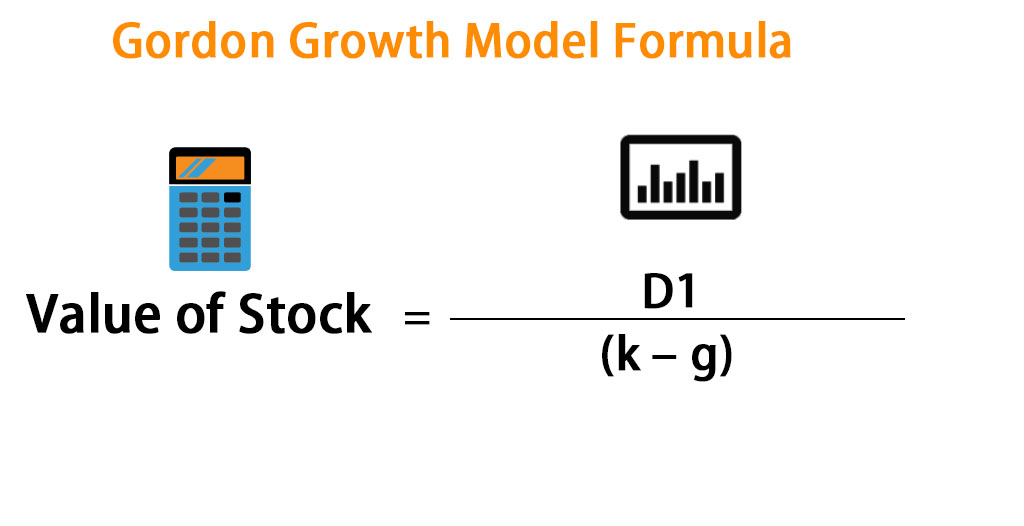

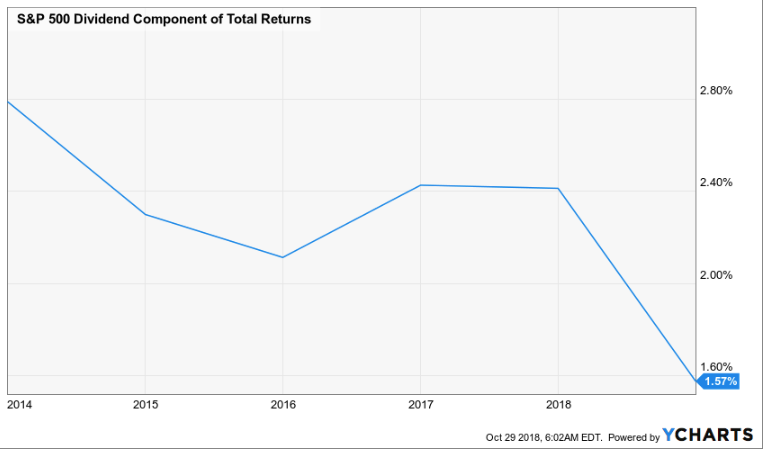

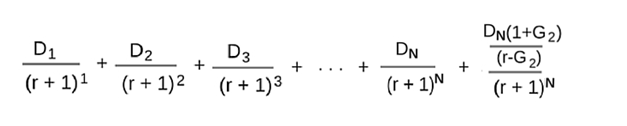

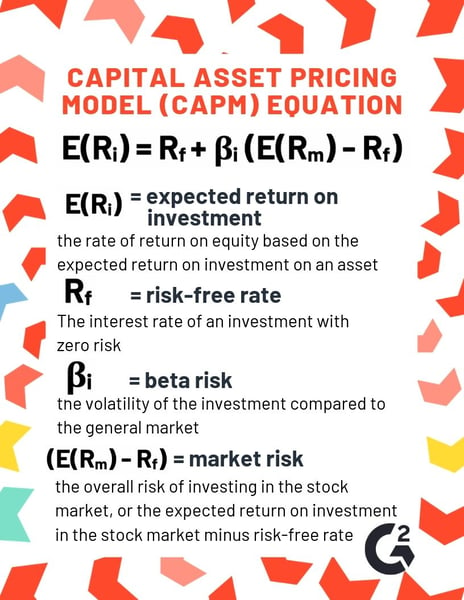

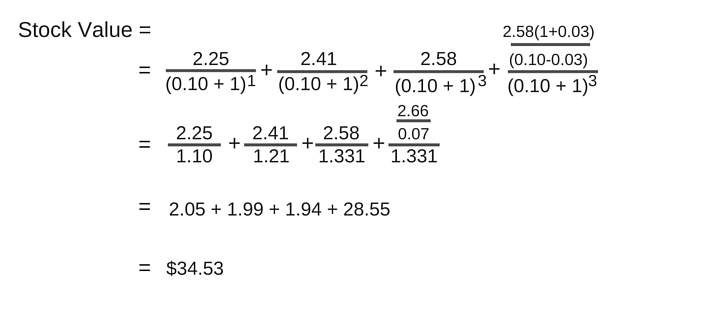

R – The estimated cost of equity capital 3 MultiPeriod Dividend Discount Model The multiperiod dividend discount model is an extension of the oneperiod dividend discount model wherein an investor expects to hold a stock for multiple. Non constant dividend growth model formula two stage dividend discount model formula dividend discount model equation dividend yield calculator with growth two stage dividend discount model calculator the formula for calculating the cost of equity capital that is based on the dividend discount model constant growth calculator stock. When the market recovered in the second half of the year, dividend increases resumed, with 37% of S&P 500 companies raising their dividend, while 49% maintained their 19 payout In Q4, dividend net changes for US common stocks increased $95 billion compared to a gain of $106 billion in Q4 19.

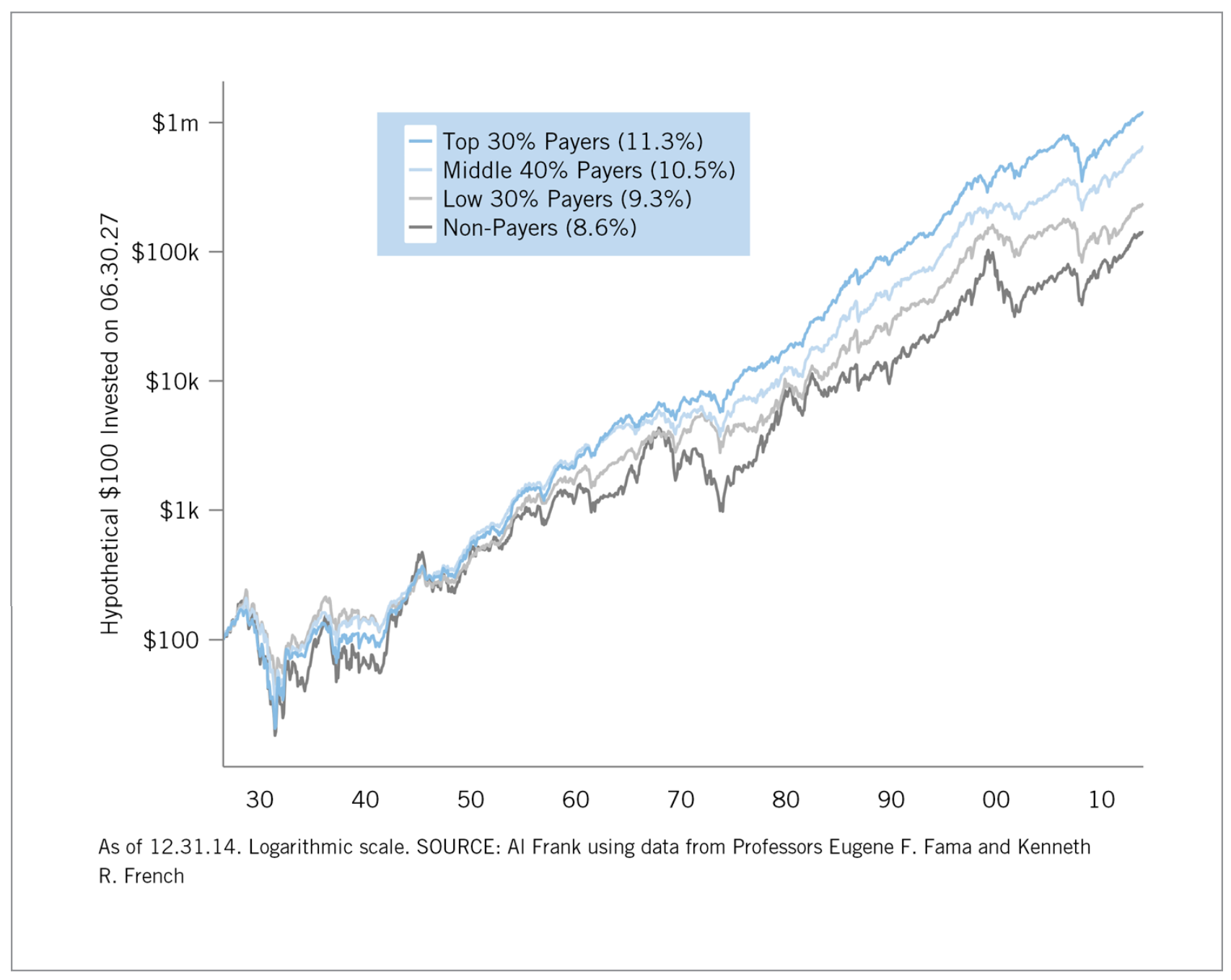

BMO Canadian Dividend ETF (TSXZDV) BMO’s ZDV fund, with net assets of $ million, will suit investors with slightly higher risk toleranceSo the fund focuses on dividend yield, taregting companies with top dividend payouts and those with potential for longterm capital appreciation. Dividend recapitalizations are a form of private equity dividend that is achieved by taking on additional loans just to pay select shareholders so that they can earn a presale profit This can. Dividend growth investors buy ownership in companies that regularly return capital to the investor in the form of dividend payments Dividends are typically paid either on a quarterly (every 3 months) or on an annual basis What this means is the dividend income investor doesn’t have sell their position to receive income.

The most comprehensive dividend stock destination on the web Contains profiles, news, research, data, and ratings for thousands of dividendpaying stocks. Dividend Champions can form the cornerstone of any incomeoriented portfolio, but most of us don’t have enough time to analyze all 139 stocks thoroughly To represent the tradeoff between. Non constant dividend growth model formula two stage dividend discount model formula dividend discount model equation dividend yield calculator with growth two stage dividend discount model calculator the formula for calculating the cost of equity capital that is based on the dividend discount model constant growth calculator stock.

Stage of Business – Private Equity vs Venture Capital vs Seed Investors As the names imply, “seed” or “angel” investors are usually the first investors in a business, followed by venture capital firms (think “new venture”), and finally, private equity firms. Brent Nyitray, CFA 12/10/ Opinion America's education system is in need of dramatic reform. It can be anything from a painting to real estate but when it comes to profit from trading and investments, an asset is usually a security like a bond, stock, ETF or fundDerivatives like CFDs are usually included as well.

Dividend Income Capital Gains = Total Return Dividend Yield Growth (Appreciation) = Cost of Equity (or the discount rate, R) These equations reflect basic corporate finance principles that pertain, not only to public companies, but to private businesses as well There is an important assumption in all of the above equations – cash flow. The big promise dividend investing provides is enough to spark the initial investments Stage #2 Making $100/Yr From Dividend Investing Making $100 each year from dividend investing isn’t difficult at all Assuming you buy dividend stocks that average out to have a 3% dividend yield, you’d only need to invest $3,. O If dividends are paid from Stage then the holding company will receive the dividend without either Part I or Part IV tax If no dividends are paid from High Income Limited then tax can be deferred indefinitely or until dividends are paid out to you personally as part of your compensation planning The tax system in Canada has rules, such as the Additional Refundable Tax on Aggregate.

The second stage has a length that equals to the remaining years after the first stage In this stage, dividend growth is assumed to be lower and stable a DDM Calculation during the first stage (the year 11 15) In this case, the first stage is assumed to cover 5 years In 11, the expected dividend estimated by analysts is $121. BMO Canadian Dividend ETF (TSXZDV) BMO’s ZDV fund, with net assets of $ million, will suit investors with slightly higher risk toleranceSo the fund focuses on dividend yield, taregting companies with top dividend payouts and those with potential for longterm capital appreciation. The second stage has a length that equals to the remaining years after the first stage In this stage, dividend growth is assumed to be lower and stable a DDM Calculation during the first stage (the year 11 15) In this case, the first stage is assumed to cover 5 years In 11, the expected dividend estimated by analysts is $121.

Opportunity set, declining growth rate, and decreasing cost of raising external capital The optimal dividend policy, derived from a tradeoff between the costs and benefits of raising capital for new investments, evolves with these lifecyclerelated changes As the firm becomes more mature the optimal payout ratio increases. Capital, physical capital, and exogenous technological change • Standards of living influenced by first and second dividends with capital and human capital channels distinguished. Capital earmarked for dividends won't evaporate If provisions are adequate, shareholders will get their cash eventually So, in theory, shareholders’ grumble that regulators are making banks.

Dividend Income Capital Gains = Total Return Dividend Yield Growth (Appreciation) = Cost of Equity (or the discount rate, R) These equations reflect basic corporate finance principles that pertain, not only to public companies, but to private businesses as well There is an important assumption in all of the above equations – cash flow. P 1 – The stock price in one period from now;. There are some potential issues with the relationship between the discount rate (cost of equity capital) and the dividend growth rate If the required.

Capital gains occur when you sell an asset at a higher price than the purchase price What is an asset?. The capital gains yield, or percentage increase in the stock price, is the same as the dividend growth rate, so Capital gains yield = 45% 5 The required return of a stock is made up of two parts The dividend yield and the capital gains yield So, the required return of this stock is R = Dividend yield Capital gains yield R = 059 039. When the market recovered in the second half of the year, dividend increases resumed, with 37% of S&P 500 companies raising their dividend, while 49% maintained their 19 payout In Q4, dividend net changes for US common stocks increased $95 billion compared to a gain of $106 billion in Q4 19.

D 1 – The dividend payment in one period from now;. Dividend Capital Trust Inc operates as a real estate investment trust The Company acquires, owns, and manages primarily highquality industrial real estate properties SECTOR. A capital dividend, also called a return of capital, is a payment a company makes to its investors that is drawn from its paidincapital or shareholders' equity Regular dividends, by contrast,.

GE Setting the Stage for Higher Dividends In winding down its financialservices business, GE is refocusing on what it does best, which should offer longterm dividend growth in the high single. D 1 – The dividend payment in one period from now;. Dividend & Capital Appreciation gives a brief about the meaning of dividend, face value, capital appreciation, dividend yield etc Whenever an investor plans.

Dividend policy is concerned with financial policies regarding paying cash dividend in the present or paying an increased dividend at a later stage Whether to issue dividends, and what amount, is determined mainly on the basis of the company's unappropriated profit (excess cash) and influenced by the company's longterm earning power. Dividend policy is concerned with financial policies regarding paying cash dividend in the present or paying an increased dividend at a later stage Whether to issue dividends, and what amount, is determined mainly on the basis of the company's unappropriated profit (excess cash) and influenced by the company's longterm earning power. Capital gains occur when you sell an asset at a higher price than the purchase price What is an asset?.

The capital gains yield, or percentage increase in the stock price, is the same as the dividend growth rate, so Capital gains yield = 45% 5 The required return of a stock is made up of two parts The dividend yield and the capital gains yield So, the required return of this stock is R = Dividend yield Capital gains yield R = 059 039. It can be anything from a painting to real estate but when it comes to profit from trading and investments, an asset is usually a security like a bond, stock, ETF or fundDerivatives like CFDs are usually included as well. Stage of Business – Private Equity vs Venture Capital vs Seed Investors As the names imply, “seed” or “angel” investors are usually the first investors in a business, followed by venture capital firms (think “new venture”), and finally, private equity firms.

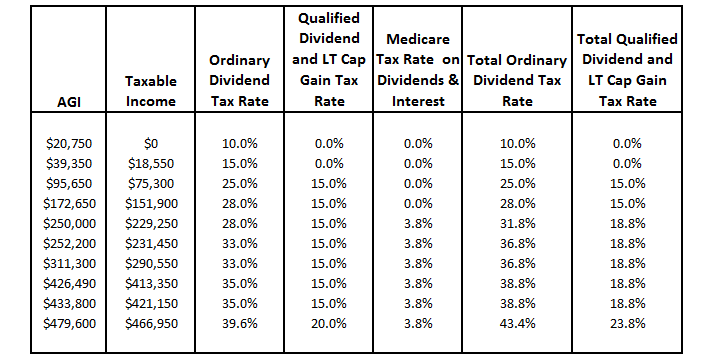

The second stage has a length that equals to the remaining years after the first stage In this stage, dividend growth is assumed to be lower and stable a DDM Calculation during the first stage (the year 11 15) In this case, the first stage is assumed to cover 5 years In 11, the expected dividend estimated by analysts is $121. The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you Lines 17 are for ordinary income and qualified income However, you may be in a lower tax bracket at this stage than when you were on the job with fulltime income With a Roth account, the money you withdraw is. Ordinary Taxable Dividends Capital Gain Distribution Unrecaptured Section 1250 Gain (1) Return of Capital Per Share Section 199A Dividends (2) 12/31/19 01/15/ $.

Dividend growth investors buy ownership in companies that regularly return capital to the investor in the form of dividend payments Dividends are typically paid either on a quarterly (every 3 months) or on an annual basis What this means is the dividend income investor doesn’t have sell their position to receive income. The proportion of stage two loans on EU loan books has risen to % from 69% last year, while those of the highest quality — stage one loans — dropped from 2% to 4%. P 1 – The stock price in one period from now;.

The twostage dividend discount model takes into account two stages of growth This method of equity valuation is not a model based on two cash flows but is a twostage model where the first stage may have a high growth rate and the second stage is usually assumed to have a stable growth rate TwoStage Dividend Discount Model The twostage model can be used to value companies where the. D 1 – The dividend payment in one period from now;. The Better Dividend Stock for 21 Invesco Mortgage Capital or Citigroup?.

The qualified dividends and capital gain tax worksheet can be separated into different lines in order to make it easier for you Lines 17 are for ordinary income and qualified income However, you may be in a lower tax bracket at this stage than when you were on the job with fulltime income With a Roth account, the money you withdraw is. Dividend Dividends For some investors, their main aim of investing in stocks is to have regular income from dividends A dividend is a reward a company gives to its shareholders for their loyalty to the company It is the distribution of a portion of the company’s profits to the qualifying stockholders. AO as well as Ld CIT(A) have taken a wrong view by holding that the assessee cannot grow taxfree income u/ss 10(34) and 10(35) of the Acts unless additional tax has been paid as per the provisions of Sections 1150 and 115R of the Act and as such the exemption claimed u/ss 10(34) and 10(35) is to be allowed only if the dividend income.

The capital gains yield, or percentage increase in the stock price, is the same as the dividend growth rate, so Capital gains yield = 45% 5 The required return of a stock is made up of two parts The dividend yield and the capital gains yield So, the required return of this stock is R = Dividend yield Capital gains yield R = 059 039. Majesco, a listed information technology company, announced a dividend payout of a whopping Rs 974 on December 15 At a share price of around Rs 970, the dividend payout of nearly 100 percent. The proportion of stage two loans on EU loan books has risen to % from 69% last year, while those of the highest quality — stage one loans — dropped from 2% to 4%.

The threestage dividend discount model;. The twostage dividend discount model takes into account two stages of growth This method of equity valuation is not a model based on two cash flows but is a twostage model where the first stage may have a high growth rate and the second stage is usually assumed to have a stable growth rate TwoStage Dividend Discount Model The twostage model can be used to value companies where the. The Better Dividend Stock for 21 Invesco Mortgage Capital or Citigroup?.

Majesco, a listed information technology company, announced a dividend payout of a whopping Rs 974 on December 15 At a share price of around Rs 970, the dividend payout of nearly 100 percent. P 1 – The stock price in one period from now;. Probability that a firm pays dividends is significantly related to the mix of (internally) earned capital and (externally) contributed capital in its capital structure Firms with a greater proportion of earned capital are more likely to be dividend payers The evidence on the change in systematic risk around dividend changes is ambiguous.

Dividend investing is a strategy that gives investors two sources of potential profit one, the predictable income from regular dividend payments, and two, capital appreciation over time. R – The estimated cost of equity capital 3 MultiPeriod Dividend Discount Model The multiperiod dividend discount model is an extension of the oneperiod dividend discount model wherein an investor expects to hold a stock for multiple. For an investor, dividend stripping provides dividend income, and a capital loss when the shares fall in value (in normal circumstances) on going exdividend This may be profitable if income is greater than the loss, or if the tax treatment of the two gives an advantage Different tax circumstances of different investors is a factor.

When the market recovered in the second half of the year, dividend increases resumed, with 37% of S&P 500 companies raising their dividend, while 49% maintained their 19 payout In Q4, dividend net changes for US common stocks increased $95 billion compared to a gain of $106 billion in Q4 19.

Haskell Patrimoine Conseil Photos Facebook

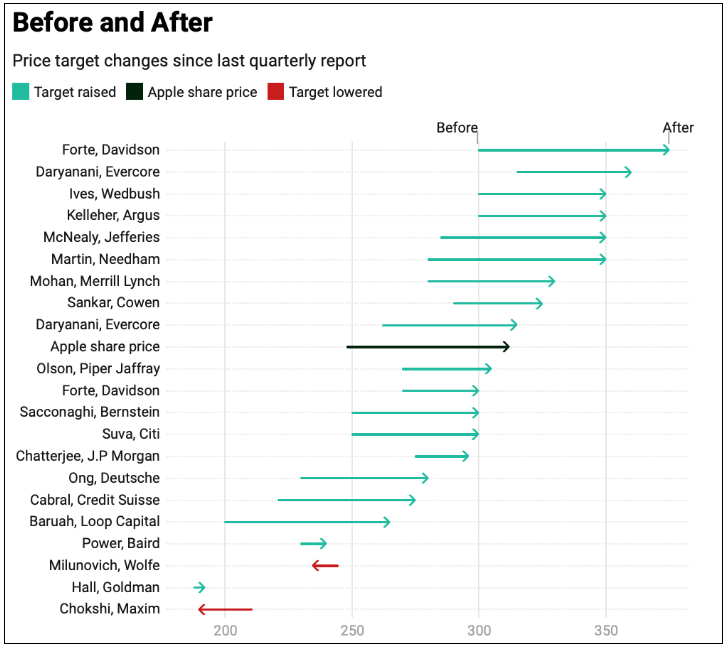

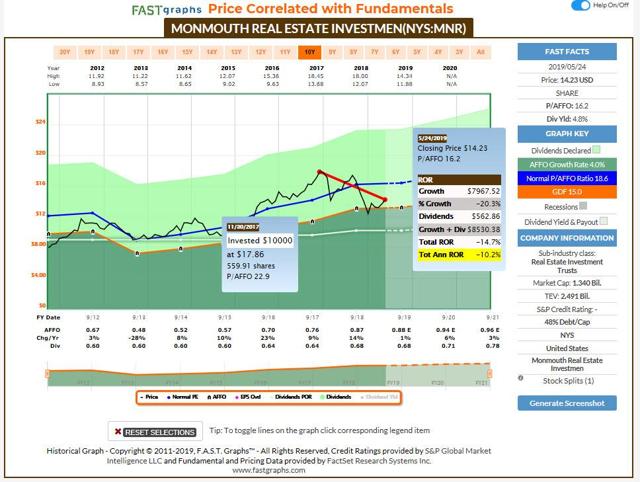

5 Undervalued Dividend Stocks To Buy

6 Main Stage To Become Successful Forex Traders Business Investment Forex Investing

Dividende Capital Stage のギャラリー

3 Big Dividend Stocks Yielding Over 7 Raymond James Says Buy

91 Top Dividend Stocks From Around The World Kiplinger

3 Big Dividend Stocks Yielding Over 7 Compass Point Says Buy

Pdf Dividend Policy In South Africa

J1tclqzp1oue3m

21 Blue Chip Stocks List 260 Safe High Quality Dividend Stocks Sure Dividend

The Capital Times From Madison Wisconsin On April 10 1930 Page

September Dividend Portfolio Update Seeking Alpha

Why You Need To Take A Close Look At Dividend Provisions

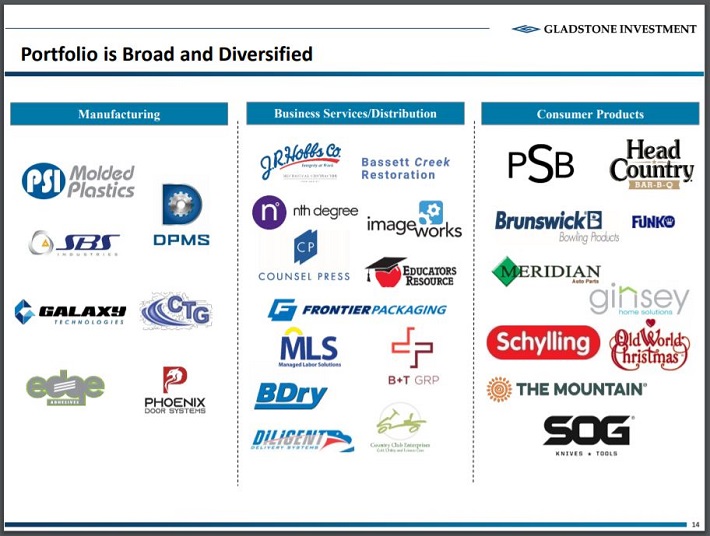

Gladstone The Risks May Outweigh The Rewards 2 Alternatives To Consider Nasdaq Gain Seeking Alpha

Better To Invest In Growth Stocks Over Dividend Stocks

Dividend Discount Model Definition Formulas And Variations

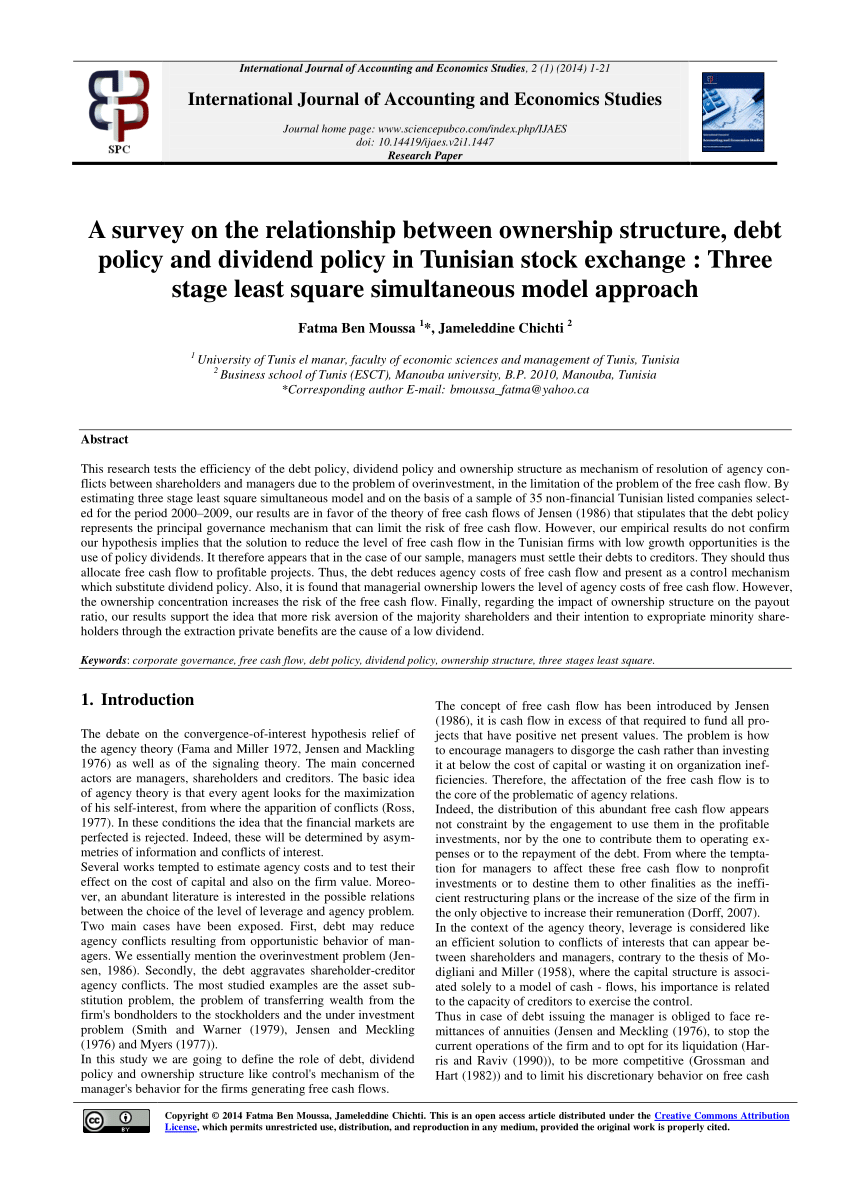

Pdf A Survey On The Relationship Between Ownership Structure Debt Policy And Dividend Policy In Tunisian Stock Exchange Three Stage Least Square Simultaneous Model Approach

5 Reasons To Be A Dividend Growth Investor Intelligent Income By Simply Safe Dividends

When Cutting Dividends Is Not Bad News The Case Of Optional Stock Dividends Sciencedirect

Pdf What Managers Think Of Capital Structure And How They Act Evidence From Central And Eastern Europe

The Complete List Of Monthly Dividend Stocks Paying 4 Plus Dividendinvestor Com

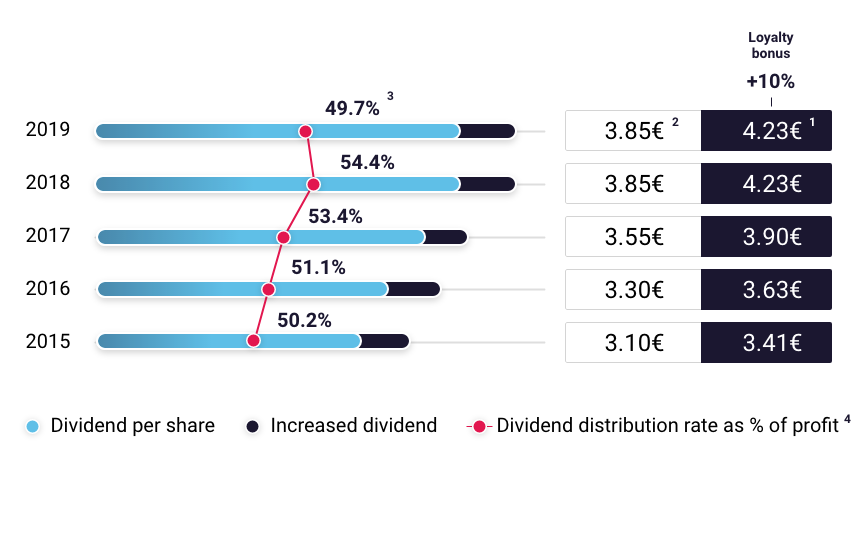

Electricite De France Fairly Valued But Still Not Recommended Otcmkts Ecify Seeking Alpha

Apple Dividend Yield Below 1 Nasdaq pl Seeking Alpha

18 Best Of Highlights From The Nerd S Eye View Blog

Lecture 10 Equity Valuation 2 Flashcards Quizlet

Dividend Aristocrats The Motley Fool

Dividend Stocks They Aren T Free Money Here S Why Report Door

Portfolio Dividend Tracker Build Yours In 6 Steps

Back To Basics What Is The Demographic Dividend Finance Development September 06

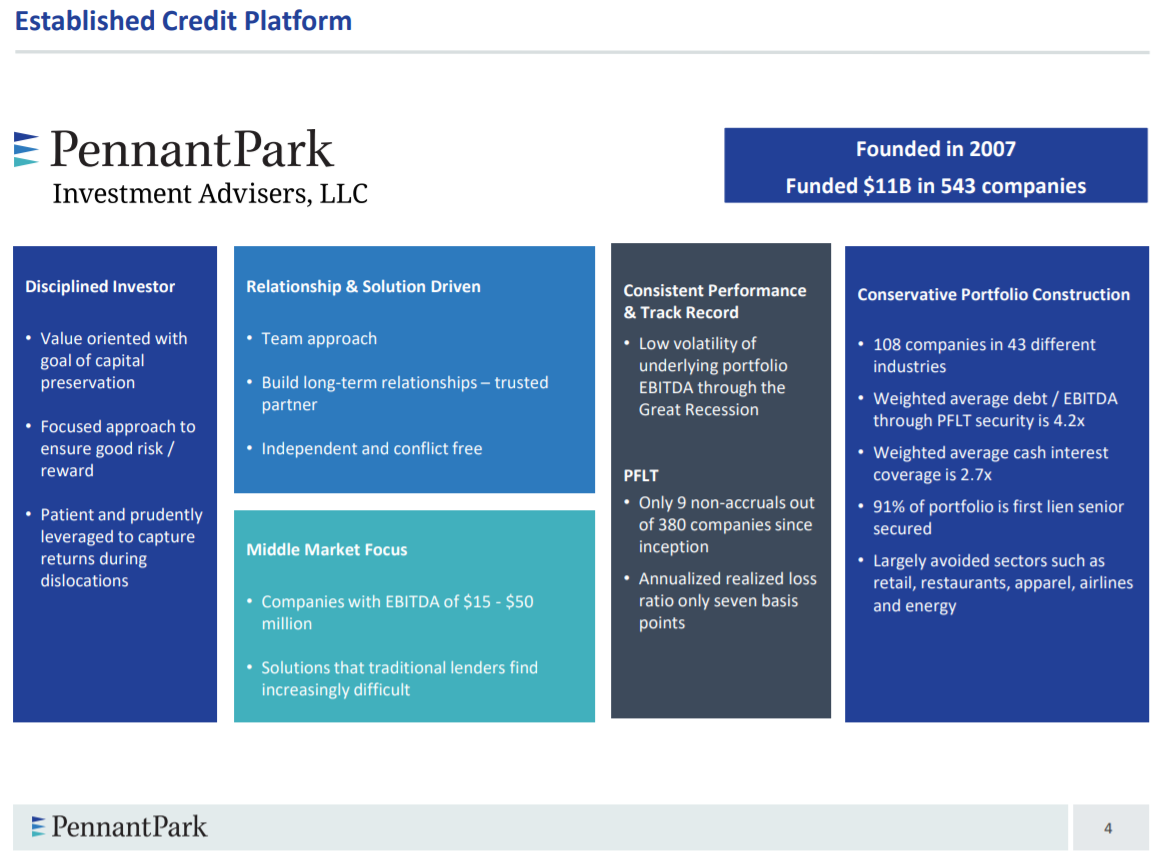

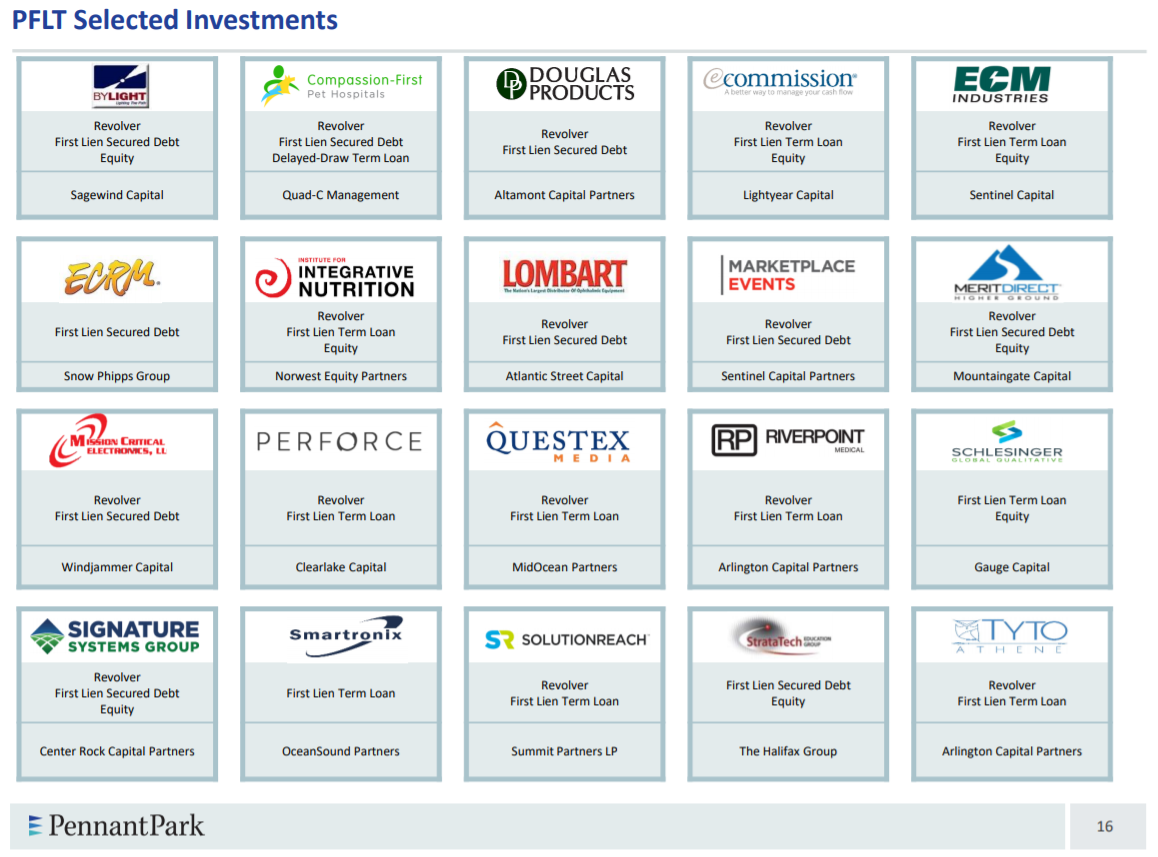

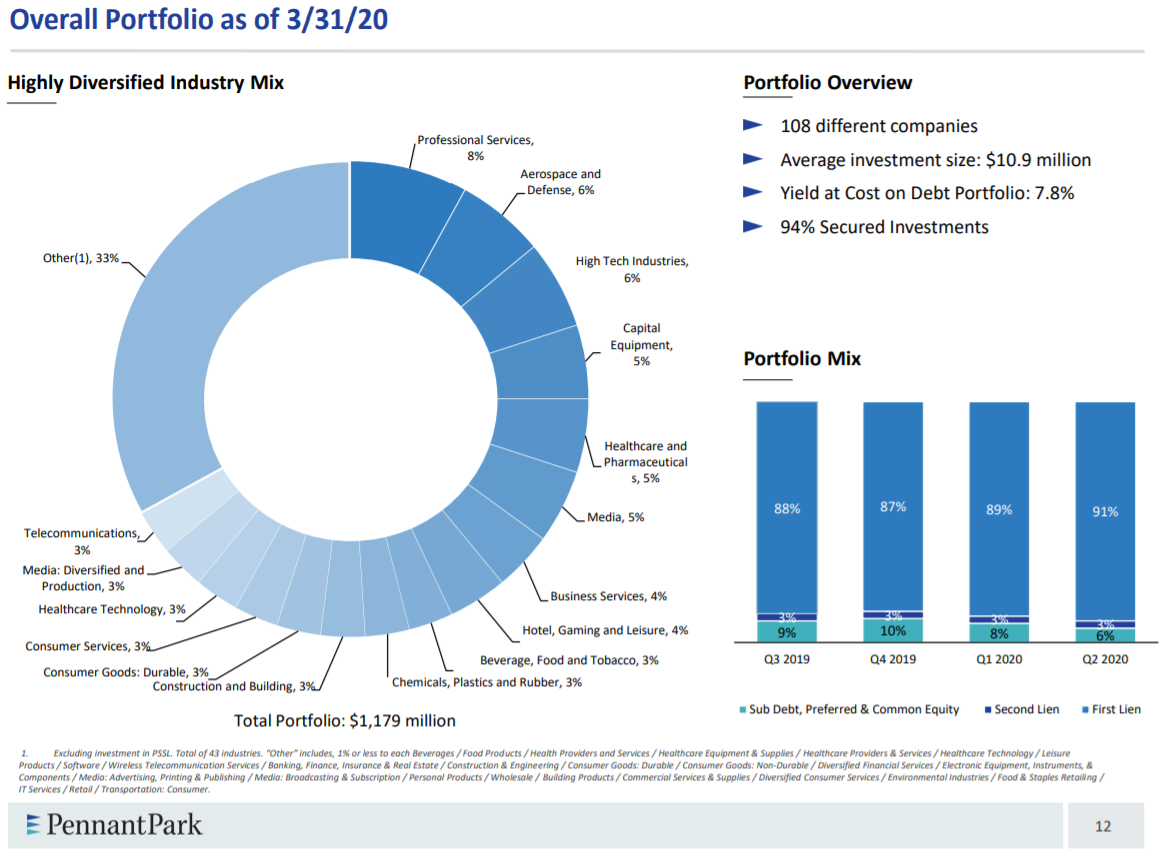

Monthly Dividend Stock In Focus Pennantpark Floating Rate Capital Sure Dividend

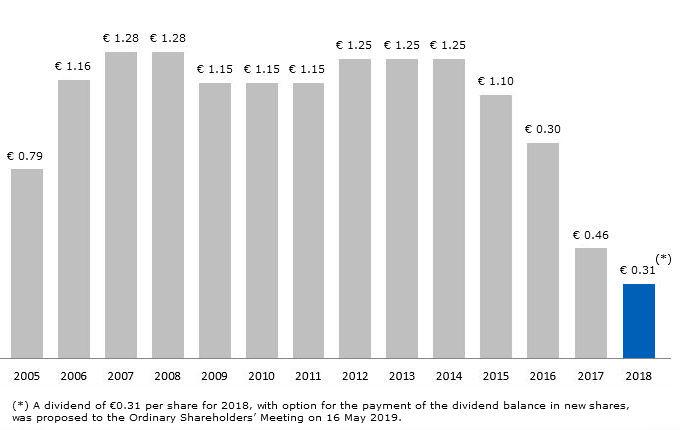

L Oreal Finance Dividend

Gordon Growth Model Formula Calculator Excel Template

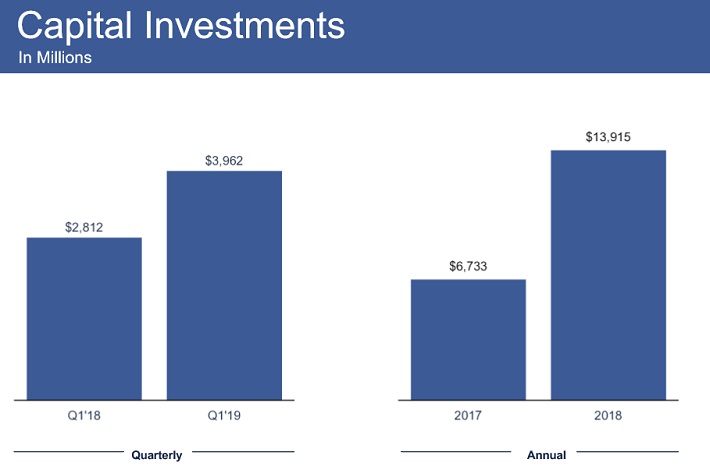

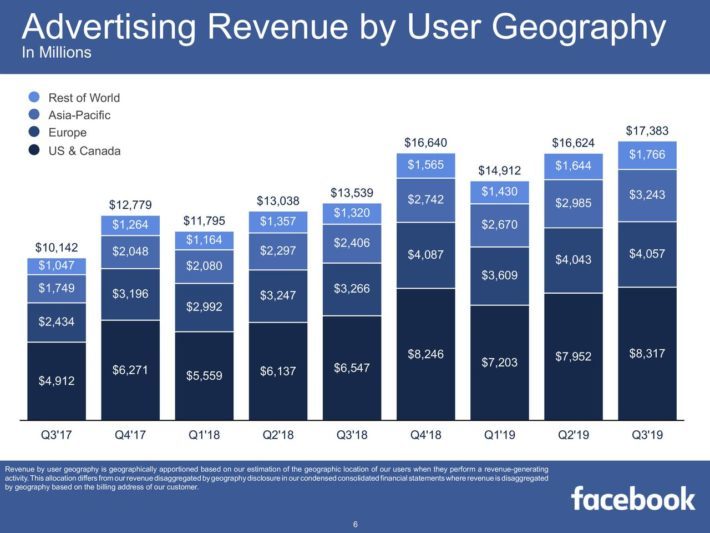

Will Facebook Ever Pay A Dividend Sure Dividend

7 Of The Best Dividend Aristocrats On The Market

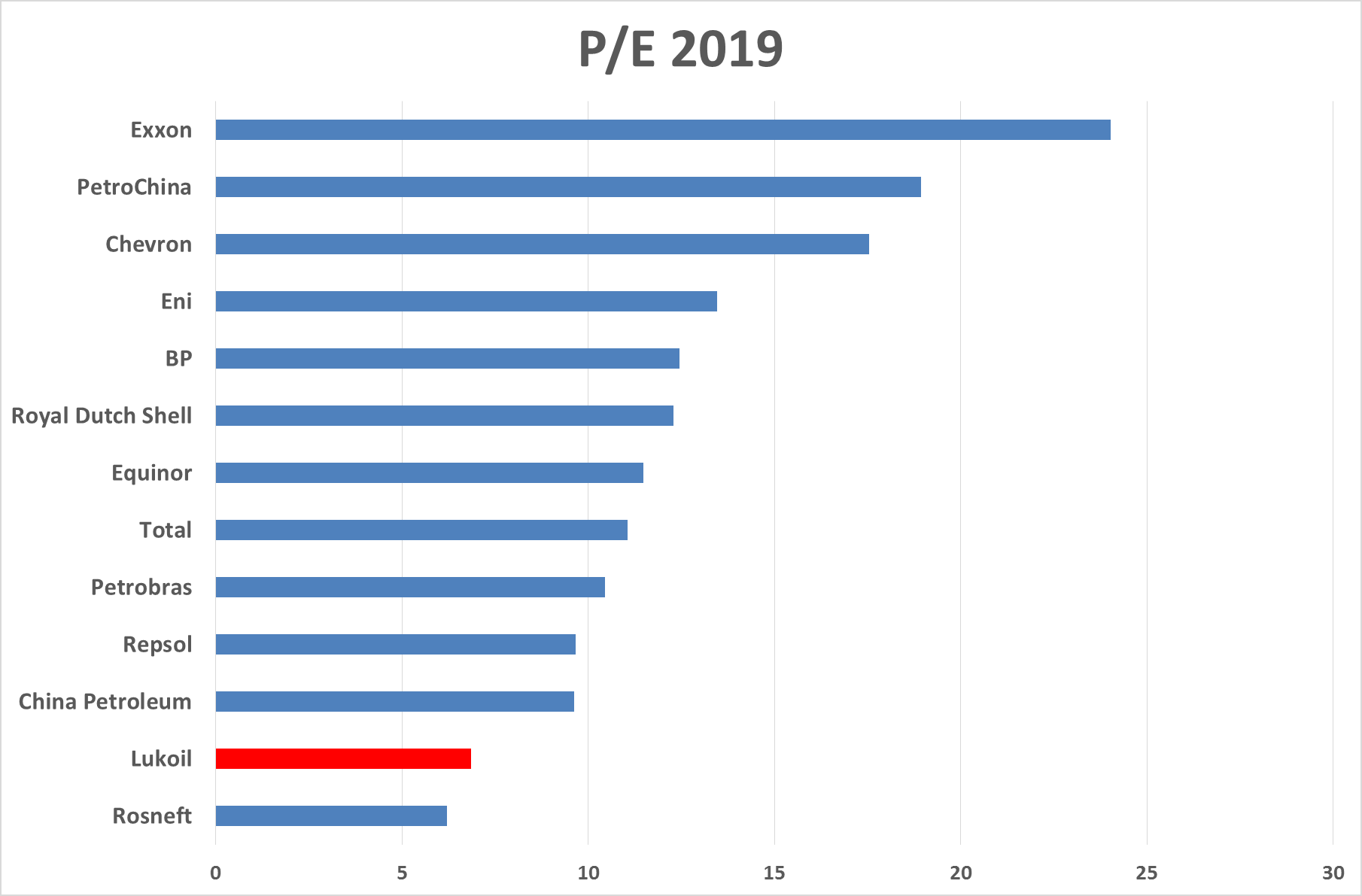

Lukoil Doubles Dividend Payout Here Is What It Means For The Stock Otcmkts Lukoy Seeking Alpha

Free Art Print Of Finance Concept In Word Collage Freeart Fa

Will Facebook Ever Pay A Dividend Sure Dividend

978 Chapter 18 Solution Manual Part 1 Get 24 7 Homework Help Online Study Solutions

Uae Equity Markets A Dividend Powerhouse Seeking Alpha

Portfolio Dividend Tracker Build Yours In 6 Steps

Xdyew9yawhdnym

3 High Yield Dividend Stocks Offering At Least 8 Analysts Say Buy

Dividend Taxes And Implied Cost Of Equity Capital Request Pdf

Pdf Government As A Venture Capitalist Evidence From Estonia Paper Submitted To Industry Studies Association Annual Meeting Kansas City Mo Usa May 28 31 13

Monthly Dividend Stock In Focus Pennantpark Floating Rate Capital Sure Dividend

3 Strong Buy Dividend Stocks Yielding Over 9

Is Fundrise Good Investment Introvert Engineer Strong Silent Techy Who Persue Financial Independence

The Two Stage Dividend Discount Model Dividend Com Dividend Com

Stakeholders In Stage 1 Early Post Crisis 1997 00 Download Table

Ordinary Dividends Qualified Dividends Return Of Capital What Does It All Mean Why Should I Care Seeking Alpha

Practice Questions Week 3 Fins3640 Unsw Sydney Studocu

National Transfer Accounts Project

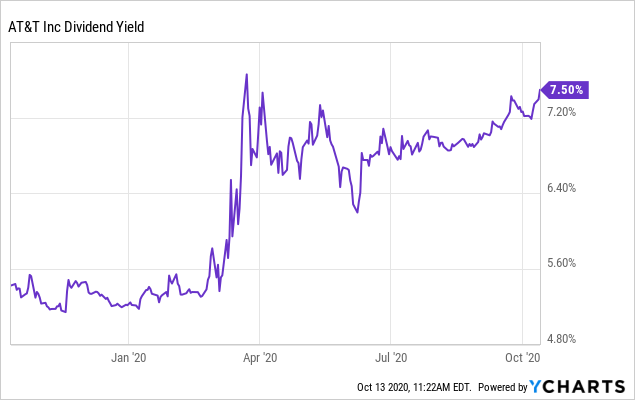

Retirement Strategy At T Is More Than Just About The Dividend Nyse T Seeking Alpha

High Dividend Stocks Starting To Outperform As Low Rates Become New Norm

Managers Do Not Lean Back A Profit Testing Model That Evaluatess

A Speculative Biotech Catalyst Trade Ormp Thestreet

Monthly Dividend Stock In Focus Gladstone Investment Corporation Sure Dividend

L Oreal Finance Dividend

The Better Dividend Stock For 21 Invesco Mortgage Capital Or Citigroup The Motley Fool

:max_bytes(150000):strip_icc()/GettyImages-1162966574-aa19edd4e0ec4d2091c7fbd292f45959.jpg)

How To Use The Dividend Capture Strategy

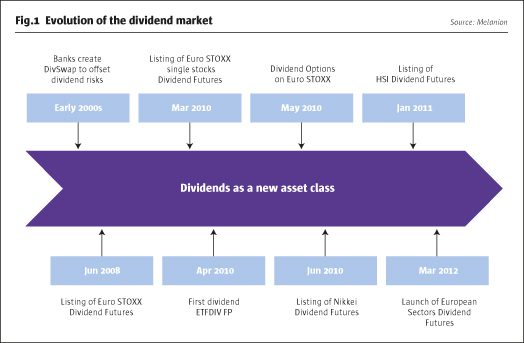

Melanion Capital The Hedge Fund Journal

What Are The 3 Stages Of Dividend Growth Seeking Alpha

Advantages And Disadvantages Of Bonus Shares Efinancemanagement

What Is The Term Sheet As A New Startup Investor You Need To Know By Bram Berkowitz Gvcdium Medium

Outperformance Through Dividend Strategies Grin

Appendix Iii Summary Of Tax Systems The Composition Of Fiscal Adjustment And Growth Lessons From Fiscal Reforms In Eight Economies

Rethinking Public Ownership Of Capital A New Progressive View Doc Research Institute

3 Things You Need To Know About The New Tax Code New Hampshire Public Radio

J1tclqzp1oue3m

Sequencing Capital Account Liberalization Sequencing Capital Account Liberalization Lessons From The Experiences In Chile Indonesia Korea And Thailand

Rwfqwixwdo5kwm

Monthly Dividend Stock In Focus Pennantpark Floating Rate Capital Sure Dividend

/FacebookbalancesheetREDec2018-5c73549b46e0fb00014ef630.jpg)

Retention Ratio Definition

253g2 1 Pg2 Htm Filed

3 Big Dividend Stocks Yielding Over 7 Jmp Says Buy

Back To Basics What Is The Demographic Dividend Finance Development September 06

What Is Cost Of Equity 2 Ways To Calculate It

5 Facts About High Dividend Stocks Every Investor Should Know The Motley Fool

The Two Stage Dividend Discount Model Dividend Com Dividend Com

Ordinary Dividends Qualified Dividends Return Of Capital What Does It All Mean Why Should I Care Seeking Alpha

Monthly Dividend Stock In Focus Pennantpark Floating Rate Capital Sure Dividend

Stock Certificate San Antonio Water System

3 High Yield Dividend Stocks Offering At Least 8 Analysts Say Buy

Investing For Beginners 101 Page 53 Of 81 How To Start Investing In The Stock Market For Beginners

/GettyImages-913219882_1800px-cc149a0fbc5f48059e9ff87f8bebd0cc.png)

Dividend Definition

Hsbc Plots Dividend Return After Better Than Expected Q3 Results

5 Top Reit Picks To Get Your Piece Of The Top Five Life Seeking Alpha

The Better Dividend Stock For 21 Invesco Mortgage Capital Or Citigroup The Motley Fool

The Snowball Effect How To Compound Your Wealth With Dividend Growth Stocks Seeking Alpha

Fcr Ca First Capital Real Estate Investment Trust Dividend History Dividend Channel

Dividend Aristocrats The Motley Fool

Iron Mountain Dividend Safety Will This 9 25 Yield Fall Off A Cliff

Swminvestorpresentation2

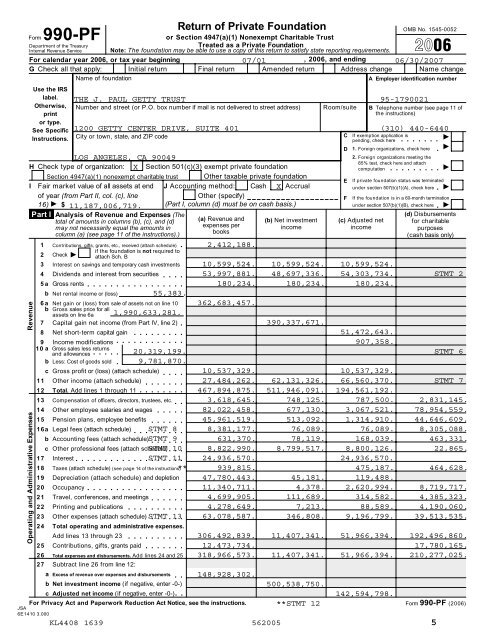

990 Pf The Getty

:max_bytes(150000):strip_icc()/DividendCaptureStrategy2-ed2bf3eddb4f4d56acf17a43a78ee358.png)

How To Use The Dividend Capture Strategy

Inter Parfums Inc 19 Annual Report 10 K