Dividende Fresenius

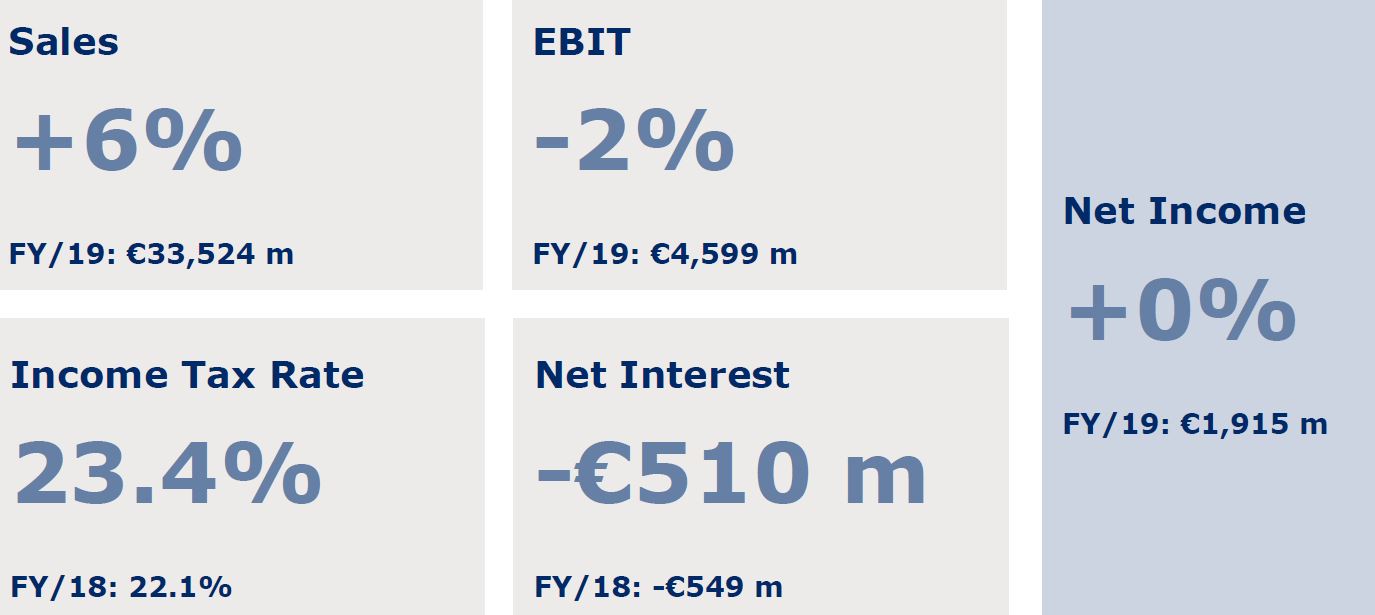

The total proposed dividend distribution will be €1551 million, equivalent to % of Group net income before special items Based on the proposed dividend and the closing price of our share at the end of 11, the dividend yield would be approximately 13% Fresenius shares are an attractive investment, especially for longterm investors.

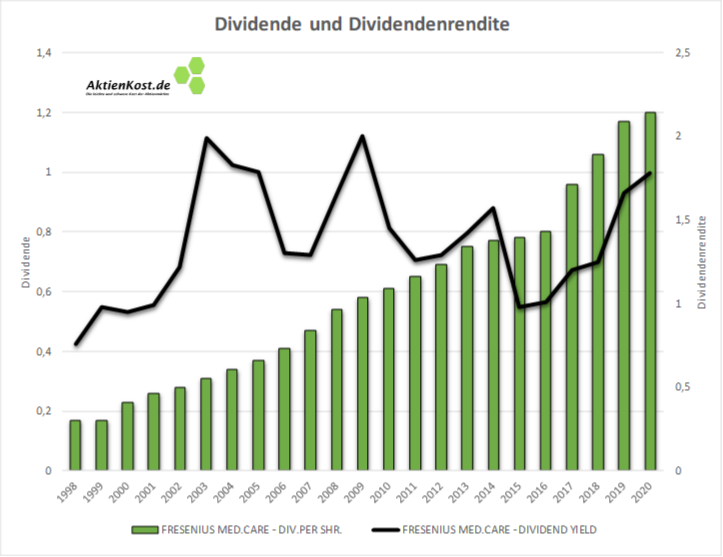

Dividende fresenius. Fully registered shareholders will be paid their dividend automatically by BNP Paribas, while holders of administered registered shares or bearer shares will be paid their dividend by the financial intermediary that manages their shares 19 dividend The Board of Directors convened on February 5, , and proposed a dividend of €315 per. Fresenius Medical Care AG & Co KGaA pays an annual dividend of $050 per share and currently has a dividend yield of 121% The dividend payout ratio of Fresenius Medical Care AG & Co KGaA is 1976% This payout ratio is at a healthy, sustainable level, below 75%. Fresenius Medical Care AG KGaA's Dividend Payout Ratio for the three months ended in Sep was 099 During the past 13 years, the highest Dividend Payout Ratio of Fresenius Medical Care AG KGaA was 030The lowest was 016And the median was 024 As of today (), the Forward Dividend Yield % of Fresenius Medical Care AG KGaA is 170%.

Find the latest dividend history for Fresenius Medical Care AG Common Stock (FMS) at Nasdaqcom. Dividend Summary The next Fresenius SE & Co KGaA dividend is expected to go ex in 4 months and to be paid in 4 months The previous Fresenius SE & Co KGaA dividend was 84¢ and it went ex 5 months ago and it was paid 5 months ago There is typically 1 dividend per year (excluding specials), and the dividend cover is approximately 49. Get the latest Fresenius stock price and detailed information including news, historical charts and realtime prices.

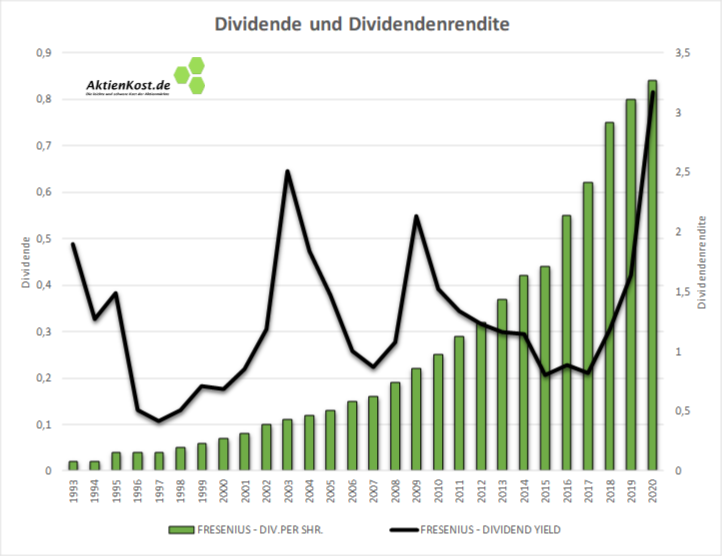

Wie für deutsche Unternehmen üblich, zahlt Fresenius seine Dividende jährlich und nicht quartalsweise, wie dies in den USA üblich ist Derzeit erhalten die Aktionäre 0,84 Euro, was einer Dividendenrendite von 2,25 Prozent entspricht Diese Rendite klingt zunächst nicht sehr hoch. Dividend Definition Dividends are common dividends paid per share, reported as of the exdividend date In general, profits from business operations can be allocated to retained earnings or paid to shareholders in the form of dividends or stock buybacks. Fresenius Medical Care AG & Co KGaA pays an annual dividend of $050 per share, with a dividend yield of 1% FMS's most recent annually dividend payment was made to shareholders of record on Friday, September 11 Fresenius Medical Care AG & Co KGaA pays out 1976% of its earnings out as a dividend.

Fresenius Medical Care AG & Co KGaA (FMS) Dividend summary yield, payout, growth, announce date, exdividend date, payout date Seeking Alpha Premium Dividend Score. Fresenius Medical Care stock price Latest price for Fresenius Medical Care stock is 6856 €* Fresenius Medical Care dividend The expected Fresenius Medical Care payout dividend amount is about 1 € / share Exdividend date is at 05// one working day after annual general meeting. Find the latest dividend history for Fresenius SE & Co KGaA (FSNUF) at Nasdaqcom.

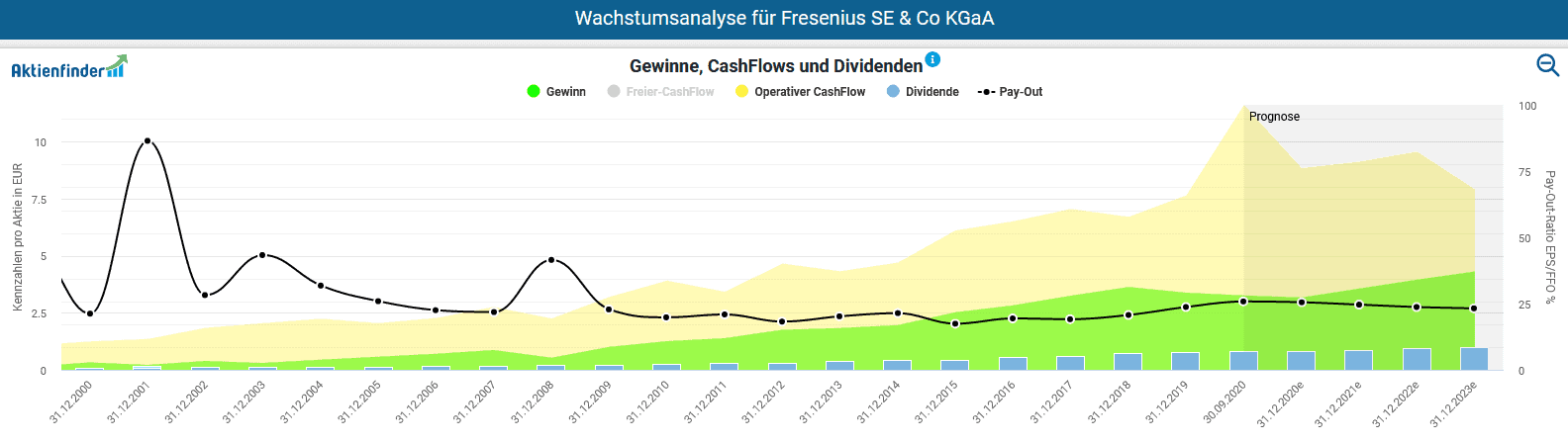

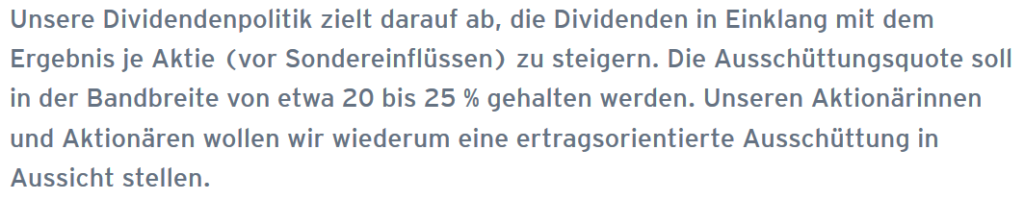

The dividend increases provided by Fresenius in the last 19 years show impressive continuity For many years, around half of the percentage increase in Group net income was paid out as a percentage increase in dividends Our new dividend policy aligns dividend with earnings per share growth (before special items) and thus broadly maintains a. FRESENIUS SE &/S pays an annual dividend of $017 per share, with a dividend yield of 157% FSNUY's most recent annual dividend payment was made to shareholders of record on Thursday, September 10 FRESENIUS SE &/S pays out 1809% of its earnings out as a dividend. FMS Dividend Type Payments Although FMS has no upcoming (meaning, Boardapproved and announced) dividends, you can sell covered calls on Fresenius Medical Care AG to create 12 extra dividend type payments per year to boost its yield.

Get information about Fresenius SE dividends and exdividend dates You can find more details by going to one of the sections under this page such as exdate, dividend and payment date. Wie für deutsche Unternehmen üblich, zahlt Fresenius seine Dividende jährlich und nicht quartalsweise, wie dies in den USA üblich ist Derzeit erhalten die Aktionäre 0,84 Euro, was einer Dividendenrendite von 2,25 Prozent entspricht Diese Rendite klingt zunächst nicht sehr hoch. Dividend Yield (TTM) is a widely used stock evaluation measure Find the latest Dividend Yield (TTM) for Fresenius Medical Care AG Co KGaA (FMS).

Fresenius Medical Care Ag & Co Kgaa yearly Dividend Pay out ratio trends Financial Information CSIMarket. ABB’s dividend policy is to pay a rising sustainable dividend The company’s annual general meeting on March 26, , has approved the ordinary dividend of 080 Swiss francs per share for 19 The dividend is in line with ABB’s dividend policy to pay a rising, sustainable dividend over time. FMS Dividend History & Description — Fresenius Medical Care AG & Co KGaA Fresenius Medical Care is a kidney dialysis company Co provides dialysis care and related services to persons who suffer from end stage renal disease as well as other health care services.

Fresenius Medical Care AG & Co KGaA pays an annual dividend of $050 per share and currently has a dividend yield of 121% The dividend payout ratio of Fresenius Medical Care AG & Co KGaA is 1976% This payout ratio is at a healthy, sustainable level, below 75%. Fresenius Medical Care AG & Co KGaA pays an annual dividend of $050 per share and currently has a dividend yield of 121% The dividend payout ratio of Fresenius Medical Care AG & Co KGaA is 1976% This payout ratio is at a healthy, sustainable level, below 75%. Comparing dividend payments to a company's net profit after tax is a simple way of realitychecking whether a dividend is sustainable Looking at the data, we can see that 25% of Fresenius SE KGaA's profits were paid out as dividends in the last 12 months.

Real time Fresenius Medical Care (FMS) Dividends The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life. Today we'll take a closer look at Fresenius Medical Care AG & Co KGaA from a dividend investor's perspectiveOwning a strong business and reinvesting the dividends is widely seen as an attractive. Relative to its peers in the largesized revenue class, it has a dividend yield higher than just 1713%.

Dividend investors should always want to know if a) a company's dividends are affordable, b) if there is a track record of consistent payments, and c) if the dividend is capable of growing. Fresenius Medical Care AG & Co KGaA (FMS) Dividend summary yield, payout, growth, announce date, exdividend date, payout date Seeking Alpha Premium Dividend Score. Real time Fresenius Medical Care (FMS) Dividends The Ascent is The Motley Fool's new personal finance brand devoted to helping you live a richer life.

A stock’s Dividend Uptrend rating is dependent on the company’s pricetoearnings (P/E) ratio to evaluate whether or not a stock’s dividend is likely to trend upward If a stock is valued near, or slightly below the market average, research has shown that the market expects the stock’s dividend to increase. Fresenius Medical Care included for 11th time in Dow Jones Sustainability Index Fresenius Medical Care, the world’s leading provider of products and services for people with chronic kidney failure, has been recognized for the 11th time as a sustainability leader with inclusion in the Dow Jones Sustainability Index (DJSI Europe). FMS Dividend Type Payments Although FMS has no upcoming (meaning, Boardapproved and announced) dividends, you can sell covered calls on Fresenius Medical Care AG to create 12 extra dividend type payments per year to boost its yield.

Dividend (TTM) is a widely used stock evaluation measure Find the latest Dividend (TTM) for Fresenius Medical Care AG & Co KGaA (FMS). Dividend Yield (TTM) is a widely used stock evaluation measure Find the latest Dividend Yield (TTM) for Fresenius Medical Care AG Co KGaA (FMS). Dividend Summary The next Fresenius Medical Care AG & Co KGaA dividend is expected to go ex in 4 months and to be paid in 4 months The previous Fresenius Medical Care AG & Co KGaA dividend was 1¢ and it went ex 5 months ago and it was paid 5 months ago There is typically 1 dividend per year (excluding specials), and the dividend cover is approximately 33.

FMS dividend history, yield, payout ratio, and stock fundamentals See upcoming exdividends and access Dividata's ratings for Fresenius Medical Care ADS. Fresenius Medical Care stock price Latest price for Fresenius Medical Care stock is 6856 €* Fresenius Medical Care dividend The expected Fresenius Medical Care payout dividend amount is about 1 € / share Exdividend date is at 05// one working day after annual general meeting. Fresenius dividend 21 The expected Fresenius payout dividend amount is about 084 € / share Exdividend date is at 05/24/21 one working day after annual general meeting The Fresenius payment date 21 is at 05/26/21 Current dividend yield The current Fresenius dividend yield based on last share price is 216 % Fresenius Dividend history.

Fresenius Medical Care (NYSEFMS) declares annual dividend of €075/share, 9% increase from prior dividend of €069, subject to approval by shareholders (PR) Feb 26, 13, 1013 AM. Dividend per share data for 1997 to 06 have been adjusted for share split in June 07 Preference shares were converted into ordinary shares on June 28, 13. FRESENIUS SE &/S pays an annual dividend of $017 per share, with a dividend yield of 157% FSNUY's most recent annual dividend payment was made to shareholders of record on Thursday, September 10 FRESENIUS SE &/S pays out 1809% of its earnings out as a dividend.

For the fiscal year 19, Fresenius Medical Care () approved a dividend increase to €1 per share on the Annual General Meeting (2700)This is the 23rd consecutive dividend increase for this European dividend aristocrat The dividend of €1 per share results in a dividend yield of ~160% and represents a payout ratio of around 30% of reported earnings per share. Review FRE dividend yield and history, to decide if FRE is the best investment for you. Fresenius SE & Co KGaA is committed to a profitdriven dividend policy and we want our shareholders to continue to participate in the company's success.

Comparing dividend payments to a company's net profit after tax is a simple way of realitychecking whether a dividend is sustainable Fresenius Medical Care KGaA paid out 27% of its profit as dividends, over the trailing twelve month period A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to. Historical dividend payout and yield for Fresenius Medical Care AG KGaA (FMS) since 00 The current TTM dividend payout for Fresenius Medical Care AG KGaA (FMS) as of November 25, is $050 The current dividend yield for Fresenius Medical Care AG KGaA as of November 25, is 119%. Fresenius Medical Care employee in Schweinfurt is Germany’s best apprentice in her specialty as electronics technician Credit relations Read more about our main financing instruments, senior notes and the credit ratings.

Digging deeper, the aspects of Fresenius Medical Care AG & Co KGaA's dividend discount model that we found most interesting were FMS generates about 17 billion US dollars in revenue annually;. Historical dividend payout and yield for FRESENIUS SE&CO (FSNUY) since 1971 The current TTM dividend payout for FRESENIUS SE&CO (FSNUY) as of December 31, 1969 is $017 The current dividend yield for FRESENIUS SE&CO as of December 31, 1969 is 149%. Get information about Fresenius SE dividends and exdividend dates You can find more details by going to one of the sections under this page such as exdate, dividend and payment date.

FMS Dividend History & Description — Fresenius Medical Care AG & Co KGaA Fresenius Medical Care is a kidney dialysis company Co provides dialysis care and related services to persons who suffer from end stage renal disease as well as other health care services. Fresenius Medical Care AG & Co KGaA is a Germanybased kidney dialysis company The Company provides dialysis care and related services to persons suffering from endstage renal disease (ESRD. Dividend The general partner and the Supervisory Board will propose a dividend increase to the Annual General Meeting For 11, a dividend of €095 per share is proposed This is an increase of about 10% The total dividend distribution will also increase by 11% to €1551 million (10 €1397 million).

Fresenius SE is a healthcare holding company based in Germany with four segments The company owns a large stake in dialysis service provider and equipment manufacturer Fresenius Medical Care. Dividend Summary The next Fresenius Medical Care AG & Co KGaA dividend is expected to go ex in 4 months and to be paid in 4 months The previous Fresenius Medical Care AG & Co KGaA dividend was 1¢ and it went ex 5 months ago and it was paid 5 months ago. Comparing dividend payments to a company's net profit after tax is a simple way of realitychecking whether a dividend is sustainable Fresenius Medical Care KGaA paid out 27% of its profit as dividends, over the trailing twelve month period A medium payout ratio strikes a good balance between paying dividends, and keeping enough back to.

Historical dividend payout and yield for Fresenius Medical Care AG KGaA (FMS) since 00 The current TTM dividend payout for Fresenius Medical Care AG KGaA (FMS) as of November 25, is $050 The current dividend yield for Fresenius Medical Care AG KGaA as of November 25, is 119%. FMS dividend history, yield, payout ratio, and stock fundamentals See upcoming exdividends and access Dividata's ratings for Fresenius Medical Care ADS. Dividend Yield Definition The dividend yield measures the ratio of dividends paid / share price Companies with a higher dividend yield tend to have a business model that allows them to pay out more dividends from net income like real estate and consumer defensive stocks.

Fmc News Der Faz Zum Dialysespezialisten

Fresenius Medical Care Aktien Fresenius Medical Care

Fresenius Erhoht Nach Rekordgewinn 15 Die Dividende Manager Magazin

Dividende Fresenius のギャラリー

Fresenius Aktie Der Unterschatzte Dividenden Aristokrat

Fresenius Se Dividendenentwicklung Seit 1993 Dividendenrendite Chart Aktienkost

Top 50 Dividend Stocks To Buy Autumn Quality Selection Personal Financial

Tuitove Ss Sdrzhanie Ot Fresenius Fresenius Twitter

Dax Uber 12 000 Fresenius Allianz Besitzen Weiterhin Viel Dividenden Potenzial The Motley Fool Deutschland

Pin Auf Dividenden

Fresenius Aktie Dividenden Gewinnwachstum Von 5 Das Wurde Uber 15 Jahre Mit Der Aktie Passieren Onvista

Fresenius Medical Care Dividende Hauptversammlung Dividendenrendite Hv Termine Finanzen Net

Fresenius Medical Care Aktie Dividende Soll Am 1 September Kommen Finanztrends

Dividendenaristokrat Fresenius Jetzt Noch Vor Dividende Kaufen Das Spricht Dafur Von The Motley Fool

Bq6d4pm2wwqtvm

Fresenius Aktie Mit Dividende Investing Com

Fresenius Aktienanalyse Wachstum Intakt Aktie Fast 50 Unter Dem Hoch

Thyssenkrupp Neuer Flirtversuch Mit Salzgitter Covestro Dividende Wird Halbiert Fresenius Morgan Stanley Lobt Onvista

Aktienkauf Fresenius Inkl Analyse Der Finanzfisch

Fresenius Se Aktie Und Aktienanalysen

Fresenius Medizin Und Gesundheitstechnik

Fundamentaldaten Fresenius Se Co Kgaa

Investors Fresenius

Fresenius Helios Etwas Mehr Umsatz Deutlich Hoherer Gewinn

Nachrichten Aus Dem Norden Nordic Market Fresenius Se Co Kgaa

Fresenius Medical Care Fmc Dividende 21

Aus Fur Aua Lenzing Streicht Dividende Fresenius Gewinnt Kurier At

Fresenius Profil Junger Anleger

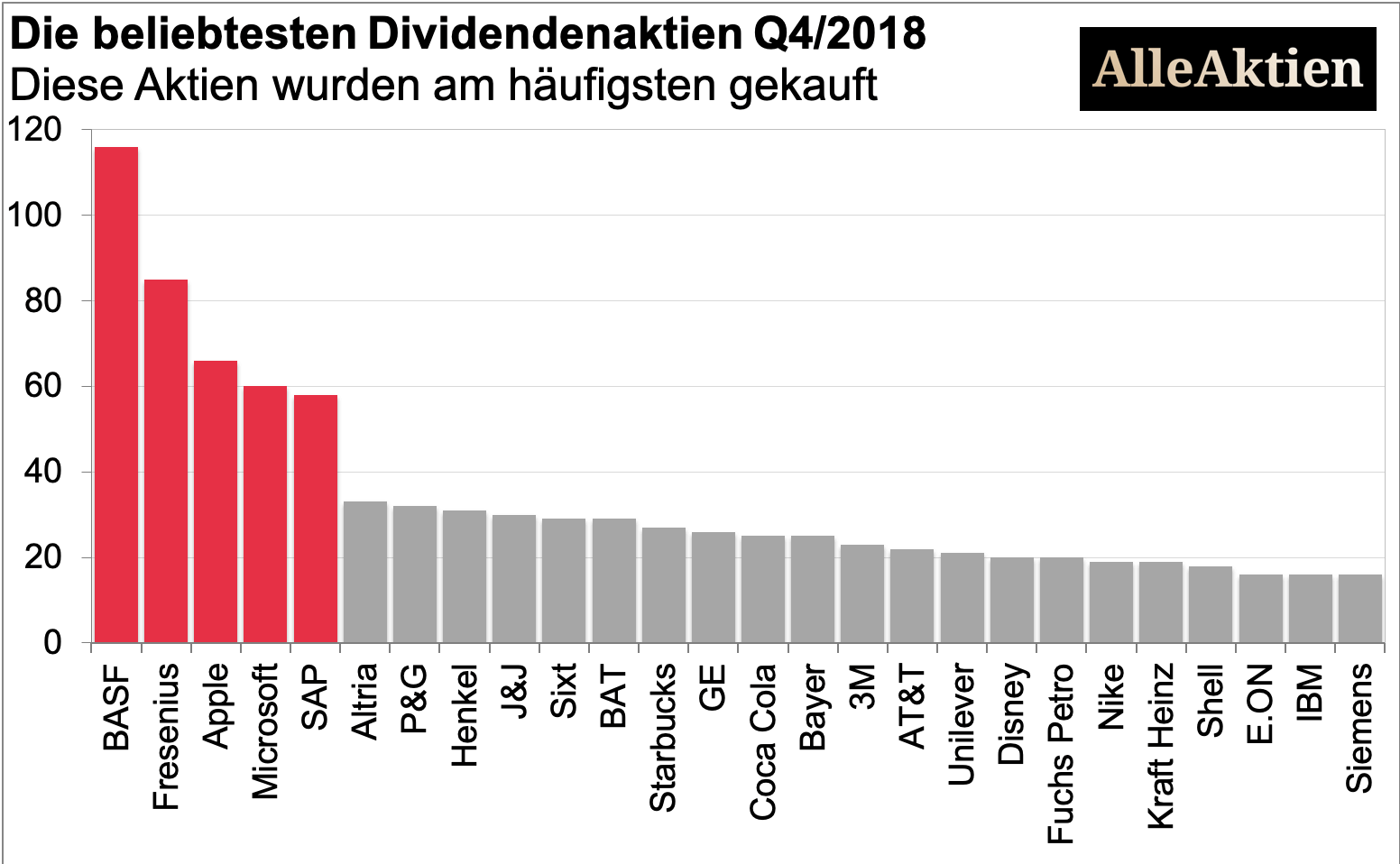

5 Top Dividenden Aktien Im Vierten Quartal 18 Alleaktien Sap

Fresenius Insidertrades Directors Dealings Insiderhandel Finanzen Net

Umsatzplus Und Hohere Dividende Asien Geschaft Gibt Fmc Schub N Tv De

Fresenius Hauptversammlung Wie Viel Dividende Zahlt Fresenius

Fresenius Der Einzige Deutsche Dividenden Aristokrat

Fresenius Aktie Der Unterschatzte Dividenden Aristokrat 23 12

Les Dividend Aristocrats En Europe La Liste Complete Etre Riche Et Independant

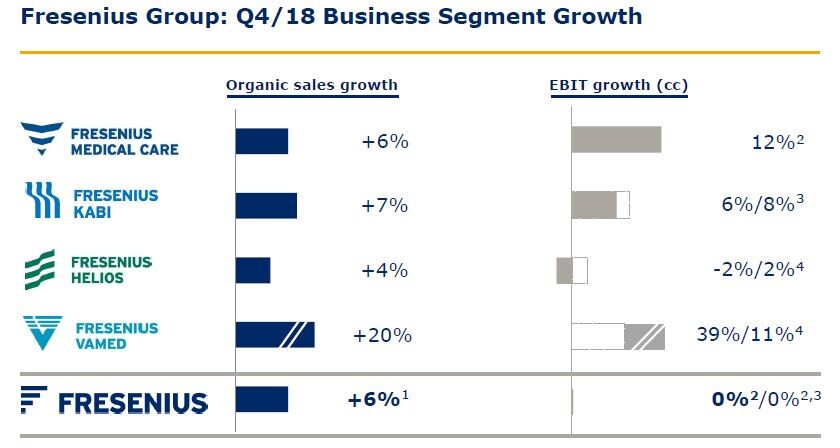

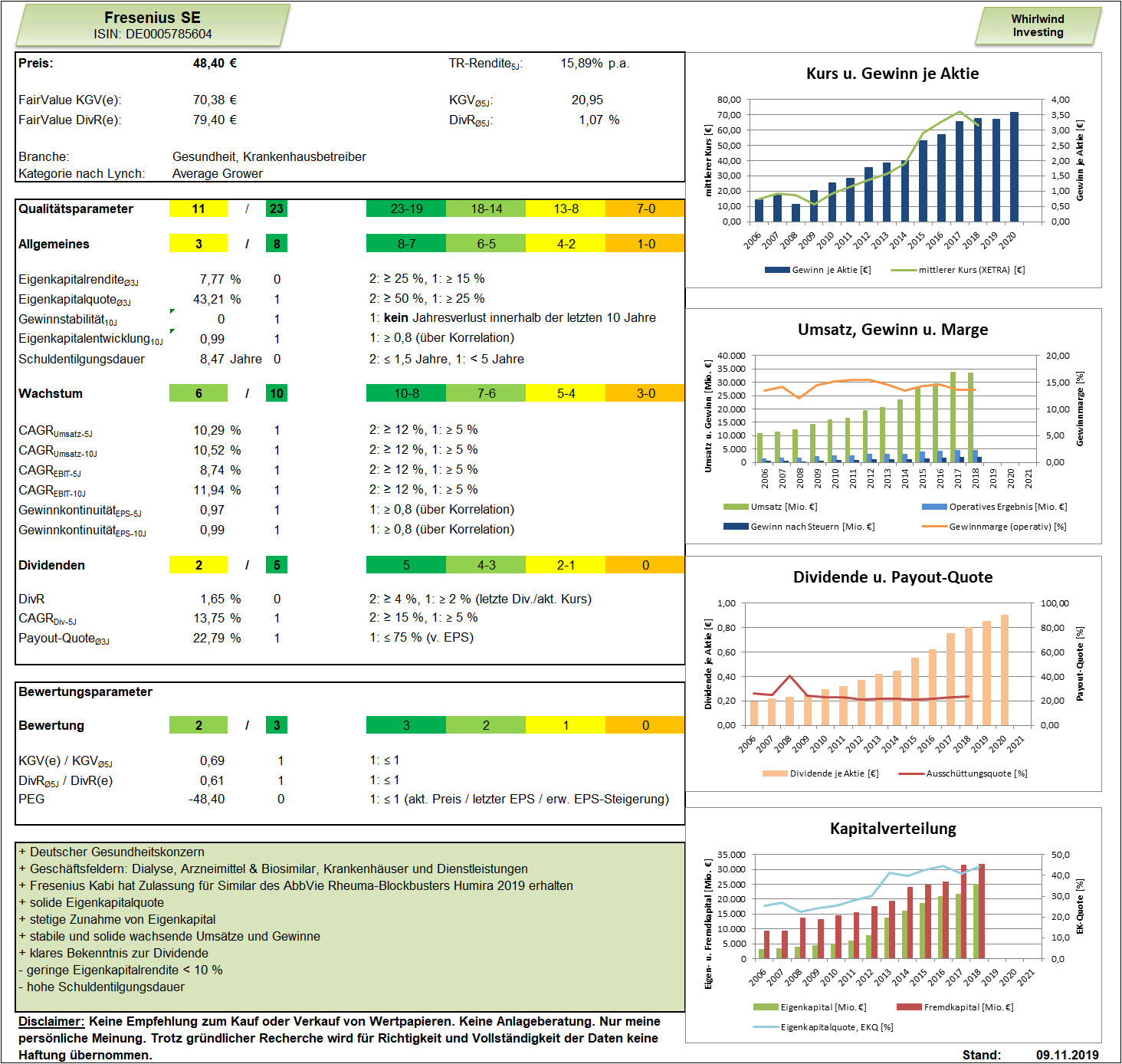

Fresenius Analyse Vom 09 11 19 Whirlwind Investing

Fresenius Medical Care S Dividends Fresenius Medical Care

Fresenius Medical Care Aktie Dividenden Und Rendite Seit 1998 Aktienkost

Fresenius Fresenius Medical Care Erhohen Dividende Manager Magazin

Fresenius Will Dividende Um 21 Und Zum 25 Mal In Folge Erhohen Alleaktien Update

Top Dividende Deutschlands Wer Wird Der Erste Deutsche Dividendenaristokrat 21 06 16

Fresenius Aktie Der Unterschatzte Dividenden Aristokrat

Les Dividend Aristocrats En Europe La Liste Complete Etre Riche Et Independant

Dividende Von Fresenius Jung In Rente

Stephan Sturm Fresenius Se Co Kgaa Finance Magazin

Dividende Fresenius

Fresenius Aktie Analyse Dividendenaristokrat Aktienanalyse Inkl Fairer Preis Youtube

Fresenius Medical Care S Dividends Fresenius Medical Care

Fresenius Zahlen Immerhin Eine Kleine Uberraschung

Gewinnplus Fresenius Erhoht Erneut Dividende Manager Magazin

Dividende Erneut Erhoht Dax Konzern Fresenius Macht Rekordgewinn N Tv De

Wie Viel Dividende Bei 1 000 Fresenius Kauf In Finanzen Aktien er Jahre

Fresenius Se Viel Hat Sich Nicht Getan Nachkauf Finanzen Mit Plan

Fresenius Aktie Kann Die Dividende Uberzeugen Finanztrends

Fresenius Medical Care Aktie Dividende Und Hauptversammlung

Tuitove Ss Sdrzhanie Ot Fresenius Fresenius Twitter

Coca Cola Fresenius Und At T 3 Dividendenaristokraten Die Trotz Korrektur Hohere Dividenden Auszahlen

Fresenius Aktie Wie Sicher Ist Die Dividende 6 Punkte Dividenden Analyse Youtube

Media Tweets By Fresenius Ir Fresenius Ir Twitter

Homepage Fresenius Online Annual Report 18

Tuitove Ss Sdrzhanie Ot Fresenius Fresenius Twitter

Fresenius Se Dass Es Tatsachlich Noch Besser Werden Konnte Finanztrends

Homepage Fresenius Online Annual Report 18

Fresenius Aktie So Viel Einsatz Benotigst Du Fur 100 Euro Dividende Passives Einkommen

Fresenius Will Dividende Um 21 Und Zum 25 Mal In Folge Erhohen Alleaktien Update

Dividends Fresenius

Fresenius Immer Mehr Fur Aktionare Ver Di

Fresenius Medical Care Ag Aktie De Dividendeninformation Auf Dividenden Rendite

Dax Dividenden Warum Nicht Mal Im Herbst Aktiencheck De

Fresenius Deutschlands Erster Dividenden Aristokrat

Fresenius Se Co Kgaa Unterbewerteter Dividenden Aristokrat Mit Riesigen Dividendenwachstum Youtube

3 Grunde Warum Die Dividende Von Fresenius Jetzt Foolisher Ist Als Die Von Royal Dutch Shell Onvista

Fresenius Dividende Und Hauptversammlung Alle Infos Focus De

Dividendenaristokrat Fresenius Mit Unglaublicher Aufholjagd Jetzt Noch Einsteigen

Fresenius Medical Care Aktie Kaufen Oder Verkaufen 21 6 Analyse Infos

Fresenius Aktie Der Unterschatzte Dividenden Aristokrat

Fresenius Der Einzige Deutsche Dividenden Aristokrat

Damr4p0yxl8frm

11 Aktien Furs Leben Capital De

Media Tweets By Fresenius Ir Fresenius Ir Twitter

Fresenius Aktie Kaufen Kurs Prognose Dividende 21

Fresenius Hauptversammlung Verschoben Dividende Vertagt Der Aktionar

Fresenius Dividende Je Aktie Bis 19 Statista

Stephan Sturm Fresenius Se Co Kgaa Finance Magazin

Fresenius Erhoht Nach Rekordgewinn 15 Die Dividende Manager Magazin

Fresenius Aktie Hauptversammlung Und Dividende

Fresenius Helios Etwas Mehr Umsatz Deutlich Hoherer Gewinn

Dividende Von Fresenius Jung In Rente

Fresenius Aktie Mit Dividende Aktiencheck De

Aktie Des Monats Fresenius Jung In Rente

Fmc Hauptversammlung Wie Viel Dividende Zahlt Fmc

Gibt S Die Fresenius Aktie Etwa Bald Mit 3 Dividendenrendite The Motley Fool Deutschland

Fresenius Und Tochter Fresenius Medical Care Starten Durch Top Gewinner Im Dax 25 Das Mussen Sie Jetzt Wissen Der Aktionar

Ist Die Fresenius Aktie Kaufenswert Aktienanalysen Kaufempfehlung

Dividende Von Fresenius Jung In Rente

Dividende Die Erfolgsbeteiligung Exklusiv Fur Aktionare Willkommen Im Blog Der Kreissparkasse Limburg

Aktie Des Monats Fresenius Investor Stories Podcast

Fresenius Medical Care Dividende Par Action14 18 Statista

Dividendenadel Us Aristokraten Kontinuitat Allein Ist Zu Wenig

Fresenius Analyse Vom 09 11 19 Whirlwind Investing

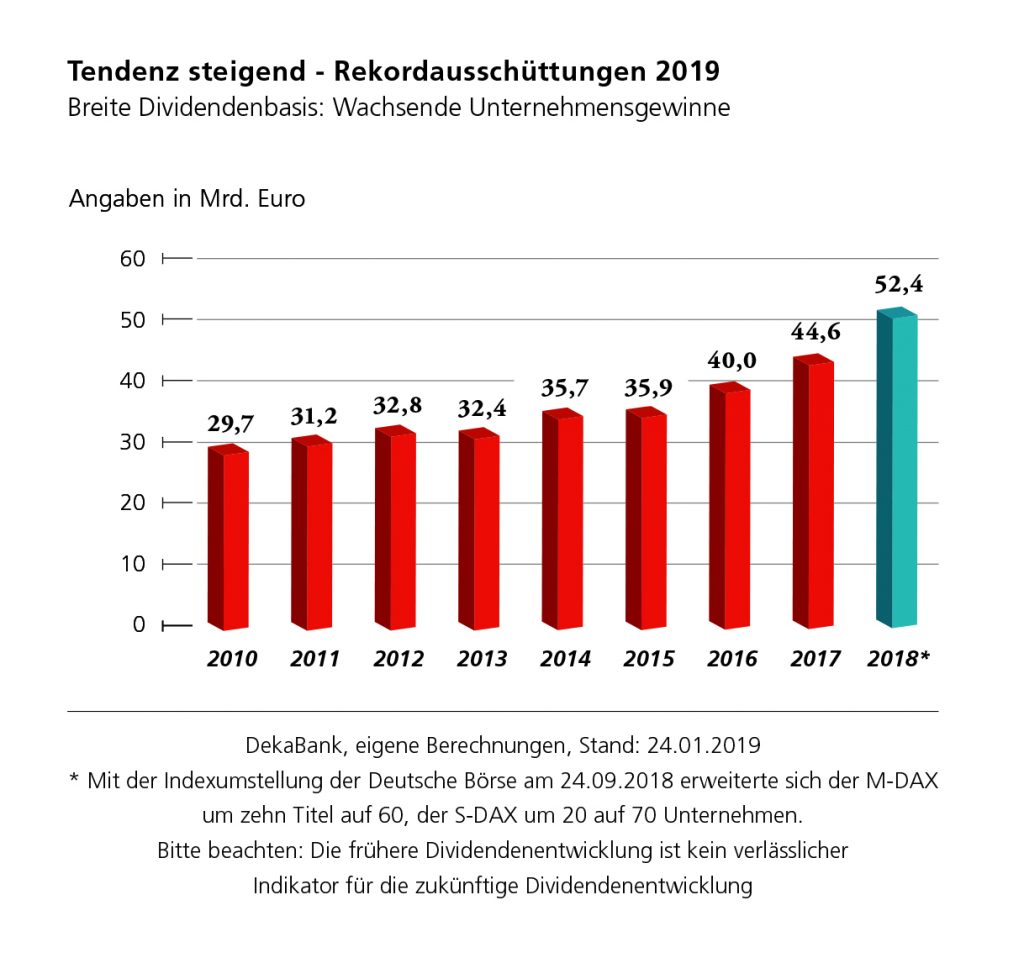

Warum Deutsche Konzerne Wieder Mehr Dividende Zahlen