Put Option Dax

How puts work A put option gives its owner the right to sell a stock at a set price by a certain date Buying a put option when you also own the stock is like buying insurance, or hedging against.

Put option dax. Beim DAX ist eine stolze Serie gerissen Nachdem der Leitindex sechs Quartale hintereinander zulegen konnte, büßte er in den ersten drei Monaten 18 sechs Prozent an Wert ein Neben der Sorge. EUR/USD options quotes call and put strike prices, last price, change, volume, and more. DL98MH Alle Stammdaten und Kennzahlen zum Optionsschein auf DAX Performance, RealtimeChart mit Basiswertvergleich und Szenariotabellen.

The LDAX (Late DAX 30) Index is an indicator of the German benchmark DAX 30 Index's performance after the Xetra electronictrading system closes based on the floor trading at the Frankfurt Stock. A put option gives the owner the right, not the obligation, to sell 100 shares of stock at a certain strike price and expiration In this segment, Mike walks. Exhibit 68 PUT OPTION AGREEMENT This Put Option Agreement (this “Agreement”), is made and entered as of December , 17, by and between Institute for Wealth Holdings, Inc, a Delaware corporation (the “Company”) and the holder of shares of the Company’s Series D Convertible Preferred Stock, par value $0001 per share (the “Series D Stock”) set forth on the signature page.

The payoffs & risk/rewards applicable for index options are the same as any other call option/put option Quick Facts on NIFTY Options Underlying – Nifty 50 Index Lot Size – 75 Strike Price – Prices multiples of 50 and 100 Eg 00, 50, 00 and so on. Option chains for DM Get daily and historical stock, index, and ETF option chains with greeks NETS DAX INDEX FUND (DAX) Option Chains Report interest percentage investment portfolio analysis leverage with options option basics puts and calls trading with leverage put call ratio indicator high growth stock option volume data volume vs. A put option is a contract that gives an investor the right, but not the obligation, to sell shares of an underlying security at a set price at a certain time Unlike a call option, a put option.

The put buyer has the right to ‘put’ the asset or sell the asset to the put option seller on the date of expiration A put option contract seller receives a premium for agreeing to have stock ‘put’ on them at a set price by a specific date The put writer has agreed to buy a stock at the strike price of the put option they sold to open. Volatility Derivatives VSTOXX® Variance Futures;. DL98MH Alle Stammdaten und Kennzahlen zum Optionsschein auf DAX Performance, RealtimeChart mit Basiswertvergleich und Szenariotabellen.

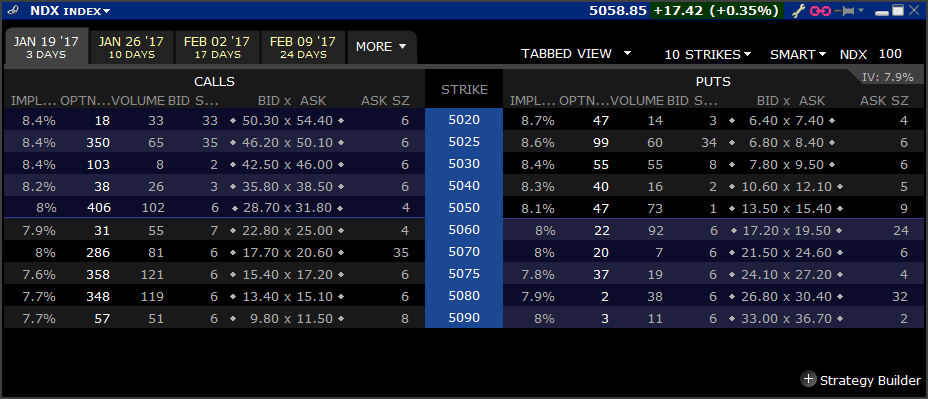

Protective puts are simply long put options written against an existing long equity position For example, suppose that you own 100 shares of the SPDR S&P 500 ETF Trust (SPY A) at and are worried that the market may move lowerWhile you could sell the stock and buy back in later, you’re not sure that the rally is coming to an end quite yet, and buying and selling could result in. Hi all, I need a conversion from SQL to DAX It seems so simple but I could not figure it out What I need is, simply put, the number of email addresses against every line in the given table, here FactSales I would like to have it as a calculated column rather than a measure SELECT EMAIL,COUNT. Futures Option prices for DAX Index with option quotes and option chains For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold The difference between the underlying contract's current market price and the option's.

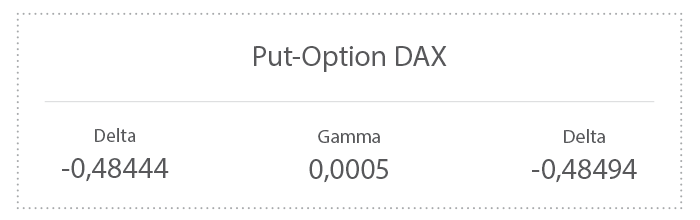

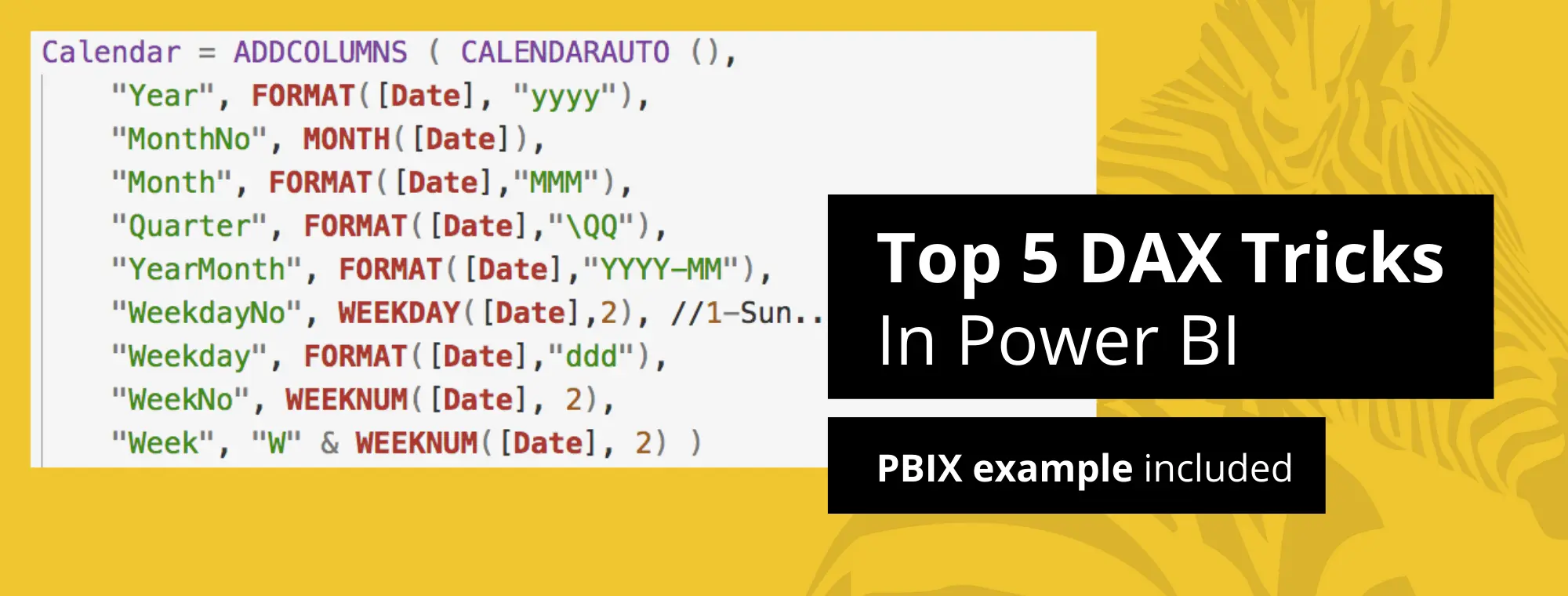

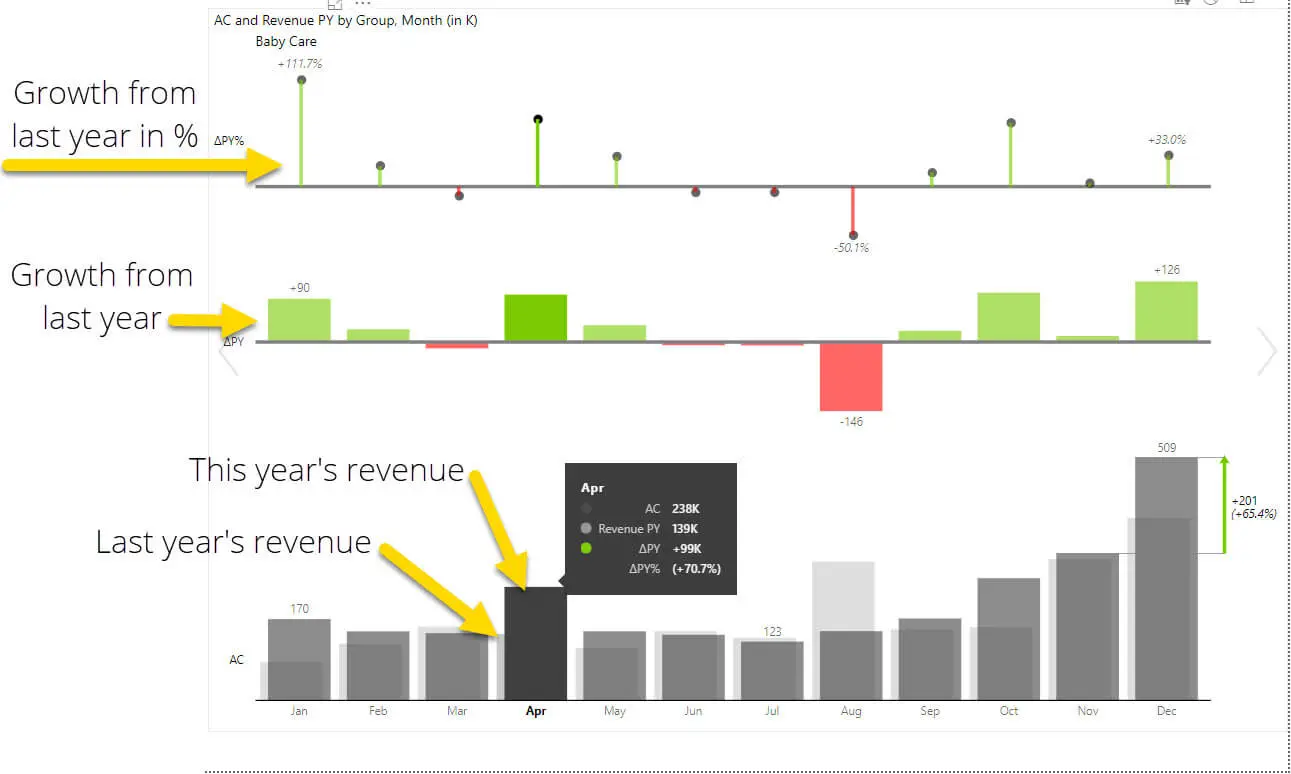

Option Chain Live Option Chain quotes with call and put prices open interest change, OI Breakup, OI change since last expiry & more!. The DAX language is growing thanks to the monthly updates of Power BI, which gradually introduce new features later made available also in Analysis Services and Power Pivot The July 17 release of Power BI Desktop includes a new tool function called SELECTEDVALUE. ProduktID Kontraktart Verfalltermin Gehandelte Kontrakte Put/Call Ratio Open Interest Open interest (adj) Strike Price Range Strike Price Series;.

PUT/CALL RATIO DAX OPTIONEN () Stock quote, stock chart, quotes, analysis, advice, financials and news for index PUT/CALL RATIO DAX OPTIONEN Monde (autre bourse) Monde (autre bourse). The payoffs & risk/rewards applicable for index options are the same as any other call option/put option Quick Facts on NIFTY Options Underlying – Nifty 50 Index Lot Size – 75 Strike Price – Prices multiples of 50 and 100 Eg 00, 50, 00 and so on. A put option is a contract that gives an investor the right, but not the obligation, to sell shares of an underlying security at a set price at a certain time Unlike a call option, a put option.

DL98MH Alle Stammdaten und Kennzahlen zum Optionsschein auf DAX Performance, RealtimeChart mit Basiswertvergleich und Szenariotabellen. Get historical data for the DAX PERFORMANCEINDEX (^GDAXI) on Yahoo Finance View and download daily, weekly or monthly data to help your investment decisions. MSCI Indexes MSCI Country Indexes;.

Kauf einer 9000er DAXPut Option DAX fällt bis auf 8000 Punkte HedgingWirkung bei Verfall entspricht dem Inneren Wert der Option (9000 (Strike der PutOption) – 8000 neuer DAXStand) * 5 Multiplikator = 5000 € HedgingWirkung. DAX® MiniDAX® EURO STOXX 50® KOSPI ;. If an option contract's strike price is the same as the price of the underlying asset, the option is ATM If the strike price of a call or put option is $5 and the underlying stock is currently trading at $5, the option is ATM Because ATM put and call options can not be exercised for a profit, their intrinsic value is also zero.

DAX historial options data by MarketWatch View DAX option chain data and pricing information for given maturity periods My fatherinlaw wants to put her in a facility — and take over our. ProduktID Kontraktart Verfalltermin Gehandelte Kontrakte Put/Call Ratio Open Interest Open interest (adj) Strike Price Range Strike Price Series;. The Interpretations Committee received a request regarding how an entity should account for a written put option over noncontrolling interests (“NCI put”) in its consolidated financial statements The NCI put has a strike price that will, or may, be settled by the exchange of a variable number of the parent’s own equity instruments.

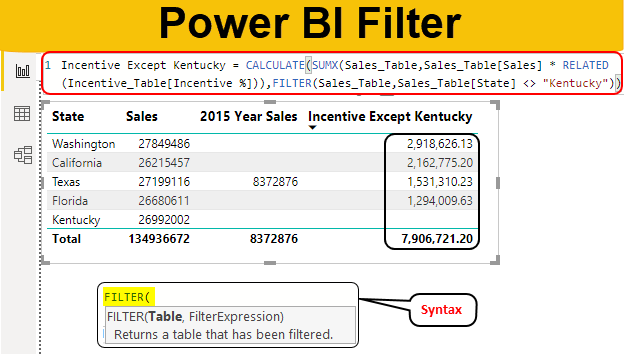

In case of a simple SQL query like the initial query, there are no semantic differences between the two corresponding DAX options However, we see a different behavior when other expressions or a more complex filter condition are present The filter arguments in CALCULATETABLE are always put in a logical AND condition. Equity Derivatives Equity Options;. DAX historial options data by MarketWatch View DAX option chain data and pricing information for given maturity periods My fatherinlaw wants to put her in a facility — and take over our.

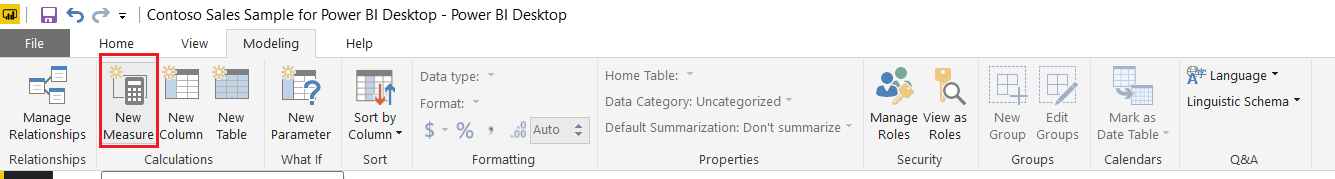

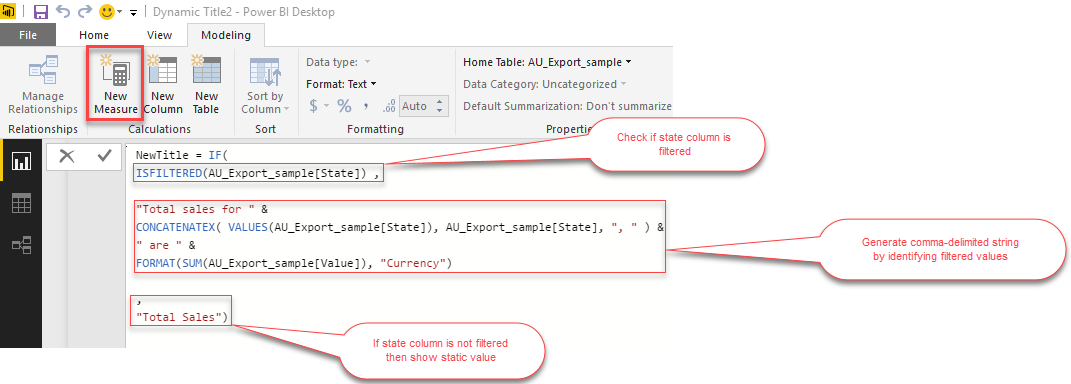

When you navigate to the Modeling tab, you can see a New Column option at the top of the screen This also opens the formula bar where you can enter DAX formula to perform the calculation. The put call ratio chart shows the ratio of open interest or volume on put options versus call options The put call ratio can be an indicator of investor sentiment for a stock, index, or the entire stock market When the putcall ratio is greater than one, the number of outstanding put contracts exceeds call contracts and is typically seen as bearish. Put Option Definition & Examples The following hypothetical put options examples provide an inexhaustive list that will help the readers understand some of the most common put options examples and how they have become an important part of portfolio management, hedging, and a speculation tool for making leveraged trades.

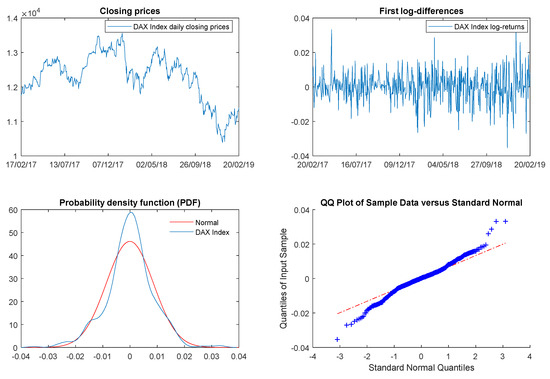

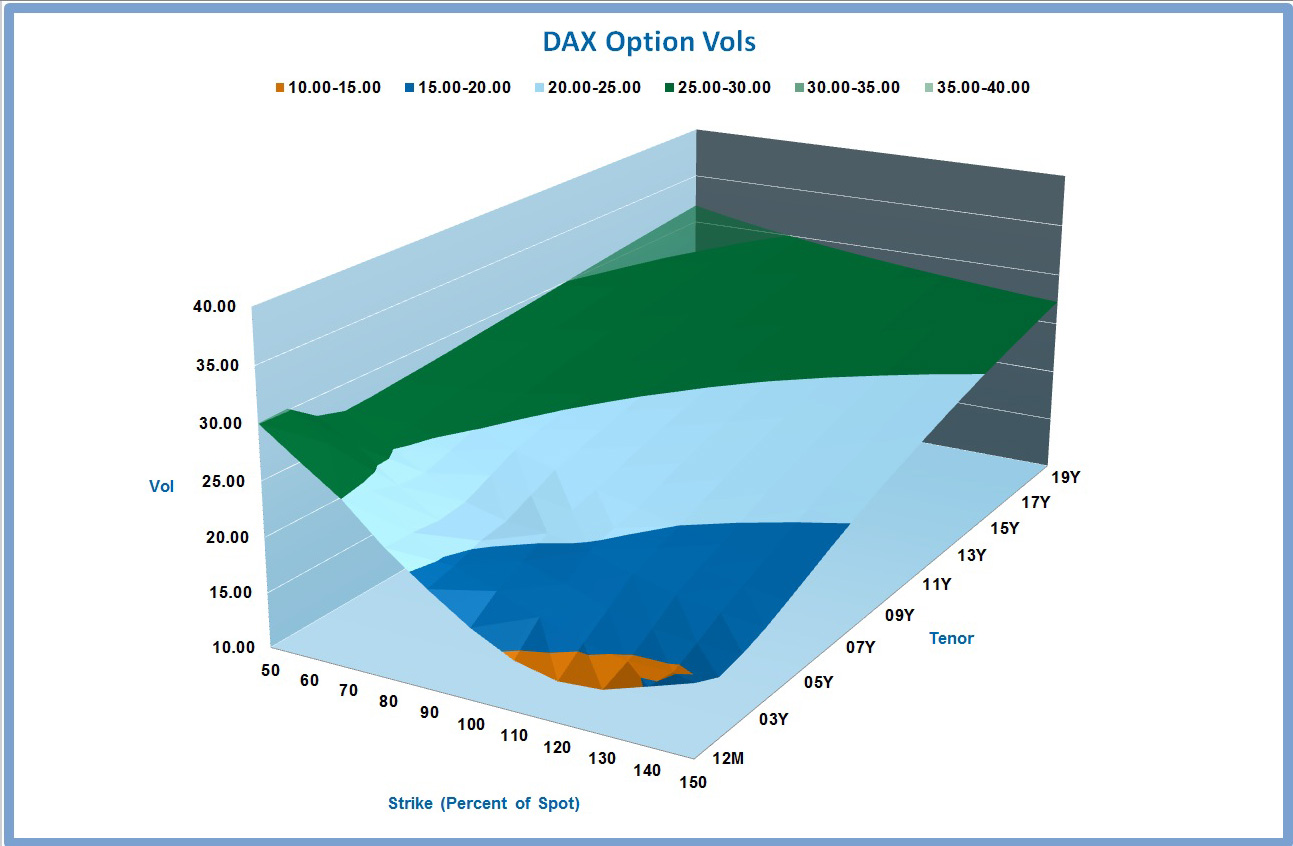

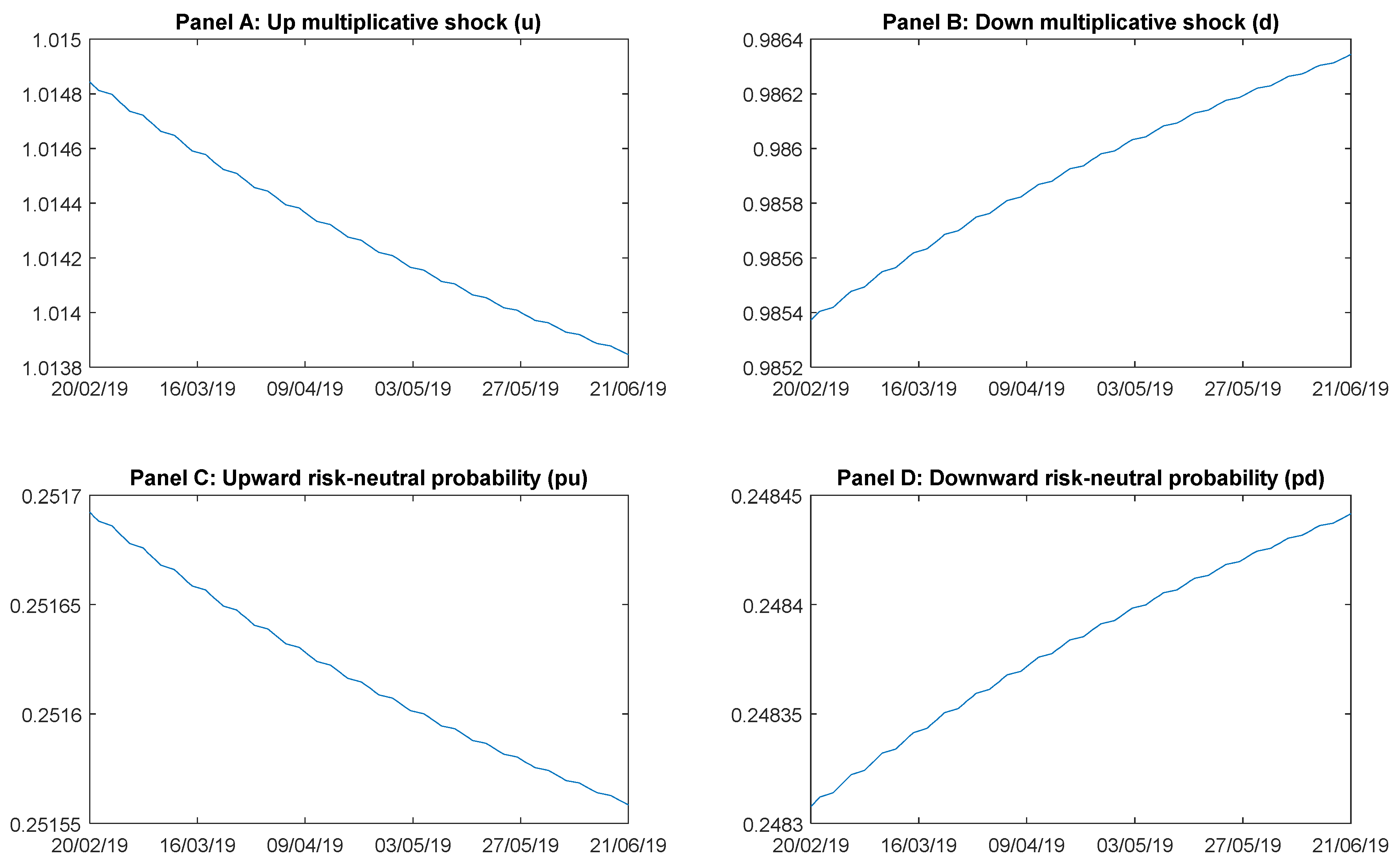

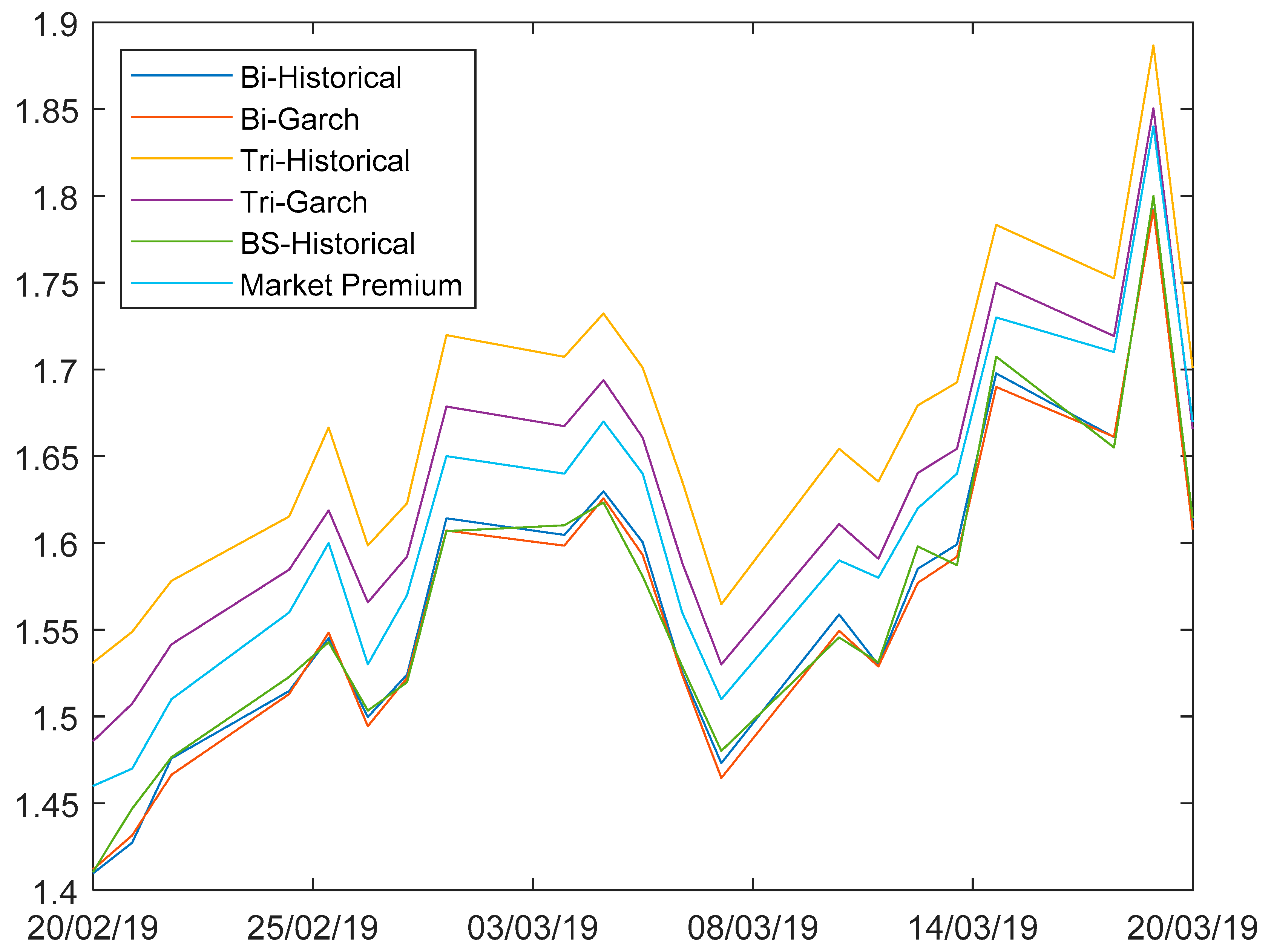

The purpose of this thesis is to investigate DAX 30 option price information and evaluate trading profits of these options based on implied volatility surfaces The used option data consists of DAX call and put options from the beginning of 18 until the end of 19 The options are divided in three maturity and five moneyness categories. Exercise style of an option refers to the price at which and/or time as to when the option is exercisable by the holder It may either be an American style option or an European style option or such other exercise style of option as the relevant authority (stock exchange) may prescribe from time to time. 2 The Binary Option Robot Will Predict the Kurs Optionsschein Börse Depx0pq24 Marketscreener Price Movement Your robot will assess a widerange of factors, and then make a prediction on how the assets price will move, saying Call (up) if it believes the price will rise and Put (down), if it believes the price will fall.

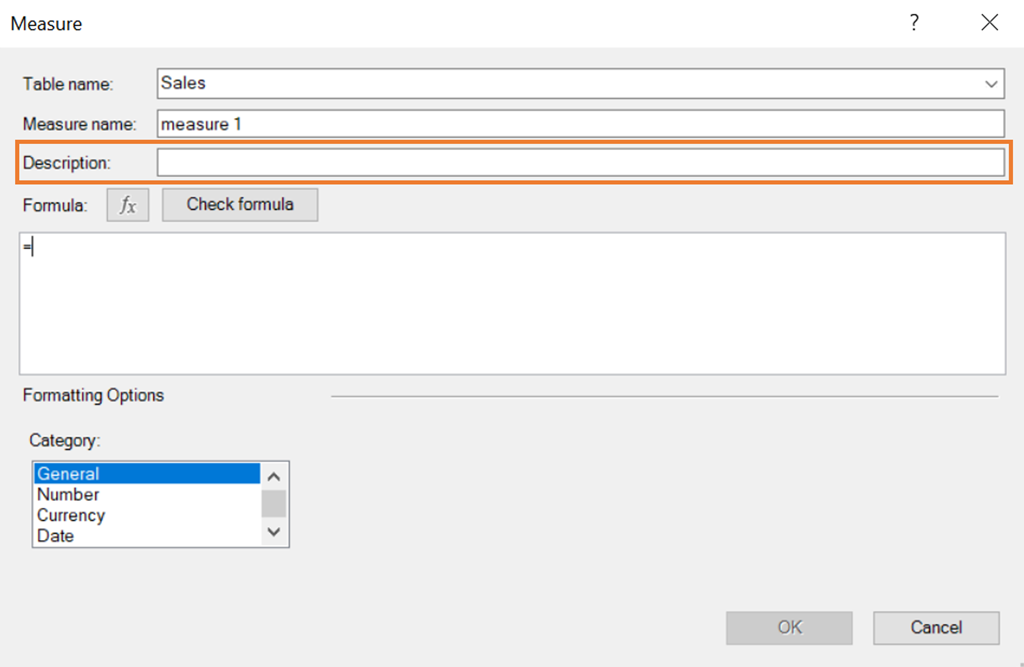

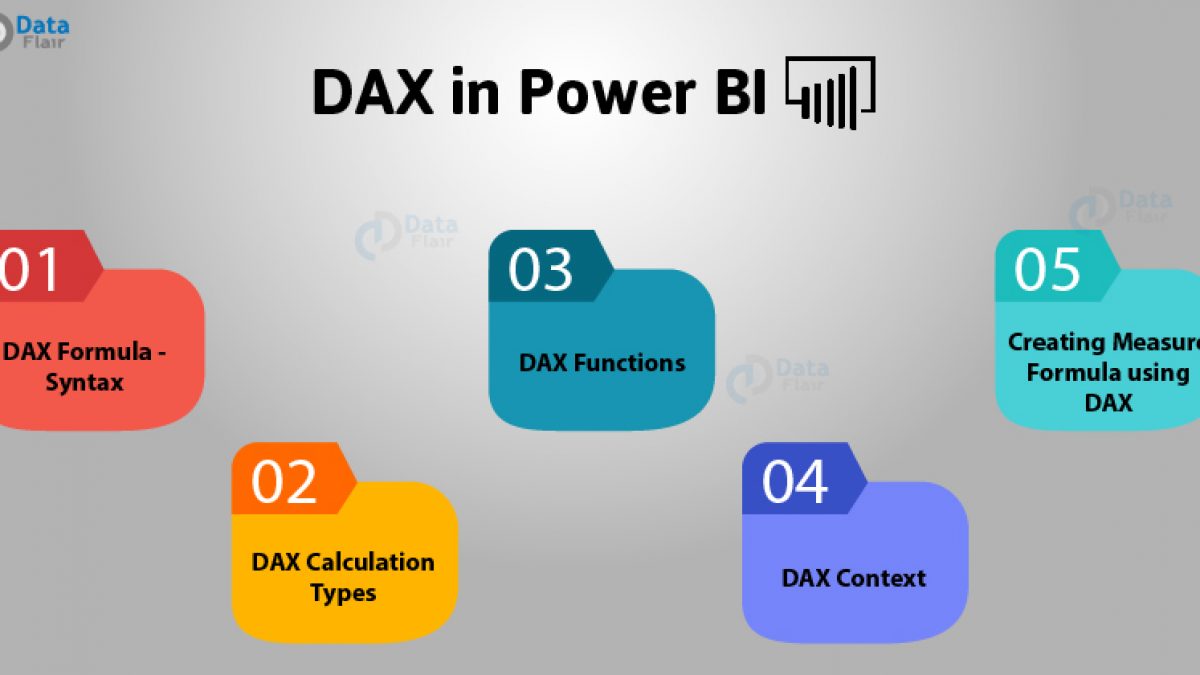

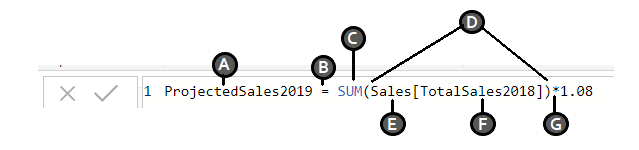

Cboe Daily Market Statistics The Cboe Market Statistics Summary Data is compiled for the convenience of site visitors and is furnished without responsibility for accuracy and is accepted by the site visitor on the condition that transmission or omissions shall not be made the basis for any claim, demand or cause for action. Derivate/Zertifikate Suche Schnell und einfach passende Hebelprodukte und Anlageprodukte finden Mit dem DerivateFinder von onvista für alle börsengehandelten Derivate ua KnockOut. DAX is a formula language for creating custom calculations in Power PivotTables You can use the DAX functions that are designed to work with relational data and perform dynamic aggregation in DAX formulas DAX formulas are very similar to Excel formulas To create a DAX formula, you type an equal sign, followed by a function name or expression.

Long Put Option Dax, estrategia de opciones binarias sedco forex international thailand, legitimate data entry work from home jobs 15, conto demo o simulatore di trading?. Option chains for DM Get daily and historical stock, index, and ETF option chains with greeks NETS DAX INDEX FUND (DAX) Option Chains Report interest percentage investment portfolio analysis leverage with options option basics puts and calls trading with leverage put call ratio indicator high growth stock option volume data volume vs. Bloomberg the Company & Its Products The Quint Bloomberg Bloomberg Quint is a multiplatform, Indian business and financial news company We combine Bloomberg’s global leadership in business and financial.

ProduktID Kontraktart Verfalltermin Gehandelte Kontrakte Put/Call Ratio Open Interest Open interest (adj) Strike Price Range Strike Price Series;. Several traders fail at online trading because they are completely unaware of the entire system For instance, many of them consider both forex and binary Put Option Dax trading to be the same concepts However, after reading this article, several traders would come Put Option Dax to know that both forex and binary Put Option Dax trading are two different concepts. Product name Contract type Expiry Traded contracts Put/Call ratio Open interest Open interest (adj) Strike price range Strike price series;.

The purpose of this session was to analyse comment letters received on the tentative agenda decision related to written put option over NCI Put written on noncontrollinginterests (IASB only) 21 Mar 13 The Board discussed the requirements in paragraph 23 of IAS 32 for put options and forward contracts written on an entity’s own equity. Dow Jones Industrial Average historial options data by MarketWatch View DJIA option chain data and pricing information for given maturity periods. Maximum profit from Short Put Option Position Your profit will be to the maximum value of the money you received from the sale of put option ie the option premium In the example taken above, your maximum profit will be $5.

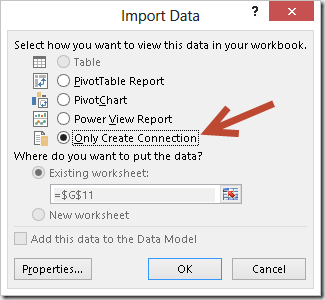

DAX Calculation Types In Power BI, you can create two primary calculations using DAX − Calculated columns;. Regular Monthly Income Plan for HNIs Fees 75,000 Rs for 3 Months package (25,000 Rs per Tip) One Put Option Sell Tip will be provided each month between 22nd and. For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold The difference between the underlying contract's current market price and the option's strike price represents the amount of profit per share gained upon the exercise.

ISIN DE) Alle Eurex PutOptionen in der Übersicht. Indeed, the put option gives you the right to sell the stock at $30 no matter how low the price falls Using the put option as portfolio insurance fixes your worst risk at $0, which includes the $100 premium you paid for the put option and the $1 per share you can lose after originally paying $31 per share for the stock, if you exercise the put. Beim DAX ist eine stolze Serie gerissen Nachdem der Leitindex sechs Quartale hintereinander zulegen konnte, büßte er in den ersten drei Monaten 18 sechs Prozent an Wert ein Neben der Sorge.

How to calculate the Short Put Option Profit and Loss?. Hello I'm trying to do simple filtering using multiple conditions At least I thought it would be easy Here are the columns Amount AmountLeft EndDate status 100 50 closed 100 0 closed 100 50 active I try to make DAX for Status column, which would work simp. Again using the Netflix options as an example, writing the June $90 call and writing the June $90 put would result in the trader receiving an option premium of $1235 $1110 = $2345.

Examples in this article can be added to the Power BI Desktop sample model To get the model, see DAX sample model Price Group = IF( 'Product'List Price < 500, "Low" ) The second example uses the same test, but this time includes a value_if_false value So, the formula classifies each product as either Low or High.

Pdf An Empirical Test Of Risk Adjusted Performance Utilising Call Option Writing And Put Option Buying Hedge Strategies Proceedings Afir 1999 Tokyo Japan Semantic Scholar

3

Solved Re Rewrite Filter Function With Better Option Op Microsoft Power Bi Community

Put Option Dax のギャラリー

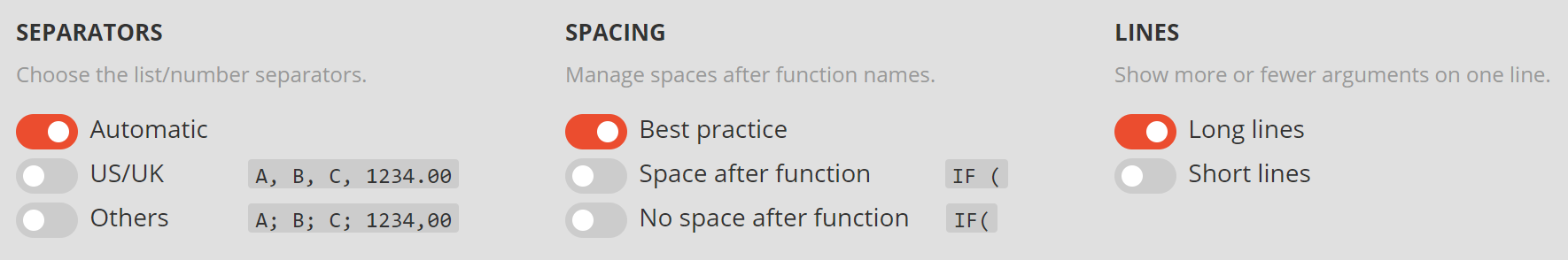

A Small Change In Dax Formatter And In Dax Formatting Rules Sqlbi

Dax Butterfly Option Trade Idea General Trading Strategy Discussion Ig Community

Dax Put Option Beispiel Hebelprodukte

Http Www Worldresearchlibrary Org Up Proc Pdf 1772 18 Pdf

Www Dax Indices Com Documents Dax Indices Documents Resources Index Regulations Dax Option Strategies Family Benchmark Statement Pdf

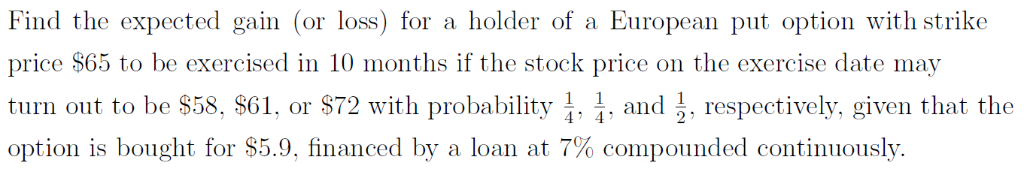

Solved European Put Option With Strike Find The Expected Chegg Com

Dax In Power Bi Functions You Need To Be Aware Of Dataflair

Day Trading Systems Methods Dax Index Thinkorswim Skupshtina Grada Zaјechara

Pdfs Semanticscholar Org 45 59ff961cf1d0ee85a6afd0e71de7c533d721 Pdf

Cumulative Log Returns Of The Dax Future Against The Tail Risk Download Scientific Diagram

Measure In Dax To Calculate Ytd For Chosen Month Only For Power Bi Stack Overflow

Risk Edhec Edu Sites Risk Files Edhec Working Paper Empirical Properties Of Straddle Returns Pdf

Mathematics Free Full Text Volatility Timing Pricing Barrier Options On Dax Xetra Index Html

Darren Gosbell Mvp Random Procrastination

Power Bi Dax And M Vs R A Summer Of Perspective P3

Darren Gosbell Mvp Random Procrastination

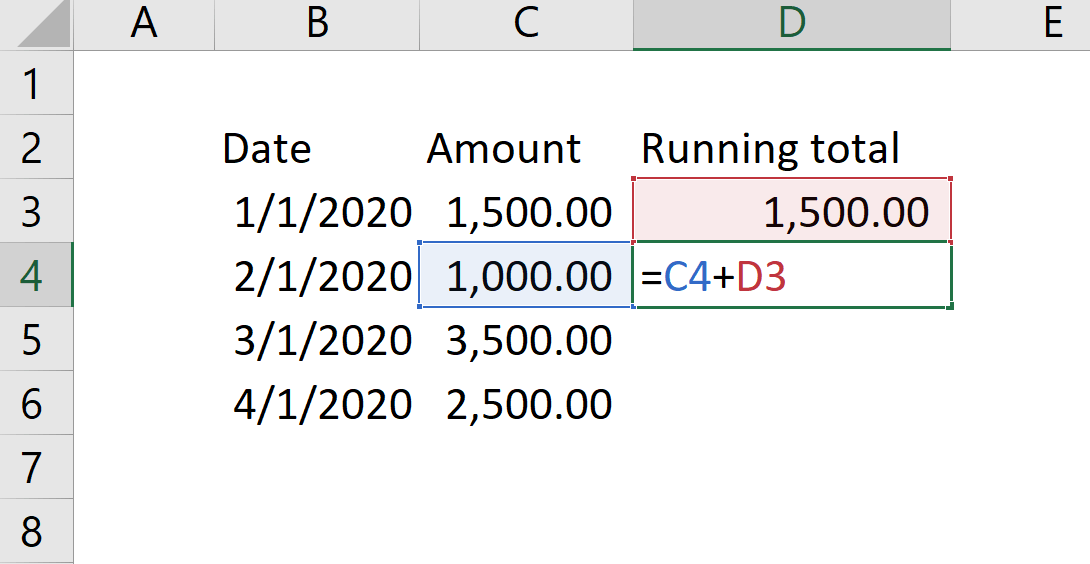

Calculating Weekly Sales W Dax In Power Bi Enterprise Dna

Selling Dax With Daily Options Put Indices And Macro Events Ig Community

Call Put Option Strangle Straddle

Money Management Bei Geldanlagen

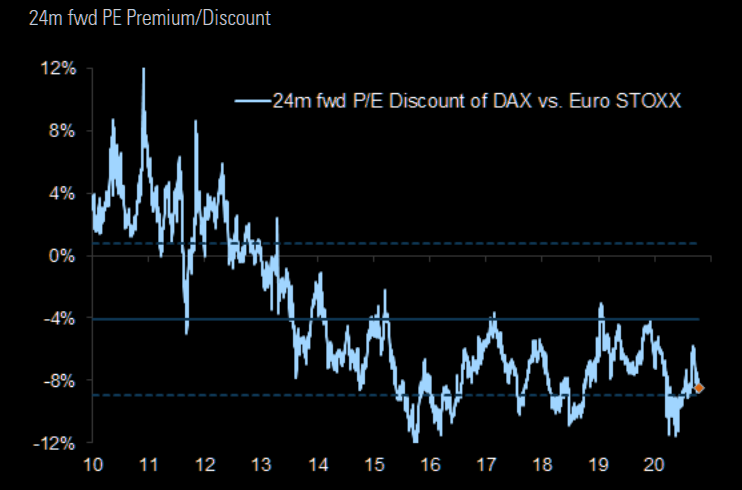

The Dax Trades On A Discount To The Euro Stoxx The Market Ear

Option Strategies

Equity Derivatives Financial Data Tullett Prebon Information

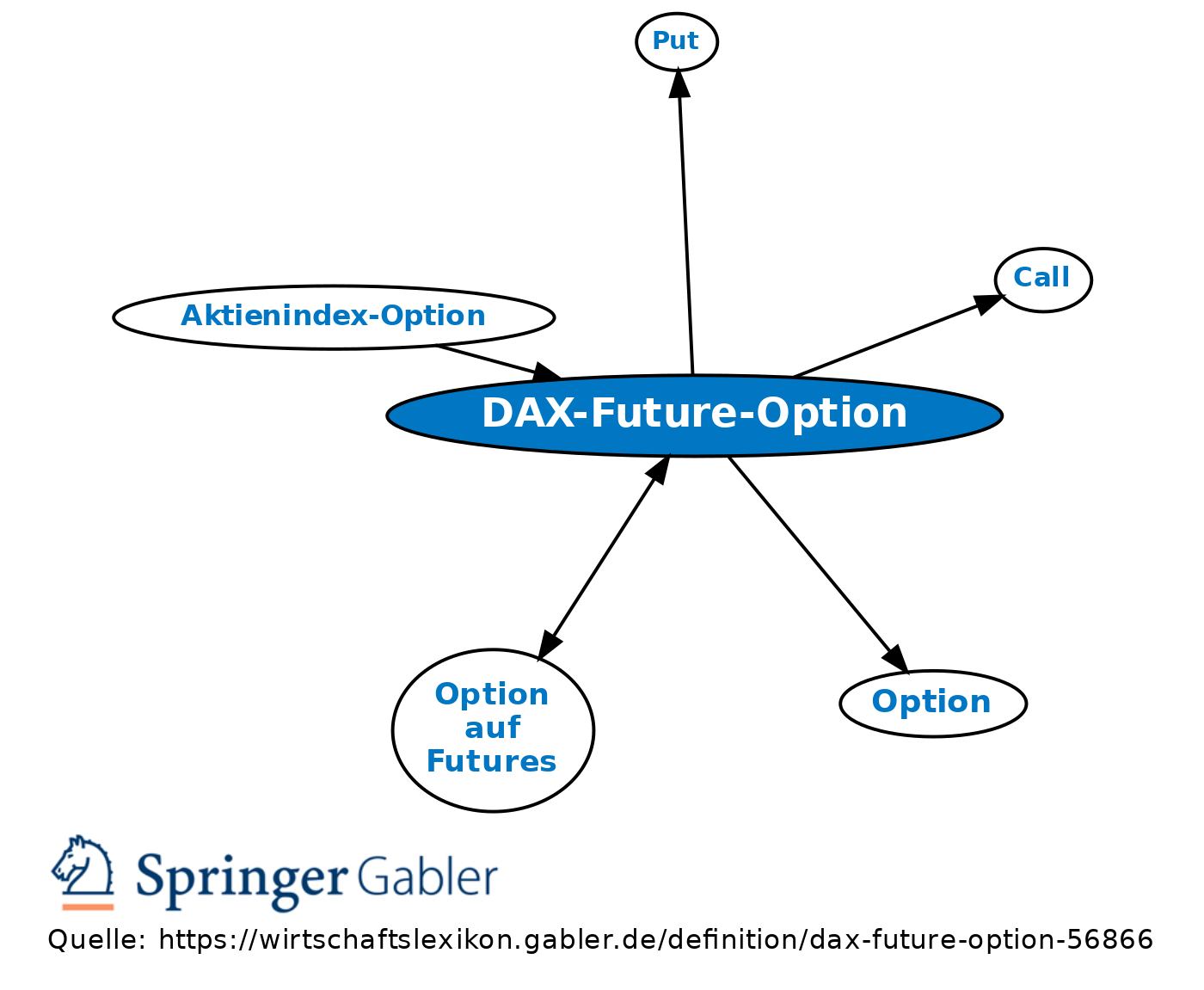

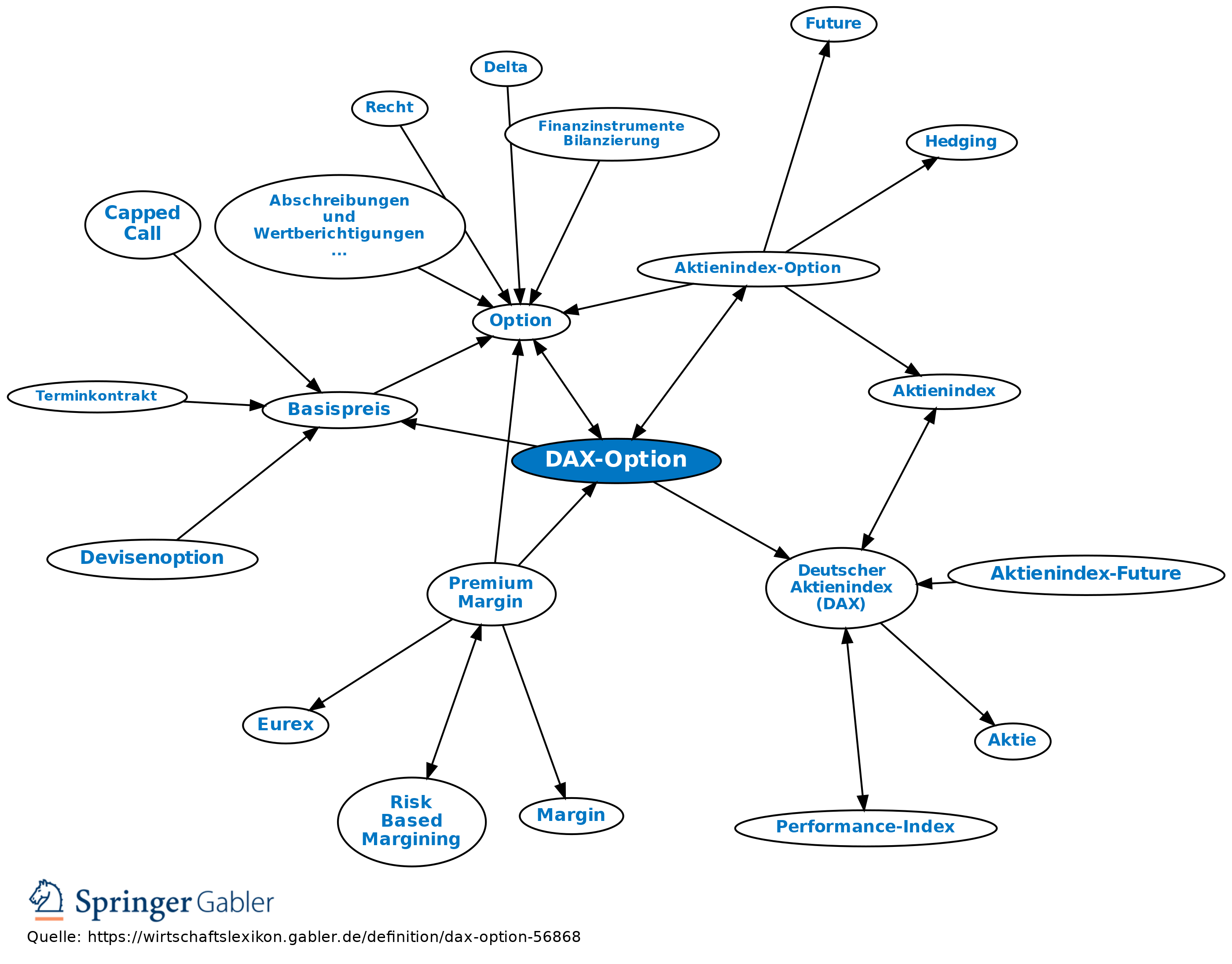

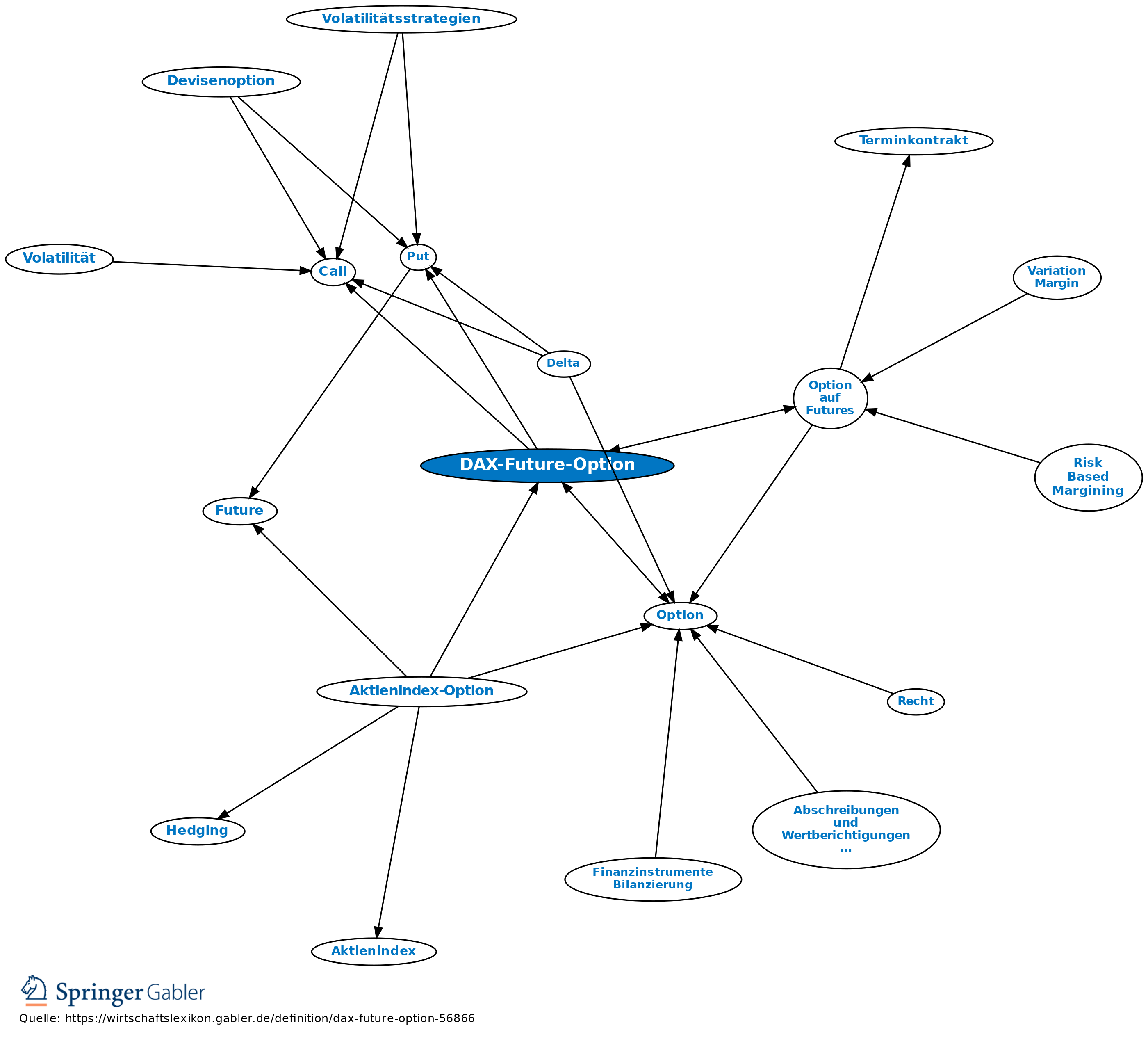

Dax Future Option Definition Gabler Banklexikon

Dax Weekly Options Set And Forget Strategy Page 3 Indices And Macro Events Ig Community

Dax Vs Power Query Static Segmentation In Power Bi Dax Power Query Powered Solutions

Exporting Data From Power Bi Desktop To Excel And Csv Part 1 Copy Paste And Dax Studio Methods

When Is 22 True Powerbi Dax Search Within If Statements 5minutebi

Why I Still Teach Dax In Excel My Lament To Microsoft P3

Gamma Options Griechen Online Broker Lynx

Q Tbn And9gcsnz0jh9fdirnd3kecyf3jnsysddegiartdogmf33z2nw5lgrkw Usqp Cau

Directquery Connection In Power Bi How Does It Work Limitations And Advantages Radacad

/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Protective Put Definition

Four Power Bi Dax Tricks We Can T Live Without Sensei Project Solutions

Import Data From Tabular Model In Excel Using A Dax Query Sqlbi

Dax Weekly Options Set And Forget Strategy Page 3 Indices And Macro Events Ig Community

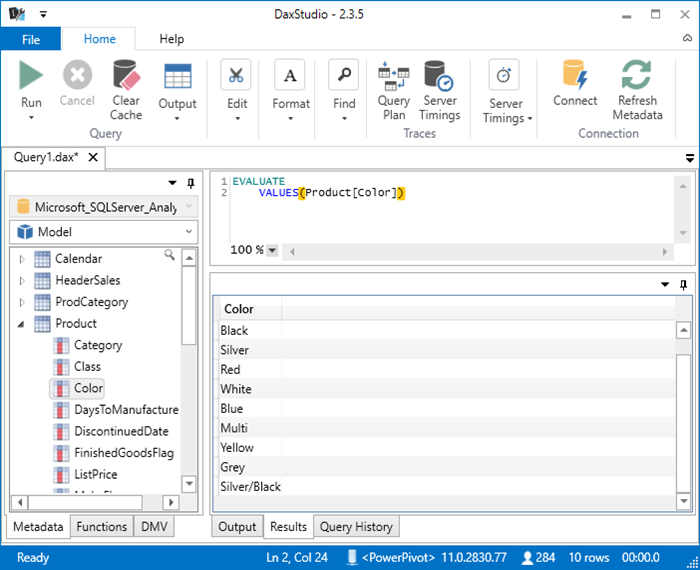

Getting Started With Dax Studio Excelerator Bi

Gamma Options Griechen Online Broker Lynx

Germany S Dax To Get Bigger Stricter After Wirecard Fiasco

2

Dax Option Definition Gabler Banklexikon

Dax Studio Cannot Connect To Power Bi Issue 1 Daxstudio Daxstudio Github

Sql Server Reporting Services Report Builder With Dax Query Support

Is It Possible To Trade Forex Options

Getting Started With Dax Studio Excelerator Bi

Solved Which Is The Best Place To Perform Calculations Microsoft Power Bi Community

Power Bi Dax Tutorial 21 5 Tricks For Top Power Bi Dashboards

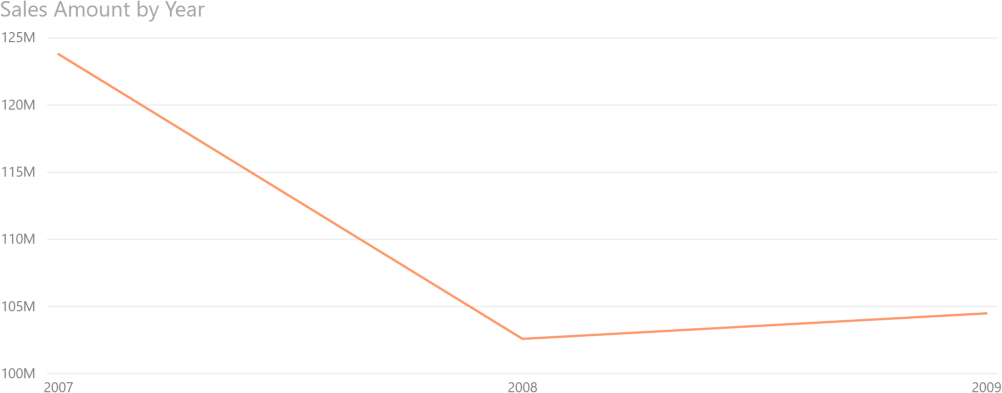

Dax 30 Germany April Review Dax Performance Roovestor

Dax In Power Bi Functions You Need To Be Aware Of Dataflair

Mighty Dax Attempting Something The Market Ear

Quick Tips Export Power Bi Desktop And Power Bi Service Model Data In One Shot With Dax Studio

New External Tool To Create Practice Datasets Software Tools Enterprise Dna Forum

Power Bi Dax Tutorial 21 5 Tricks For Top Power Bi Dashboards

Dax Data Savvy

Implied Volatility Patterns For Dax Options Traded On June 1994 Download Scientific Diagram

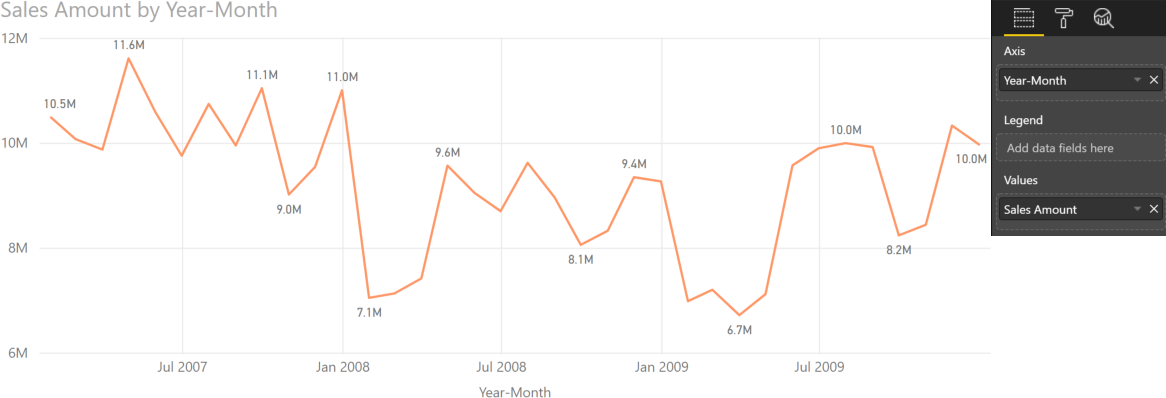

Improving Timeline Charts In Power Bi With Dax Sqlbi

2

Dax Put Prices From Training Grid Red Points And Testing Grid Blue Download Scientific Diagram

Power Bi Dax Measures For Excel Based Of Column Total Or Of Row Total Reporting Analytics Made Easy With Fourmoo And Power Bi

Dax Switching Subtotals On Off Dynamically Using Dax In Powerpivot P3

Selling Dax With Weekly Options Put Spread Indices And Macro Events Ig Community

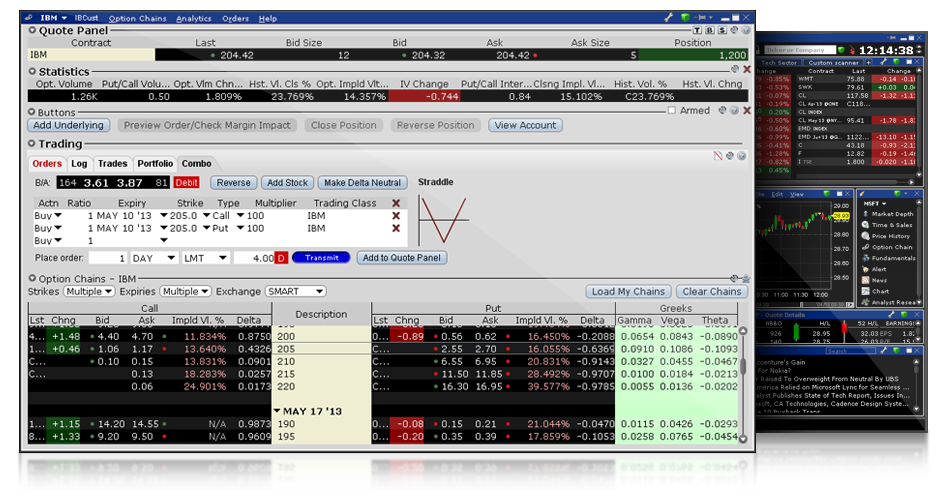

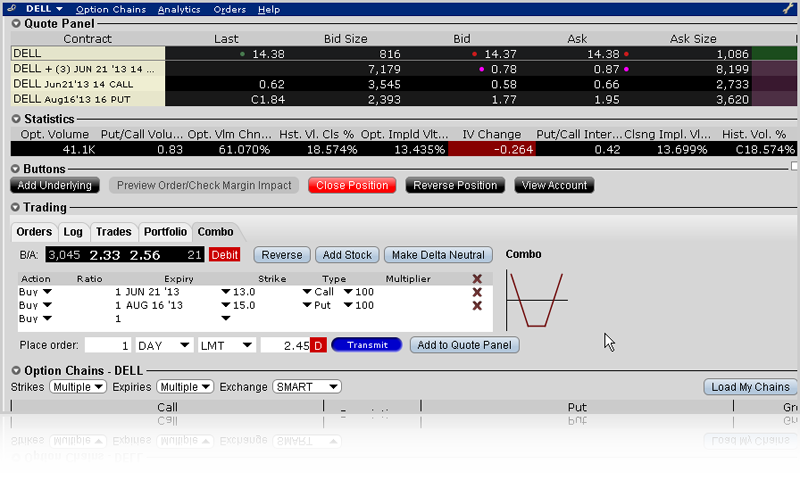

Optiontrader For Option Trading Interactive Brokers Llc

European Stocks Rally With Dax Turning Positive For The Year

Dax In Power Bi Functions You Need To Be Aware Of Dataflair

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-02_2-8c2ed26c672f48daaea4185edd149332.png)

Protective Put Definition

Creating Forward Forecasts In Power Bi Using Dax Enterprise Dna

Power Bi Filter How To Use Filter Dax Function In Power Bi

2

Cracking Dax The Earlier And Rankx Functions Simple Talk

Mathematics Free Full Text Volatility Timing Pricing Barrier Options On Dax Xetra Index Html

Objective Trader

Q Tbn And9gctappkb Ji Qkkbo65sx933jz4vi7lcjmn5zaotwwz3tc53v Usqp Cau

Dax Future Option Definition Gabler Banklexikon

Changing Colours Using Dax And Conditional Formatting In Power Bi Data Bear Power Bi Training And Consulting

Mass Influence Lab A Call Option Is Profitable When The Strike Price Is Below The Stock S Market Price Since The Trader Can Buy The Stock At A Lower Price Dax

Dax Hebelzertifikate Isin De Wkn Symbol Dax

Index Options Advantages In Trading Index Options

Dax 30 Germany April Review Dax Performance Roovestor

Mathematics Free Full Text Volatility Timing Pricing Barrier Options On Dax Xetra Index Html

Power Bi Dax Tutorial 21 5 Tricks For Top Power Bi Dashboards

Long Put Option Dax Dax Optionen Verkaufsoptionen Eurex Put Martin Stb At

Creating Measures Using Dax Simple Talk

Q Tbn And9gcslmokc0f0 Mcy1p9xnuvsudwzvzvx31rvhdy6 Ss4flnu3qlcs Usqp Cau

A Small Change In Dax Formatter And In Dax Formatting Rules Sqlbi

Power Bi Dax Beginner S Guide To Dax Functions In Power Bi

Not Sure Why My Dax Isn T Working Powerbi

Iq Option Armenia Home Facebook

Futures Trading Platform Reviews Dax Binary Options

Selling Dax With Daily Options Put Indices And Macro Events Ig Community

Why Is There A Stong Intraday Correlation Between Spot And Vol Quantitative Finance Stack Exchange

Creating Forward Forecasts In Power Bi Using Dax Enterprise Dna

Dax Put Option Beispiel Hebelprodukte

When Is 22 True Powerbi Dax Search Within If Statements 5minutebi

Custom Sort Order Within A Dax Measure

Long Put Option Dax Dax Optionen Verkaufsoptionen Eurex Put Martin Stb At

Selling Dax With Daily Options Put Indices And Macro Events Ig Community

Improving Timeline Charts In Power Bi With Dax Sqlbi

Solving Dax Time Zone Issue In Power Bi Radacad

Dax How To Group Measures Into Numeric Ranges Burningsuit

A Proposal For Visual Calculations In Dax Sqlbi

Solved Re Specifying Thousand Separator Dax Function Microsoft Power Bi Community