Strungmann Family Office

Investors in Ganymed included German investment fund MIG Fonds as the family office of twins Thomas and Andreas Strüngmann, who now hold a large stake in BioNTech The brothers have long been big.

Strungmann family office. Investors in Ganymed included German investment fund MIG Fonds as the family office of twins Thomas and Andreas Strüngmann , who now hold a large stake in BioNTech The brothers have long been. Founded in 08, BioNTech’s financial shareholders include the MIG Fonds, Salvia and the Struengmann Family Office, with the Struengmann Family Office as the majority shareholder. Investors in Ganymed included German investment fund MIG Fonds as the family office of twins Thomas and Andreas Strüngmann, who now hold a large stake in BioNTech The brothers have long been big investors in biotech, having sold their generic drug company Hexal to Swiss drugmaker Novartis NVS, 038%.

Investors in Ganymed included German investment fund MIG Fonds as the family office of twins Thomas and Andreas Strüngmann, who now hold a large stake in BioNTech The brothers have long been big. The consortium of new investors includes Shinhan, Baxter and ATHOS (Strüngmann Family Office), together with Alvogen and Aztiq Pharma as existing shareholders Aztiq Pharma, led by Robert. Investors in Ganymed included German investment fund MIG Fonds as the family office of twins Thomas and Andreas Strüngmann, who now hold a large stake in BioNTech.

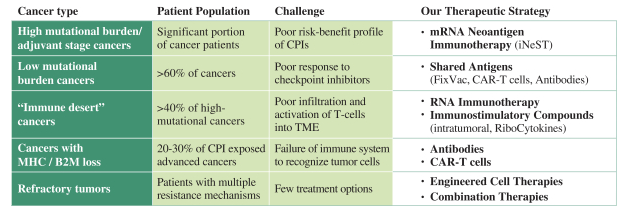

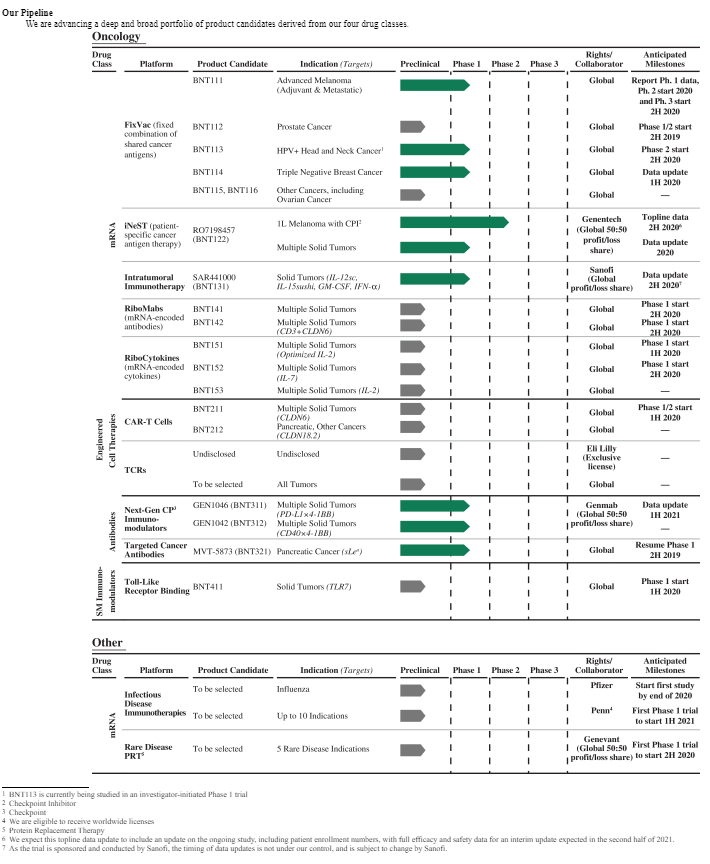

The Highworth Single Family offices Database shows that the brothers are Andreas and Thomas Strüngmann and their family office is Athos Service GmbH Athos Service holds 5033 per cent of BioNTech through an investment vehicle named AT Impf GmbH BioNTech was listed on Nasdaq with a market cap on 9 November at 1400 Eastern Time of $253. Founded in 08, BioNTech’s financial shareholders include the Struengmann Family Office as its majority shareholder, Fidelity Management & Research Company, Invus, Janus Henderson Investors. BioNTech has raised $270 million (€224 million) The series A round positions the German biotech to mount a multifront attack on cancer, spearheaded by mRNA therapies and supported by a clutch.

Andreas and Thomas Strüngmann and their Single Family Office;. An example of alternative investment choice is the inspirational investors behind the BioNTech/Pfizer COVID19 vaccine, the Strüngmann brothers who actively invest in the pharmaceuticals industry through their Family Office The Strüngmann brothers are one of the few SingleFamily Offices globally who have a single holding in their portfolio. Helmut Jeggle serves as Managing Director at ATHOS Service GmbH, the Family Office of the Strüngmann brothers In this role, he has been responsible for the pharma and life sciences sector since July 07 Helmut serves as a Chairman of the Supervisory Board of BioNTech AG and Sidroga AG, and is member of numerous other supervisory boards.

This is now paying off The "Strüngmann Family Office" is the majority shareholder today * Merkurde is part of the IppenDigital network Corona vaccine CureVac, BioNTech and IDT Biologika receive money from the federal government. Athos Service GmbH, control BioNTech holding 5033% through investment They have significantly funded the company and it appears it has massively paid off, of course from a public health perspective, but financially too. The brothers set up their family office, Athos Service , soon after Novartis AG announced in 05 it was buying their drugmaker, Hexal, along with their stake in affiliate EON Labs for a combined.

Santo Venture Capital, the VC arm of the Strüngmann family office, is to increase its stake in online home move and removal booking platform Movinga,Expansion,DACH,Consumer ,Germany,Earlybird,Rocket Internet. The fund raising was upsized and was led by Fidelity Management & Research Company with participation from both new and existing investors, including Redmile Group, Invus, MiraeAsset Financial Group, Platinum Asset Management, Jebsen Capital, Steam Athena Capital, BVCF Management and the Struengmann Family Office. Movinga, a platform for moving services, has raised €22 million from a number of investors New backers Santo Venture Capital, of the Strüngmann family office, will invest €9 million and previous investors Earlybird Venture Capital and Rocket Internet will provide €44 million.

Willett Advisors, the family office of Michael Bloomberg, invested in a biotech company called Finch Therapeutics Group RNT Capital, the family office of Ratan Tata, invested in an India biotech group called Axio Biosolutions Strüngmann Family Office, the investment group of the Strüngmann brothers, invested in BioNTech, a German biotech group. In 05, Andreas Struengmann and twin brother Thomas sold their generic drugmaker Hexal (plus a stake in Eon Labs) to Novartis for some $7 billion They cofounded Hexal in 1986 The company. "Ugur is the visionary who shows us the future, and Özlem then tells us how to get there," said Helmut Jeggle, BioNTech supervisory board chairman and manager of the Strüngmann family office.

Issuer Business Deal Size Market Cap. "Ugur is the visionary who shows us the future, and Özlem then tells us how to get there," said Helmut Jeggle, BioNTech supervisory board chairman and manager of the Strüngmann family office The brothers, he said, were happy to give the two scientists broad strategic leeway. We also recently reported on the Single Family Office with a controlling stake in the company which has since become one of the few Family Offices across the world with a single holding in their portfolio valued at over $12BN But while the Strüngmann brothers at Athos Service GmbH deservedly celebrate, several hedge funds are regrettably.

For the biopharma industry investment, business development and competitive intelligence professionals who require information to support financing, partnering and licensing activities, BCIQ provides accurate information and context to support profitable and strategic decision making Unlike other intelligence solutions, BCIQ exclusively supports the unique needs of the biopharma industry and. Founded in 08, BioNTech is privately held and shareholders include the MIG Fonds, Salvia, and the Strüngmann Family Office, with the Strüngmann Family Office as the majority shareholder. The family office of the Reitans, who control one of Norway’s biggest businesses, the Reitan Group Only recently set up, Reitan Kapital is managed by a family member, Magnus Reitan Waycrosse The family office of members of the Cargills and MacMillans, who control the huge agricultural trading group, Cargill.

Alvotech’s shareholder base includes, among others, Aztiq Pharma, led by founder and Chairman Mr Robert Wessman, Fuji Pharma from Japan, Shinhan from Korea, Baxter Healthcare SA, YAS Holdings. An dem 08 gegründeten Unternehmen Biontech war das Family Office von Andreas und Thomas Strüngmann mit einem Startkapital von rund 180 Millionen USDollar beteiligt Noch im Juli gehören etwa 50 Prozent an Biontech der Vermögensverwaltung der beiden Unternehmer. Issuer Business Deal Size Market Cap.

Strüngmann Family Office – Santo Holding (und Athos Service) im Portrait 11 November 18 Es gibt in Deutschland milliardenschwere Unternehmerfamilien, die in der Öffentlichkeit wenig von sich reden machen und dennoch zielstrebig ihren Reichtum mehren Nur wenn wieder mal eine große Transaktion stattfindet, gerät ihr Name in die. “Ugur is the visionary who shows us the future, and Özlem then tells us how to get there," said Helmut Jeggle, BioNTech supervisory board chairman and manager of the Strüngmann family office. Movinga, a platform for moving services, has raised €22 million from a number of investors New backers Santo Venture Capital, of the Strüngmann family office, will invest €9 million and previous investors Earlybird Venture Capital and Rocket Internet will provide €44 million.

Founded in 08, BioNTech is privately held and shareholders include the MIG Fonds, Salvia, and the Strüngmann Family Office, with the Strüngmann Family Office as the majority shareholder Information about BioNTech is available at wwwbiontechde Bayer Science For A Better LifeBayer is a global enterprise with core competencies in the Life. Helmut Jeggle serves as Managing Director at ATHOS Service GmbH, the Family Office of the Strüngmann brothers In this role, he has been responsible for the pharma and life sciences sector since July 07 Helmut serves as a Chairman of the Supervisory Board of BioNTech AG and Sidroga AG, and is member of numerous other supervisory boards. The fundraising was upsized and was led by Fidelity Management & Research Company with participation from both new and existing investors, including Redmile Group, Invus, MiraeAsset Financial Group, Platinum Asset Management, Jebsen Capital, Steam Athena Capital, BVCF Management and the Struengmann Family Office Twothirds of the funding came.

BioNTech came to the venture market relatively late, having relied on $180 million in seed capital from a family office for the first 10 years of its life. Founded in 08, BioNTech is privately held and shareholders include the MIG Fonds, Salvia, and the Strüngmann Family Office, with the Strüngmann Family Office as the majority shareholder. Thomas and Andreas Strüngmann are among the most outstanding entrepreneurs in the pharmaceutical industry In the mid1980s, they founded HEXAL AG, the largest German generic drug company, which they subsequently sold in 05 to Novartis for USD 75 billion, along with their shares in USbased Eon Labs.

The Series B, which also happens to be the largest completed biotech transaction in the world so far this year, was led by Fidelity with participation from investors including BVCF, Steam Athena Capital and the company's majority shareholder, the Struengmann Family Office. BioNTech came to the venture market relatively late, having relied on $180 million in seed capital from a family office for the first 10 years of its life. Athos Group is a highly regarded provider of trust and corporate services for private clients, entrepreneurs and family owned businesses Athos Group operates as an international trust boutique with offices in key locations worldwide, including Cyprus, Czech Republic, Liechtenstein, Malta, The Netherlands, Switzerland and the Caribbean As an independent group, we work with a selection of tax.

Another prominent family officebacked biotech group is the Germanbased Biontech, which claims to be Europe’s biggest privatelyheld biotech group Biontech’s biggest shareholder is the Strüngmann Family Office, which is owned by the brothers Thomas and Andreas Strüngmann The brothers sold their pharma company Hexal for more than $7. Investors in Ganymed included German investment fund MIG Fonds as the family office of twins Thomas and Andreas Strüngmann, who now hold a large stake in BioNTech The brothers have long been big investors in biotech, having sold their generic drug company Hexal to Swiss drugmaker Novartis NVS, 038%. Founded in 08, BioNTech’s financial shareholders include the Struengmann Family Office as its majority shareholder, Fidelity Management & Research Company, Invus, Janus Henderson Investors, MIG Fonds, Redmile Group, Salvia and several European family offices For more information, please see wwwbiontechde.

Biontech’s biggest shareholder is the Strüngmann Family Office, which is owned by the brothers Thomas and Andreas Strüngmann The brothers sold their pharma company Hexal for more than $7 billion in 05 “ But biotech investing isn’t for orphans and widows, and even some of the most experienced investors can get burnt ”. Backers include the Strüngmann family office (49%), MIG Fonds (6%), and Fidelity Investments (5%) 6 Biotechs on the Renaissance IPO Calendar;. Athos Service GmbH, control BioNTech holding 5033% through investment.

The Struengmann Family Office, an existing investor in BioNTech, also participated in the capital raise BioNTech will use the capital to further advance its clinical pipeline of individualized immunotherapies covering a number of new approaches including mRNA and CART / TCell receptors for the treatment of cancer and other diseases with high. The fundraising was upsized and was led by Fidelity Management & Research Company with participation from both new and existing investors, including Redmile Group, Invus, MiraeAsset Financial Group, Platinum Asset Management, Jebsen Capital, Steam Athena Capital, BVCF Management and the Struengmann Family Office Twothirds of the funding came. Investors in Ganymed included German investment fund MIG Fonds as the family office of twins Thomas and Andreas Strüngmann, who now hold a large stake in BioNTech.

Struengmann Family Office Germany BioNTech Raises USD$325M in Series B Financing Published on July 9, 19 By FinSMEs Germany BioNTech Completes $270M Series A. This is now paying off The "Strüngmann Family Office" is the majority shareholder today * Merkurde is part of the IppenDigital network Corona vaccine CureVac, BioNTech and IDT Biologika receive money from the federal government. HT Family Office (HTFO) was established in 1999 The management team is situated in Beijing and Hong Kong HTFO covers a fullspectrum of strategies in different sectors (Healthcare, IT, AI, TMT etc), at different stages (early stage VC, late stage VC, PE fund and PE FOF etc) and in different regions (US, EU, Israel and Asia) by both co.

Backers include the Strüngmann family office (49%), MIG Fonds (6%), and Fidelity Investments (5%) 6 Biotechs on the Renaissance IPO Calendar;. Andreas Strüngmann (born 1950) is a German businessman and founded generic drug maker Hexal AG ($16 billion sales during 04) in 1986 It became Germany's secondlargest generic drug producer In February 05, he and his brother Thomas sold Hexal and their 677% of US Eon Labs to Novartis for $75 billion, making Sandoz the largest genericdrug company in the world. Santo Venture Capital, the VC arm of the Strüngmann family office, is to increase its stake in online home move and removal booking platform Movinga,Expansion,DACH,Consumer ,Germany,Earlybird,Rocket Internet.

On January 1, 08, Private venture capital for seed was raised in teh amount of 2,935,005 led by the Struengmann Family Office, and other funders, followed by a round of Series A funding in January 4, 18, led by the Redmile Group In July of 19, a round of series B funding led by Fidelity and the Redmile Group raised an additional. Santo Venture Capital serves as family office for the Strüngmann brothers, which sold their pharma company for multiple billions of euros Santo Venture Capital is one of Germany’s most active venture capital single family offices with many major investments in pharma and growth companies Sources Deutsche Startups, Icons8 team. On January 1, 08, Private venture capital for seed was raised in teh amount of 2,935,005 led by the Struengmann Family Office, and other funders, followed by a round of Series A funding in January 4, 18, led by the Redmile Group In July of 19, a round of series B funding led by Fidelity and the Redmile Group raised an additional.

Founded in 08, BioNTech’s financial shareholders include the MIG Fonds, Salvia and the Struengmann Family Office, with the Struengmann Family Office as the majority shareholder. Founded in 08, BioNTech’s financial shareholders include the MIG Fonds, Salvia and the Struengmann Family Office, with the Struengmann Family Office as the majority shareholder. Santo Venture Capital serves as family office for the Strüngmann brothers, which sold their pharma company for multiple billions of euros Santo Venture Capital is one of Germany’s most active venture capital single family offices with many major investments in pharma and growth companies Sources Deutsche Startups, Icons8 team.

It seems behind the brilliant scientists at BioNTech sit two brothers in a Single Family Office in Munich Andreas and Thomas Strüngmann and their Single Family Office;. HT Family Office (HTFO) was established in 1999 The management team is situated in Beijing and Hong Kong HTFO covers a fullspectrum of strategies in different sectors (Healthcare, IT, AI, TMT etc), at different stages (early stage VC, late stage VC, PE fund and PE FOF etc) and in different regions (US, EU, Israel and Asia) by both co. ATHOS Service GmbH is the family office of Thomas und Andreas Strüngmann ATHOS Service GmbH is based in Munich, Germany Lists Featuring This Company Family Investment Offices with Investments in European Union (EU).

In 05, Thomas Strüngmann and his twin brother Andreas sold the generic drug manufacturer Hexal to the Baselbased pharmaceutical company Novartis for more than € 5 billion As a result, the brothers founded their family office at Rosenheimer Platz in Munich and thought about which industry would be able to reinvest part of the sales proceeds. Strüngmann single family office as majority shareholder and important biotech investor The Strüngmann brothers invested in BioNTech through their family office ATHOS Service from early on Today, they are the largest shareholder of the Mainzbased company Other investors of BioNTech include MIG Fonds, Redmile Group or Janus Henderson Investors. The Highworth Single Family offices Database shows that the brothers are Andreas and Thomas Strüngmann and their family office is Athos Service GmbH Athos Service holds 5033 per cent of BioNTech through an investment vehicle named AT Impf GmbH BioNTech was listed on Nasdaq with a market cap on 9 November at 1400 Eastern Time of $253.

Sec Filing Biontech

Merger Between Widex And Sivantos Receives Final Clearance From Ec Sivantos

Here Are 5 Things To Know About Biontech And The Married Couple Behind The Covid 19 Vaccine Developed With Pfizer Marketwatch

Strungmann Family Office のギャラリー

Family Offices And The Biotech Nexus One Big Deal And Others Await Family Capital

Brothers Build 22 Billion Fortune On Hope For Covid 19 Vaccine

Everything You Need To Know About Biontech And The Married Couple Behind The Covid 19 Vaccine At The Front Of A Global Race The Broker Times

Here Are 5 Things To Know About Biontech And The Married Couple Behind The Covid 19 Vaccine Developed With Pfizer Marketwatch

Associated Institute Ernst Strungmann Institute Esi For Neuroscience Max Planck Gesellschaft

German Billionaire Thomas Struengmann Says A Coronavirus Vaccine From His Biotech Firm Would Be A Dream Come True

Boxine Company Information Funding Investors Dealroom Co

Boxine Company Information Funding Investors Dealroom Co

Biotechnology Sector A German Trailblazer Developing Cancer Vaccines

Why Asset Managers Are Increasingly Offering Multi Family Office Services

Michael Riemenschneider Jetzt Bei Athos Family Office Der Bruder Strungmann Fyb Financial Yearbook

Strungmann Group Invests In Further Expansion Of Cortec Cortec Thinking Ahead Innovationen Im Bereich Neurotechnologie Cortec Thinking Ahead Innovationen Im Bereich Neurotechnologie

Admin Autor Bei Familyofficehub Io Page 12 Of 27

Covid 19 Vaccine News Struengmann Brothers Win With Biontech Pfizer Pfi Shot Bloomberg

Strungmann Single Family Office Invests In German Company Biontech

Family Offices And The Biotech Nexus One Big Deal And Others Await Family Capital

Philippines Prepares To Evacuate Citizens In Middle East

Strungmann Bruder Wir Sind Keine Couponschneider Manager Magazin

Helmut Jeggle Glycotope

Strungmann Single Family Office Invests In German Company Boxine

Strungmann Bruder Beteiligen Sich An Biotech Unternehmen

Siemens Purchased By Eqt And Strungmann Family Hearing Review

F 1

Why Setting Up A Family Office Can Make You More Money Creation

Family Office Wem Reiche Ihr Geld Anvertrauen Manager Magazin

Strungmann Bruder Wir Sind Keine Couponschneider Manager Magazin

Sivantos And Widex Merge To Create Global Hearing Aid Leader Sivantos

Family Offices And The Biotech Nexus One Big Deal And Others Await Family Capital

Update Here Are 5 Things To Know About Biontech And The Married Couple Behind The Covid 19 Vaccine With Pfizer

New Managing Director At One Of Europe S Biggest Family Offices Family Capital

European Biopharma Scales New Heights In With 12 7b Equity Investment 21 01 05 Bioworld

Sivantos And Widex Complete Merger New Company Ws Audiology Sivantos

New Managing Director At One Of Europe S Biggest Family Offices Family Capital

Family Office Portraits Archive Familyofficehub Io

William Hill Stock Reaches Record High As It Strikes Big Us Sports Deal

Single Family Office Archive Page 14 Of 19 Familyofficehub Io

Miwkfd Zixzhnm

Uk Gives Green Light To Family Office Controlled Biontech Vaccine Agreus

V4y9h2xu4rjvvm

Sy Investing Bntx Biontech Filed For A 100m Ipo German Mrna Oncology Collabs W Rhhby Sny Gmab Lly Bayn Pfe Genevant Raised 1 3b To Date Aggregate

Sy Investing Bntx Biontech Filed For A 100m Ipo German Mrna Oncology Collabs W Rhhby Sny Gmab Lly Bayn Pfe Genevant Raised 1 3b To Date Aggregate

Strungmann Bruder Wir Sind Keine Couponschneider Manager Magazin

Armira Investor Portfolio Rounds Team Dealroom Co

Sivantos And Widex Announce Plans To Merge

Biotech Archive Familyofficehub Io

Family Offices And The Biotech Nexus One Big Deal And Others Await Family Capital

Coronavirus Tegernseer Investor Plant Impfstoff In Lichtgeschwindigkeit Tegernsee

Miwkfd Zixzhnm

Admin Autor Bei Familyofficehub Io Page 12 Of 27

Boxine Company Information Funding Investors Dealroom Co

Jeremy Coller Single Family Office Invests In 3d Protein Printer Firm

Exclusive The Single Family Office Behind World S First Successful Covid 19 Vaccine Trial

New Managing Director At One Of Europe S Biggest Family Offices Family Capital

Family Offices And The Biotech Nexus One Big Deal And Others Await Family Capital

Miwkfd Zixzhnm

Family Offices How The Rest Of The Reimanns Invest Their Inherited Fortune

Intellasia East Asia News Alvotech Announces Private Placement Financing

Family Office Portraits Archive Familyofficehub Io

Family Office Portraits Archive Familyofficehub Io

Strungmann Single Family Office Invests In German Company Biontech

Boxine Company Information Funding Investors Dealroom Co

Alvotech Announces Private Placement Financing Setting A New Standard In Biosimilars

Finding The Corona Vaccine Is A Race Against Time Archyde

Andreas Struengmann Family

V4y9h2xu4rjvvm

Www Sivantos Com Wp Content Uploads Sites 138 19 02 Sivantos And Widex Successfully Complete Merger Pdf

F 1

Strungmann Family Office Santo Holding Und Athos Service Im Portrait

Thomas Struengmann Family

Miwkfd Zixzhnm

V4y9h2xu4rjvvm

New Managing Director At One Of Europe S Biggest Family Offices Family Capital

Family Offices And The Biotech Nexus One Big Deal And Others Await Family Capital

Family Offices And The Biotech Nexus One Big Deal And Others Await Family Capital

New Managing Director At One Of Europe S Biggest Family Offices Family Capital

Biotech Investor Strungmann Zero Opportunities In Germany Archyde

Family Office Portraits Archive Familyofficehub Io

New Managing Director At One Of Europe S Biggest Family Offices Family Capital

Strungmann Bruder Beteiligen Sich An Biotech Unternehmen

The Single Family Office Behind The Covid 19 Vaccine Agreus

Armira Investor Portfolio Rounds Team Dealroom Co

Bioeq Com The Strungmann Group

Singapore Family Office Acquires Munich Office Building For 350m

Www Luxempart Lu Sites Default Files Medias Document 07 Luxempart Invests In Boxine Gmbh Pdf

2

Strungmann Bruder Beteiligen Sich An Biotech Unternehmen

Siemens Purchased By Eqt And Strungmann Family Hearing Review

Family Offices How The Rest Of The Reimanns Invest Their Inherited Fortune

Astellas Snaps Up Cancer Antibody Play Ganymed For Up To 1 4b Fiercebiotech

Biocentury Biontech Ipo Filing Says Trade War Hong Kong Unrest May Be Delaying 100m Of Series B

Alvotech Alvotech Ccht Biopharmaceutical And Yangtze River Pharmaceutical Agree On An Exclusive Biosimilar Partnership In China Setting A New Standard In Biosimilars

Siemens Purchased By Eqt And Strungmann Family Hearing Review

Family Office Portraits Archive Familyofficehub Io

New Managing Director At One Of Europe S Biggest Family Offices Family Capital

European Family Offices Get Serious About Backing Startups Family Capital

Discover The Digital Health Company Taking Disease Management A Step Further

Thomas Andreas Strungmann Bloomberg