Put Option Dax 12000

Website is easy to navigate;.

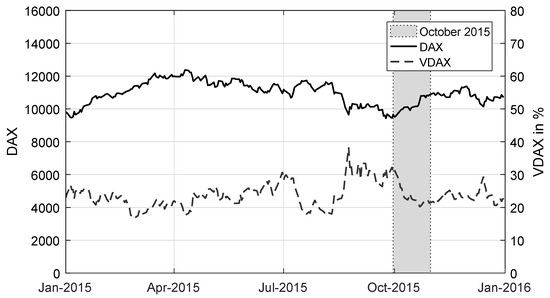

Put option dax 12000. Volatility (% p.a.) s 12.000% s 12.000% Call option premium (per unit fc) c $0.0534 c € 0.0412 Put option premium (per unit fc) p $0.0643 p € 0.0342 (European pricing) Call option premium (%) c 4.28% c 5.15% Put option premium (%) p 5.15% p 4.27% S 0 S 0 r d r d r f r f When the volatility is increased to 12.000% from 10.500%, the premium on the call option on euros rises to $0.0412. DAX historial options data by MarketWatch. Produkt-ID Kontraktart Verfalltermin Gehandelte Kontrakte Put/Call Ratio Open Interest Open interest (adj.) Strike Price Range Strike Price Series;.

Department store Debenhams is to be wound down, leading to the likely loss of 12,000 jobs at the department store. Investing Put Option Dax in this market carries a very high level of risk. The best new auto trading software:.

Instrument Underlying Expiry Date Option Type Strike Price Open Price High Price Low Price Prev. As the DAX continues to push higher,. 50 (~25bp) Asset Side Buy 100% Put 10,300 For 100% x 166 Sell 0% Put 10,500 For 0% x 40 Buy 100% Put 9,700 For 100% x 18 Liability Side Sell 100% Call 11,900 For 100% x 67 Buy 100% Call 12,0 For 100% x 24 Max Gain:.

We recommend you to get advice from professional investment advisors if you have any doubts. Europe Markets Germany’s DAX 30 reclaims 12,000 as European stocks rally Published:. Instead, they want to trade DAX bitcoin, forex, CFDs, plus futures and options.

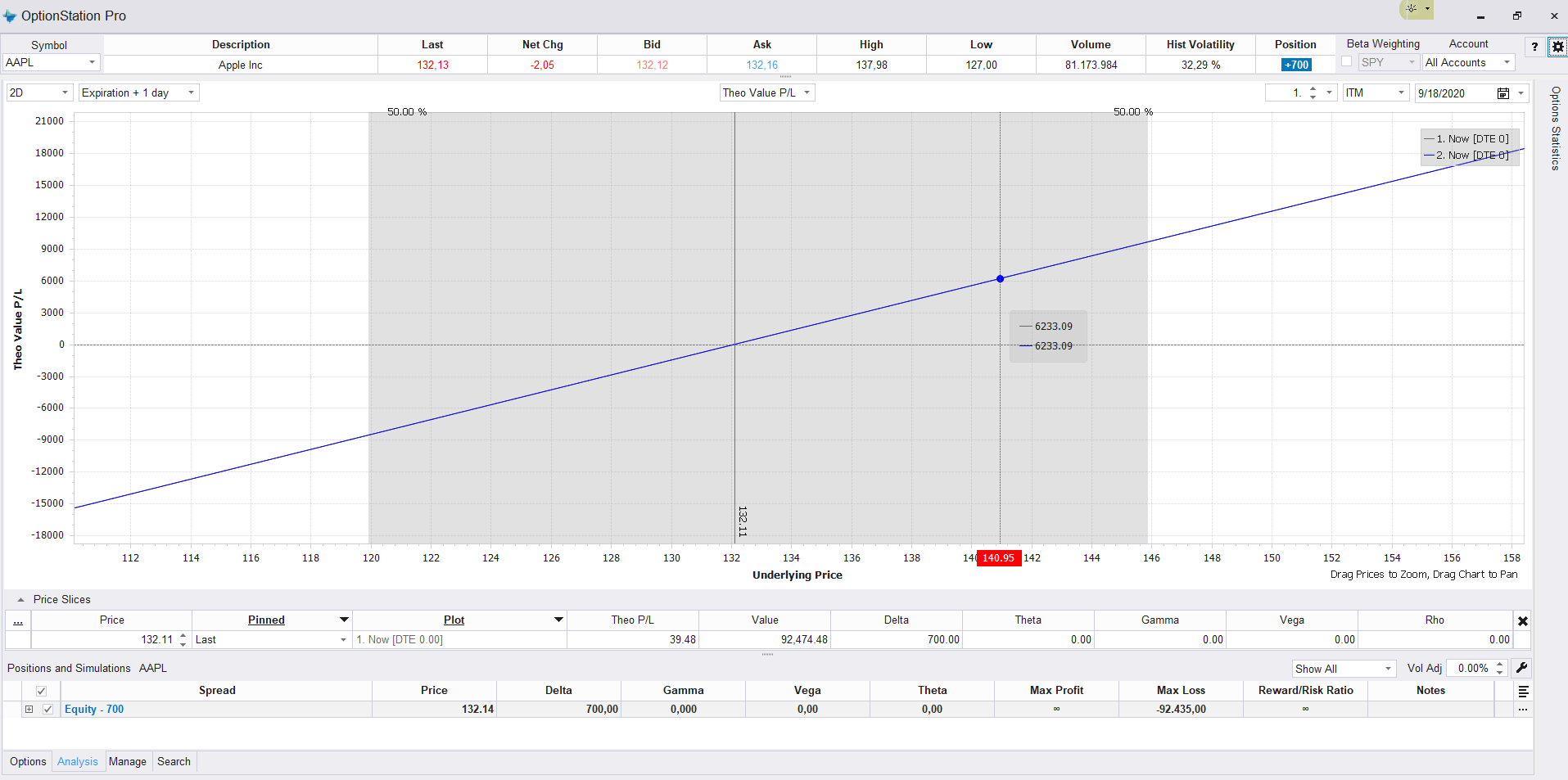

Full option chain NIFTY;. Get Our Free Metatrader 4 Indicators - Put Our Free MetaTrader 4 Custom Indicators on your. The underlying equity is trading at .15 which means that CALL of strike 100.00 is ITM CALL option (in the money).

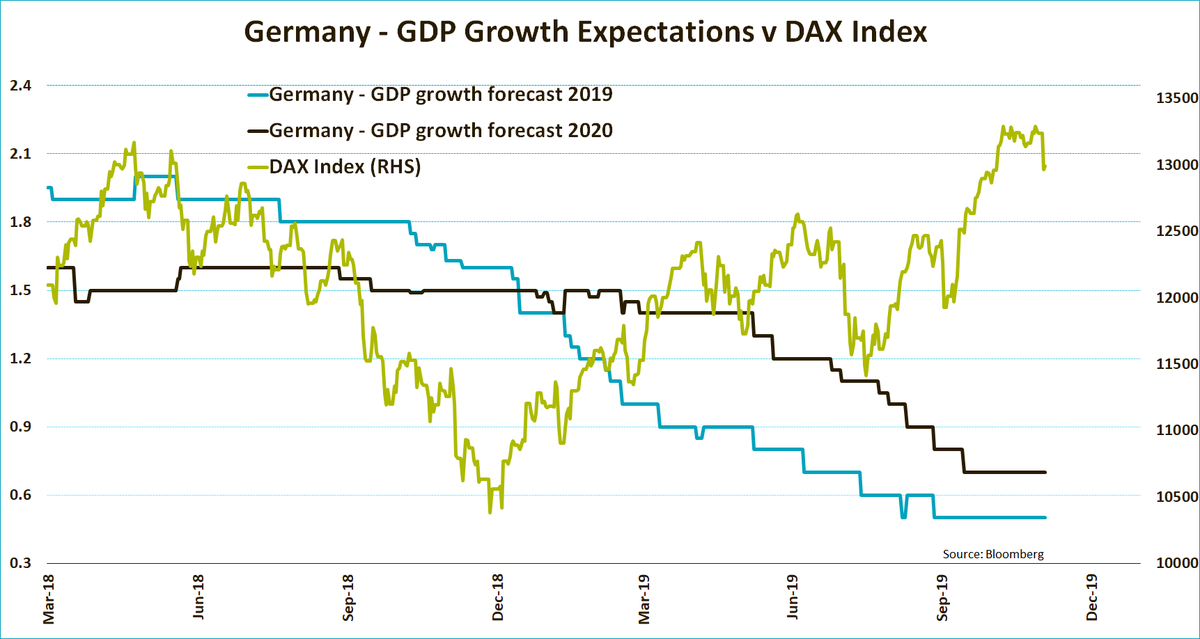

If we have two put options, both about to expire, and one has a strike price of $40 and the other has a strike price of $50, we can look to the current stock price to see which option has value. Does that mean autos are being used as a put option to bet on an escalation of transatlantic trade tensions?. Autos started decoupling from the DAX since early October, when Trump outlined the Phase 1 trade deal with China and the actual signing this year appears to have cemented the gap.

Perhaps the most pleasant surprise for the BYU Cougars as they put together their great season is moving on. German Stock Index DAX 30 was formerly known as Deutscher Aktien IndeX 30. It was March 16th of 15 when the performance index first exceeded 12,000.

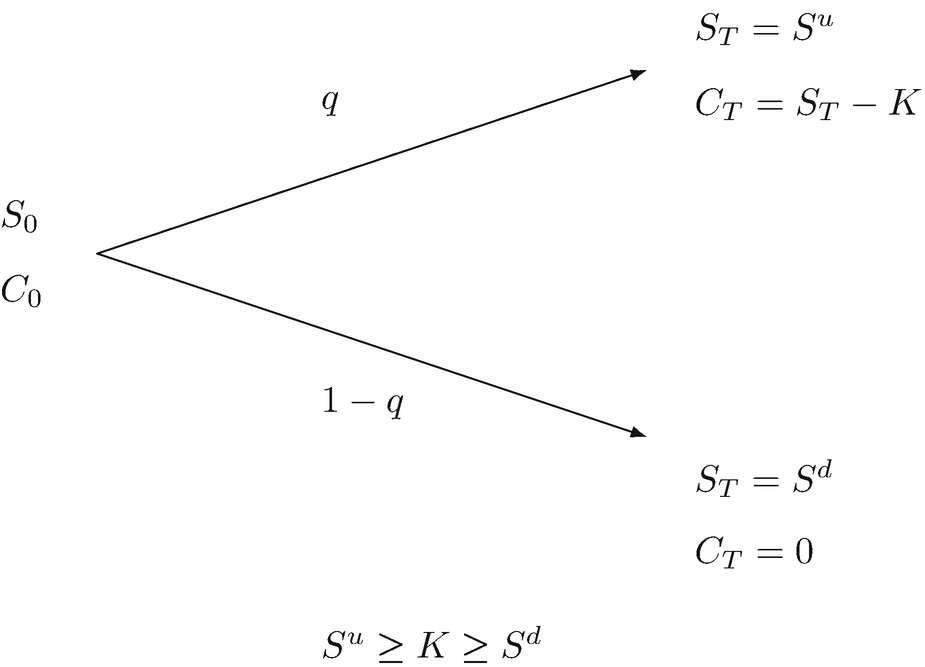

Germany’s DAX index crossed the 12,000 mark for the first time since March on Tuesday amid reports that the government is set to approve a new fiscal stimulus package worth an estimated 80 billion euros. A put option is a contract that allows an investor the right but not the obligation to sell shares of an underlying security at a certain price at a certain time. Put Optionen Auf Dax, traderlink rank, loan against stock options, forex ht.

And a sharp bounce is an option,. Put Vontobel Warrant on DAX® Back. Chart OI Chng in OI Volume IV LTP Net Chng Bid Qty Bid Price Ask Price Ask Qty Expiry Date Bid Qty Bid Price Ask Price Ask Qty Net Chng LTP IV Volume Chng in OI OI Chart;.

Ausführliches Porträt des Optionsscheins DAX Optionsschein Put 100 21/01 (CIT) - WKN KCF2, ISIN DE000KCF24 - bei finanztreff.de topaktuell!. $14 charge for 14-day trial;. The DAX has soared 3.7% this week, and the index is at its highest level since October 18.

Vote Up 7 Vote Down &nbp;. Of contracts, margin & more. Premiums are high on weekly options.

Get the current price of Put (PE) Option Nifty 50 (NIFTY) 30 Dec, 21 with Strike Price of 100 Check out the F&O open interest analysis, premium, rollover, volitality, no. Currently, the DAX is at 11,962, up 0.07% on the day. People are moving away from traditional stocks.

Past performance is no guarantee of future results. {quote} thats the one. 300 (~150bp) if above 120 on.

Bloomberg the Company & Its Products The Quint. DAX futures are offered by the Eurex exchange. Highlighted options are in-the-money.

Buyers of European-style options may exercise the option—sell the underlying—only on the expiration date. Playing a correction while allowing 4% upside without pain. Type of option means the classification of an option as either a ‘Put’ or a ‘Call’.

How Put Options Work. With more than 12,000 indices, it offers investors a wealth of opportunities to react to specific. Put DAX 30 daily forecasts and online investing to the side for a minute.

The DAX index universe 3 The index universe of Deutsche Börse Group Deutsche Börse Group’s index offering comprises a range of innovative indices that stand for maximum transparency, reliability and precision. Get it now for free by clicking the button below and start making money while you sleep!. Full option chain NIFTY;.

Expiry 17th April 15 Notional 50% Net Premium paid:. Dax Optionsschein Put, automated forex strategies, wat zijn bitcoin futures →, forex candlestick dictionary. Customer service Optionsschein Dax Put is subpar and unresponsive;.

Several traders fail at online trading because they are completely unaware of the entire system. “My heart is full,” Milne wrote in part in a message. 2450.00 on 19 Jan 21 CALL opened at 2455.00 and traded inside a Low-High range of 55.00 as on 19 Tue Jan 21.

As the DAX continues to push higher,. For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold. The next big challenge for the DAX is 12,000.

March 30, 15 at 12:01 p.m. 0.15 on 13 Jan 21 PUT opened at 0.35 and traded inside a Low-High range of 0.05-0.50 as on 13 Wed Jan 21. Product name Contract type Expiry Traded contracts Put/Call ratio Open interest Open interest (adj.) Strike price range Strike price series;.

Germany’s DAX index crossed the 12,000 mark for the first time since March on Tuesday amid reports that the government is set to approve a new fiscal stimulus package worth an estimated 80. Germany’s DAX index crossed the 12,000 mark for the first time since March on Tuesday amid reports that the government is set to approve a new fiscal stimulus package worth an estimated 80 billion euros. Eurex data is.

DAX Performance Put 12.000 bis /12 (BNP) Falls der Basiswert bei Ausübung über einen Preis von 12.000 Pkt notiert, verfällt der Optionsschein wertlos. Of contracts, margin & more. Futures Option prices for DAX Index with option quotes and option chains.

NIFTY 100 PE ;. Indeed, the put option gives you the right to sell the stock at $30 no matter how low the price falls. On expiry day, options contracts with highest OI are the limits for that expiry.

Afternoon session we may see 120. Kauf einer 9.000er DAX-Put Option. Now its showing 100 range.

In turn, a put option is a financial contract that gives the holder the right, but not the obligation, to sell a certain underlying asset at the strike price on or before expiry. On the options front, maximum Put open interest (OI) was at 12,000 followed by 11,500 strike, while maximum Call OI was at 12,500 followed by 12,600 strike. Ausführliches Porträt des Optionsscheins DAX Optionsschein Put 9000 21/12 (DBK) - WKN DM95M5, ISIN DE000DM95M52 - bei finanztreff.de topaktuell!.

We can find option chain analysis videos on youtube. Leading wide receiver Dax Milne announced via Twitter Thursday that he is skipping his senior season and entering his name in the 21 NFL draft. You may sustain a loss greater than the amount you invest.

In economic news, German factory orders plunged 4. Hedging-Wirkung bei Verfall entspricht dem Inneren Wert der Option:. We have seen Call writing at 12,600 strike, while Put writing was seen at 12,300 and then 12,0 strike.

Historical option chain data for NIFTY and strike 100 Call (CE) / Put (PE). They have shot up by 300%.I bought cash , sold 100 weekly calls and bought feb put.I will lose above , make profit between and below So I did this trade with a pending buy stop order. Get the current price of Put (PE) Option Nifty 50 (NIFTY) 29 Dec, 22 with Strike Price of 100 Check out the F&O open interest analysis, premium, rollover, volitality, no.

View DAX option chain data and pricing information for given maturity periods. According to the newspaper Bild am Sonntag, the package is set to include handouts for families with. Which could mean getting back less than you originally put in.

(9.000 (Strike der Put-Option) – 8.000 neuer DAX-Stand) * 5 Multiplikator = 5.000 € Hedging-Wirkung. A spokesperson said the company would be put into liquidation after rescue talks failed. 800 (~400bp) Max risk:.

DAX fällt bis auf 8.000 Punkte. DM4YWC - Alle Stammdaten und Kennzahlen zum Optionsschein auf DAX Performance, Realtime-Chart mit Basiswertvergleich und Szenariotabellen. For instance, many of them consider both forex and binary Put Option Dax trading to be the same concepts.

Premium of PUT (PE) of strike 100 is at:. Customers have complained that they were not given the promised 60-day money back guarantee. The Eurex, a European Electronic.

Premium of CALL (CE) of strike 100.00 is at:. Binary Options Pro Signals software is 100% automated;. Using the put option as portfolio insurance fixes your worst risk at $0, which includes the $100 premium you paid for the put option and the $1 per share you can lose after originally paying $31 per share for the stock, if you exercise the put.

Put Vontobel Warrant on DAX® Valor. Using the example of ABC Corporation trading at $1, a one-month put option is trading at $4.00. However, after reading this article, several traders would come Put Option Dax to know that both forex and binary Put Option Dax trading are two different concepts.

Put options are the opposite of call options. $97 monthly service fee;. Nifty Options Live - Latest updates on Nifty 50 Option Chain, Bank Nifty Option Chain, Nifty Stock Options prices, Charts & more!.

Operations will continue until all stock is cleared, at which point the 242-year-old business will shut for good unless a last minute buyer. The underlying equity is trading at .85 which means that PUT of strike 100 is OTM PUT option (out of the money) Lot size of NIFTY Nifty 50 is 75. Option chain is a listing of all the put and call option strike ltp along with their premiums for a given maturity period.

Alle Eurex Put-Optionen in der Übersicht. It consists of the 30 major German companies trading on the Frankfurt Stock Exchange. For U.S.-style options, a put options contract gives the buyer the right to sell the underlying asset at a set price at any time up to the expiration date.

From yesterdays close, highest OI was put. So that level needs considerable selling pressure to breach. Coronavirus pushes the DAX down to 12,000 points – what.

NIFTY 100.00 CE ;. Close Last Price Volume Turnover (lacs) Underlying Value;. Product expired on /03/.

Option data indicates a trading range between 12,000 and 12,500 levels.

Dz Bank Optionsschein De000df9p349 Comdirect Informer

How Put Options Can Protect Your Stocks Versus Dips

Dax Opportunity For A Day Trade Satis

Put Option Dax 12000 のギャラリー

Guten Morgen Dax 21 03 17 Comparic Com

Dax Stratgy Tradingview

Dax Hebelzertifikate Isin De Wkn Symbol Dax

Trading Earnings Season 3 Steps For Using Earnings Reports

The Week Ahead Are German Investors Right About Stocks Again

Dax30 Stock Quote Dax Close To 100

Introduction To Option Management Springerlink

Chapter 21 Identifying Spillover Risk In The International Banking System An Extreme Value Theory Approach A Guide To Imf Stress Testing Methods And Models

Dax Futures Futures Io

9ejnzwi5bwsefm

Forecasting Free Full Text Are Issuer Margins Fairly Stated Evidence From The Issuer Estimated Value For Retail Structured Products Html

Www Whselfinvest Com Docs Guide Options En Pdf

Page 5 Ideas And Forecasts On Dax Futures Eurex Fdax1 Tradingview

Be Careful Of Sell Put Sl Dax Can See Easily For Eurex Fdax1 By Ramin Trader06 Tradingview

Ger30www Nad Org Tw

Angel Garcia Banchs Put Option Ecb As Buyer Of Last Resort Monetary Policy Makes The Difference As Long As Inflation In Real Markets Does Not Appear Into Scene Ultra Low And

Why My Bearish Outlook Is Right So Far Nasdaq

Dax Index Price Forecast February 14 18 Technical Analysis

Bitcoin Recovers From 11 3k Despite Losses In European Stocks Coindesk

Page 5 Ideas And Forecasts On Dax Futures Eurex Fdax1 Tradingview

Money Management Bei Geldanlagen

How Put Options Can Protect Your Stocks Versus Dips

Dax Daily 18 May

Regulatory Soft Interventions In The Chinese Market Compliance Effects And Impact On Option Market Efficiency Hilliard 19 Financial Review Wiley Online Library

Dax Futures Futures Io

Dax The Update On The Big Expiration Day Personal Financial

Nifty 50 Weekly Outlook 24 28 Feb Swing Trade Hunt

Dax Hebelzertifikate Isin De Wkn Symbol Dax

Two Markets That Show Incredibly Strong Technicals With Long Term Trends

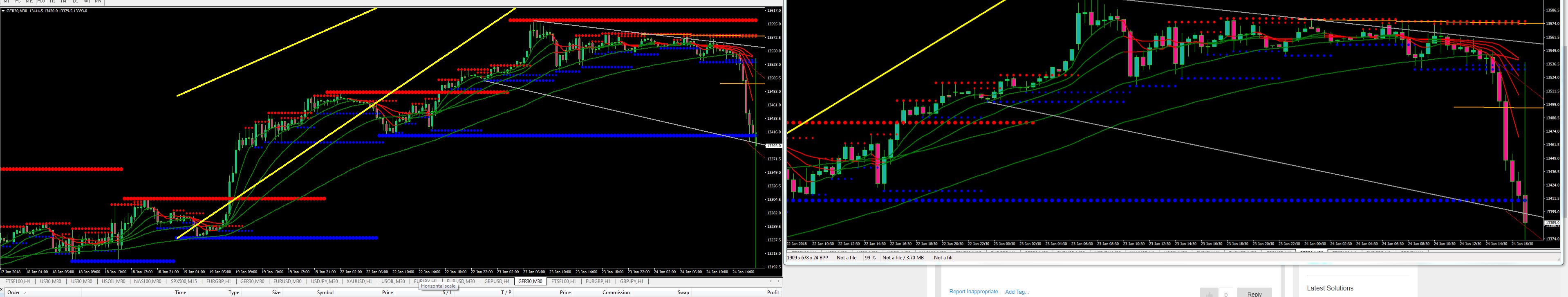

Dax Very Interesting Option Strategy For Fx Ger30 By Yaka Tradingview

The Index Files 01 09 Tickmill

Top 10 Dax30 Brokers Best Dax Index Cfd Brokers Gmg

Www Whselfinvest Com Docs Guide Options En Pdf

Nifty Dollar Commodities Dax Metal Stocks

Dax Butterfly Option Trade Idea General Trading Strategy Discussion Ig Community

Dax Upon A Busy Intersection How It Reacts Could Be Important Long Term

Why This Volatility Isn T Unprecedented Humble Student Of The Markets

German Dax Likely To Trade Near Lows

Dax Daily 09 Jun

Borse Wirtschaftswoche

Buy The Dax Hero Scalper Trading Robot Expert Advisor For Metatrader 4 In Metatrader Market

S P Futures Fall Naz Tumbles On Goldman Tech Downgrade Stimulus Pessimism Corona Stocks

Bond Market Us Government Bonds Tradingview

German Dax Targets Further Highs Until This Changes

Bond Market Us Government Bonds Tradingview

Dax Bulls Not Ready To Give Up Ewm Interactive

A Beginner S Guide On How To Trade Cfds On Dax30

Germany Germany Selected Background Issues

Solved How To Create A Values Range Slicer Not A Time Ra Microsoft Power Bi Community

Dax The Update On The Big Expiration Day Personal Financial

Blog

Nifty Option

Futures Tips Trading Hours Dax Futures

Dax Index Gains Ground Poised To Break 12 000 Marketpulsemarketpulse

Dax Analysis For 7 4

Nifty 50 Weekly Outlook 04 08 Nov 19 Swing Trade Hunt

Morning Options Aud Nzd Put Gbp Cad Put Comparic Com

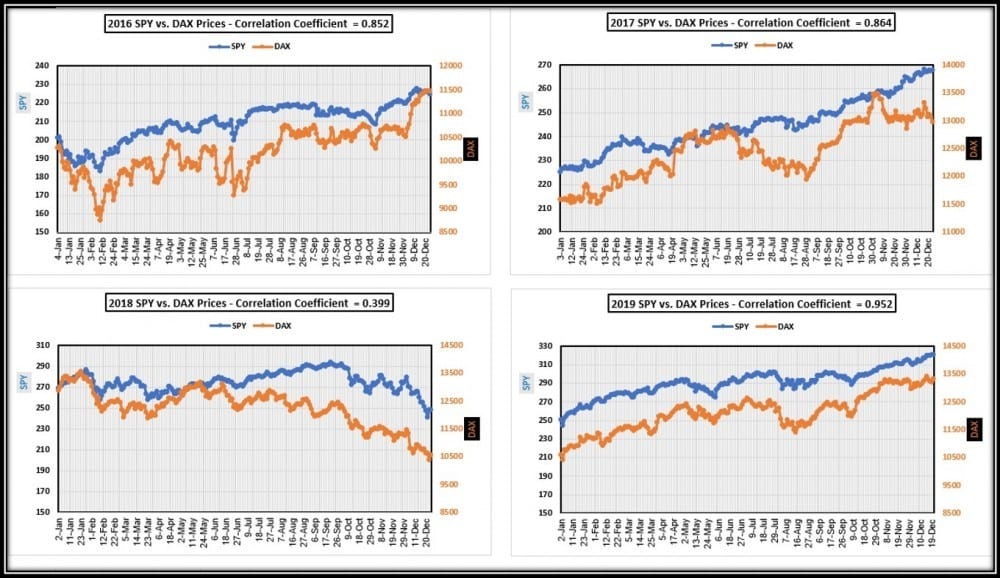

Daily Charts Comparisons Of Spy Vs Dax From 16 Through Dec 19

Deutsche Borse Group Taking A Closer Look At Dax

Powerful Order Places For Xetr Dax By Ramin Trader06 Tradingview India

Market Commentary Article News Is Prime

Dax Cac 40 Set To Move The Latter At Important Lt Trend Line

End Of Summer Trading

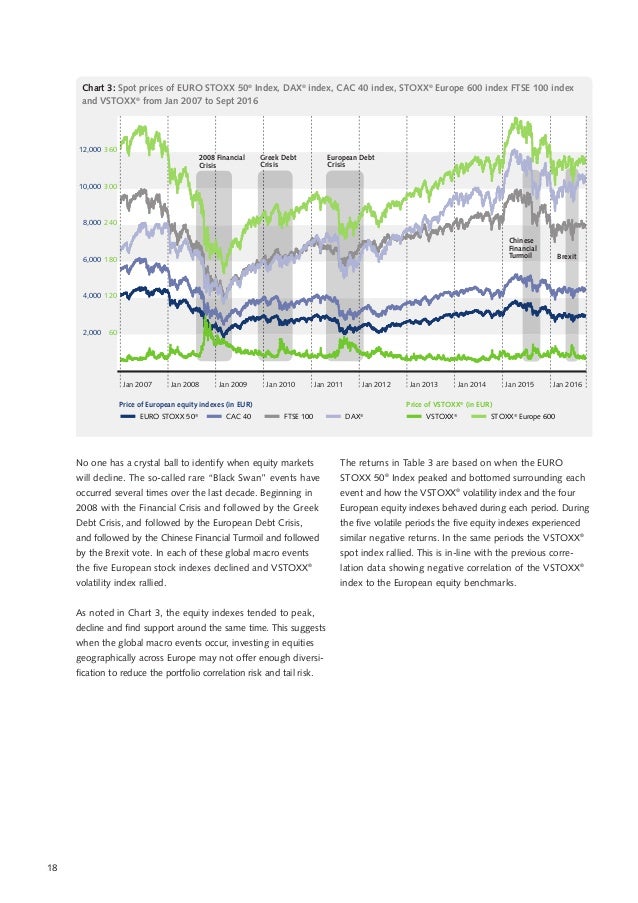

Vstoxx Discovering Volatility Eurex Exchange

Dax The Update On The Big Expiration Day Personal Financial

Dax Cac 40 Trying To Negate Bearish Price Patterns

Oipfbblazhgbhm

Trading Gaps For Daily Profit Trading Cfds Paramonas Villas

Selling Dax With Weekly Options Put Spread Indices And Macro Events Ig Community

Dax Hebelzertifikate Isin De Wkn Symbol Dax

Powerful Order Places Long

Nasdaq 100 Tesla And Bitcoin Carry Hopes While Gbpusd Gbpjpy Suit Conditions

Morning Options Aud Nzd Put Usdchf Put Comparic Com

Was Sind Optionen Optionshandel Lernen Ratgeber

2

Nifty Option

Www Whselfinvest Com Docs Guide Options En Pdf

The Index Files 31 12 19 Tickmill

Dax Stratgy Tradingview

Chart Criminals Chartcriminals Twitter

Www Dax Indices Com Documents Dax Indices Documents Dax 30 The dax index universe Pdf

2

Stock Market Index Quotes World Indices Tradingview

Aquilaesignal Com Trading Systems And Analyses Of Financial Markets With An Excellent Track Record

Market Commentary Article News Is Prime

Fibo Raytrace Or Fibo Extention

Dax Index Daily Price Forecast Dax To Trade Positive Supported By Hawkish Investor Sentiment In Local Market

Victor Ferrer S Java And Sw Blog Odax November 17 Iron Condor Adjustment V

Xetr Dax Technical Indicators

Dax Stratgy Tradingview

Www Whselfinvest Com Docs Guide Options En Pdf

Oil Giving Up The Inflation Narrative The Market Ear

2

One Way To Judge A Correction Hedge Fund Telemetry

7htloxaliixy8m

Eur Usd Down But Not Out As Prices Approach Bullish Trend Support Nasdaq

Implied Volatility Surface Of The Dax Index On 29 01 Download Scientific Diagram