Hsbc Cashback Card

Cash Point accumulated is up to a maximum of 12,000 points per year for HSBC VISA Advance Cashback Cards (Definition of the "Year" refers to a 12month period starting from the month of card issuance) Cash Points of the Primary and Supplementary cards are accumulated together.

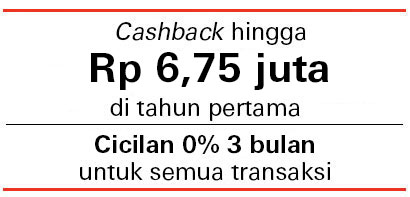

Hsbc cashback card. Tambahan cash back program ini adalah sebesar 25% dari total gabungan transaksi di kategori merchant poin 1a atau maksimum Rp per bulan hingga 12 bulan sejak Kartu Utama HSBC disetujui Maksimum cash back dalam program ini di luar maksimum cash back secara keseluruhan fitur kartu kredit HSBC Platinum Cash Back. Hoàn tiền không giới hạn 1% cho chi tiêu bảo hiểm, giáo dục và đến 8% cho tiêu tại các siêu thị, cửa hàng tiện ích Mở Thẻ Tín Dụng HSBC Visa Cash Back NGAY!. HSBC Cashback Signature Credit Card Exclusive offer for new applicants to get up to NT$1,000 rebate Instalment with up to 3% interest on insurance products with 122% cash rebate.

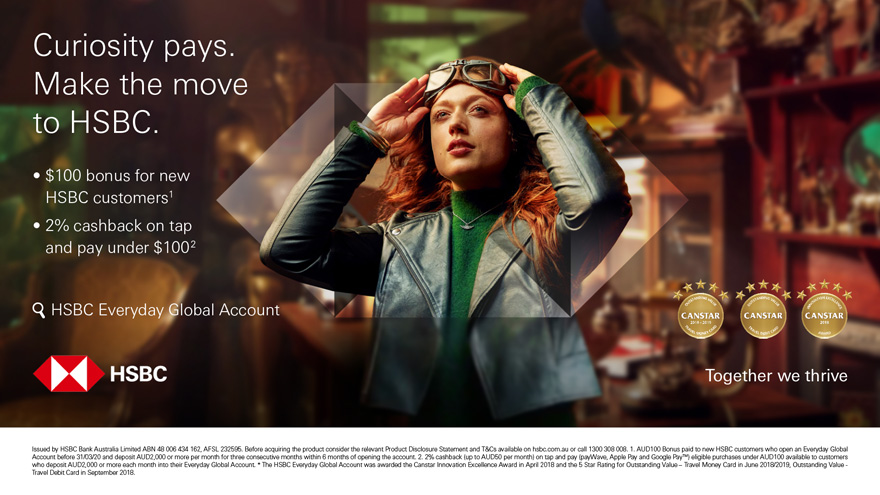

New HSBC Everyday Global customers can get a $100 bonus after signing up, and all customers can earn 2% cashback on eligible tap and pay purchases. The HSBC Cash Rewards credit card is a simple noannualfee credit card that offers a reasonable 15% cash back on all purchases Instead of a traditional welcome bonus, the card offers Earn an. Manage your finances and earn cashback as you shop at popular brands with one of our credit.

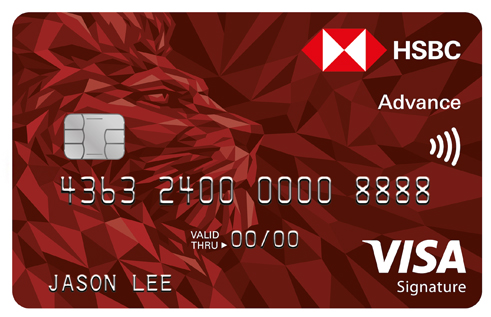

HSBC Advance Credit Card is the goto cashback credit card for Heartland Boy once he reaches the spending limits on his UOB One Credit Card In his previous review on the HSBC Advance Credit Card, he demonstrated how he was consistently getting a cashback rate of 25% to 35%HSBC Bank has announced some changes that will affect existing HSBC Advance cardholders from 1 Nov onwards. To apply for an HSBC Visa Platinum Cashback Credit Card, you must Have a minimum monthly income. The markup fee is 350% of the amount transacted.

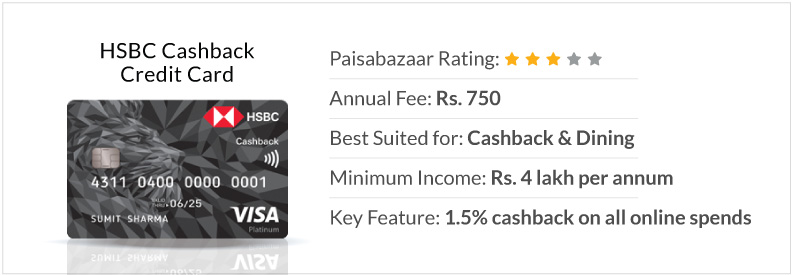

The annual fee on this credit card is Rs 750 which will be waived if the user spends Rs 300 lakh in the previous year What is the foreign currency markup fee on HSBC Cashback credit card?. The HSBC Cash Rewards Mastercard® credit card provides an easy way to earn some rewards no matter what you’re buying Ordinarily, it provides 15% cash back for every purchase But for the first year, you’ll earn at a 3% cash back rate for up to $10,000 in purchases thanks to the card’s current introductory bonus. The Verdict The HSBC Cash Rewards Credit Card is among the top cash back credit cards on the market, especially early on You get 3% cash back on all purchases in the first 12 months, up to the first $10,000 And you’ll also earn 15% cash back on all purchases after that.

HSBC Cashback Credit Card Enjoy benefits such as up to 10% cashback on everyday spends, automatic credit of cashback every month and 0% for up to 24 months Balance Transfer To apply, you'll need a minimum monthly salary of AED 10,000 No annual fee for the 1st year and 2nd year onwards waiver subject to meeting minimum spend 2. HSBC Cashback Signature Credit Card Exclusive offer for new applicants to get up to NT$1,000 rebate Instalment with up to 3% interest on insurance products with 122% cash rebate. The second is that the card can only be obtained if you have a HSBC Premier bank account HSBC Premier has tough eligibility criteria See here and scroll down to see the criteria As well as opening a HSBC Premier current account, you must ALSO have £50,000 invested with HSBC, either in a savings account or via an investment product.

The HSBC Cash Rewards credit card is a simple noannualfee credit card that offers a reasonable 15% cash back on all purchases Instead of a traditional welcome bonus, the card offers Earn an. You can receive Cash Back redemptions as a direct deposit or as a statement credit to your HSBC Cash Rewards Mastercard credit card If you select Cash Back as a direct deposit, only HSBC Bank USA, NA consumer checking and savings accounts in your name alone or as a joint accountholder are eligible. The My Rewards Points program is not available as one of the HSBC Cashback Credit Card features;.

You can redeem your HSBC Rewards points for cashback via direct deposit into your HSBC checking or savings account Alternatively, you can redeem your HSBC Rewards points for statement credits for your HSBC credit card To do this, you can visit the online US HSBC website or call the Rewards Department at 8516. The second is that the card can only be obtained if you have a HSBC Premier bank account HSBC Premier has tough eligibility criteria See here and scroll down to see the criteria As well as opening a HSBC Premier current account, you must ALSO have £50,000 invested with HSBC, either in a savings account or via an investment product. It pays to be a loyal HSBC Amanah MPower Platinum Credit Cardi cardholder as you are in for a world of privileges and VIP treatments via HSBC Smart Privileges Programme This promotion site brings in over 6,500 nationwide merchants, ranging from dining, shopping and travel in a single web page with discounts and cashback.

You can apply for an HSBC Cashback Credit Card if you're able to meet the following criteria Cashback credit card eligibility criteria You must be aged between 18 to 65 Your annual income must be at least INR400,000 per annum (for salaried individuals). HSBC Credit Cards Cashback Credit Card Credit Card Min Salary10K AED foreign exchange rate 2% onwards Cashback Balance transfer Dining Benefits Golf No Annual fees Apply for Credit Cards Online. Other Benefits of HSBC Cashback Credit Card With your HSBC Cashback Credit Card, you get some additional benefits, such as Contactless PaymentHSBC Cashback credit card is enabled with Visa Paywave technology which lets you make payments up to Rs 2,000 without having to swipe or dip the card in the POS machineSuch payments can be made only at NFCenabled POS terminals by tapping or waving.

You can apply for an HSBC Cashback Credit Card if you're able to meet the following criteria Cashback credit card eligibility criteria You must be aged between 18 to 65 Your annual income must be at least INR400,000 per annum (for salaried individuals) You must be an Indian resident. HSBC Cashback Credit Card Fee and Payment Options After knowing all the features, you must be eager to know the fees and other charges of this credit card So, have a look at the joining fees, renewal, fees, and all other charges of the HSBC Cashback Credit Card Fee and Other Charges. The HSBC Cash Rewards Mastercard® credit card earns 3% back on all purchases in your first year up to $10,000 spent After that, it earns 15% back on everything The annual fee is $0.

A variable Purchase APR and variable Balance Transfer APR of 1399% to 2399%, depending on your creditworthiness, will apply to credit card purchases, balance transfers for the HSBC Cash Rewards Mastercard® credit card Student Account The variable Cash APR applies to cash advances and overdrafts, and is 2499%. By contrast, the introductory bonus with the HSBC Cash Rewards depends on earning the card's 15% in extra cashback rewards on your spending over the first year To earn a bonus of $150, then. The defining feature of the HSBC Cash Rewards Mastercard® credit card is a firstyear rewards rate that you won't find on most other cashback cards in its class.

The second is that the card can only be obtained if you have a HSBC Premier bank account HSBC Premier has tough eligibility criteria See here and scroll down to see the criteria As well as opening a HSBC Premier current account, you must ALSO have £50,000 invested with HSBC, either in a savings account or via an investment product. What is the annual fee on HSBC Cashback credit card?. A variable Purchase APR and variable Balance Transfer APR of 1399% to 2399%, depending on your creditworthiness, will apply to credit card purchases, balance transfers for the HSBC Cash Rewards Mastercard® credit card Student Account The variable Cash APR applies to cash advances and overdrafts, and is 2499%.

Therefore, in case of transfer to an HSBC Cashback Credit Card, the accumulated Rewards Points on the HSBC Visa Platinum, Premier or Advance Mastercard will not be transferred to the new HSBC Cashback Credit Card. The second is that the card can only be obtained if you have a HSBC Premier bank account HSBC Premier has tough eligibility criteria See here and scroll down to see the criteria As well as opening a HSBC Premier current account, you must ALSO have £50,000 invested with HSBC, either in a savings account or via an investment product. The markup fee is 350% of the amount transacted.

The Offer is applicable to all locally issued HSBC Platinum Cashback Credit Cards (BIN 4910 14) only To avail the Offer, the Cardholder shall make the full payment by using the HSBC credit card Minimum Bill Value will be LKR3500 5% Bonus cashback will be given by Arpico at the time of transaction. HSBC Cashback Credit Card Failure to do so may mean that you are no longer eligible to earn Cashback • The Cashback amount will be credited after being rounded off up to 2 decimal places • Any Cashback amount credited to your Account will offset against your outstanding balance as per the existing. The HSBC Cashback card also comes with a Swiggy voucher of Rs250 which must be redeemed within the first 60 days of card issuance A discount of 5% will be given on your purchases of more than Rs1,000 at Amazon.

Tambahan cash back program ini adalah sebesar 25% dari total gabungan transaksi di kategori merchant poin 1a atau maksimum Rp per bulan hingga 12 bulan sejak Kartu Utama HSBC disetujui Maksimum cash back dalam program ini di luar maksimum cash back secara keseluruhan fitur kartu kredit HSBC Platinum Cash Back. Consumers who mostly spend on food and transport can benefit from Citi Cash Back Card's 8% cashback on dining, groceries, and petrol worldwide, capped at S$75/month While its rate and cap are higher than HSBC Visa Platinum Card's, the minimum monthly spend is a lofty S$8, and the S$1926 fee is waived only 1 year. Apply for HSBC Cashback Titanium card during campaign period to get free trial membership gift card (up to 1 year free trial membership) Enroll LINE MUSIC with HSBC cashback titanium card to get % LINE POINTS rebate.

The HSBC Cashback Credit Card provides regular card benefits like cash advance, additional credit cards, global access and access through Phone Banking It also can be used for your online transactions perfect for online shopping and entertainmentRefer to the Credit Card Services Guide (PDF, 750 KB) for full details, as well as the corresponding terms and conditions. Total Cash Back awarded to Eligible Cardholders with an HSBC Eligible Purchases in a calendar month Advance banking Relationship Above S$3,571 003% (“Bonus Cash back”) Above S$2,000 up to S$3,571 35% S$2,000 and below 25% Cash Back in a calendar month Up to S$125 Bonus Cash back (003% applied on Eligible. HSBC Advance Credit Card is the goto cashback credit card for Heartland Boy once he reaches the spending limits on his UOB One Credit Card In his previous review on the HSBC Advance Credit Card, he demonstrated how he was consistently getting a cashback rate of 25% to 35%HSBC Bank has announced some changes that will affect existing HSBC Advance cardholders from 1 Nov onwards.

The HSBC Cash Rewards Mastercard credit card earns 3% cash back on up to $10,000 in purchases during the first 12 months after opening an account After that, the card offers 15% unlimited cash back on all purchases The HSBC card charges an annual fee of $0 and no foreign transaction fee New cardholders get a 12month 0% APR introductory. This card offers plenty of ways to earn cash back — and you don’t need to be an HSBC member to apply With the HSBC Cash Rewards Mastercard® credit card, you’ll earn unlimited 15% cash back on all purchases Plus, during your first year of having the card, you’ll earn cash back at a rate of 3% on all purchases (on up to $10,000 spent). Therefore, this HSBC cash back credit card provides its cardholders amazing saving opportunities while spending Features of the HSBC Visa Cashback Credit Card The HSBC Visa Cashback Credit Card comes with a wide range of amazing and unique features Here is a list of all of them Annual Fee.

HSBC Cashback Credit Card Failure to do so may mean that you are no longer eligible to earn Cashback • The Cashback amount will be credited after being rounded off up to 2 decimal places • Any Cashback amount credited to your Account will offset against your outstanding balance as per the existing. 10 Points or Cash Back rebate means each earn rate for Points or Cash Back rebate applicable to a Card that participates in the HSBC Rewards Program, including i) the base earn rate of 075 Point / 075% rebate for every $100 in eligible purchases, ii) any special bonus Points or rebate offer that we may offer and for which you are qualified. HSBC Cash Rewards Credit Card Unlimited Cash Rewards with no expiration Earn on all purchases in the first 12 months from Account opening, up to the first $10,000 in purchases 1 Get 15 Cash Rewards on every $1 you spend on all new, net purchases after the intro period 1.

The HSBC Cash Rewards Credit Card is a cash back credit card that does not charge an annual fee The hook for this card is a 12month introductory period of 3% cash back rewards along with an introductory 0% APR offer for both new purchases and balance transfers. The Verdict The HSBC Cash Rewards Credit Card is among the top cash back credit cards on the market, especially early on You get 3% cash back on all purchases in the first 12 months, up to the first $10,000 And you’ll also earn 15% cash back on all purchases after that. It pays to be a loyal HSBC Amanah MPower Platinum Credit Cardi cardholder as you are in for a world of privileges and VIP treatments via HSBC Smart Privileges Programme This promotion site brings in over 6,500 nationwide merchants, ranging from dining, shopping and travel in a single web page with discounts and cashback.

Hoàn tiền không giới hạn 1% cho chi tiêu bảo hiểm, giáo dục và đến 8% cho tiêu tại các siêu thị, cửa hàng tiện ích Mở Thẻ Tín Dụng HSBC Visa Cash Back NGAY!. Earn a $0 Bonus after you spend $500 on purchases in your first 3 months from account opening Earn 5% cash back on up to $1,500 in combined purchases in bonus categories each quarter you activate. Tambahan cash back program ini adalah sebesar 25% dari total gabungan transaksi di kategori merchant poin 1a atau maksimum Rp per bulan hingga 12 bulan sejak Kartu Utama HSBC disetujui Maksimum cash back dalam program ini di luar maksimum cash back secara keseluruhan fitur kartu kredit HSBC Platinum Cash Back.

HSBC Credit Cards Cashback Credit Card Credit Card Min Salary10K AED foreign exchange rate 2% onwards Cashback Balance transfer Dining Benefits Golf No Annual fees Apply for Credit Cards Online. The annual fee on this credit card is Rs 750 which will be waived if the user spends Rs 300 lakh in the previous year What is the foreign currency markup fee on HSBC Cashback credit card?. What is the annual fee on HSBC Cashback credit card?.

Card Name HSBC Premier Mastercard Black credit card Points you will earn 2 reward points 3,000 free points upon activation (new applicants only) & 40,000 Bonus Points for spending $,000 in the first 3 months. Card Name HSBC Premier Mastercard Black credit card Points you will earn 2 reward points 3,000 free points upon activation (new applicants only) & 40,000 Bonus Points for spending $,000 in the first 3 months. Issued by HSBC Bank Malaysia Berhad (Company No (V)) 1 HSBC 21 Cashback Acquisition Promotion Terms and Conditions apply Cashback amount received by Eligible Cardholder is subject to the Eligible Criteria stated in the Promotion, on a first come first served basis, subject to availability.

Hsbc Advance Cashback Credit Card Singapore Hsbc Sg

Hsbc Cashback Credit Card Full Details Youtube

Is Hsbc Advance Credit Card A Better Cashback Card Heartland Boy

Hsbc Cashback Card のギャラリー

Hsbc Advance Cashback Credit Card Singapore Hsbc Sg

Hsbc Cashback Credit Card Benefits Fees Creditcardmantra Com

Malaysian Save Money Tng Reload Cashback With Hsbc Credit Card

Hsbc Advance Cashback Credit Card Singapore Hsbc Sg

Online Application For Visa Cashback Credit Card Hsbc In

Hsbc Advance Credit Card Still Gives Up To 3 5 Cashback Heartland Boy

Hsbc Credit Card Application A Guide For First Timers

Hsbc Cashback Card Hsbc Indonesia

Hsbc Revolution Card Who Should Get It Credit Card Review Valuechampion Singapore

Best Hsbc Credit Cards In Singapore Updated January 21

0y7bv Uyugxapm

21 Hsbc Cash Back Credit Card Review Wallethub Editors

Hsbc Amanah Mpower Platinum Credit Card I Relaunch New Cashback For E Wallet Reloads More

Credit Cards Hsbc Indonesia

Compare Apply Hsbc Credit Cards Online Hsbc In

Hsbc Rewards Customers With Everyday Extras About Hsbc Hsbc Australia

Hsbc Visa Platinum Credit Card No Annual Fee Hsbc Sg

Hsbc Cashback Card Hsbc Indonesia

Hsbc Cashback Credit Card Check Offers Benefits

Best Hsbc Credit Cards Singapore 21 Compare Apply Online Moneysmart Sg

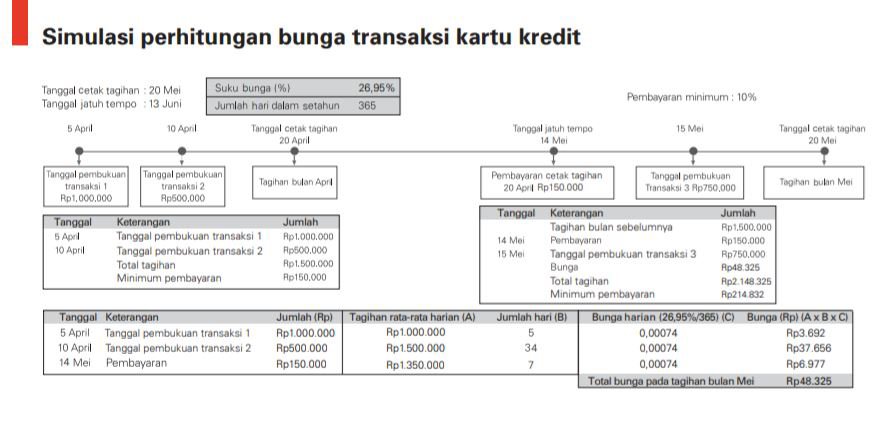

Cashback Credit Card Key Things You Should Know

Hsbc Advance Cashback Credit Card Singapore Hsbc Sg

Amanah Premier World Mastercard Credit Card I Hsbc My Amanah

Credit Cards Hsbc Indonesia

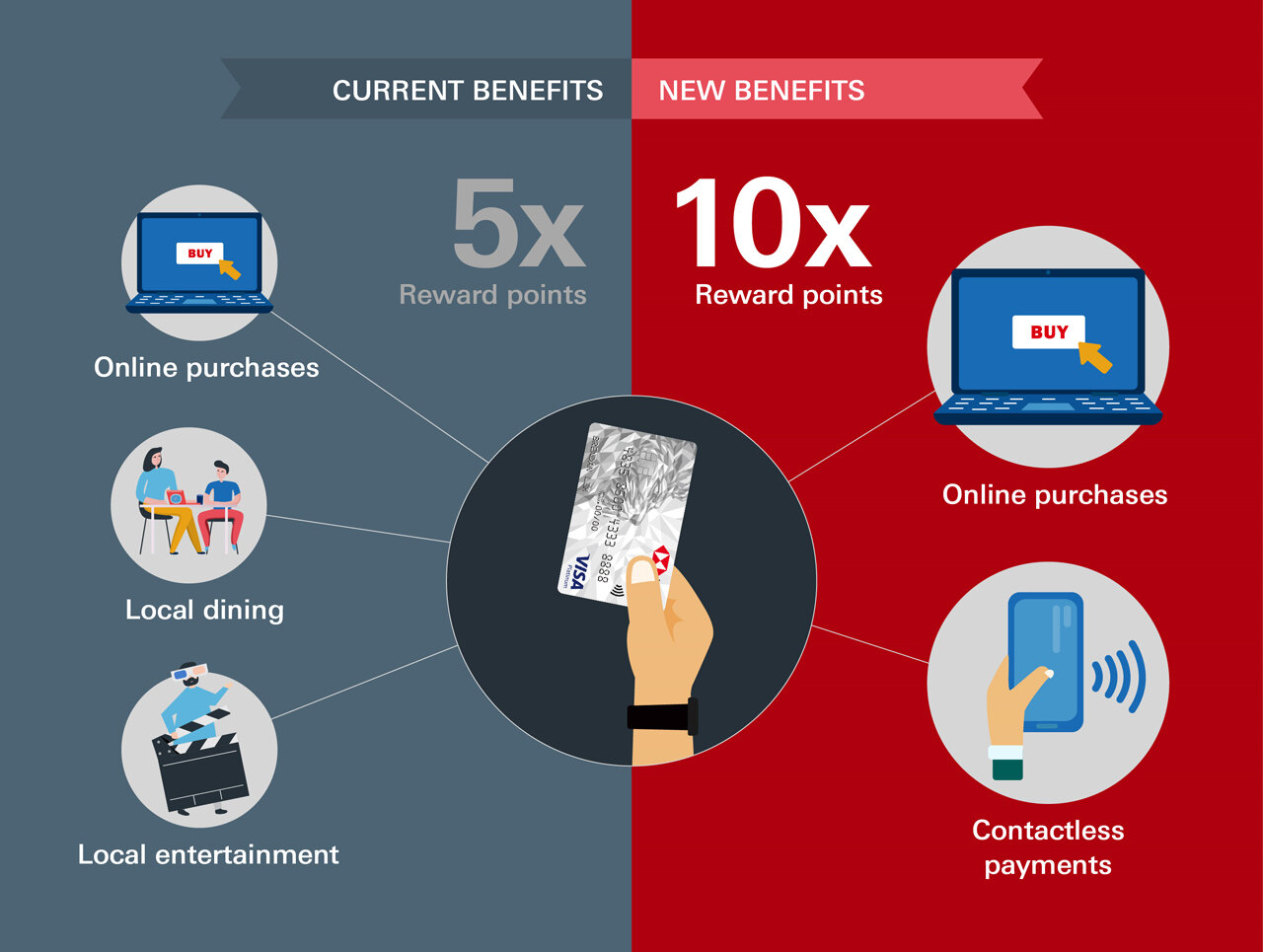

Awesome Hsbc Revolution Receiving Major Upgrade From 1 August The Milelion

Hsbc Cashback Card Hsbc Indonesia

Gold Visa Cash Back Cash Rebate Credit Card Hsbc Ph

Best Cashback Credit Cards In Singapore 21 Valuechampion Singapore

1

Cashback For Everyone Credit Card Offers Hsbc My

1

Hsbc Cash Back Credit Card Uae Features Benefits Cash Back Rates Youtube

Q Tbn And9gcrfkj9d9mptrsym64naebucwao2vui F5bpyelzqmrmh6s Xypc Usqp Cau

Hsbc Cashback Credit Card Review Features Benefits Welcome Offers 16 January 21

Online Application For Visa Cashback Credit Card Hsbc In

Is The Hsbc Advance Credit Card The Best Cashback Card Right Now

Cash Back Offer At Big C With Hsbc Visa Cash Back Credit Card

Get Rm250 Cashback With A New Hsbc Credit Card

How To Easily Earn Up To 3 5 Cashback On Hsbc Advance Credit Card Heartland Boy

Online Application For Visa Cashback Credit Card Hsbc In

Hsbc Cashback Credit Card Features Benefits Eligibility Apply

2 Mar Onward Hsbc Cashback Promotion With Hsbc Advance Credit Card Sg Everydayonsales Com

Hsbc Cash Rewards Mastercard Credit Card Worth Applying For Credit Card Review Valuepenguin

Hsbc Cashback Card Hsbc Indonesia

Best Hsbc Credit Cards In Singapore Credit Card Reviews Moneysmart Sg

22 Aug 31 Jan 21 Touch N Go Hsbc Cashback Promo Everydayonsales Com

Hsbc Cashback Credit Card Hsbc Uae

How To Easily Earn Up To 3 5 Cashback On Hsbc Advance Credit Card Heartland Boy

Cashback Visa Card Cash Rebate Credit Card Hsbc Vn

Standard Chartered Unlimited Vs Hsbc Advance Vs American Express True Cashback How Do You Choose A Credit Card If All 3 Cards Are Similar

Hsbc Cashback Credit Card

Hsbc Visa Platinum Hsbc Indonesia

Compare And Apply For Credit Cards Online Credit Cards Hsbc Sg

Hsbc Revolution Credit Card Will Award 4 Miles Per Dollar Or 2 5 Cashback On Online And Contactless Payments From 01 August The Shutterwhale

Apply For Visa Platinum Credit Card Online Hsbc In

Hsbc Credit Card Promotion Touch N Go Ewallet Rm15 Cashback

Hsbc Cashback Credit Card Features Benefits Eligibility Apply

Best Hsbc Credit Cards In India Valuechampion India

Moshims Hsbc Cashback Credit Card Charges

Hsbc Cashback Card Hsbc Indonesia

Hsbc Advance Credit Card Up To 3 5 Cashback On All Purchases The Shutterwhale

Hsbc Amanah Mpower Platinum Credit Card I Get 8 Cashback

Hsbc Gold Visa Cash Back Card Dine And Get 5 Cash Back

Credit Cards Hsbc Indonesia

Hsbc Credit Card Application Everything You Need To Know

Hsbc Expat Credit Card Credit Cards Hsbc Expat

Hsbc Credit Cards Hsbc Bank Usa

Hsbc Credit Cards Launch The First Ever Visa Cashback Card In Sri Lanka Ceylon Business Reporter

Premier Mastercard Credit Card Products Hsbc Sg

5 Best Cashback Credit Cards Singapore Uob One Stanchart Unlimited Hsbc Advance Citi Cash Back And Dbs Live Fresh Card

Is Hsbc Advance Credit Card A Better Cashback Card Heartland Boy

Hsbc Cashback Credit Card Review Details Offers Benefits Fees How To Apply Eligibility Status Limit Wealth18 Com

Hsbc Credit Cards V 2

Compare And Apply For Credit Cards Online Credit Cards Hsbc Sg

Hsbc Visa Platinum Credit Card Moneysmart Review Moneysmart Sg

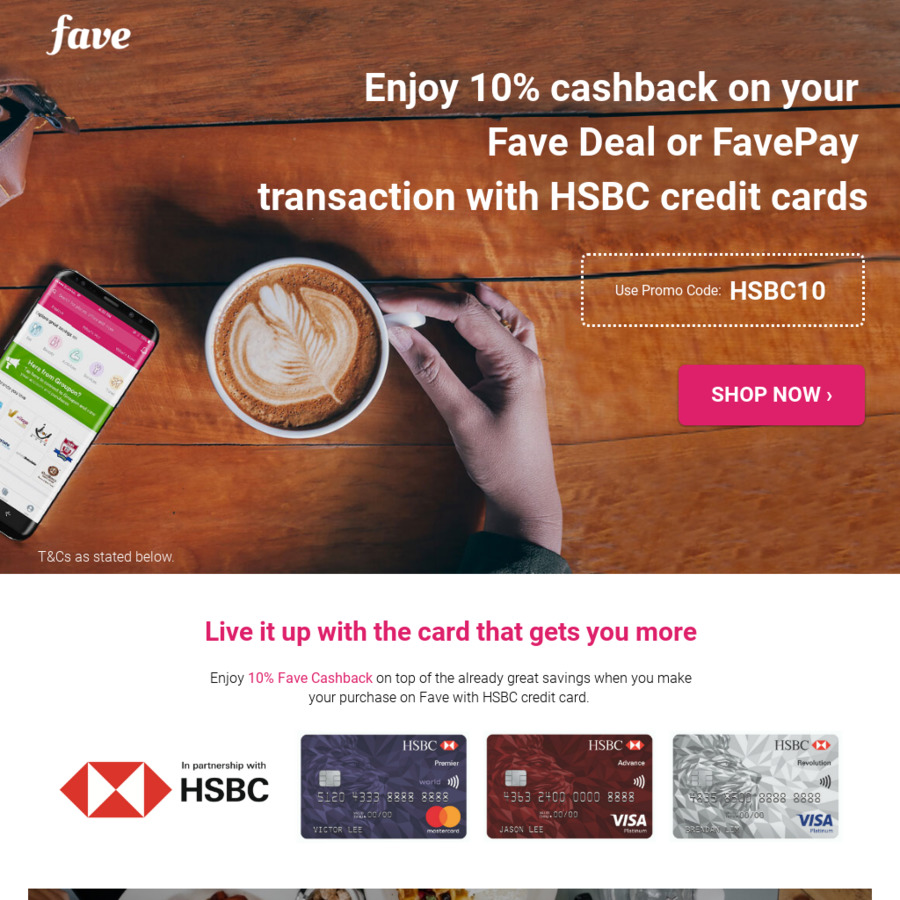

Enjoy 10 Cashback On Your Fave Deal Or Favepay Transaction With Hsbc Credit Cards Cheapcheaplah

Meet The Hsbc Cashback Credit Card You Won T Regret It Bankbazaar The Definitive Word On Personal Finance Meet The Hsbc Cashback Credit Card You Won T Regret It

Hsbc Amanah Mpower Platinum Credit Card I Relaunch New Cashback For E Wallet Reloads More

.jpg)

Hsbc Credit Card Offer Cashback On Flight Booking Indigo

Hsbc Is Rewarding Cardholders For Using E Wallets Here S How To Earn 26 67 Returns

Mpower Platinum Credit Card I Credit Cards Hsbc My Amanah

Advance Visa Cashback Credit Card Hsbc Tw

Hsbc Cashback Urban Ladder

Credit Cards Hsbc Indonesia

Hsbc Credit Card Check Eligibility Apply Online For Best Hsbc Cards 24 January 21

Credit Cards Hsbc Tw

Rm25 Cashback From Pharmacy With Hsbc Hsbc Amanah Credit Debit Card Best Credit Co Malaysia

Apply For A Visa Cashback Credit Card Apply Online Today Hsbc Eg

Best Credit Cards For Insurance Premium Payment 21 Valuechampion Singapore

Hsbc Revolution Credit Card Will Award 4 Miles Per Dollar Or 2 5 Cashback On Online And Contactless Payments From 01 August The Shutterwhale

Hsbc Singapore S Latest Credit Card Promotions Hsbc Sg

Hsbc Advance Credit Card Still Gives Up To 3 5 Cashback Heartland Boy

Hsbc Cashback Credit Card Review Best Cashback Credit Card Youtube

Hsbc Credit Cards Launch The First Ever Visa Cashback Card In Sri Lanka Adaderana Biz English Sri Lanka Business News

Best Hsbc Cash Back Credit Cards Singapore 21 Moneysmart Sg

Hsbc Cashback Card Hsbc Indonesia

Best Hsbc Cash Back Credit Cards Singapore 21 Moneysmart Sg

Hsbc Amanah Premier World Mastercard I Takaful Protection

Hsbc Credit Cards V 2

How To Easily Earn Up To 3 5 Cashback On Hsbc Advance Credit Card Heartland Boy