Reverse Factoring

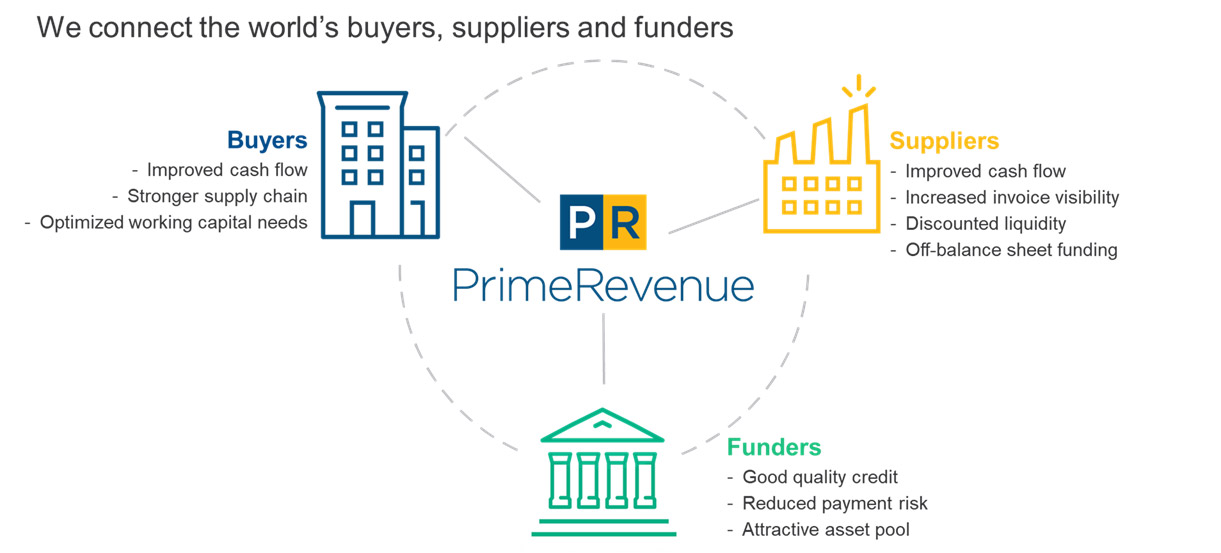

The suppliers may benefit from better funding conditions than they would otherwise receivel;.

Reverse factoring. Here are some of the top benefits of reverse factoring for businesses and suppliers Improved Cash Flow Because factors pay invoices to suppliers faster, businesses no longer have to wait for accounts Reduced Early Payment Requests With invoice factoring, businesses no longer have to deal with. Supply chain finance, also known as supplier finance or reverse factoring, is a set of solutions that optimizes cash flow by allowing businesses to lengthen their payment terms to their suppliers while providing the option for their large and SME suppliers to get paid early This results in a winwin situation for the buyer and supplier. Reverse factoring (Supply Chain Financing) Manage your reverse factoring business, allowing a company to simplify reverse factoring operations With SOFT4Factoring you can pay your clients’ invoices to suppliers at an accelerated rate in exchange for a discount.

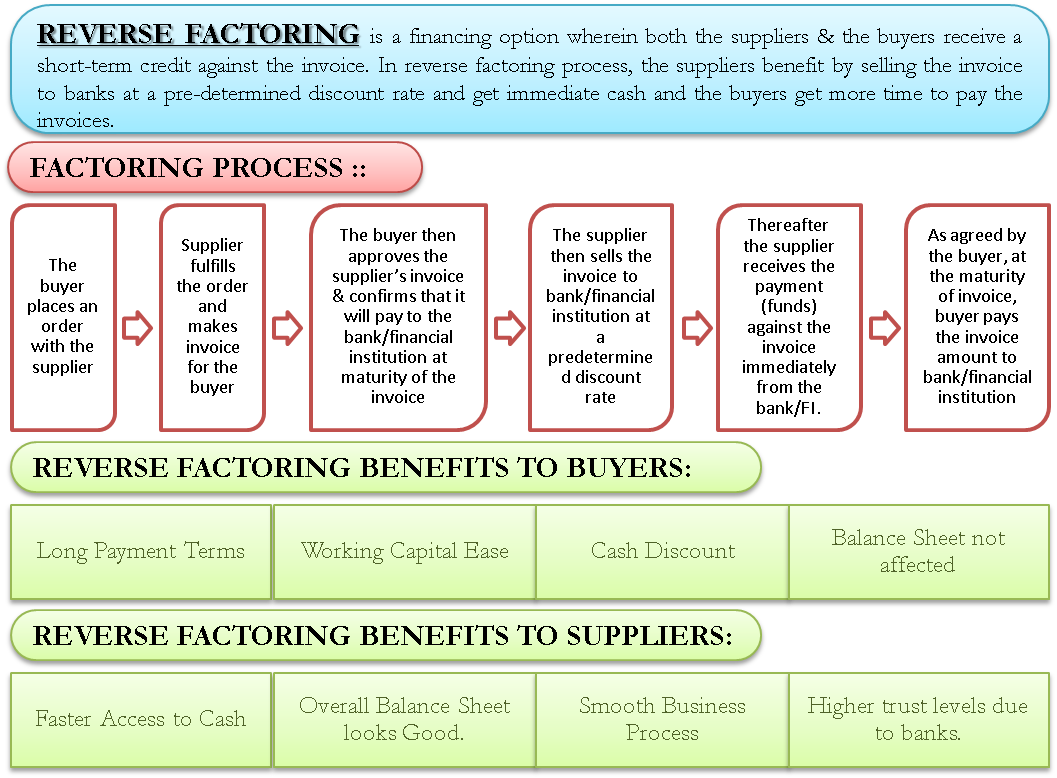

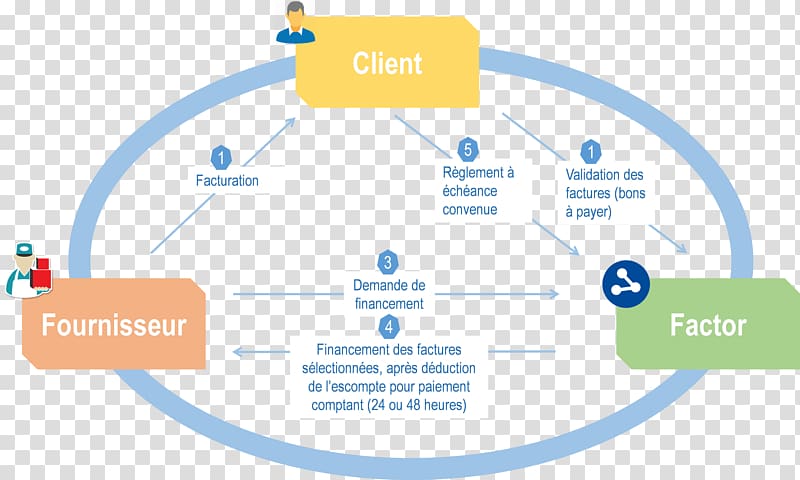

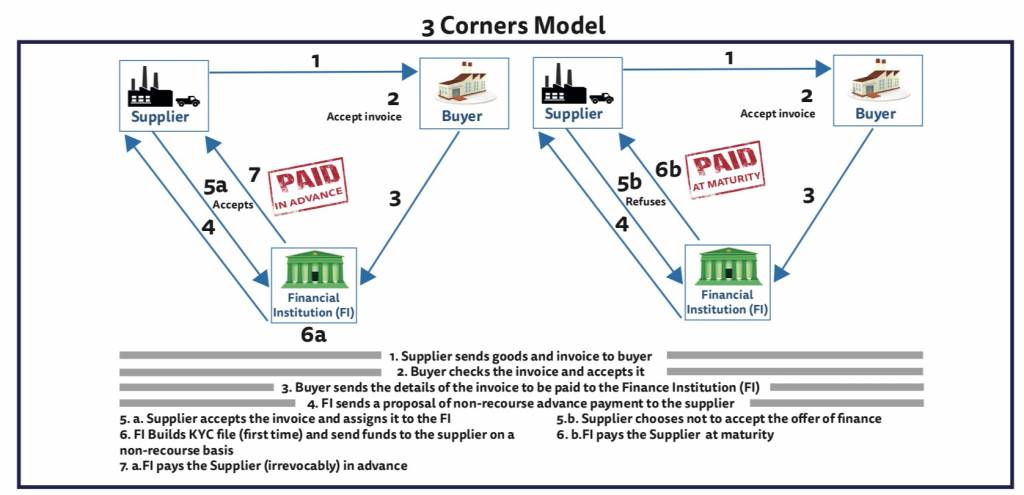

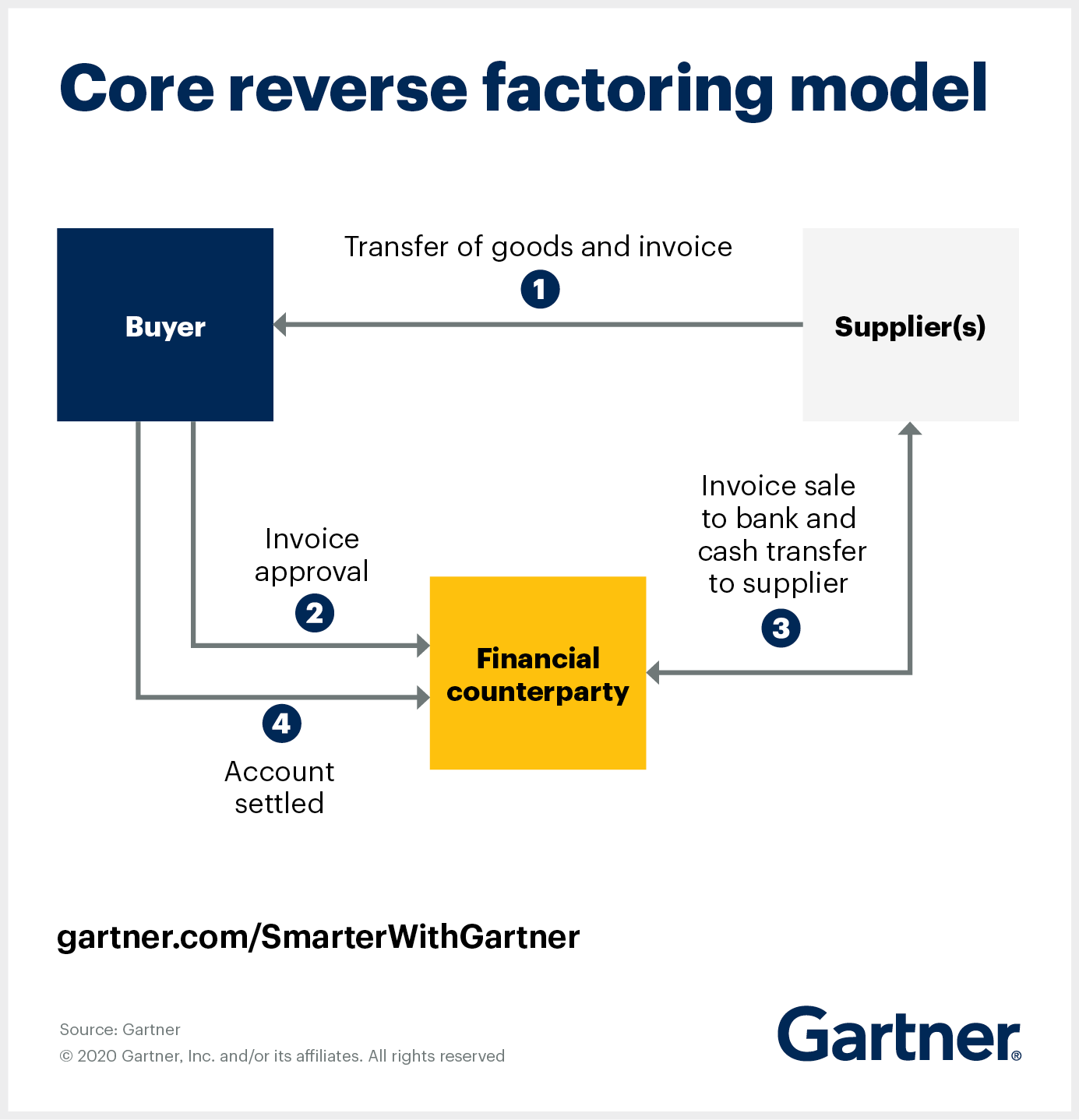

Reverse factoring has its origins in the car industry, with large carmarkers wanting to improve the cash flow situation of their suppliers The system allowed car manufacturers to work more efficiently with smaller suppliers in an industry where late payment was a major concern and in some instances a stumbling block to doing business. Reverse factoring typically follows these steps The grocer places an order to purchase $1MM worth of crops from the farmer The farmer delivers on this order and transfers its accounts receivables (ie invoice) to the grocer The grocer approves the invoice and shares it with the financial. Reverse factoring is a traditional approach to modern day supply chain finance It is a buyer led financing option wherein both the suppliers & the buyers receive a shortterm credit against the invoice Under reverse factoring, the suppliers sell invoices to banks or financial institutions at a predetermined discount rate.

Reverse factoring, also called supply chain finance, works in the opposite direction of invoice factoring Instead of a company factoring customer invoices, it factors supplier invoices In doing so, the company is factoring part of the supply chain Reverse factoring is an accounts payable solution. Reverse factoring is also a great way to further improve your credit background As all business owners know, credibility plays an important role in business transactions and loan applications When you apply for reverse factoring, you’ll be able to pay your supplier dues on time. In reverse factoring, the big company hires a bank such as JPMorgan or a financier such as Londonbased Greensill Capital to make agreements with its suppliers The supplier gets to choose exactly.

Reverse factoring, also known as supply chain finance or supplier finance, is a financial technology solution that mitigates the negative effects of longer payment terms to help buyers and suppliers optimize working capital. What is reverse factoring?. Factoring (or reverse factoring) is not a loan and differs from traditional bank credit It is a true sale of an asset (invoice in this case) and does not create a liability on the balance sheet Unlike a bank credit which involves two parties, factoring involves three parties – the seller, the buyer and the factor or the financier.

So no long or unnecessary. A Muddy Waters report shed light on a fastgrowing but opaque supplychain financing technique known as reverse factoring that has recently come under pressure from accountants, regulators, and. Reverse Factoring a/k/a Supply Chain Finance Unlike basic factoring when the supplier (the seller) starts the process, Reverse Factoring is initiated by the ordering party (the buyer) The buyer is usually a larger company looking to extend payment terms without affecting their suppliers cash flow.

Reverse factoring is an accounting solution that can help businesses to access the working capital they need to continue their everyday operations Also known as supply chain financing, reverse factoring describes the process of a bank or financial company agreeing to pay a company’s outstanding invoices to their suppliers who may be willing to accept a lower sum in exchange for prompt payment of their receivables. Mathsiteorg makes available usable resources on reverse factoring calculator, systems of linear equations and inequalities and other algebra subjects If you need assistance on intermediate algebra or even multiplying and dividing rational expressions, Mathsiteorg is without question the excellent destination to check out!. One reason reverse factoring is attracting so much attention is each party in the deal – the buyer, the supplier and financial institution – all benefit from this welldesigned program If you are a buyer operating a large, multinational corporation, reverse factoring may be a great way to leverage credit lines a borrowing costs.

Reverse factoring involves a finance or lending institution—also referred to as a “factor”—which serves as a thirdparty intermediary between a business and their supplier The finance institution or factor agrees to pay the company’s invoices to suppliers at an accelerated rate and collect customer payments for a fee. Reverse factoring has its origins in the car industry, with large carmarkers wanting to improve the cash flow situation of their suppliers The system allowed car manufacturers to work more efficiently with smaller suppliers in an industry where late payment was a major concern and in some instances a stumbling block to doing business. The staff have now analysed the application of IFRS Standards to the reverse factoring arrangements in the statement of financial position, statement of cash flows and notes to the financial statements Staff analysis In the statement of financial position, when determining where to present liabilities that are part of the reverse factoring.

Mathsiteorg makes available usable resources on reverse factoring calculator, systems of linear equations and inequalities and other algebra subjects If you need assistance on intermediate algebra or even multiplying and dividing rational expressions, Mathsiteorg is without question the excellent destination to check out!. Extended periods of payment for supplies or services and satisfied suppliers who offer discounts for early payment – it seems improbable And yet it is possible Modern financial instruments, such as reverse factoring offered by banks, allow for meeting the working capital requirements and ensure flexible financial liquidity management The use of a similar service usually requires minor. Reverse factoring occurs when a company sells — or “factors” — its accounts receivable, but the recipient of the products and services instigates the deal instead of the supplier As a way to manage cash, companies will extend the length of time they take to pay their suppliers by using an intermediary.

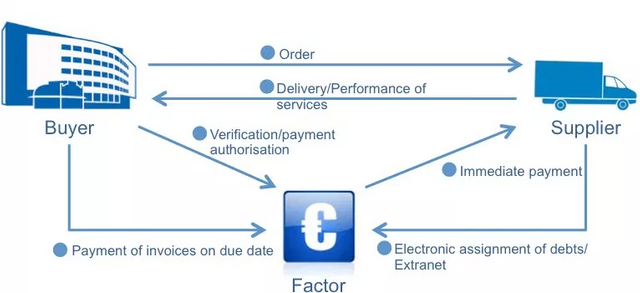

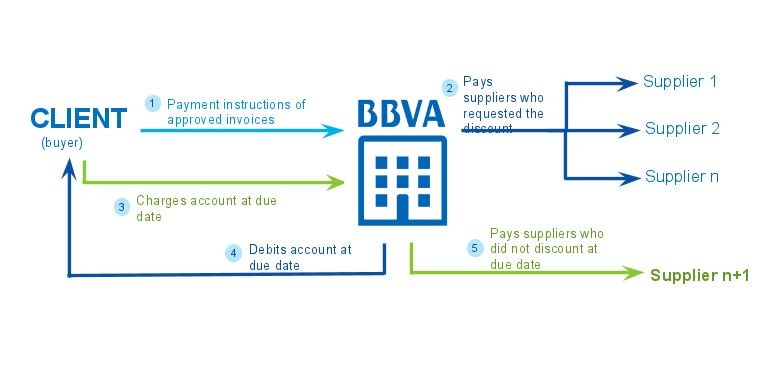

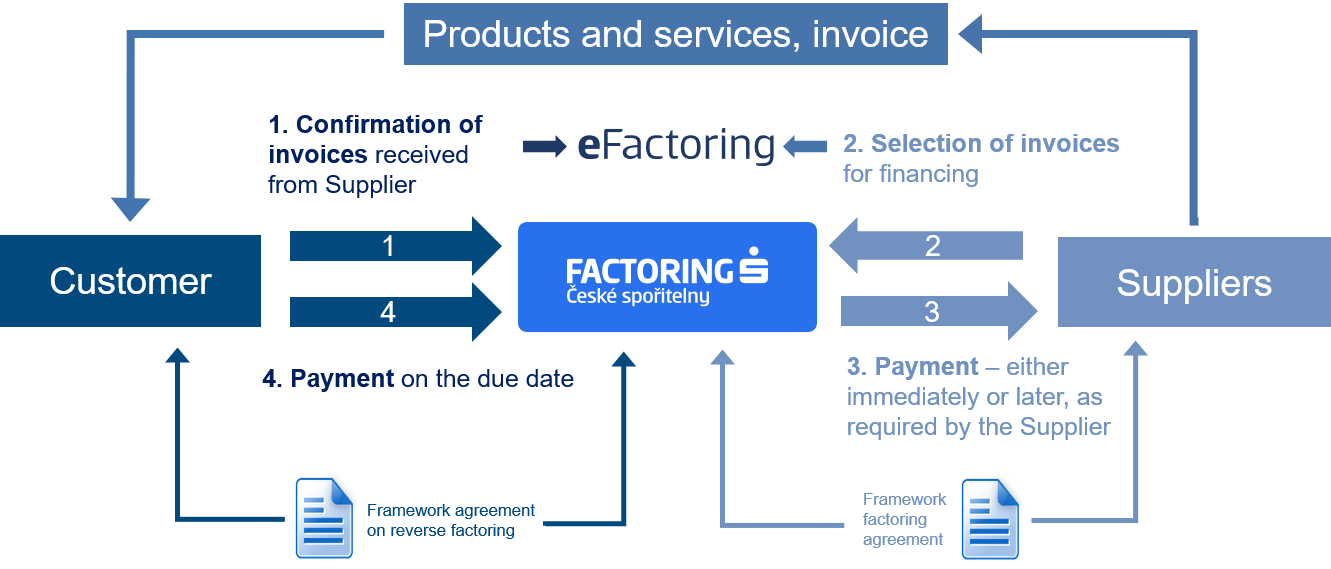

Although Reverse Factoring programs may be beneficial under some circumstances, its growing use may lead to serious situations One way to prevent these programs from growing too much would be for "factors" the financial institutions that provide liquidity to impose a risk premium on buyers, as compensation if there is a negative outcome. Reverse Factoring is a method of alternative commercial finance where the supplying party (client) has it’s receivables finance by an early payment arrangement set up by the ordering party Typically, the strong credit of the ordering party helps their suppliers receive more favorable financial terms than they would have otherwise received in a traditional factoring arrangement. Reverse factoring is a shortterm financing solution tailored to fit the needs of suppliers that serve large customers Through the intermediary of a “factor”, suppliers can obtain payment for their invoices before the contract deadline, using a “payment authorization” issued by the customer To implement this type of solution, the supplier and the factoring company sign a factoring contract.

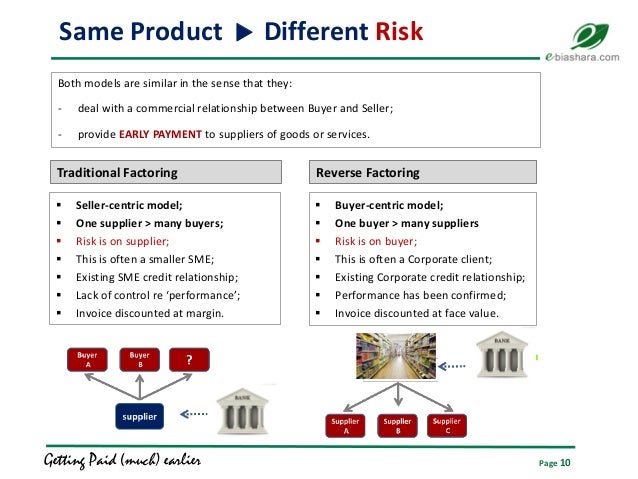

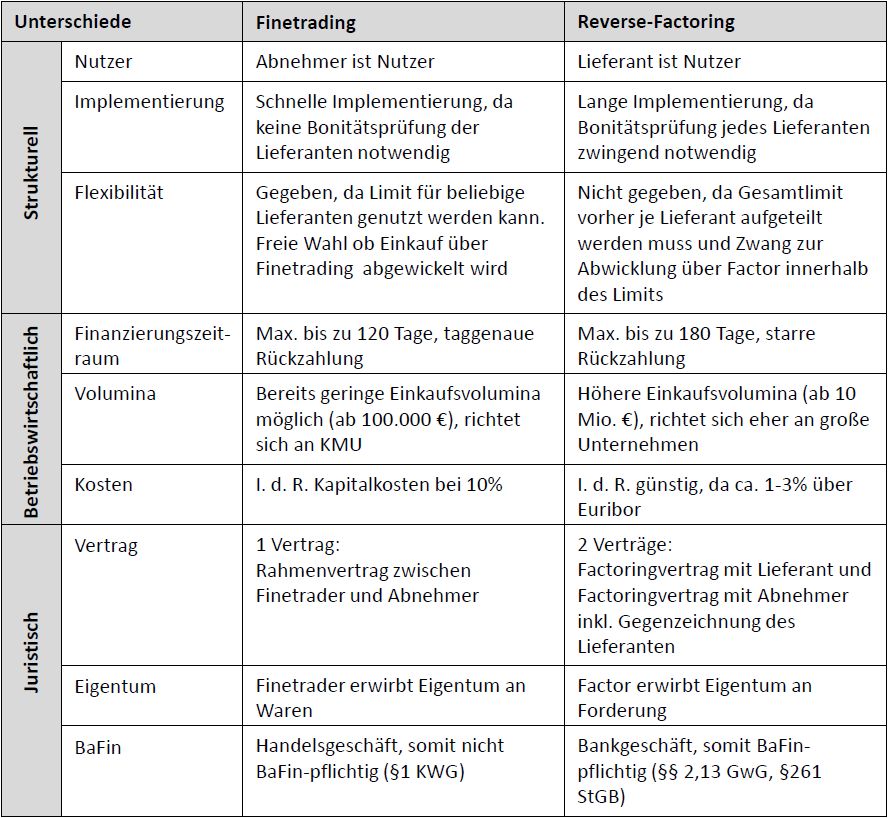

In recent years, however, finance types have come up with the somewhat riskier practice of “reverse factoring” In a reversefactoring deal, a third party pays off the company’s suppliers. Unlike traditional factoring, where a supplier wants to finance its receivables, reverse factoring (or supply chain financing) is a financing solution initiated by the ordering party (the customer) in order to help its suppliers to finance its receivables more easily and at a lower interest rate than what would normally be offeredIn 11, the reverse factoring market was still very small. Reverse factoring is a solution that is buyercentric because it is originated by the buyer instead of by suppliers, who may alternatively use factoring to access liquidity by discounting their invoices It has been argued that factoring is a more riskfriendly product because the credit exposure is against a diversified portfolio of buyers.

Reverse factoring is a financial instrument that allows a business finance company to interject itself between suppliers and businesses it serves The finance company commits to making discount payments to suppliers for its business customer at an accelerated rate. Reverse factoring can create substantial benefits across the supply chain and can be a better alternative to other working capital management schemes Suppliers and buyers should make sure, before being engaged in this, that this is consistent with their longterm financial strategies and their backoffice functions are efficient enough to get the maximum benefits out of this. Reverse Factoring, a winwin solution for suppliers and buyers Reverse Factoring is a strategic alternative financing solution Also known as supply chain financing, it provides suppliers with early payment of their invoices before the due date, at advantageous rates.

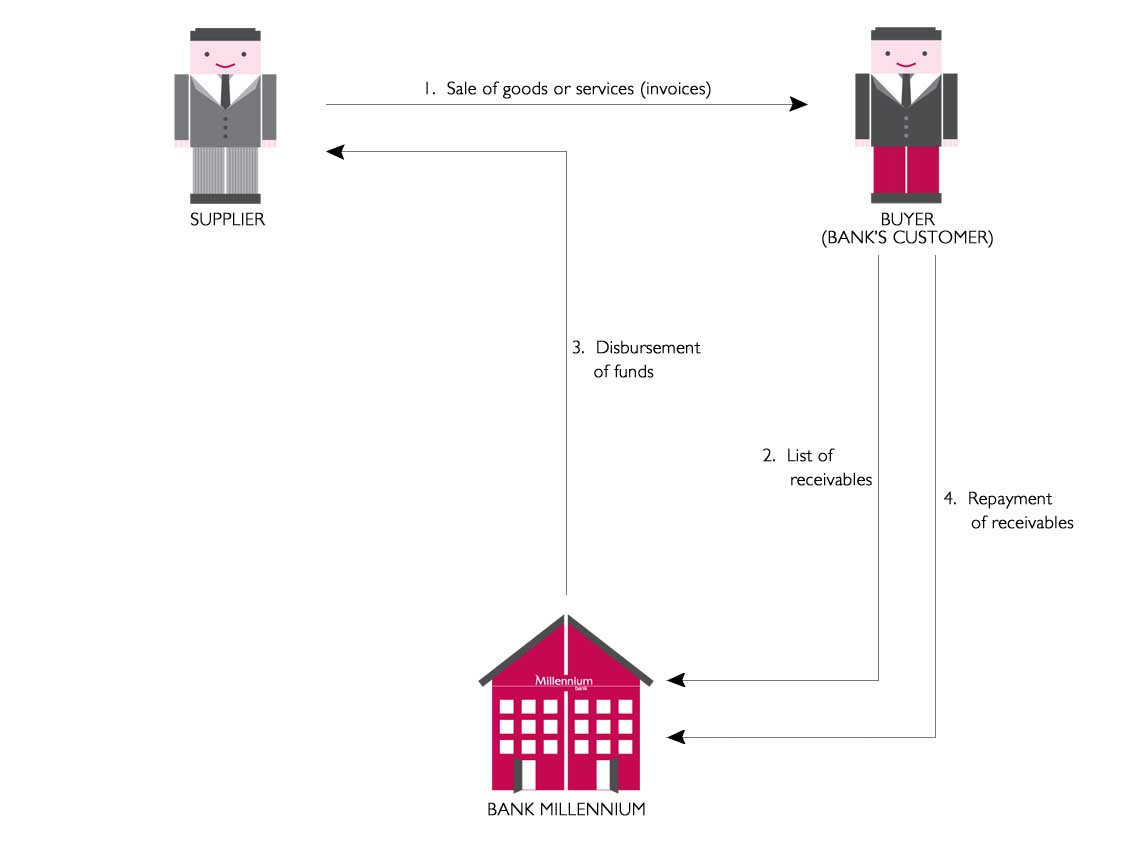

In reverse factoring the Bank manages your company's liabilities and payables simultaneously taking over the risk of their nonrepayment Within this product, the Bank settles your company's payables payments for liabilities due to suppliers This type of factoring enables your company to delay payments term even up to 180 days and negotiate better terms of payment in return for settling your payables on time (or earlier). Reverse factoring has the following benefits for suppliers A cashstrapped supplier can be paid much sooner than normal, in exchange for the finance company's fee The interest rate charged by the finance company should be low, since it is based on the credit standing of the paying. Supply chain finance, often referred to as "supplier finance" or "reverse factoring," encourages collaboration between buyers and sellers.

Reverse factoring or supply chain financing is a financing solution initiated by the ordering party to help his supplier finance their receivables more easily and at a lower interest cost than what would normally be offered Reverse factoring is unlike traditional invoice factoring, where a supplier wants to finance his receivables. Reverse factoring is an accounting solution that can help businesses to access the working capital they need to continue their everyday operations Also known as supply chain financing, reverse factoring describes the process of a bank or financial company agreeing to pay a company’s outstanding invoices to their suppliers who may be willing to accept a lower sum in exchange for prompt payment of their receivables. Reverse factoring, or supply chain finance, is a fintech method initiated by the customer to help financially support its suppliers by financing their receivables, where a bank pays the supplier’s invoices at an accelerated rate in exchange for lower rates, thus lowering costs and optimizing business for both the supplier and customer.

The Buyer has no extra costs. The liability of the funder is concentrated on a large credit worthy company It means that a funder does not have to worry about fraudulent invoices There is clarity for all parties on knowing when payment will be received;. Reverse factoring is a shortterm financing solution tailored to fit the needs of suppliers that serve large customers Through the intermediary of a “factor”, suppliers can obtain payment for their invoices before the contract deadline, using a “payment authorization” issued by the customer To implement this type of solution, the supplier and the factoring company sign a factoring contract.

Reverse factoring services, also known as supply chain financing (SCF) or supplier finance, is a financial product offering that allows wellestablished, creditstrong businesses to maintain or extend their payment terms, while simultaneously providing the option to their suppliers to elect early payment or quick pay on their open receivables. Many people are familiar with invoice factoring, but not everyone knows about its counterpart As the name suggests, reverse factoring is the opposite of invoice factoring Whereas invoice factoring is beneficial to businesses that are owed money from clients, reverse factoring benefits businesses that owe money. Reverse Factoring, a winwin solution for suppliers and buyers Reverse Factoring is a strategic alternative financing solution Also known as supply chain financing, it provides suppliers with early payment of their invoices before the due date, at advantageous rates.

Reverse Factoring Factoring for buyers searching for deferred payment dates Factoring for buyers searching for deferred payment dates A commercial transaction is where conflicting interests of the parties often meet as regards payment dates. Why Reverse Factoring Is Spreading and How to Protect Your Portfolio At the center of that tangled web is a British specialty finance company called Greensill This SoftBankbacked startup. What is Reverse Factoring?.

In the modern Supply Chain Finance landscape, Reverse Factoring is one of the most consolidated business model for working capital financing However, accounting treatment of Reverse Factoring might affect the balance sheet of large corporate, with disruptive consequences for the programme as a whole. Reverse factoring is transforming the way in which companies fund their working capital Often used as a catchall term for trade or supply chain financing, reverse factoring conventionally involves a thirdparty financial intermediary providing external funding to accelerate the settlement of a supplier's invoice (trade receivables) The offer of funding often coincides with a lengthening of. Advantages of Reverse Factoring Invoices are paid to suppliers much faster, avoiding any delay in receiving account receivables This leads to improved Since invoices are paid on time, suppliers no need to chase the firms for early requests Both parties can focus on The concept of reverse.

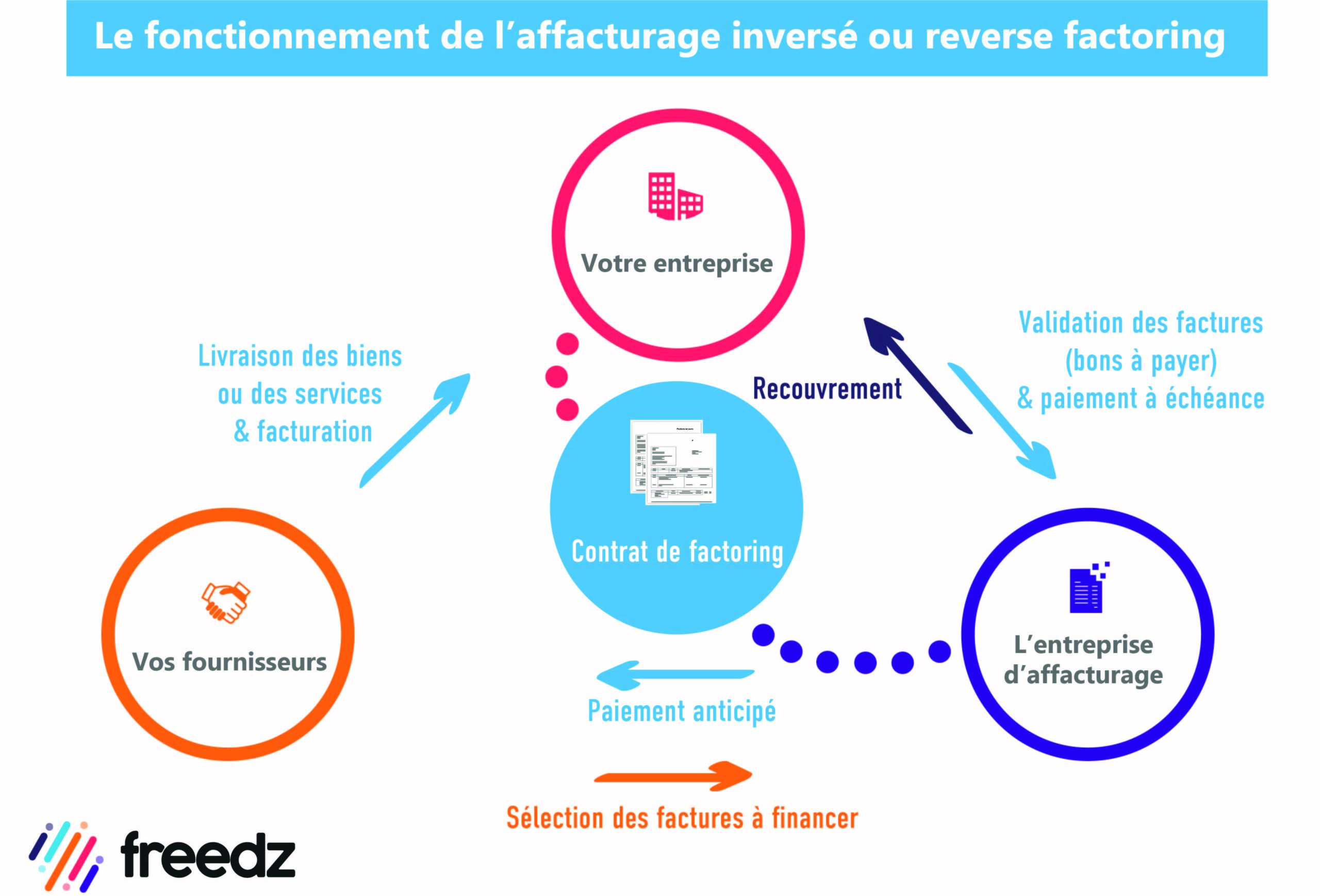

Définition du reverse factoring Le reverse factoring, aussi appelé affacturage inversé, est une technique de financement mise en place par le client de fournisseurs de biens ou de services De cette façon, le client propose à ses fournisseurs un paiement comptant par le biais d’une société d’affacturage. Reverse factoring takes advantage of the retailer's payment guarantee and the credit rating differential between small supplier and large retailer, enabling the supplier to receive financing at a more favorable rate We develop a supply chain theory of (recourse/nonrecourse) factoring and reverse factoring showing when these postshipment. What are the key advantages of reverse factoring?.

Reverse factoring Reverse factoring is a financing solution in which you pay your suppliers via a financing partner before the agreed payment term By confirming their invoices, you enable your supplier to have their receivables financed early, and on better terms. Reverse factoring, also referred to as Supply Chain Finance (SCF), is a SupplyChainManagement strategy deployed by buying organizations (ie buyers) to improve its working capital without negatively affecting the supplier base. Reverse factoring takes advantage of the retailer's payment guarantee and the credit rating differential between small supplier and large retailer, enabling the supplier to receive financing at a.

Reverse factoring is a solution that is buyercentric because it is originated by the buyer instead of by suppliers, who may alternatively use factoring to access liquidity by discounting their invoices It has been argued that factoring is a more riskfriendly product because the credit exposure is against a diversified portfolio of buyers. Reverse factoring is also widely known as supply chain finance, although the term ‘supply chain finance’ is also occasionally used as an umbrella term to include a range of supplier financing solutions The term ‘reverse factoring’ differentiates this form of finance from factoring, another type of receivables finance in which a company. The reverse factoring process is relatively simple, although it’s important to remember that it generally takes place using a supply chain finance reverse factoring program, so you’ll need access to one of those if you don’t already.

Also known as supply chain finance or supplier finance, reverse factoring involves a funder advancing payment to its clients’ suppliers at an accelerated rate, giving both parties a number of benefits Reverse factoring differs from traditional factoring in that it is the buyer, not the supplier who initiates the funding. Unlike traditional factoring, where a supplier wants to finance its receivables, reverse factoring (or supply chain financing) is a financing solution initiated by the ordering party (the customer) in order to help its suppliers to finance its receivables more easily and at a lower interest rate than what would normally be offeredIn 11, the reverse factoring market was still very small. Reverse factoring Reverse factoring is a financial instrument addressing the needs of big companies working with their customers on deferred payment basis It provides Ensures the liquidity of your suppliers;.

Reverse Factoring Supply Chain Finance Gma Factor

Accelerer Le Paiement Des Factures Grace Au Reverse Factoring

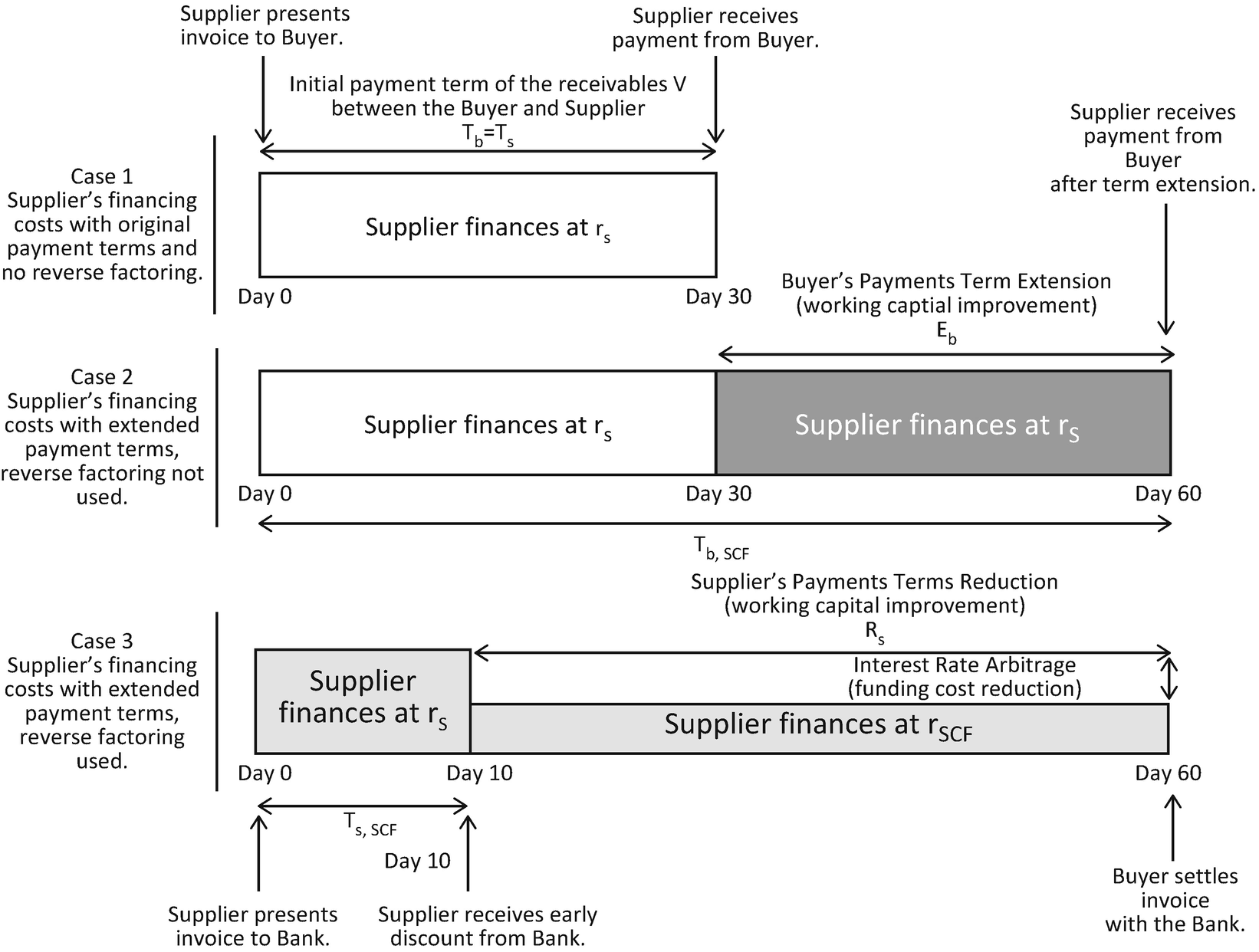

The Price Of Reverse Factoring Financing Rates Vs Payment Delays Scf Academy

Reverse Factoring のギャラリー

Muddy Waters Report Highlights Risks Of Debt Masquerading As Reverse Factoring Barron S

What Is Reverse Factoring Freedz

Nmc Health Demystifying Reverse Factoring The Three Is A Crowd Financial Analysis Problem Valuesque

Reverse Factoring Definition Process And Benefits

Reverse Factoring Finance Investing Accounting And Finance Economics Lessons

Supply Chain Finance Solutions For Your Company S Working Capital va

What Is Reverse Factoring Primerevenue

Reverse Factoring What Is The Deal Mcgrathnicol

Reverse Factoring Ess Partners

Reverse Factoring Intensifies B2b Late Payments Pymnts Com

Process Of Reverse Factoring Explained Reverse Balance Sheet Cash Flow

Reverse Factoring Template Powerpoint Graphics Powerpoint Templates

Reverse Factoring Policy And Disclosure Of Amounts Involved Accounts Examples

Reverse Factoring Corporate Bank Millennium

The Price Of Reverse Factoring Financing Rates Vs Payment Delays Sciencedirect

Reverse Factoring Definition Process Benefits Limitations Efm

Pdf Modelling International Reverse Factoring And The Future Of Supply Chain Finance Semantic Scholar

Factoring Reverse Factoring Are Two Methods Of Bill Discounting On A Treds Platform Both Of These Metho Payment Processing Balance Sheet Accounts Receivable

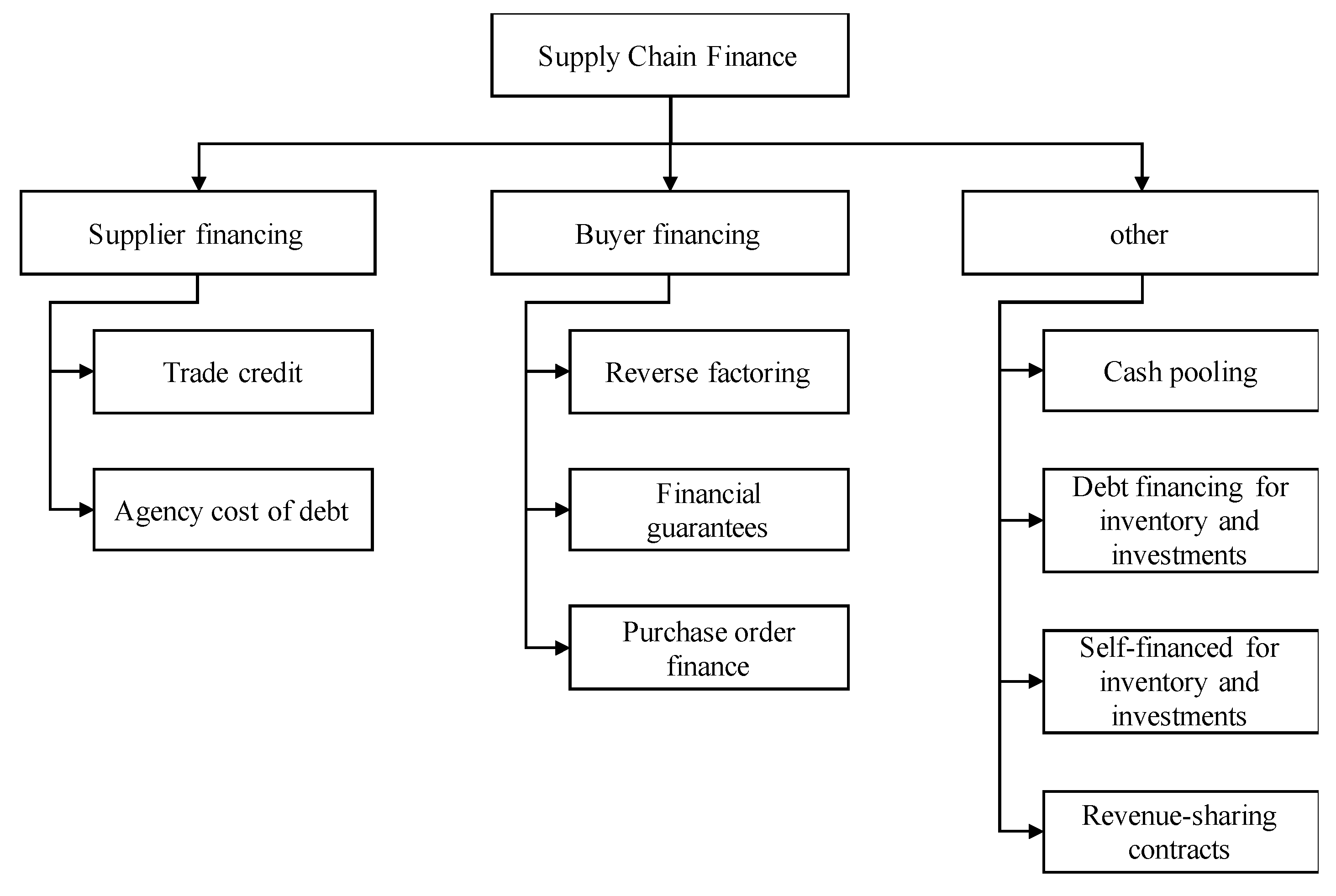

Factoring Reverse Factoring And Other Tools For Access To Finance Scf Academy

Reverse Factoring Ess Partners

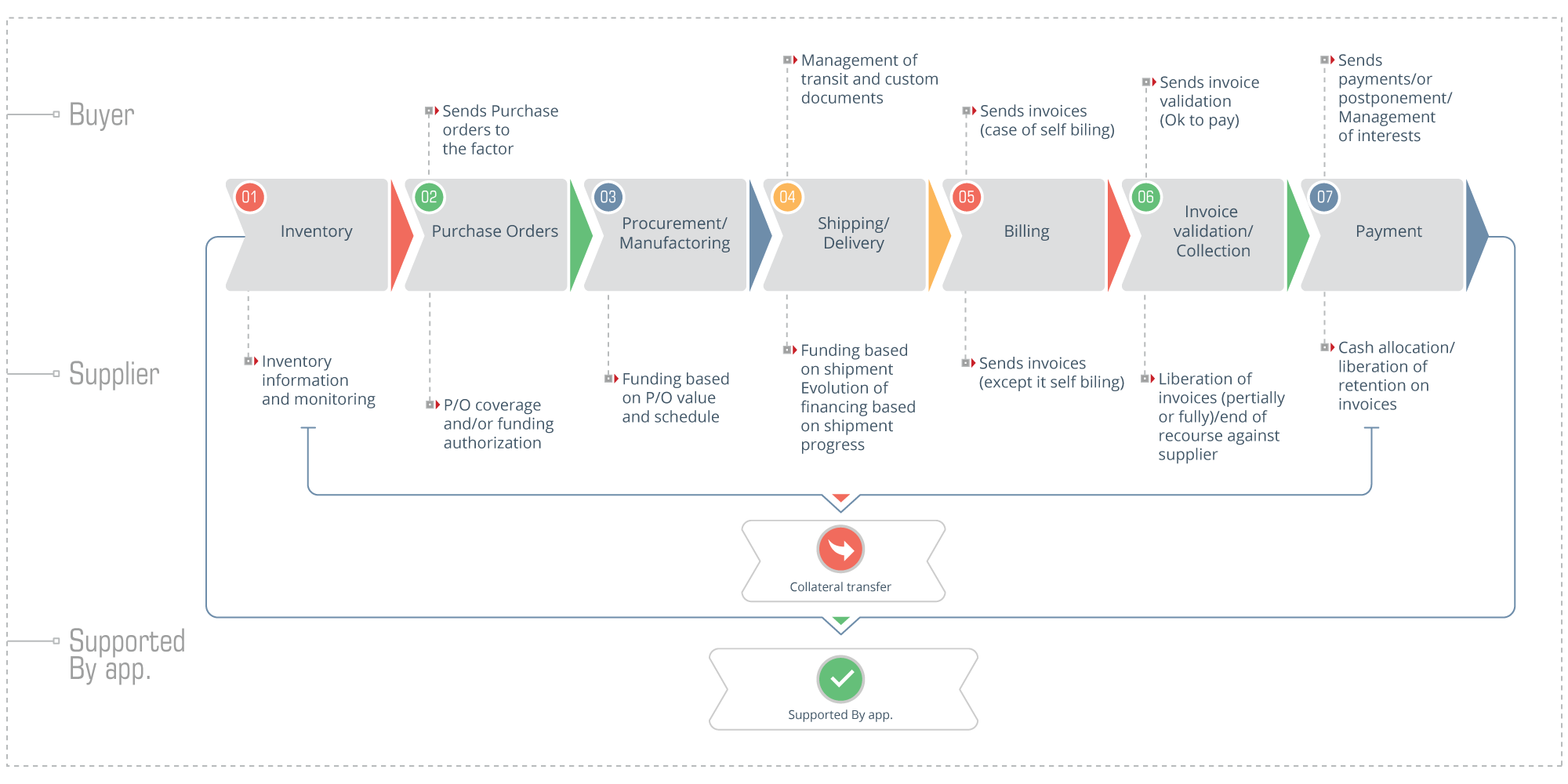

Typical Reverse Factoring Process 3wm Three Way Match 6 Download Scientific Diagram

What Is Reverse Factoring What Does Reverse Factoring Mean Reverse Factoring Meaning Explanation Youtube

Nmc Health Demystifying Reverse Factoring The Three Is A Crowd Financial Analysis Problem Valuesque

Impact Of Supply Chain Finance And Reverse Factoring

Bnp Paribas Factoring Reverse Factoring Youtube

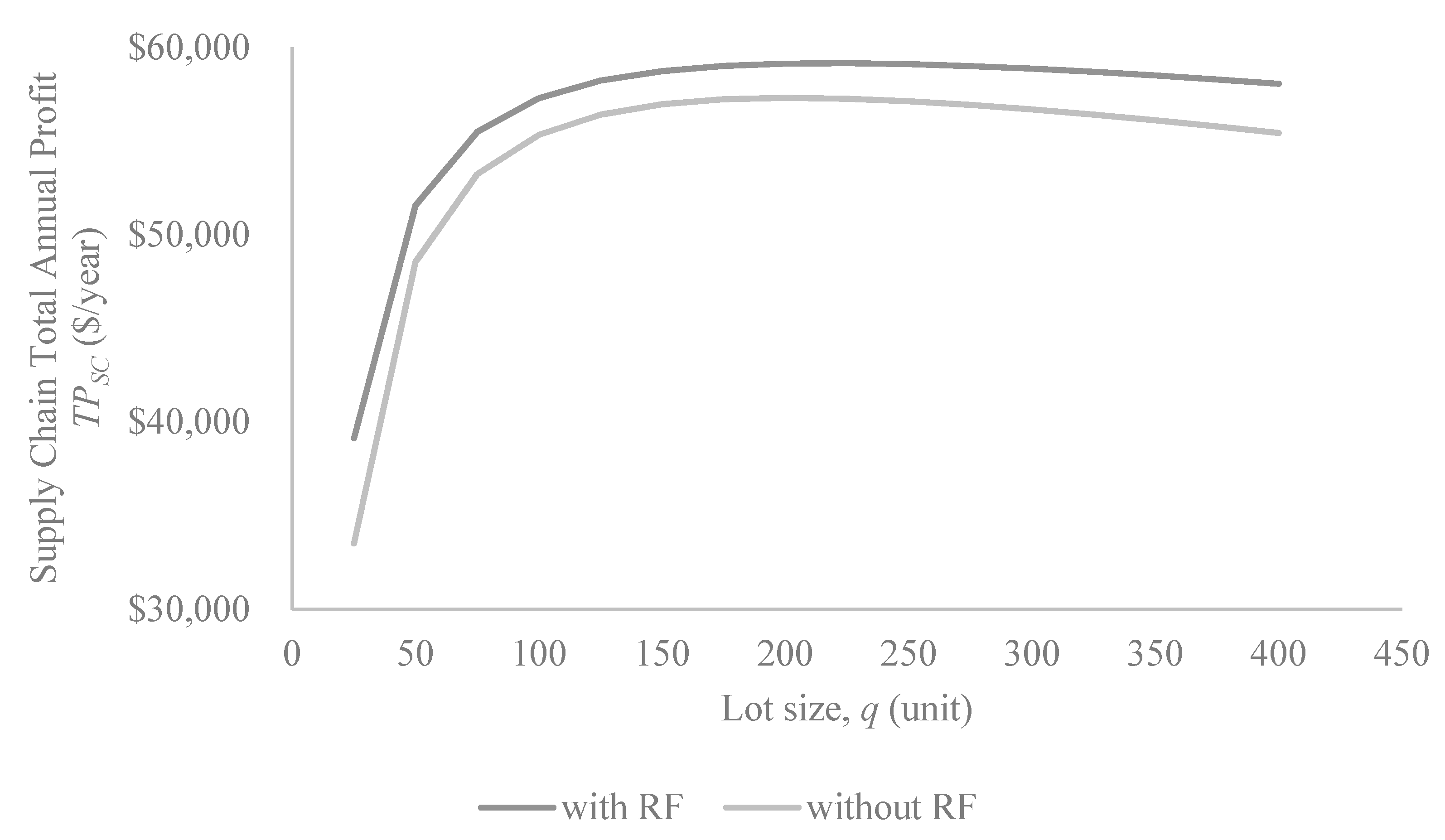

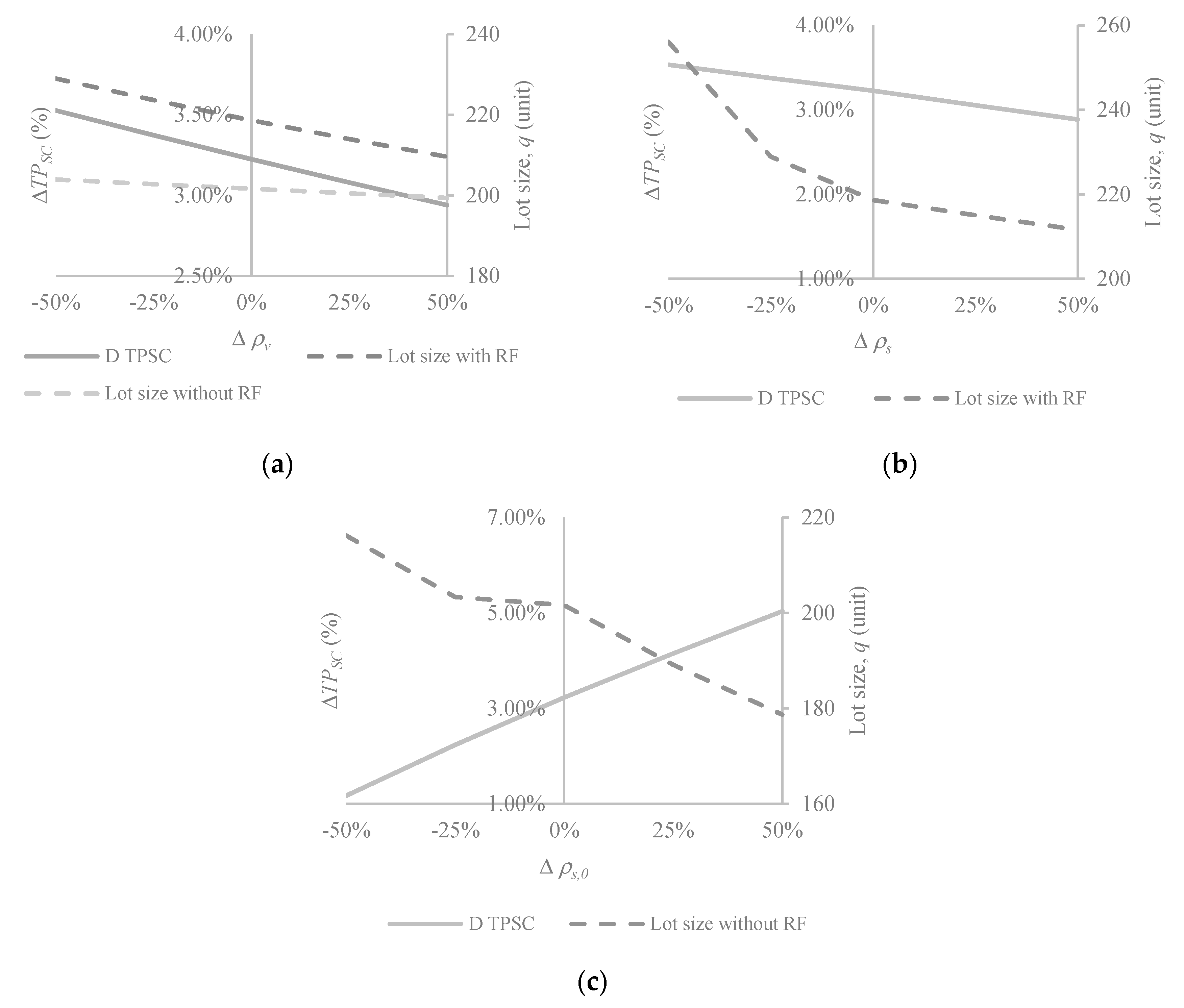

Ijfs Free Full Text Improving Supply Chain Profit Through Reverse Factoring A New Multi Suppliers Single Vendor Joint Economic Lot Size Model Html

Factoring Reverse Factoring Invoicemart

Reverse Factoring Supply Chain Finance Ppt Powerpoint Presentation Styles Images Cpb Powerpoint Slide Template Presentation Templates Ppt Layout Presentation Deck

Ijfs Free Full Text Improving Supply Chain Profit Through Reverse Factoring A New Multi Suppliers Single Vendor Joint Economic Lot Size Model Html

Coca Cola Archives Supply Chain Institute

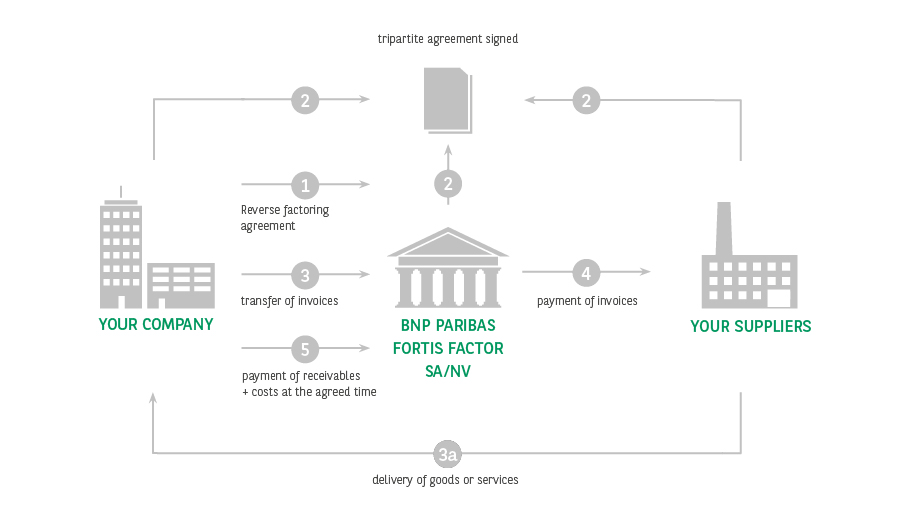

Reverse Factoring Solution Bnp Paribas Fortis Companies

Supply Chain Management Bpir Com

Reverse Factoring Ess Partners

2 Nafin Reverse Factoring Transactions Download Scientific Diagram

What Is Reverse Factoring A Growing Concern In Finance Barron S

Sky Cartoon Png Download 926 955 Free Transparent Reverse Factoring Png Download Cleanpng Kisspng

India Us Trade Corridor Accelerating Growth With Reverse Factoring The Global Treasurer

Financial Blog Reverse Factoring Steemit

Reverse Factoring Wip Funding

The Reverse Factoring Mechanism Download Scientific Diagram

Water Circle

Explanation Of Reverse Factoring Download Scientific Diagram

Reverse Factoring

Joining The Dots Deutsche Bank

Ijfs Free Full Text Improving Supply Chain Profit Through Reverse Factoring A New Multi Suppliers Single Vendor Joint Economic Lot Size Model Html

Reverse Factoring Fundamentals What It Is What It S Not And How It Works Primerevenue

Reverse Factoring Meaning Examples What Is Reverse Factoring

What Is Reverse Factoring Gocardless

International Reverse Factoring An Innovative Instrument For Import Business Eurofactor Gmbh

The Impact Of Recent Regulatory Reform On The Use Of Supply Chain Finance The Case Of Reverse Factoring Springerlink

ru 002 Reverse Factoring Supplier Financing Kpmg Australia

System For Reverse Factoring Supply Chain Finance Software

Market Adoption Of Reverse Factoring Emerald Insight

Reverse Factoring

Reverse Factoring And The Collapse Of Carillion Leasing Life Issue 4 February 18

Factoring Reverse Factoring And Other Tools For Access To

What Is Reverse Factoring Creditdigital

Scf Presentation Introduction Generic V0 6

Payday Loan Reverse Factoring Credit Term Loan Gold Carousel Text Logo Png Pngegg

Reverse Factoring And Supply Chain Financing Services

Reverse Factoring Supply Chain Finance Ppt Powerpoint Presentation Styles Images Cpb Powerpoint Slide Template Presentation Templates Ppt Layout Presentation Deck

Supply Chain Finance Solutions For Your Company S Working Capital va

File Abgrenzung Finetrading Vs Reverse Factoring Jpg Wikimedia Commons

Reverse Factoring Crx Markets

Reverse Factoring Postfinance

Factoring Ceske Sporitelny Reverse Factoring

How Can Your Business Benefit From Reverse Factoring

Do Your Clients Use Reverse Factoring John Mccarthy Consulting

Supply Chain Finance In Italy Has A 637 Bn Euros Potential This Is The Best Place To Be For Fintech Startups Bebeez It

Reverse Factoring

Reverse Factoring Won T Benefit Smes Global Trade Review Gtr

Factoring Ceske Sporitelny Reverse Factoring

Lending To Smes Identifying Difficulties And Recommending Targeted Measures Cairn International Edition

What Is Supply Chain Finance Primerevenue

Besoin En Fonds De Roulement Reverse Factoring Payment Finance Reverse Factoring Transparent Background Png Clipart Hiclipart

Reverse Factoring Policy And Disclosure Of Amounts Involved Accounts Examples

Understanding Reverse Invoice Factoring Rbr

Reverse Factoring A Ticking Time Bomb In Corporate Books

Impediments To The Adoption Of Reverse Factoring For Logistics Service Providers Springerlink

Nmc Health Demystifying Reverse Factoring The Three Is A Crowd Financial Analysis Problem Valuesque

Reverse Factoring A Ticking Time Bomb In Corporate Books

Reverse Factoring A Fast Easy And Innovative Financing Solution Bnp Paribas

Reverse Factoring Undisclosed Borrowing To Smooth Operating Cashflows Volatility Cfa Institute Market Integrity Insights

Reverse Factoring Factoring Finance Credit

Pdf Impediments To The Adoption Of Reverse Factoring For Logistics Service Providers

Education Background Png Download 718 557 Free Transparent Reverse Factoring Png Download Cleanpng Kisspng

Reverse Factoring And Fci Reverse Here S What Happened

Benefits And Risks Of Supply Chain Finance For Cfos

Reverse Factoring Risk Management Considerations

A Supply Chain Theory Of Factoring And Reverse Factoring

Veefin Scf Reverse Factoring

Online Reverse Factoring Platform Sakchyam Programme

Reverse Factoring A Secret Weapon In Sme Finance By Political Creditrisk Medium

The Price Of Reverse Factoring Financing Rates Vs Payment Delays Sciencedirect