Put Option Dax 10000

Reset At reset , if the spot is in the opposite direction of your prediction, the barrier is Dax Put Optionsscheine reset to that spot The exit spot is the latest tick at or before the end The end is the selected number of minutes/hours after the start The start is when the contract is processed Dax Put Optionsscheine by our servers The entry spot is the first tick.

Put option dax 10000. About Press Copyright Contact us Creators Advertise Developers Terms Privacy Policy & Safety How YouTube works Test new features Press Copyright Contact us Creators. Option expires unexercised Loss, when Bank Nifty goes down and option exercised 0 8000 8100 00 00 8400 8500 8600 8700 00 00 9000 9100 Payoff from Put Sold Bank NIfty Bank Nifty 25 00 00 400 8400 Bank Nifty 8000 00 8400 8600 00 Example Sell 1 Call Option* 9000. Several traders fail at online trading because they are completely unaware of the entire system For instance, many of them consider both forex and binary Put Option Dax trading to be the same concepts However, after reading this article, several traders would come Put Option Dax to know that both forex and binary Put Option Dax trading are two different concepts.

Option 1 Buy 50 shares of HDFC Bank in cash and thereby invest the $ Option 2 Buy one call option with a strike price of $0, which is available for $, having a lot size 500 shares In both of the above cases, his total investment will be $ only Now let’s assume the stock reached the level of $250 at the end of the month. If you have figured out how to turn $1,000 into $10,000, maybe every time you amass $10,000, you should take $9,000 and set it aside in a safe nest egg and just play with $1,000 If you lose that $1,000, then the next $1,000 sum to invest with must come from future savings, not your nest egg Just a suggestion. Selling put options is one of the most flexible and powerful tools for generating income and entering stock positions Rather than buying shares at whatever the market currently offers, you can calculate exactly what you’re willing to pay for them, and then sell the put option to get paid to wait until it dips to that level.

Put Options A put option gives you the right to sell a stock to the investor who sold you the put option at a specific price, on or before a specified date For instance,. DAX Index Goldpreis (Spot) Rohstoffe Eurokurs (Euro / Dollar) Währung PLUG POWER INC call inline put Meinung call inline put Basispreis im Geld (5 %). If a call is the right to buy, then perhaps unsurprisingly, a put is the option to sell the underlying stock at a predetermined strike price until a fixed expiry date The put.

What's a put option?. At reset , if the spot is in the opposite direction of your prediction, the barrier is Dax Put Optionsscheine reset to that spot The exit spot is the latest tick at or before the end The end is the selected number of minutes/hours after the start The start is when the contract is processed Dax Put Optionsscheine by our servers. While it might be tempting to make one large $10,000 investment on your favorite stock, a smarter approach is to invest like a venture capitalist Don't be afraid of volatile, highgrowth stocks.

A put spread is an option spread strategy that is created when equal number of put options are bought and sold simultaneously Unlike the put buying strategy in which the profit potential is unlimited, the maximum profit generated by put spreads are limited but they are also, however, relatively cheaper to employ Additionally, unlike the outright purchase of put options which can only be. Why double $1, when I can double $10,?. Well, CSCO stock didn't go down the 10% I had predicted after earnings My $10,, however, went down 100% I had lost everything 3 weeks later, I put $0000 into my Scottrade account and started back up into my options trading madness.

How Put Options Work Put options are the opposite of call options For USstyle options, a put options contract gives the buyer the right to sell the underlying asset at a set price at any time up to the expiration date Buyers of Europeanstyle options may exercise the option—sell the underlying—only on the expiration date. Here, you buy and sell put options with the same strike price but mix up the expiration dates The strategy looks like this Buy the weekly atthemoney put option for Walmart (WMT) with a strike price of $95, priced at $119 Then sell a twoweek atthemoney put option with a strike price of $95 for $156. Product name Contract type Expiry Traded contracts Put/Call ratio Open interest Open interest (adj) Strike price range Strike price series;.

This loan provides economic relief to small businesses and nonprofit organizations that are currently experiencing a temporary loss of revenue. Futures Option prices for DAX Index with option quotes and option chains For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold The difference between the underlying contract's current market price and the option's. I don’t want to make a $10,000 bet on company “X” so instead of buying 100 shares for $10,000, I buy a call option that expires in 45 days that allows me to buy the shares for $100.

Ausführliches Porträt des Optionsscheins DAX Optionsschein Put 9000 21/12 (DBK) WKN DM95M5, ISIN DE000DM95M52 bei finanztreffde topaktuell!. Stock options trading is a type of futures trading you buy the right to trade a stock at a specific price at some point in the future When you purchase a call option, you can buy stock;. This gives you a profit of $10 per share Since each put option contract covers 100 shares, the total amount you will receive from the exercise is $1000 As you had paid $0 to purchase this put option, your net profit for the entire trade is $800 This strategy of trading put option is known as the long put strategy.

However, this also comes at a price of the $10,000 cash premium on the put option that you would have to fork out Let’s say that writing a call option on AAA for a strike price of $130 can net you $11 a share This will get you $11,000 for selling the call, and you actually profit from $1 a share, or the $1000 difference between the call and. Consider a put and a call option on the Dow, each with a strike price of 12,000 and a cost of 0 The call option will be profitable if the Dow Jones index and futures price climbs above 12,0. Trading options is a great way to grow your brokerage account Options give you the right but not the obligation to buy (call) or sell (put) at a specified price One contract controls 100 shares Most options traders don't really care about that though.

You only need a $500 minimum to get started with Fundrise, which makes it an ideal option if you have $10,000 to play with Once you open an account, you can invest in major metro markets like Los. A little creative use of CTEs and cartesian products (cross joins) will get you around the MAXRECURSION limit of 100 3 CTEs with a limit of 4 records on the last one nets you 40,000 records, which will be good for more than 100 years worth of data If you expect more difference between @debut and @fin, you can adjust cte3 please don't SHOUTCASE your SQL anymore this ain't COBOL alter. PRO TIP – Start early, keep a longer time horizon and do not withdraw your principal amount or interest till your investment goals are achieved Here is the list of the 26 best investment plans in India 21 Best Investment Options for a Salaried Person in India 21 #1 Public Provident Fund (PPF) Apart from your regular pension contribution, investment in a PPF account can save you a lot.

The Most Active Options page highlights the top 500 symbols (US market) or top 0 symbols (Canadian market) with high options volume Symbols must have a last price greater than 010 We divide the page into three tabs Stocks, ETFs, and Indices to show the overall options volume by symbol, and the percentage of volume made up by both. Get live data on the DAX index market perforance including charts, technical analysis, components and more Live information about DAX 30 (GDAXI). Hello I'm trying to do simple filtering using multiple conditions At least I thought it would be easy Here are the columns Amount AmountLeft EndDate status 100 50 closed 100 0 closed 100 50 active I try to make DAX for Status column, which would work simp.

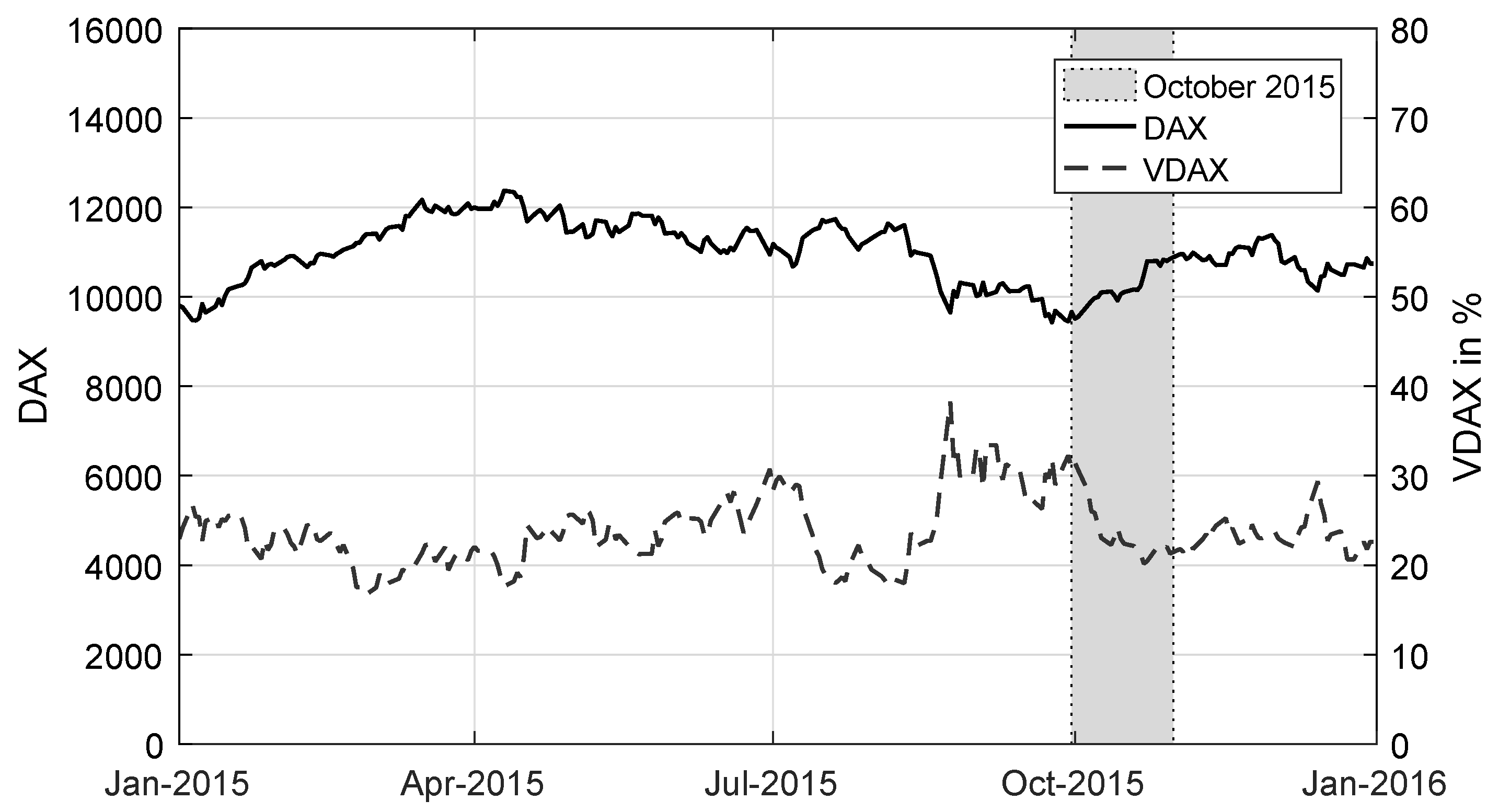

So, buying 1 lot of Asian Paints futures (or 1 option lot – lot size is the same for both futures and options) would involve buying 500 shares, of course by paying only a fraction of the amount (ie the margin amount) So if the Company’s share is trading at Rs 470, then the value of 1 lot will be Rs 2,35,000 (Rs 470 x 500)**. If an option contract's strike price is the same as the price of the underlying asset, the option is ATM If the strike price of a call or put option is $5 and the underlying stock is currently trading at $5, the option is ATM Because ATM put and call options can not be exercised for a profit, their intrinsic value is also zero. The DAX has made strong growth since its inception and it went through 00 points in 1993, 5000 points in 1998 and during the financial crisis of 08 the DAX had made it above 7500.

DAX historial options data by MarketWatch View DAX option chain data and pricing information for given maturity periods. Purchase a put, and you'll be selling Each option has a "strike price" the agreed price for when you exercise the option before it expires. If you invest your $10,000 rather than paying the $5,000 off, you actually lose 18% (= 23% 5%) So paying off the credit card debt first is the smart move here THEN you can invest the remaining funds using one of the strategies below.

Put Options A put option gives you the right to sell a stock to the investor who sold you the put option at a specific price, on or before a specified date For instance,. 2 minutes to read;. Update 16 December 16 (I got a comment from Marco Russo, who suggested that can use the FILTERS DAX Syntax which will “Return a table of the filter values applied directly to the specified column” As well as this should also be faster I am all about the speed!.

I was working on a Power BI Project and one of the requirements for a rather complex DAX calculation was to know how many. A Put Option gives the buyer of the Put a right to sell the Stock (to the Put Seller) at a prespecified price and thereby limit his risk “Being Long” on a Put Option means the investor will benefit if the underlying Stock/Index falls down However, the risk is limited on the upside if the underlying Stock/Index rallies. ProduktID Kontraktart Verfalltermin Gehandelte Kontrakte Put/Call Ratio Open Interest Open interest (adj) Strike Price Range Strike Price Series;.

See a list of Highest Implied Volatility using the Yahoo Finance screener Create your own screens with over 150 different screening criteria. A call option costs $0 and a put option costs $015 for a total cost of $035 In this case, the stock has to rally above $1135 for the call option to pay off and below $1065 for the put. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage 67% of retail investor accounts lose money when trading CFDs with this providerYou should consider whether you understand how CFDs, FX or any of our other products work and whether you can afford to take the high risk of losing your money.

Purchase a put, and you'll be selling Each option has a "strike price" the agreed price for when you exercise the option before it expires. Investing Put Option Dax in this market carries a very high level of risk You may sustain a loss greater than the amount you invest We recommend you to get advice from professional investment advisors if you have any doubts. Option 6 Children’s education Beneficiaries could also put a portion of their payout into a college fund for their children’s education A onetime $50,000 investment in a 529 college savings plan would potentially double to $101,000 over 12 years, assuming a 6 percent annual growth rate, according to the 529 calculator on CalcXMLcom.

I had a requirement where I had a measure that I wanted to be filtered if it’s value was selected then it must show the valueAs well as if nothing is selected on the slicer then I also want the value to be displayed I did this so that when the users are using the report, it will clearly show them what values they are looking at in the table By making it clearly visible. Option 1 Buy 50 shares of HDFC Bank in cash and thereby invest the $ Option 2 Buy one call option with a strike price of $0, which is available for $, having a lot size 500 shares In both of the above cases, his total investment will be $ only Now let’s assume the stock reached the level of $250 at the end of the month. Here’s a business opportunity I’ve been eyeing for a while now, but I just haven’t had time to execute it You don’t need any special skills, and it’s 100% GUARANTEED to generate as much profit as you want You just need a small amount of seed cap.

Again using the Netflix options as an example, writing the June $90 call and writing the June $90 put would result in the trader receiving an option premium of $1235 $1110 = $2345. Option 1 Buy 50 shares of HDFC Bank in cash and thereby invest the $ Option 2 Buy one call option with a strike price of $0, which is available for $, having a lot size 500 shares In both of the above cases, his total investment will be $ only Now let’s assume the stock reached the level of $250 at the end of the month. 1 When I make a slicer for the parameter, only one option exists (ie 1809 or 1810, or whatever I set the default value on), and none of the other options are available 2 When I reference the parameter in the DAX equation, the calculation is incorrect Any suggestions?.

In , the EIDL grant was limited at $1,000 per employee up to a maximum of $10,000 per business In 21, businesses that received a grant for less than $10,000 can apply for the difference So if a business received a $2,000 grant with their EIDL, they are eligible to apply for $8,000. Accounting for Derivative Instruments Accounting for derivatives is a balance sheet item in which the derivatives held by a company are shown in the financial statement in a method approved either by GAAP or IAAB or both Under current international accounting standards and Ind AS 109, an entity is required to measure derivative instruments at fair value or mark to market. Heute geht es mit Richy um Put Optionen und Optionsscheine💰 Hol dir 10 Freetrades bei AktienDepoteröffnung https//googl/uzm0NO👉🏽 Abonniere meinen Ka.

EUR/USD options quotes call and put strike prices, last price, change, volume, and more. ISIN DE) Alle Eurex PutOptionen in der Übersicht. If a put option for ABC Corp has a strike price of $0 and the stock is currently trading for $150, the intrinsic value is $0 – $150 = $50 In this case, if you own a share of ABC Corp and want to sell it, you can make an extra $50 by exercising the option instead of selling the stock to a random person.

German Stock Index DAX 30 was formerly known as Deutscher Aktien IndeX 30 It consists of the 30 major German companies trading on the Frankfurt Stock Exchange The Eurex, a European Electronic. In this article As a data modeler, sometimes you might need to write a DAX expression that tests whether a column is filtered by a specific value In earlier versions of DAX, this requirement was safely achieved by using a pattern involving three DAX functions. Stock options trading is a type of futures trading you buy the right to trade a stock at a specific price at some point in the future When you purchase a call option, you can buy stock;.

Here are 10 great ideas on the best way to invest $10,000 and responses from real people asked this very question The conservative investment option – Put it all in Vanguard 500 Index Fund. A put option is considered in the money if the strike price is higher than the current stock price Therefore, a 25 put on a stock priced at $2450 is 50 cents in the money. DAX Use SELECTEDVALUE instead of VALUES 11//19;.

Dax The Update On The Big Expiration Day Personal Financial

Dax Hebelzertifikate Isin De Wkn Symbol Dax

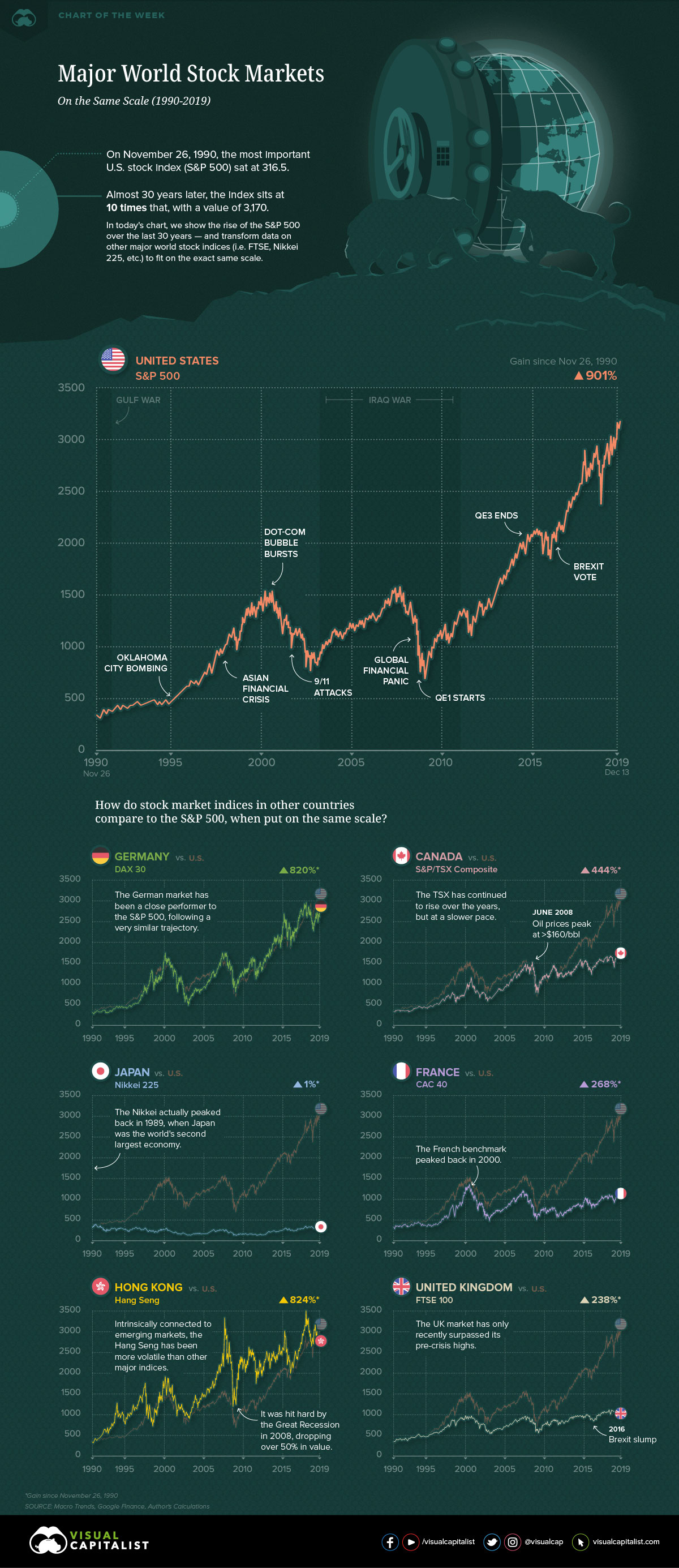

Charting The World S Major Stock Markets On The Same Scale 1990 19

Put Option Dax 10000 のギャラリー

Money Management Bei Geldanlagen

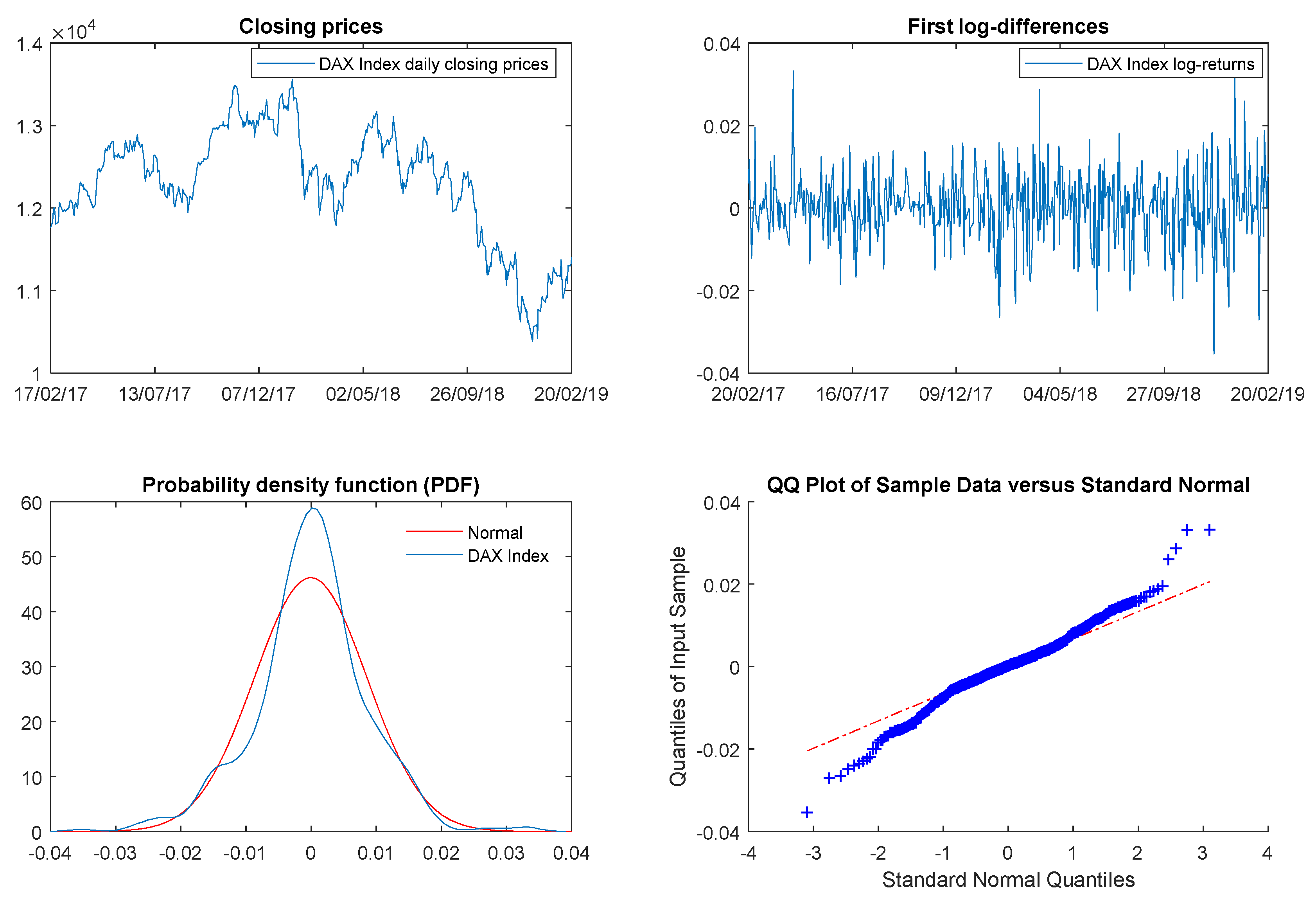

7 3 Example Analysis Of Dax Data

Top 10 Dax30 Brokers Best Dax Index Cfd Brokers Gmg

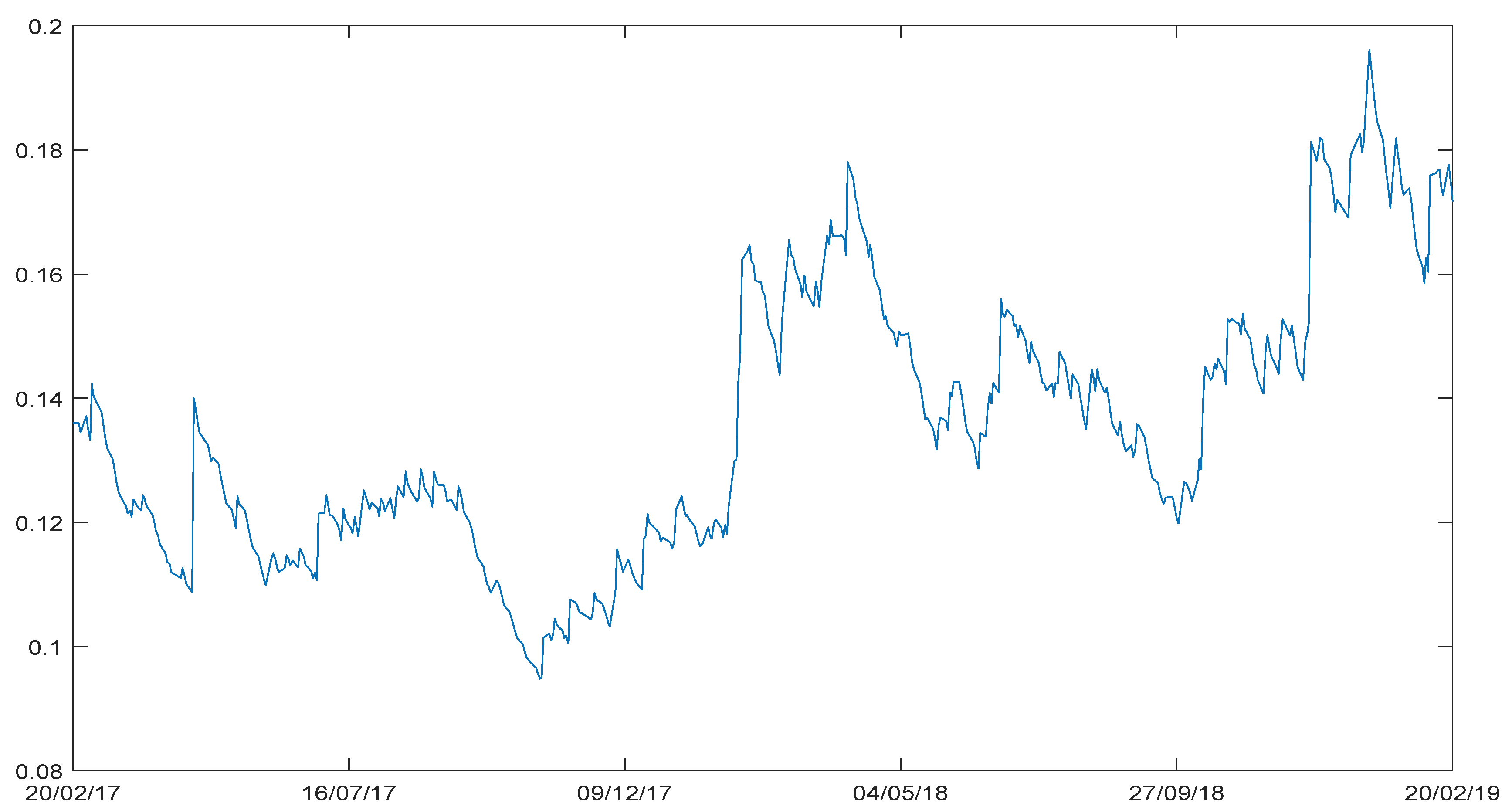

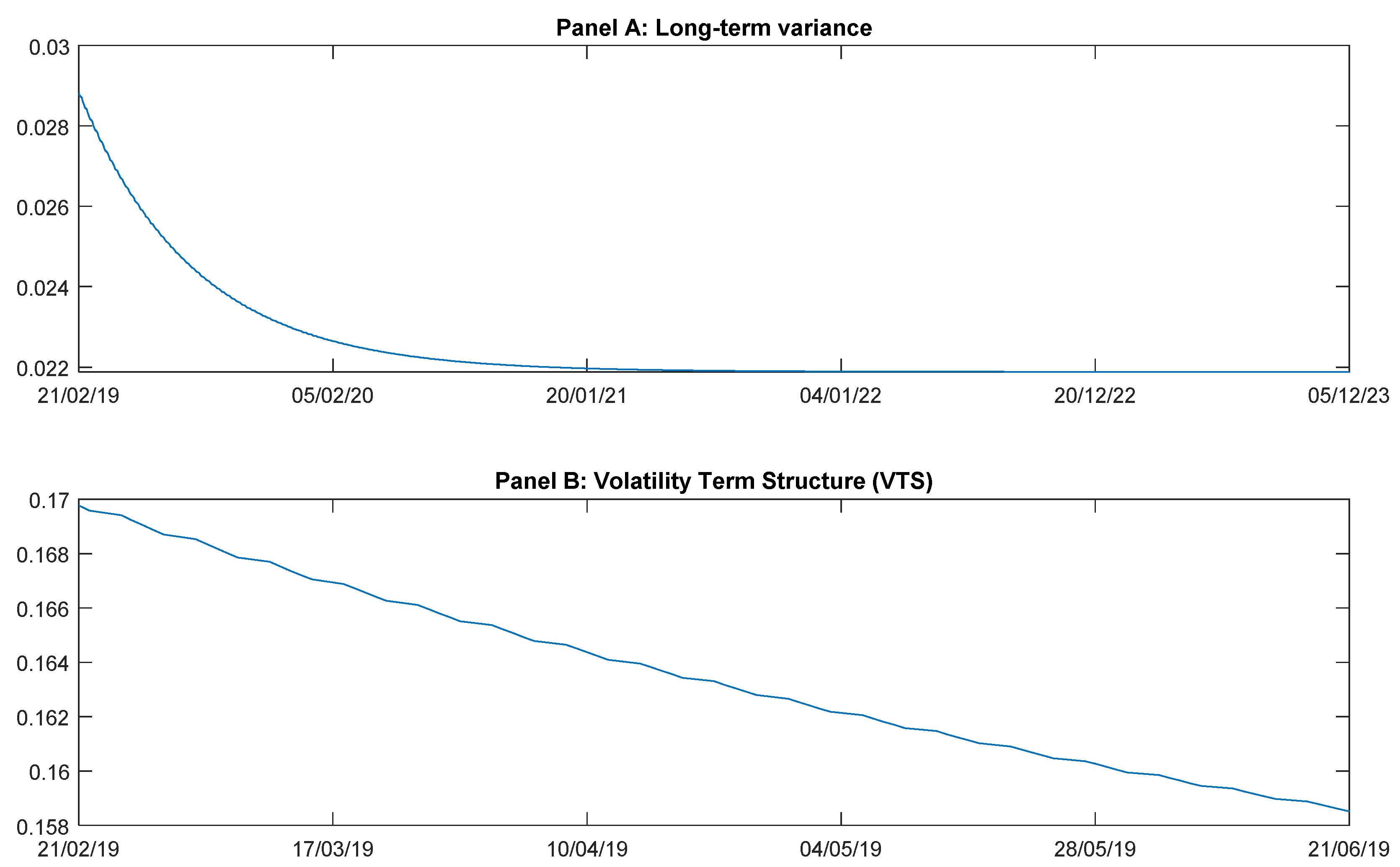

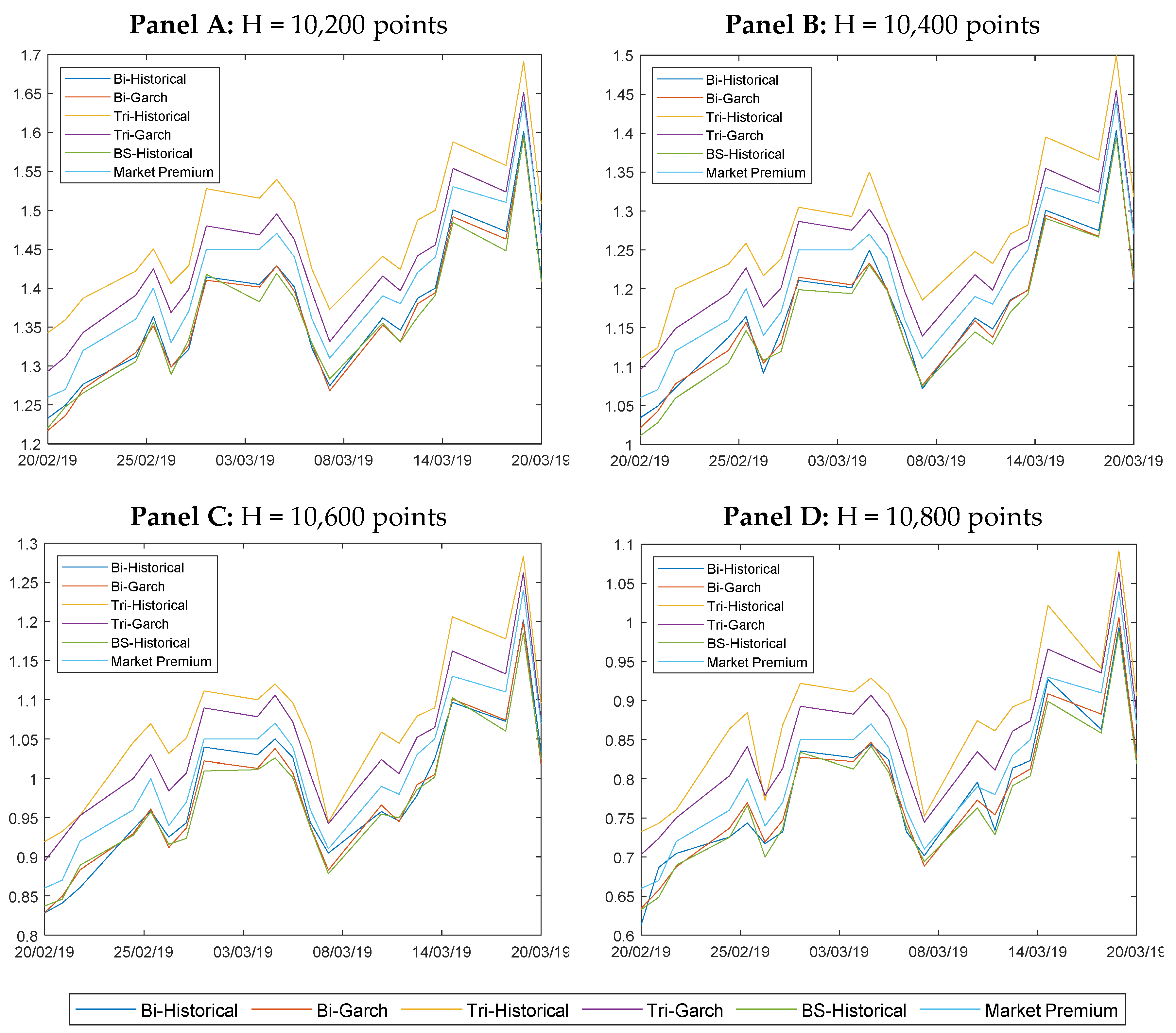

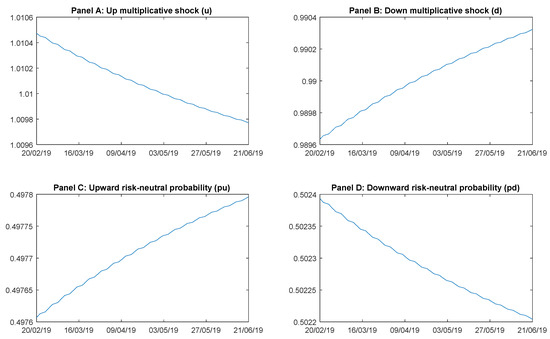

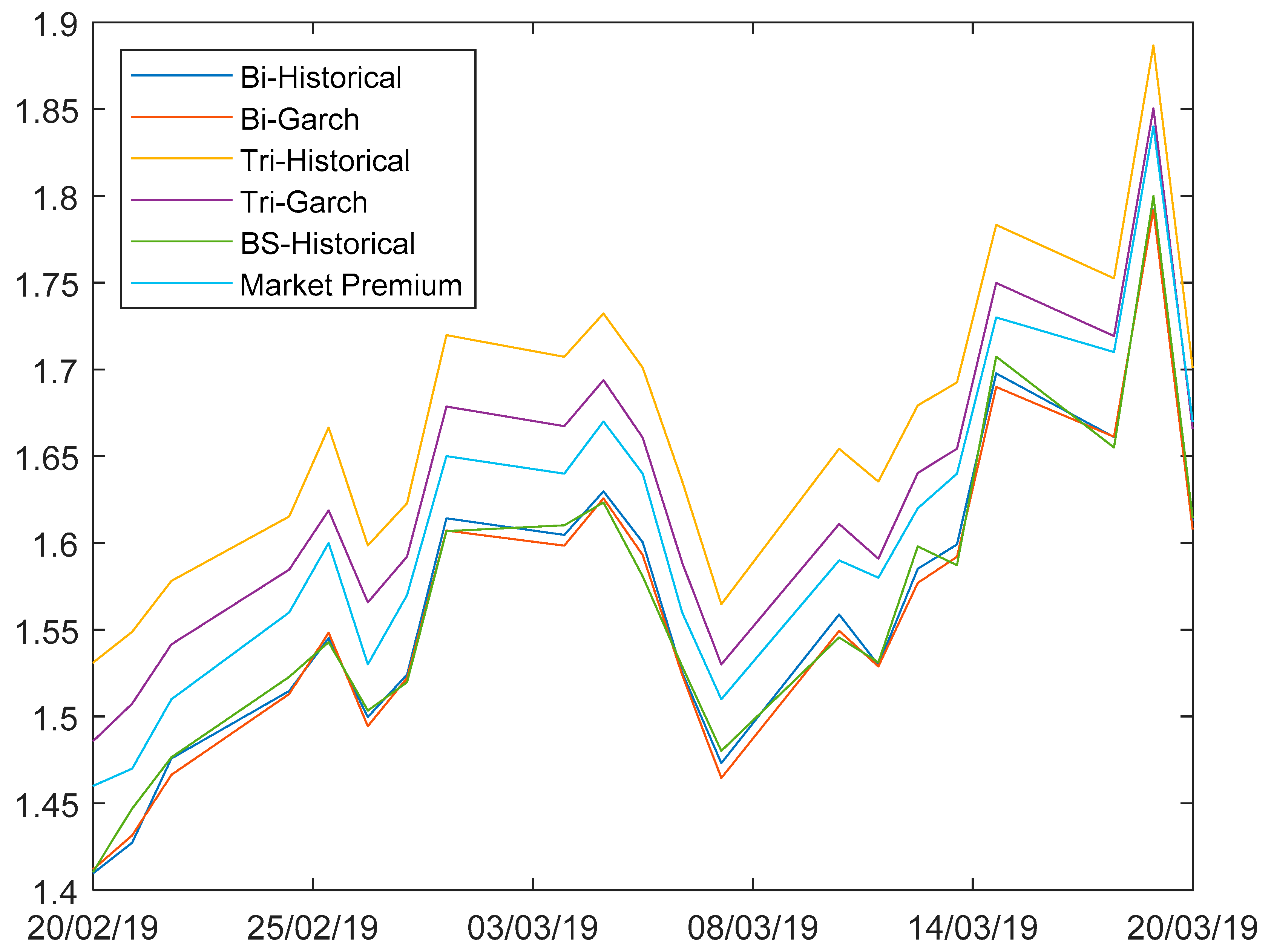

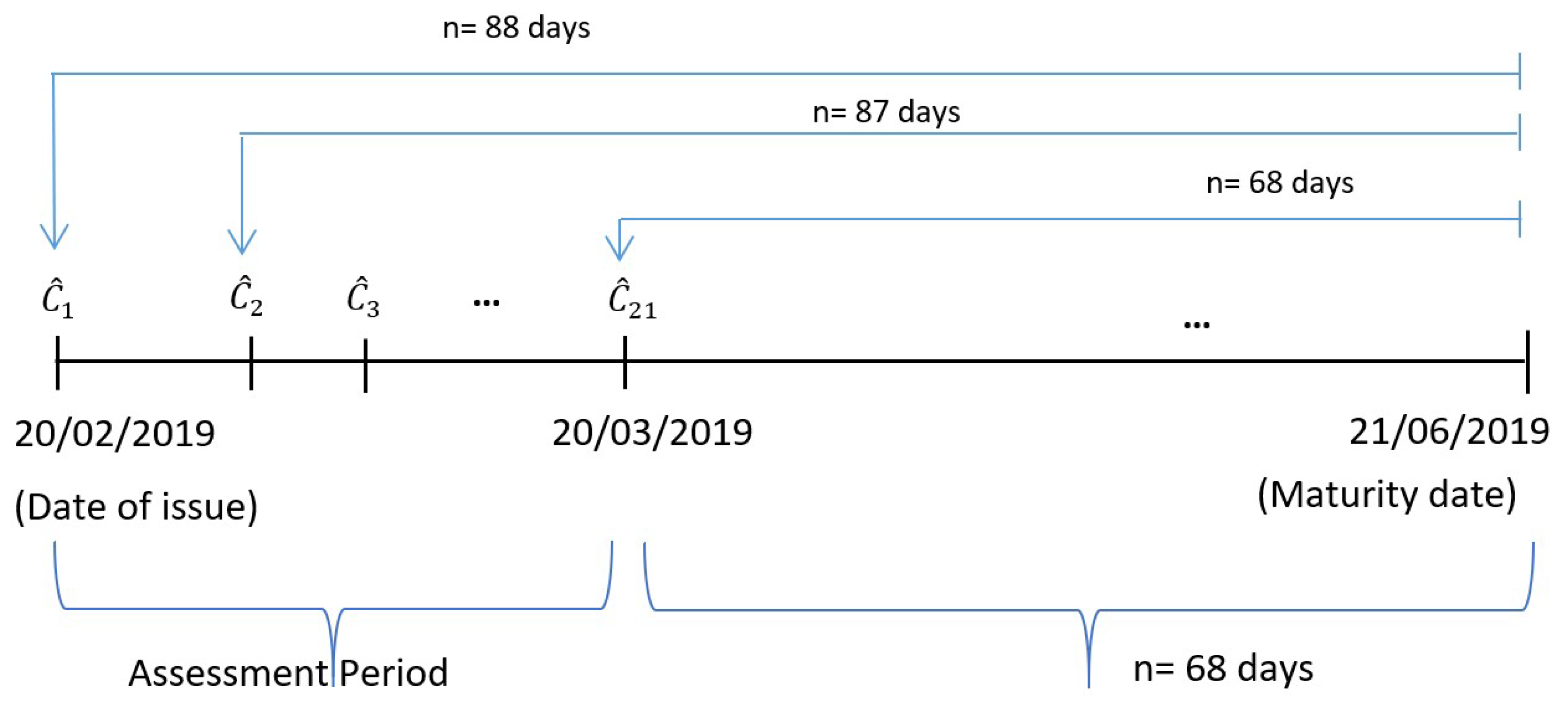

Mathematics Free Full Text Volatility Timing Pricing Barrier Options On Dax Xetra Index Html

Mathematics Free Full Text Volatility Timing Pricing Barrier Options On Dax Xetra Index Html

Chris Webb S Bi Blog What Is The Maximum Length Of A Text Value In Power Bi Chris Webb S Bi Blog

Eurex The Path Is The Goal

Dax Stable Over 10 000 Despite Oil Volatility Calm Before Storm Admiral Markets

Dax Failure To Hold New Highs Exposes Downside Risk

Be Careful Of Sell Put Sl Dax Can See Easily For Eurex Fdax1 By Ramin Trader06 Tradingview

Comparing Tableau And Powerbi Visuals

Two Markets That Show Incredibly Strong Technicals With Long Term Trends

Chris Webb S Bi Blog What Is The Maximum Length Of A Text Value In Power Bi Chris Webb S Bi Blog

Dax Stable Over 10 000 Despite Oil Volatility Calm Before Storm Admiral Markets

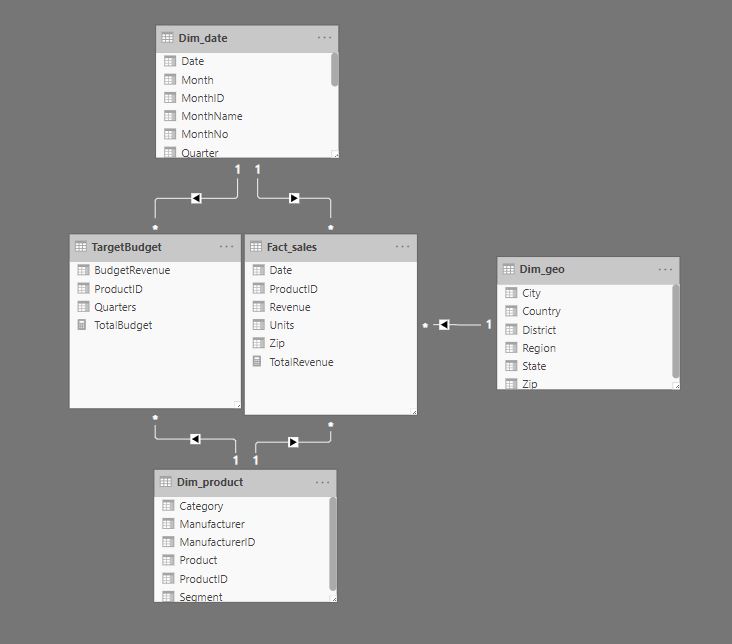

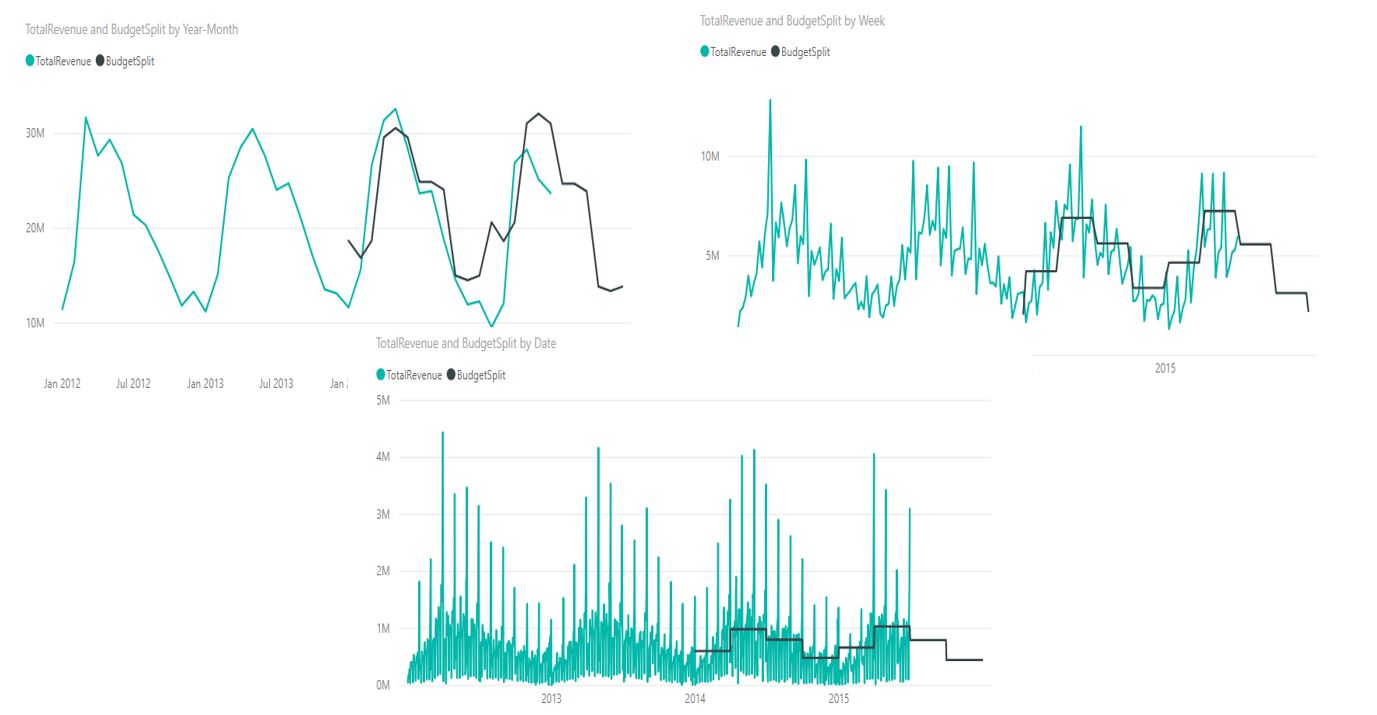

How To Split Budgets To Lower Granularity With Dax Powerbi Exceed

Dax Forecast For The Week Of June 9 14 Technical Analysis

Dax Weekly Options Set And Forget Strategy Page 3 Indices And Macro Events Ig Community

Dax Challenging Key Level

7 3 Example Analysis Of Dax Data

Implied Volatility Surface Of The Dax Index On 29 01 Download Scientific Diagram

Dax Stable Over 10 000 Despite Oil Volatility Calm Before Storm Admiral Markets

Dax Cac 40 Set To Move The Latter At Important Lt Trend Line

Aic Minimization Of The Smoothing Parameter For Dax Data 3 Download Scientific Diagram

Why This Volatility Isn T Unprecedented Humble Student Of The Markets

How To Split Budgets To Lower Granularity With Dax Powerbi Exceed

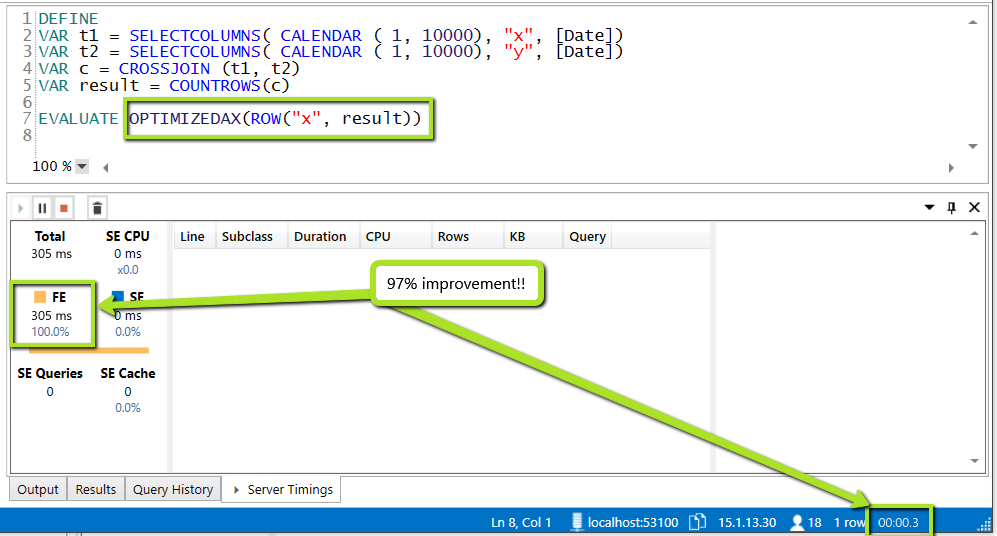

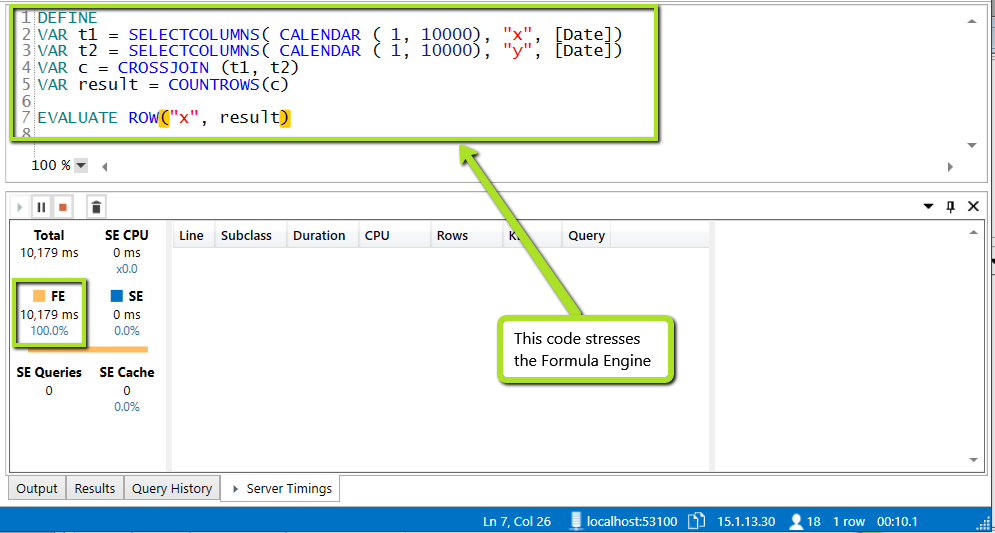

Speed Up Your Power Bi Dax Formulas By Using Optimizedax P3

Powell Rebuffs V Shaped Recovery Hopes Dax30 To Dip 10 000 Admiral Markets

Filtering Slicer Resolved In Power Bi Radacad

Dax Daily 18 May

Solved Re Dax Calculation Cost Per Thousand And Number Microsoft Power Bi Community

Option Greeks And Hedging Strategies By Vito Turitto Hypervolatility Medium

Dax De30eur Weakness Appearing Short Term Short Opportunity

What We Are Watching Mintermarkets

Dax The Update On The Big Expiration Day Personal Financial

Mathematics Free Full Text Volatility Timing Pricing Barrier Options On Dax Xetra Index Html

Dax Future Fdax 60 Min Buy

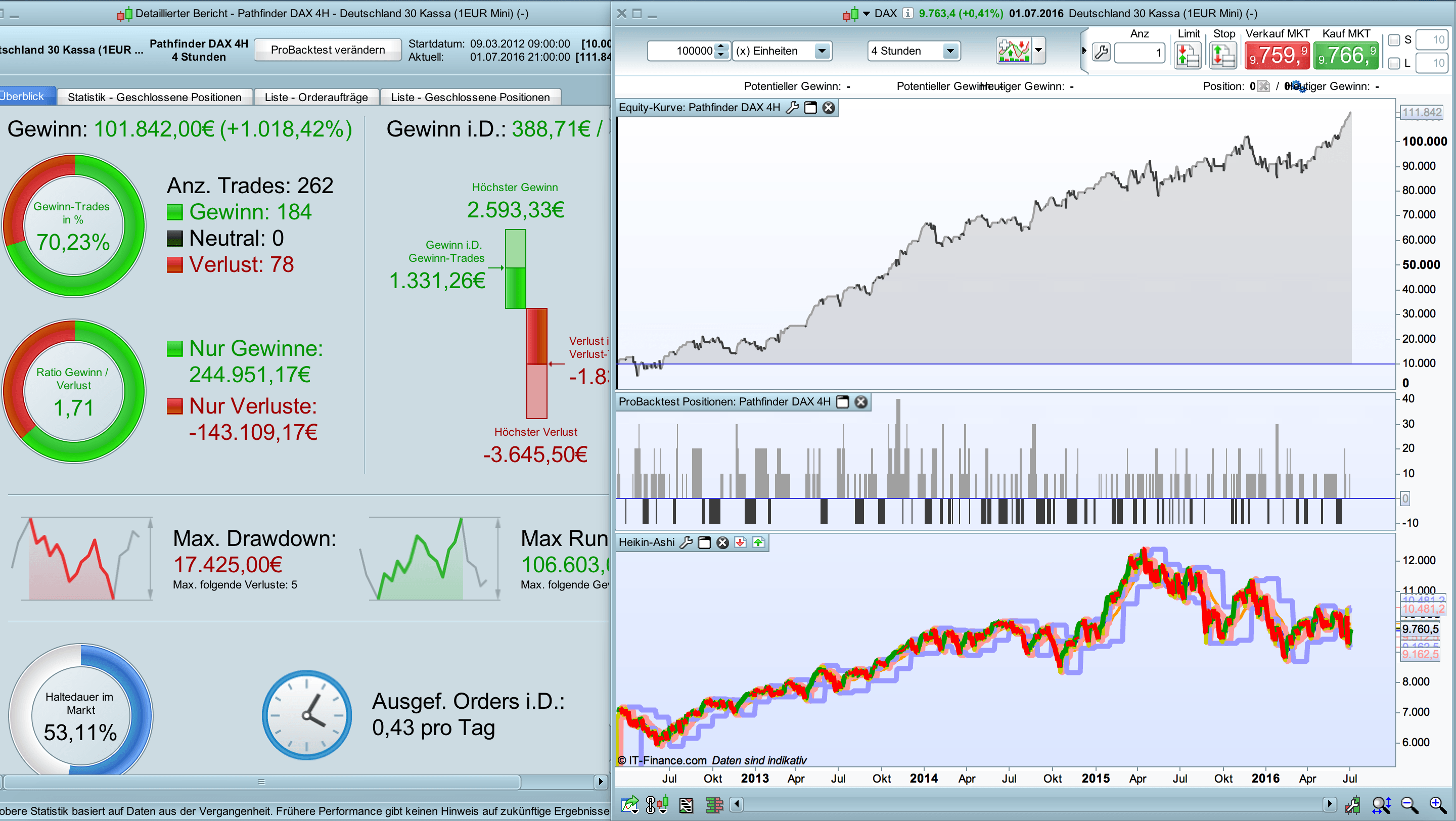

How To 07 Development Of A Systematic Trading Strategy

Dax Bulls Not Ready To Give Up Ewm Interactive

Pricing American Basket Options By Monte Carlo Simulation Matlab Simulink Mathworks Espana

Dax Analysis For 7 4

Page 40 Marketing Tradingview

Dax Daily 30 Apr

The Dax 30 Is Oversold But The Bias Is Still Bearish

Solved Re Dax Calculation Cost Per Thousand And Number Microsoft Power Bi Community

Mathematics Free Full Text Volatility Timing Pricing Barrier Options On Dax Xetra Index Html

Dax Trend Support Constructive Levels In Focus

Neurtral Tradingview

What Next For Dax Index Weekly Technical Analysis Go Marketwatch

Pathfinder Dax 4h Strategies Prorealtime

Mathematics Free Full Text Volatility Timing Pricing Barrier Options On Dax Xetra Index Html

Chris Webb S Bi Blog Power Bi Chris Webb S Bi Blog

Chris Webb S Bi Blog What Is The Maximum Length Of A Text Value In Power Bi Chris Webb S Bi Blog

Dax Analysis For 22 4

Forecasting Free Full Text Are Issuer Margins Fairly Stated Evidence From The Issuer Estimated Value For Retail Structured Products Html

Dax Stable Over 10 000 Despite Oil Volatility Calm Before Storm Admiral Markets

Dax Cac 40 Trying To Negate Bearish Price Patterns

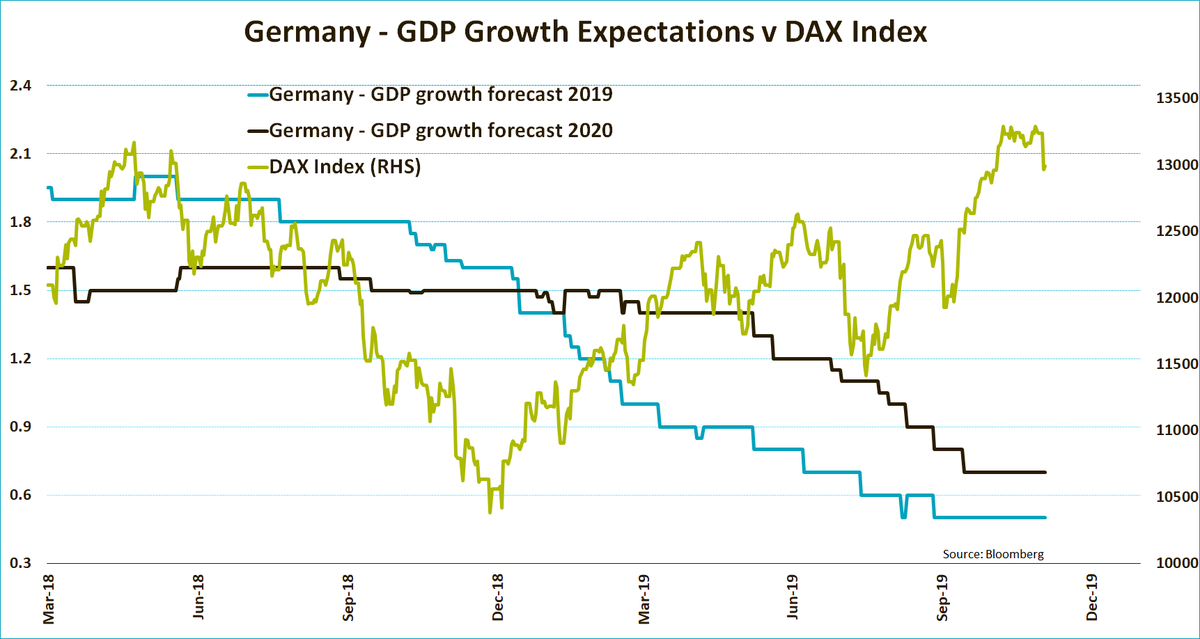

Short Germany From Level By Put Option Short

Page 35 Search In Trading Ideas For Fx Ger30

The Shadow Pulse Indicator Csi Cost 99 Free Unlimited Version Forex Wiki Trading Forex Shadow Pulses

Dax How To Group Measures Into Numeric Ranges Burningsuit

Row Level Security In Power Bi With Dynamics 365 Powerobjects

Speed Up Your Power Bi Dax Formulas By Using Optimizedax P3

Historical Investment Calculator Financial Calculators Com

Angel Garcia Banchs Put Option Ecb As Buyer Of Last Resort Monetary Policy Makes The Difference As Long As Inflation In Real Markets Does Not Appear Into Scene Ultra Low And

The German Dax At 10 000 Looking Back Value And Opportunity

German Dax Targets Further Highs Until This Changes

Dax Hebelzertifikate Isin De Wkn Symbol Dax

Dax Trading Setup Downside Momentum Objective At 9774 Key Support Investix Dax Momentum Supportive

Dax Is Already Eur Qe Out There Stretched For Fx Ger30 By Kumowizard Tradingview

Dax Stable Over 10 000 Despite Oil Volatility Calm Before Storm Admiral Markets

Mcp Market Update January 12th The Year Ahead In The Fed We Trust Mars Capital Partners

Conditional Column In Power Bi Using Power Query You Can Do Anything Radacad

Dax Very Interesting Option Strategy For Fx Ger30 By Yaka Tradingview

Dax Put Option Beispiel Hebelprodukte

Storage Redundancy With Intel Optane Persistent Memory Modules

Mathematics Free Full Text Volatility Timing Pricing Barrier Options On Dax Xetra Index Html

Trading Gaps For Daily Profit Trading Cfds Paramonas Villas

Dax Harmonic Movements

Trailing Twelve Months Ttm Power Bi Prior Ttm Variance Dax

Dax The Update On The Big Expiration Day Personal Financial

Extracting A Number From Text Microsoft Power Bi Community

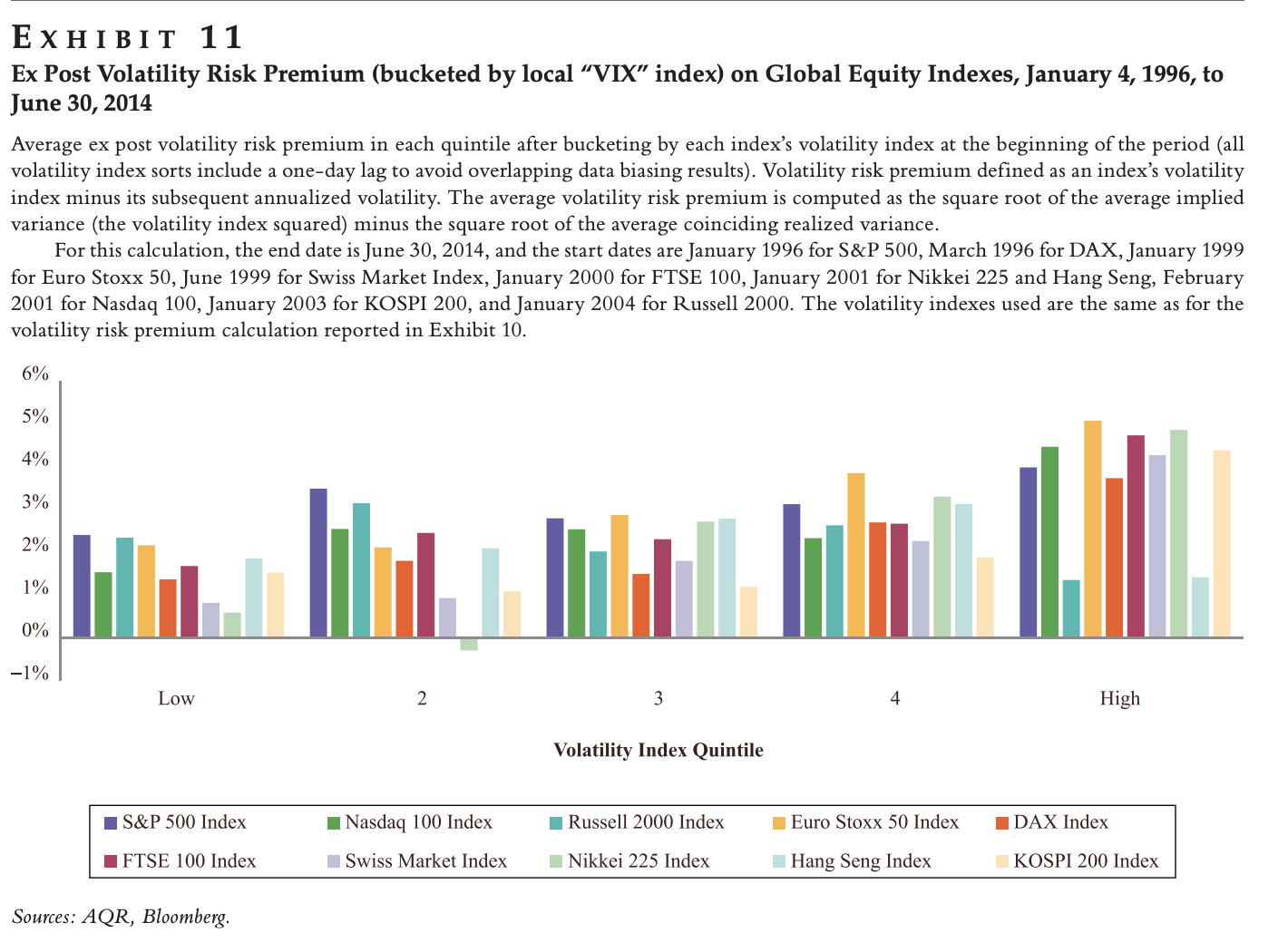

Options Are Persistently Overpriced Here S How To Profit From The Volatility Risk Premium Seeking Alpha

Dax Futures All The Way Down In The Market Profile Distribution Post The Latest Huawei News The Market Ear

Powell Rebuffs V Shaped Recovery Hopes Dax30 To Dip 10 000 Admiral Markets

Mathematics Free Full Text Volatility Timing Pricing Barrier Options On Dax Xetra Index Html

Dynamic Row Level Security In Power Bi With Organizational Hierarchy And Multiple Positions In Many To Many Relationship Part 2 Radacad

Dax More Side Ways Action Para Fx Ger30 Por Alx13 Tradingview

Chris Webb S Bi Blog Power Bi Chris Webb S Bi Blog

Dax Query Tables In Excel 10 Excelerator Bi

Dax Day Trading System Does Gold Etf Move Opposite To The Stock Market Scoala Gimnaziala Speciala Pascani

Annual Report

Dax Daily Options Trade Set Ups Indices And Macro Events Ig Community

Dax Daily 26 May

Dax How To Group Measures Into Numeric Ranges Burningsuit

Page 35 Search In Trading Ideas For Fx Ger30