Bankhaus Herstatt

IIA Bankhaus Herstatt 1974 was a traumatic year for the world economy The sharp increase in oil prices caused major economic dislocations, exacerbated inflationary pressures and intensified exchange rate volatility and three internationally active banks failed– the BritishIsrael Bank in London, Franklin National Bank in New York, and Bankhaus.

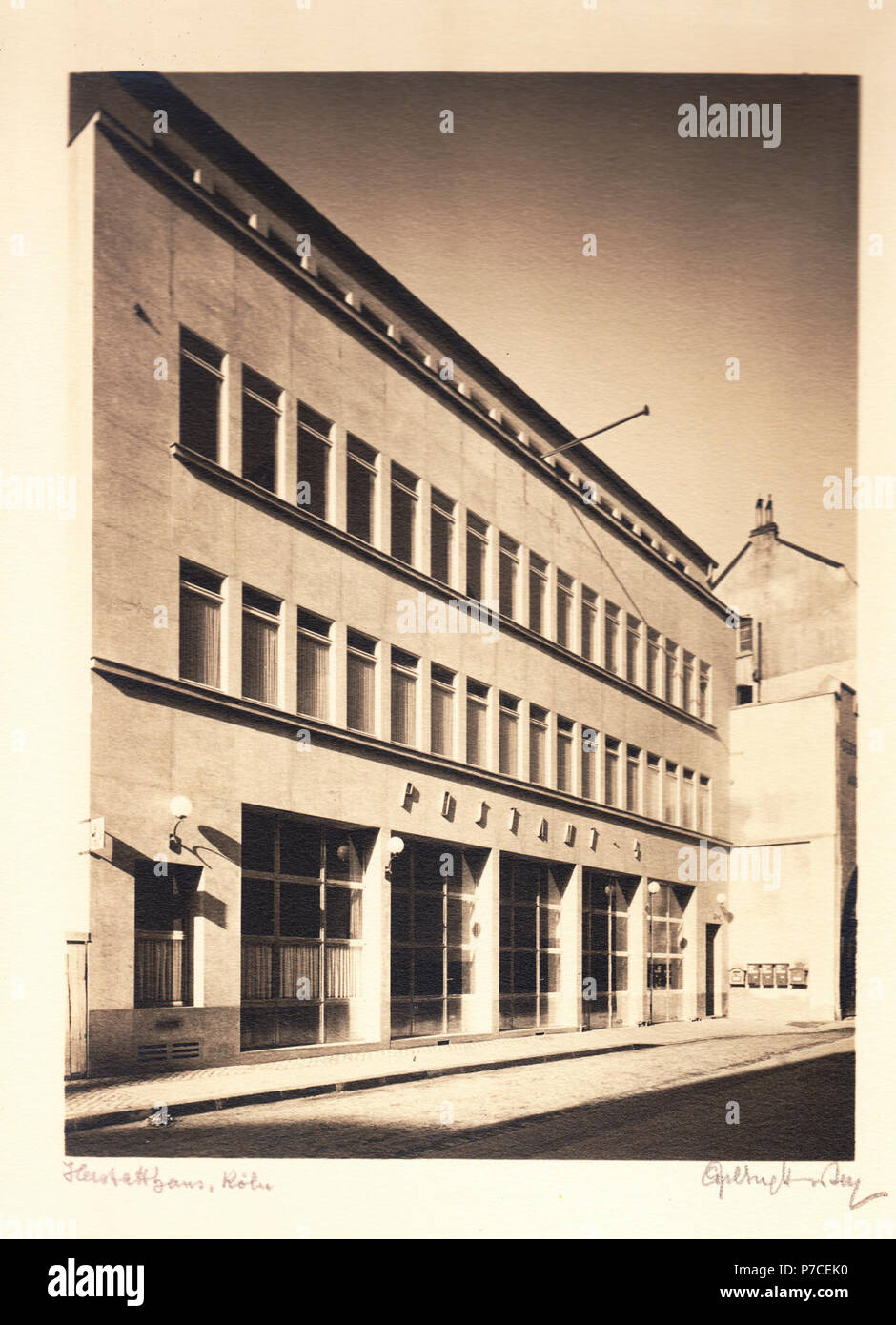

Bankhaus herstatt. In 1974 a small bank in Germany, Bankhaus Herstatt, was closed in the middle of the day by regulators The bank was insolvent and it left the dollars that it owed on its foreignexchange deals. MILAN, Italy, June 28—The failure of West Germany's biggest private bank, Bankhaus I D Herstatt of Cologne, has dealt another blow at confidence in the monetary world and has caused a general. Bankhaus Herstatt, June 1974 The closure of this German bank at 1030am New York time resulted in a classic chainreaction of mistrust, as Herstatt's dollar FX payments failed to settle Continental Illinois, 19 to 1984 This could have been the big one, but the realization of this big bank's insolvent position took two years.

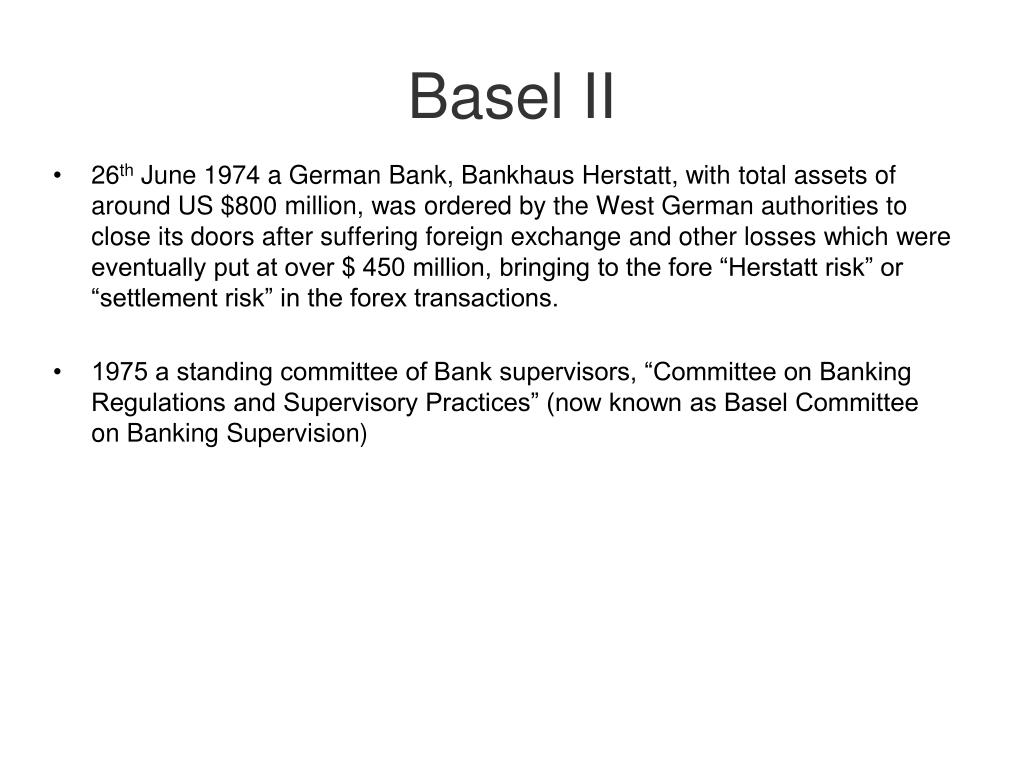

During a Zentralbankrat meeting, about Herstatt’s foreign exchange transactions26 According to a reliable Swiss source, Tu¨ngeler explained, Bankhaus Herstatt had been involved in the Swiss foreign exchange market, ‘over the 100 million DM limit’ Ernst Fessler, president of the NordrheinWestfalen Landeszentralbank, recommended to. Second, on 26 June 1974, Bankhaus Herstatt, a midsized German bank that was active in the Eurodollar market, failed (Schenk, 14). Positions in foreign exchange and commodities to at most 30 per cent of bank capital In addition, banking regulation worldwide was affected by the Herstatt default The Basel Committee on Banking Supervision, a committee of banking supervisory authorities was established in 1974 as a consequence of the Herstatt default In 19, the Committee recommended the Basel Accord, subsequently known.

Explains the Herstatt risk banking terminology that originated from the Herstatt Bank failure Herstatt risk // International Dictionary of Finance, 4th Edition;03, p127 Information on the term "Herstatt risk" is presented It refers to the risk of loss in the capital value of a currency transaction, where one side of the bargain is completed. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June 1974 in a famous incident illustrating settlement risk in international finance. Settlement risk is also called delivery risk or Herstatt risk Key Takeaways Settlement risk is the possibility that one or more parties will fail to deliver on the terms of a contract at the.

Remarks by Ricki Helfer Chairman Federal Deposit Insurance Corporation before the Institute of International Bankers Washington, DC March 4, 1996 In 1974, the collapse of Bankhaus Herstatt reminded us that a global system of financial institutions is only as strong as its weakest component. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt.

Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt. But after the close of the German interbank payments system (330pm local time). Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June 1974 in a famous incident illustrating settlement risk in international finance.

Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June 1974 in a famous incident illustrating settlement risk in international finance. The most wellknown example of settlement risk is the failure of a small German bank, Bankhaus Herstatt in 1974 On 26 th June 1974, the firm's banking licence was withdrawn, and it was ordered into liquidation during the banking day;. Our culture is modeled off the German word "gemutlichkeit," which describes a space or state of warmth and friendliness We believe in being a bank you'll actually want to visit.

The failure of Herstatt resulted in litigation over many years—both in Germany, where Herstatt was subject to liquidation proceedings, and in the US Quite apart from the immediate impact on Herstatt’s counterparties, however, the failure of Bankhaus Herstatt made fi nancial market participants and policymakers aware of. This is known as settlement risk, or “Herstatt Risk”, after the German bank, Bankhaus Herstatt, which collapsed in June 1974 leaving many of its FX counterparties with significant losses CLS GroupWikipedia. Others hold growth of banking is.

Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt. First of which was the Bankhaus Herstatt crisis of 1974 which saw the German Banking Authorities withdrawing Herstatt’s banking license because of its enormous foreign exchange exposures which tripled the value of its capital. Collapse of the Herstatt Bank in Germany and creation of the Basel Committee The collapse of this mediumsized bank sparked a deep crisis in the foreign exchange market, on which it was very active The New York interbank market came to a standstill, almost leading to the collapse of a number of other institutions.

1 INTRODUCTION The collapse in 1974 of Bankhaus Herstatt, a small Cologne bank, first highlighted the risks associated with the FX settlement process In this case, a number of counterparties irrevocably sold Deutschmark to Herstatt prior to the announcement that Herstatt's banking licence had been withdrawn and that it had been ordered into liquidation. This is known as settlement risk, or “Herstatt Risk”, after the German bank, Bankhaus Herstatt, which collapsed in June 1974 leaving many of its FX counterparties with significant losses CLS Group Wikipedia. On 26 June 1974, West Germany’s Federal Banking Supervisory Office withdrew Bankhaus Herstatt’s banking licence after finding that the bank’s foreign exchange exposures amounted to three times its capital Banks outside Germany took heavy losses on their unsettled trades with Herstatt, adding an international dimension to the turmoil.

What is Bankhaus, exactly?. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of CologneIt went bankrupt on 26 June 1974 in a famous incident illustrating settlement risk in international finance It led to the creation of the Basel Committee on Banking Supervision a committee composed of representatives from central banks and regulatory authorities to help find ways to avoid. In this section, bank failures are examined on a case by case basis, the objective being to identify the qualitative causes of bank failure After a brief historical review, the main focus is on modern bank failures, commencing with the failure of Bankhaus Herstatt in 1974 Continue reading here Historical Overview Was this article helpful?.

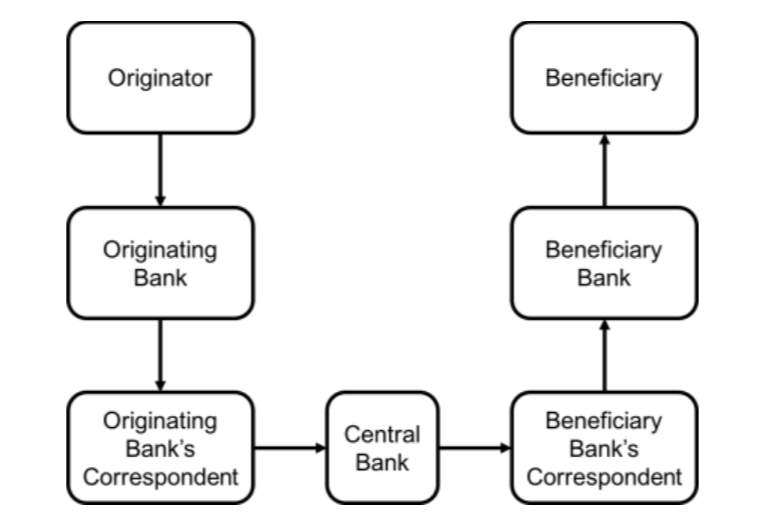

In June 1974, Bankhaus Herstatt, a small bank in Frankfurt, Germany, became insolvent and was closed in the middle of the day by regulators Earlier that day, a number of banks had released payments of Deutsche Marks (DEM) to Herstatt in exchange for US Dollars (USD) to be delivered in New York later in the day. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt. Thirtyseven years ago this month, the failure of a small German bank sent shock waves through the system, costing banks from New York to Singapore some $6 million in lossesThe collapse of Bankhaus Herstatt in Cologne made the front page of the June 27, 1974, issue of American Banker, which we've republished today on our 175 anniversary Flashback site.

The Basel Committee initially named the Committee on Banking Regulations and Supervisory Practices was established by the central bank Governors of the Group of Ten countries at the end of 1974 in the aftermath of serious disturbances in international currency and banking markets (notably the failure of Bankhaus Herstatt in West Germany). The Herstatt Effect Bankhaus Herstatt of Cologne went bellyup in 1974 because of currency speculation It wasn’t a very large bank by today’s standards, and it wasn’t a key player in the global banking system Yet it had a large foreign exchange business. After the collapse of Bretton Woods, many banks incurred large foreign currency losses On 26 June 1974, West Germany’s Federal Banking Supervisory Office withdrew Bankhaus Herstatt’s banking licence after finding that the bank’s foreign exchange exposures amounted to three times its capital (Read for more detail) Basel Capital Framework.

Bankhaus Herstatt’s closure was the first and most dramatic case of a bank failure where incomplete settlement of foreign exchange transactions caused severe problems in payment and settlement systems Several other episodes occurred in the 1990s but they were less disruptive4 In February. Failure of Bankhaus Herstatt in West Germany 1) The Committee’s mandate is to strengthen the regulation, supervision and practices of banks worldwide with the purpose of enhancing financial. With its international supervisory and regulatory implications, the failure of Bankhaus Herstatt is one of the landmarks of postwar financial history This article offers the first comprehensive h.

CLS helps clients navigate the changing FX marketplace – reducing risk and creating efficiencies Our extensive network and deep market intelligence enable CLS specialists to lead the development of standardized solutions to real market problems. Settlement risk is the risk that a counterparty (or intermediary agent) fails to deliver a security or its value in cash as per agreement when the security was traded after the other counterparty or counterparties have already delivered security or cash value as per the trade agreement The term covers factors incidental to the settlement process which may suspend or prevent a trade from. National Bank in the US1 and Bankhaus Herstatt in Germany in 1974, monetary authorities and policy makers throughout the world decided that the increasingly more.

In 1974, the German authorities ordered the immediate liquidation of Bankhaus Herstatt, a German commercial bank that, as a result of its closure, failed to deliver US dollars to counterparties with whom it had previously struck foreign exchange deals This event gave rise to the concept of “Herstatt risk”, which is a kind of operational. In 1974 Bankhaus Herstatt in Germany failed, leaving American banks which had completed FX transactions with it the previous day unable to collect their side of the trades International banks and. Federal Banking Supervisory Office withdrew Bankhaus Herstatt’s banking licence after finding that the bank’s foreign exchange exposures amounted to three times its capital Banks outside Germany took heavy losses on their unsettled trades with Herstatt, adding an international dimension to the turmoilIn.

With its international supervisory and regulatory implications, the failure of Bankhaus Herstatt is one of the landmarks of postwar financial history This article offers the first comprehensive historical account of the Herstatt crisis, and contributes to the wider discussions on international supervisory and regulatory reform since the mid1970s, including regulatory capture, markets' self. Bank Bankhaus Herstatt, with the purpose of making banking regulations more effective The cause of Herstatt’s failure was its speculation in the foreign exchange markets After the collapse of the Bretton Woodssystem, in 1973,the management of the bank seriously underestimated the risk of free floating currencies. Fairfax State Savings Bank in Fairfax, IA offers banking & lending services for personal, business and ag, as well as wealth management services.

In 1974, the German authorities ordered the immediate liquidation of Bankhaus Herstatt, a German commercial bank that, as a result of its closure, failed to deliver US dollars to counterparties with whom it had previously struck foreign exchange deals This event gave rise to the concept of “Herstatt risk”, which is a kind of operational. Continuing impact of Bankhaus ID Herstatt '74 collapse on internatl banking revd;. But after the close of the German interbank payments system (330pm local time).

Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June 1974 in a famous incident illustrating settlement risk in international finance. The failure of Herstatt resulted in litigation over many years—both in Germany, where Herstatt was subject to liquidation proceedings, and in the US Quite apart from the immediate impact on Herstatt’s counterparties, however, the failure of Bankhaus Herstatt made fi nancial market participants and policymakers aware of. The most wellknown example of settlement risk is the failure of a small German bank, Bankhaus Herstatt in 1974 On 26 th June 1974, the firm's banking licence was withdrawn, and it was ordered into liquidation during the banking day;.

In June of 1974, a small German bank, Herstatt Bank, failed While the bank itself was not large, its failure became synonymous with fx settlement risk, and its lessons served as the impetus for work over the subsequent three decades to implement realtime settlement systems now used the world over Documents from the Bank of. How Herstatt Bank’s Failure Highlighted FX Risk In International Payments This sort of FX risk is known as “Herstatt risk”, after a German bank whose failure in 1974 nearly caused meltdown of the international FX settlement system At 330 pm local time on June 26, 1974, German regulators closed Bankhaus Herstatt. When Bankhaus Herstatt had its licence withdrawn at the end of the German banking day on 26 June 1974, it was 1030 am for its New York correspondent ECB The CLS was established as a market response to the pressure exercised by central banks to reduce foreign exchange settlement risk (known as « Herstatt risk ") # he ECB performs a dual role with regard to the CLS.

How Herstatt Bank’s Failure Highlighted FX Risk In International Payments This sort of FX risk is known as “Herstatt risk”, after a German bank whose failure in 1974 nearly caused meltdown of the international FX settlement system At 330 pm local time on June 26, 1974, German regulators closed Bankhaus Herstatt. Herstatt Bank (Bankhaus ID Herstatt KGaA) was a privately owned bank in the German city of Cologne It went bankrupt on 26 June in a famous incident illustrating settlement risk in international finance Settlement risk is sometimes called “Herstatt risk,” named after the wellknown failure of the German bank Herstatt. Collapse of the Herstatt Bank in Germany and creation of the Basel Committee The collapse of this mediumsized bank sparked a deep crisis in the foreign exchange market, on which it was very active The New York interbank market came to a standstill, almost leading to the collapse of a number of other institutions.

In June of 1974, a small German bank, Herstatt Bank, failed While the bank itself was not large, its failure became synonymous with fx settlement risk, and its lessons served as the impetus for work over the subsequent three decades to implement realtime settlement systems now used the world over Documents from the Bank of. IIA Bankhaus Herstatt 1974 was a traumatic year for the world economy The sharp increase in oil prices caused major economic dislocations, exacerbated inflationary pressures and intensified exchange rate volatility and three internationally active banks failed– the BritishIsrael Bank in London,. Bundesbank pres Otmar Emminger holds similar collapse could not occur now, int;.

Basel Committee On Banking Supervision A Brief History Of The Basel Committee Pdf Free Download

Herstatt Bank Failure

Cds Chain Netting Risk Designing Better Futures

Bankhaus Herstatt のギャラリー

Herstatt Skandal Devisenzocker Ruinierten Deutschlands Vorzeigebank Welt

2

Bankhaus Herstatt By Suzy Zain On Prezi Next

Table 4 From Management Of Fx Settlement Risk In Hungary Report Ii Semantic Scholar

Losses Of Banks In London Due To Herstatt Bankhaus Collapse Usd Million Download Table

2

Transferwise Viewpoints Which Matter

Herstatt High Resolution Stock Photography And Images Alamy

Herstatt Bank Scars Remain The New York Times

Www Fsa Go Jp Singi Roundtable Houkoku Final Report 03 Pdf

Western Von Gestern Die Pleite Der Herstatt Bank

Category Verwaltungsgebaude Bankhaus Herstatt Wikimedia Commons

Www Bis Org Cpmi Publ D17 Pdf

Iwan David Herstatt Portal Rheinische Geschichte

Bankhaus I D Herstatt Koln Geschaftsbericht 1970 Mit Abb Eur 18 90 Picclick De

Preface

2

2

Was Wirecard Mit Der Herstatt Pleite Vor 46 Jahren Gemeinsam Hat

La Faillite De La Banque Herstatt En 1974 Fb Bourse Com

Www Igi Global Com Viewtitle Aspx Titleid

Herstatt Bank Failure

E Forex Magazine Supplements

Www Bis Org Publ Qtrpdf R Qt0212f Pdf

Elischolar Library Yale Edu Cgi Viewcontent Cgi Article 1038 Context Journal Of Financial Crises

Boe Archives Reveal Little Known Lesson From The 1974 Failure Of Herstatt Bank Bank Underground

Years Of Economy Collapse Of The Herstatt Bank In Germany And Creation Of The Basel Committee

Http Ccl Yale Edu Sites Default Files Files Macey ppt for friday 9 18 13 Pdf

Www Jstor Org Stable

Herstatt Bank

Richard Russell Review July 5 1974 New Low Observer

Herstatt Bank Wikiwand

Failure Of Herstatt Disturbs Banking The New York Times

Bank For International Settlements Financial Institutions Management Lecture Slides Docsity

3 Guilty In Herstatt Failure The New York Times

Herstatt Bank

How To Pronounce Bankhaus Herstatt In Dutch Howtopronounce Com

Trust Is Good Control Is Better The 1974 Herstatt Bank Crisis And Its Implications For International Regulatory Reform Emmanuel Mourlon Druol

Dpa Files Creditors Of The Bankrupt Herstatt Bank Are Registered Stock Photo Alamy

Boe Archives Reveal Little Known Lesson From The 1974 Failure Of Herstatt Bank Bank Underground

Http Www Spaeth Ru Hs1516 Artikel 14 Pdf

Www Econstor Eu Bitstream 1 x Pdf

2

Http Www Hoover Org Sites Default Files Paper Herring Pdf

Herstatt Risk How Does Cls Reduce Herstatt Risk Fintelligents Finance

Sal Oppenheim Wikipedia

2

Herstatt Bank Wikipedia

Wenn Eine Bank Zumacht Dann Der Vermogensverwalter Portfolio Concept

The Foreign Exchange Market International Corporate Finance P V Viswanath Ppt Download

Basel Committee Anti Money Laundering

Full Article Trust Is Good Control Is Better The 1974 Herstatt Bank Crisis And Its Implications For International Regulatory Reform

Elischolar Library Yale Edu Cgi Viewcontent Cgi Article 1038 Context Journal Of Financial Crises

Ppt Overview Of Banking Prof Ganga S Timsr Powerpoint Presentation Id

Trust Is Good Control Is Better The 1974 Herstatt Bank Crisis And Its Implications For International Regulatory Reform Request Pdf

Cepr Org Sites Default Files Geneva Reports Genevap1 Pdf

Herstatt Bank Risk

Boe Archives Reveal Little Known Lesson From The 1974 Failure Of Herstatt Bank Bank Underground

Are We At Another Herstatt Risk Moment In The Global Financial System

W 3kktphg4 Fkm

Manage The Settlement Risk

Citeseerx Ist Psu Edu Viewdoc Download Doi 10 1 1 46 7113 Rep Rep1 Type Pdf

7 Payment System Risk And Risk Management The Payment System Design Management And Supervision

Bankhaus I D Herstatt Kgaa Unentwertet Coupons

High Rated Aussie Canada Banks Snare More Fx Trade Reuters

Herstatt Bank

Herstatt Risk Settlement Risk Youtube

Cologne Trial Opens For Herstatt And 7 The New York Times

2

Herstatt Bank Wikivisually

E Forex Magazine Supplements

Herstatt Bank

Years Of Economy Collapse Of The Herstatt Bank In Germany And Creation Of The Basel Committee

Trust Is Good Control Is Better The 1974 Herstatt Bank Crisis And Its Implications For International Regulatory Reform Enlighten Publications

Pdf Extensive Analysis Of Settlement Risk In Financial Transactions Masashi Nakajima Academia Edu

Overview Of Banking Prof Ganga S Timsr Guess What Ppt Download

Elischolar Library Yale Edu Cgi Viewcontent Cgi Article 1038 Context Journal Of Financial Crises

Www Tandfonline Com Doi Pdf 10 1080 14

Promoting Sound Financial Standards And Regulations

Http Blogs Law Columbia Edu Glawfin Files 13 10 05 The Legal Construction Of The Global Foreign Exchange Market By Rachel Harvey Pdf

2

5 Herstatt Risk And Collapse Of Herstatt Bank

Losses Of Banks In London Due To Herstatt Bankhaus Collapse Usd Million Download Table

Promoting Sound Financial Standards And Regulations

Herstatt Bank Crisis 1974

Geldhauser Deutschlands Grosste Bankenkrisen Manager Magazin

Heinonline Org Hol Cgi Bin Get Pdf Cgi Handle Hein Journals Abaj62 Section 234

:max_bytes(150000):strip_icc()/155258776-5bfc393e46e0fb00511d7d0f.jpg)

Settlement Risk

W 3kktphg4 Fkm

Basel Accord Basel Ii Capital Requirement

Losses Of Banks In London Due To Herstatt Bankhaus Collapse Usd Million Download Table

6bypqifrtsgkzm

Http Www International Economy Com Tie F05 Engelen Pdf

Herstatt Bank

Www Ecb Europa Eu Pub Financial Stability Fsr Focus 07 Pdf Ecb Ccda416def Fsrbox0712 19 Pdf

Onlinelibrary Wiley Com Doi Pdf 10 1002

Table 4 From Management Of Fx Settlement Risk In Hungary Report Ii Semantic Scholar