Sal Oppenheim Bank

Bank Sal Oppenheim jr and Cie (Österreich) AG Magyarországi Fióktelepe participates in the deposit guarantee scheme of Hungary This deposit guarantee scheme applies to current accounts, savings accounts, time deposit accounts made by natural persons (Hungarian and foreign), legal entities and covers up to up to 100,000 EUR per bank per depositor.

Sal oppenheim bank. Frankfurtbased BHFBank was acquired by Sal Oppenheim in January 05 "Financière Atlas is a very established house in French institutional asset management and the deal complements our strategy of positioning ourselves as a European asset management and investment bank," remarked Matthias Graf von Krockow, Oppenheim's chief executive. Sal Oppenheim jr & Cie KGaA is one of the largest privately owned banks in Europe, headquartered in LuxembourgIt manages and administers €138 billion of assets and employs around 3,800 emloyees in more than 30 sites in Germany and Europe. Bank Sal Oppenheim jr and Cie (Österreich) AG Magyarországi Fióktelepe participates in the deposit guarantee scheme of Hungary This deposit guarantee scheme applies to current accounts, savings accounts, time deposit accounts made by natural persons (Hungarian and foreign), legal entities and covers up to up to 100,000 EUR per bank per depositor.

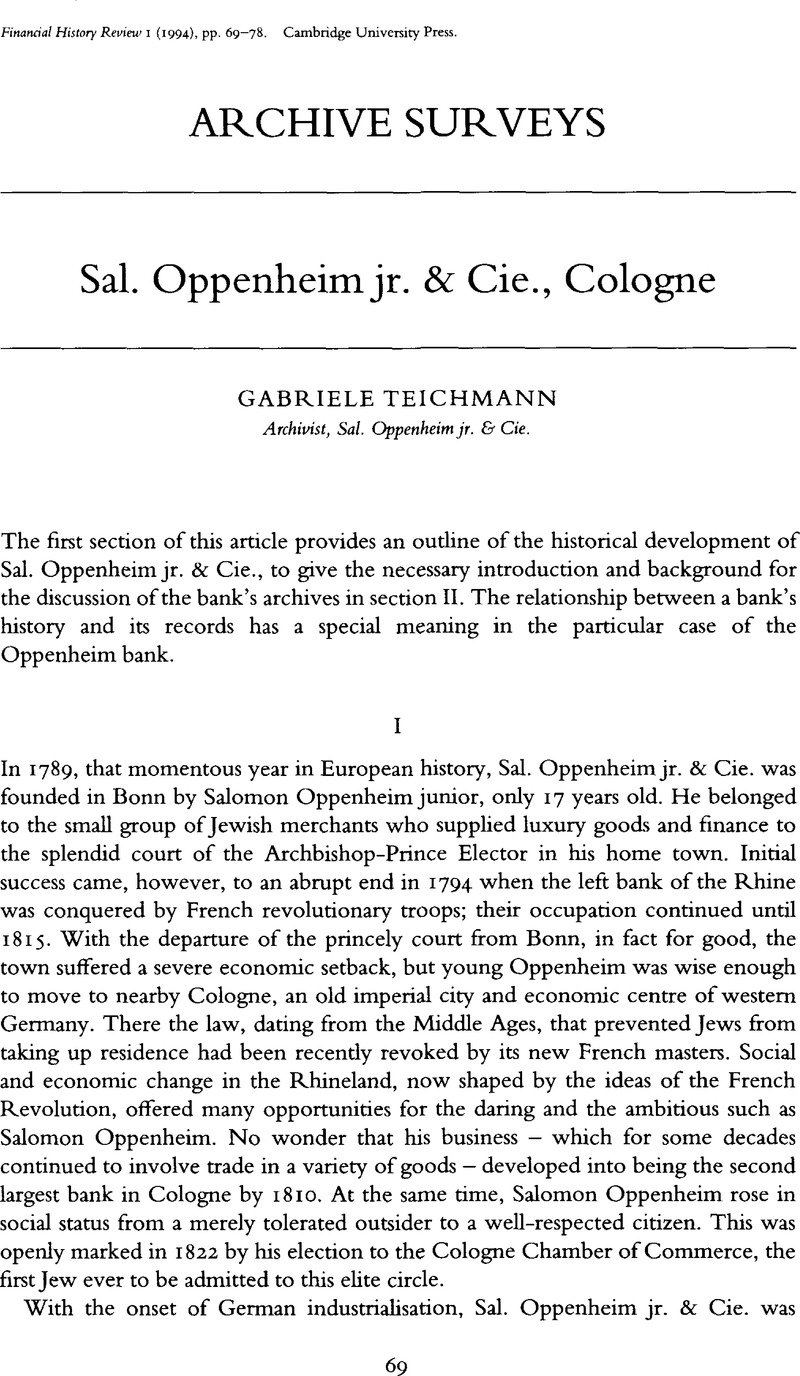

Sal Oppenheim was a German private bank founded in 17 and headquartered in Cologne, Germany It provided asset management solutions for wealthy individual clients and institutional investors The bank became a subsidiary of Deutsche Bank in 09. The bank was founded in 17 in the city of Bonn by seventeenyearold Salomon Oppenheim, Jr as a commissions and exchange house Oppenheim dealt in commodities, exchanging of foreign currency, and extending credit In 1798, the business moved to Cologne, then the most important banking place in GermanyIn 18, Salomon Oppenheim, Jr, died, and his wife Therese took over the direction of. By its part, the private wealth management division of Sal Oppenheim will be integrated into Deutsche’ private and commercial bank in 18, bringing as final result the dissapearance of the Sal Oppenheim brand Once it is complete, Sal Oppenheim’s wealth management clients will be transferred to the wealth management unit of Deutsche Bank.

Sal Oppenheim jr & Cie KGaA is one of the largest privately owned banks in Europe, headquartered in LuxembourgIt manages and administers €138 billion of assets and employs around 3,800 emloyees in more than 30 sites in Germany and Europe. Sal Oppenheim wird als eine Marke der Deutsche Oppenheim fortgeführt Der aktive Geschäftsbetrieb in der Vermögensverwaltung/beratung des Bankhauses Sal Oppenheim wurde zum 30 Juni 18 eingestellt Seit dem 1 Juli 18 werden die NichtKernGeschäftstätigkeiten in der rechtlichen Einheit SOP fortgeführt, die nun unter dem neuen. Deutsche Bank AG, Germany’s biggest bank, agreed to buy wealth manager Sal Oppenheim Group for 1 billion euros ($15 billion), the second purchase this month as it tries to cut reliance on.

Home > Luxembourg > LUXEMBOURG > SAL OPPENHEIM JR UND CIE SCA SWIFT/BIC Codes Find SWIFT Codes or BIC Codes across all the banks in the world Swift code is used while transferring money between banks, particularly for international wire transfers. Bank Sal Oppenheim jr & Cie (Switzerland) Ltd Uraniastrasse 28 CH8022 Zurich Switzerland Phone 41 44 Fax 41 44 wwwoppenheimch History Sal Oppenheim jr & Cie SCA is a European Bank, currently headquartered in Luxembourg It manages and administers €138 billion of assets and employs around 3,800 employees in. Sal Oppenheim was a German private bank founded in 17 and headquartered in Cologne, Germany It provided asset management solutions for wealthy individual clients and institutional investors The bank became a subsidiary of Deutsche Bank in 09.

The Oppenheim Family is a German Jewish banking family which founded Europes biggest private bank Sal Oppenheim jr & Cie According to Manager Magazin 08, the Oppenheim Family was among the 30 richest families in Germany, with assets over 8 Billion Euros. Sal Oppenheim jr & Cie AG & Co Kommanditgesellschaft auf Aktien operates as an asset management bank The Bank offers institutional asset management, mutual funds, investments, and custodian. The takeover marks the end of Sal Oppenheim's independence after more than 0 years The Luxemburgbased bank was founded in 17 The banking group said last year it had recorded losses for the.

Sal Oppenheim is a German Private Bank founded in 17 and headquartered in Cologne, Germany It offers asset management solutions for wealthy individual clients and institutional investors As an active quantitative investment manager, Sal Oppenheim analyzes financial markets on the basis of scientific methods using the latest technology. Sal Oppenheim On March 15, 10, Deutsche Bank AG (“Deutsche Bank”) closed the full acquisition of the Sal Oppenheim Group for a total purchase price of approximately € 13 billion paid in cash, of which approximately € 03 billion was for BHF Asset Servicing GmbH (“BAS”), which was onsold in the third quarter 10. Bank Sal Oppenheim jr & Cie (Switzerland) Ltd is an exclusive private bank with a tradition dating back over 2 years to 17 in Cologne We focus exclusively on asset management for private.

The Oppenheim Family is a German Jewish banking family which founded Europe's biggest private bank Sal Oppenheim jr & Cie According to Manager Magazin 08, the Oppenheim Family was among the 30 richest families in Germany, with assets over 8 Billion Euros. For 08, Sal Oppenheim reported a net loss of €117 million, down from its net income for 07 of €255 million Assets under management were €132, down from the €152 billion it held at the beginning of the year However, thanks to the support of the bank's owners, Sal Oppenheim is in a position to digest a loss of these proportions. In 07, the last year before the financial crisis, Sal Oppenheim had a €41bn balance sheet and €22bn of equity The next year it reported a €117m loss, its first since the second world war.

Oppenheimer's team of over 100 investment banking professionals is committed to providing emerging growth and midsized businesses with strategic advisory services and capital market strategies We pride ourselves on a tradition of client service that goes back more than a century and now spans the globe. Sal Oppenheim jr &. If you are planning to make an online money remittance to SAL OPPENHEIM JR & CIE KGAA, Sharemoney can make it fast and easy for you to transfer money to your loved ones What's more, we offer one of the best exchange rates in the market.

Sal Oppenheim jr & Cie, Geschichte einer Bank und einer Familie (Cologne, 2nd edn, 1992) Inhouse brochure available through the archivist. Frankfurtbased BHFBank was acquired by Sal Oppenheim in January 05 "Financière Atlas is a very established house in French institutional asset management and the deal complements our strategy of positioning ourselves as a European asset management and investment bank," remarked Matthias Graf von Krockow, Oppenheim's chief executive. Cie SCA Luxembourg 168 followers on LinkedIn Europas größte Privatbank, largest private bank in europe.

Sal Oppenheim é um banco privado alemão fundado em 17 e sediado em Colônia, Alemanha 1 Forneceu soluções de gerenciamento de ativos para clientes individuais ricos e investidores institucionais 2 O banco tornouse uma subsidiária da Deutsche Bank em 09 Em 17, Deutsche Bank decidiu descontinuar o Sal Marca Oppenheim e integrar totalmente seus negócios. Bank Sal Oppenheim jr & Cie (Schweiz) AG participates in the deposit guarantee scheme of Switzerland This deposit guarantee scheme applies to credit balances made by private individuals (Swiss and foreign), legal entities (Swiss and foreign) and covers up to up to 100,000 CHF per bank per depositor Bank Sal. Years of international expansion followed and the first bank, a joint venture between Sal Oppenheim and Pierson, Heldring & Pierson bank, was opened in Luxembourg A major event in the body's history is the 07 acquisition of the Frankfurt BHFBank AG which turned Sal Oppenheim into Europe’s largest independent private bank.

For 08, Sal Oppenheim reported a net loss of €117 million, down from its net income for 07 of €255 million Assets under management were €132, down from the €152 billion it held at the beginning of the year However, thanks to the support of the bank's owners, Sal Oppenheim is in a position to digest a loss of these proportions. Sal Oppenheim jr & Cie AG & Co Kommanditgesellschaft auf Aktien operates as an asset management bank The Bank offers institutional asset management, mutual funds, investments, and custodian. Deutsche Bank's billioneuro buyout of Europe's biggest private bank, the Luxembourgbased Sal Oppenheim group, spells the end of a historic financial institution The bank was founded in the.

Home > Luxembourg > LUXEMBOURG > SAL OPPENHEIM JR UND CIE SCA SWIFT/BIC Codes Find SWIFT Codes or BIC Codes across all the banks in the world Swift code is used while transferring money between banks, particularly for international wire transfers. Oppenheims Dies und die gesamtwirtschaftliche Lage (steigende Arbeitslosigkeit, politische Instabilität, Abwertung der Rentenmark, Vertrauensverlust bei den Anlegern) brachte auch die Bank Sal Oppenheim in große Schwierigkeiten. Find the perfect sal oppenheim bank stock photo Huge collection, amazing choice, 100 million high quality, affordable RF and RM images No need to register, buy now!.

Oppenheim is headed for a splitup once flagship German lender Deutsche Bank DBKGnDE has taken an equity stake, sources close to the situation told Reuters Luxembourgbased Sal. Sal Oppenheim jr & Cie SCA is now a wholly owned subsidiary of Deutsche Bank AG All Sal Oppenheim Group operations, including all of its asset management activities, the investment bank, BHF Bank Group, BHF Asset Servicing and Sal Oppenheim Private Equity Partners were transferred to Deutsche Bank At the end of the year 09, Sal. Deutsche Bank is in talks to take a minority stake in Sal Oppenheim that could eventually lead to a take over of the embattled private bank and herald further consolidation in Europe's.

Sal Oppenheim wird als eine Marke der Deutsche Oppenheim fortgeführt Der aktive Geschäftsbetrieb in der Vermögensverwaltung/beratung des Bankhauses Sal Oppenheim wurde zum 30 Juni 18 eingestellt Seit dem 1 Juli 18 werden die NichtKernGeschäftstätigkeiten in der rechtlichen Einheit SOP fortgeführt, die nun unter dem neuen. Sal Oppenheim jr & Cie KGaA is one of the largest privately owned banks in Europe, headquartered in LuxembourgIt manages and administers €138 billion of assets and employs around 3,800 emloyees in more than 30 sites in Germany and Europe. Sal Oppenheim was a German private bank founded in 17 and headquartered in Cologne, Germany It provided asset management solutions for wealthy individual clients and institutional investors The bank became a subsidiary of Deutsche Bank in 09 In 17, Deutsche Bank decided to discontinue the Sal Oppenheim brand and to fully integrate their business.

Sal Oppenheim is a German private bank founded in 17 and headquartered in Cologne, Germany It provided asset management solutions for wealthy individual clients and institutional investors The bank became a subsidiary of Deutsche Bank in 09 In 17, Deutsche Bank decided to discontinue the S. Verurteilter ExVorstand der Bank Sal Oppenheim hat Gefängnisstrafe angetreten Freigeschaltet am um 1731 durch Andre Ott. The Oppenheim Family is a German Jewish banking family which founded Europe's biggest private bank Sal Oppenheim jr & Cie According to Manager Magazin 08, the Oppenheim Family was among the 30 richest families in Germany, with assets over 8 Billion Euros.

The bank was founded in 17 in the city of Bonn by seventeenyearold Salomon Oppenheim, Jr as a commissions and exchange house Oppenheim dealt in commodities, exchanging of foreign currency, and extending credit In 1798, the business moved to Cologne, then the most important banking place in GermanyIn 18, Salomon Oppenheim, Jr, died, and his wife Therese took over the direction of. Sal Oppenheim Deutsche Bank PBC Sal Oppenheim Deutsche Bank PBC Investor Relations 10/09 · page 7 Invested assets are defined as assets DB holds on behalf of customers for investment purposes and/or client assets that are managed by DB DB manages invested assets on a discretionary or advisory basis, or these assets are deposited with DB. Oppenheim) is an originator of financial products and services that are appropriate only for a limited number of high net worth individuals and certain corporate entities, institutions, and foundations (collectively referred to herein as “Sophisticated Investors”) The information that Sal.

The Oppenheim Family is a German Jewish banking family which founded Europes biggest private bank Sal Oppenheim jr & Cie According to Manager Magazin 08, the Oppenheim Family was among the 30 richest families in Germany, with assets over 8 Billion Euros. SOPPDK XXX SWIFT Code (BIC) SALOPPENHEIM JRUCIEAG UCOKGAA in KOELN GERMANY Swift Code SOPPDK is the unique bank identifier for SALOPPENHEIM JRUCIEAG UCOKGAA's head office branch located in KOELN GERMANY and it's used to verify financial transactions such as a bank wire transfers (international wire transfers) Check the SOPPDKXXX SWIFT / BIC code details below. Bank Sal Oppenheim jr & Cie (Schweiz) AG participates in the deposit guarantee scheme of Switzerland This deposit guarantee scheme applies to credit balances made by private individuals (Swiss and foreign), legal entities (Swiss and foreign) and covers up to up to 100,000 CHF per bank per depositor Bank Sal.

Die SalOppenheim jr & Cie AG & Co KGaA war eine deutsche Bank mit Sitz in KölnSie wurde 17 als Privatbank gegründet und gehörte Angehörigen der Familie von OppenheimBis zum Verkauf der Bank durch die Familie im Oktober 09 an die Deutsche Bank für 1,3 Milliarden Euro, war Sal Oppenheim mit einer Bilanzsumme von 41,4 Milliarden Euro und über 150 Milliarden Euro an verwalteten. Deutsche Bank said it would acquire Sal Oppenheim and various subsidiaries of the private bank in a deal the companies valued at about $192 billion. Deutsche Bank's billioneuro buyout of Europe's biggest private bank, the Luxembourgbased Sal Oppenheim group, spells the end of a historic financial institution The bank was founded in the.

Years of international expansion followed and the first bank, a joint venture between Sal Oppenheim and Pierson, Heldring & Pierson bank, was opened in Luxembourg A major event in the body's history is the 07 acquisition of the Frankfurt BHFBank AG which turned Sal Oppenheim into Europe’s largest independent private bank. Sal Sal Oppenheim was a German private bank founded in 17 and headquartered in Cologne, Germany It offers asset management solutions for wealthy individual clients and institutional investors The bank became a subsidiary of Deutsche Bank in 09 In 17, Deutsche Bank decided to discontinue the Sal Oppenheim brand and to fully integrate their business. The Oppenheim Family is a German Jewish banking family which founded Europes biggest private bank Sal Oppenheim jr & Cie According to Manager Magazin 08, the Oppenheim Family was among the 30 richest families in Germany, with assets over 8 Billion Euros.

Oppenheim is headed for a splitup once flagship German lender Deutsche Bank DBKGnDE has taken an equity stake, sources close to the situation told Reuters Luxembourgbased Sal. Oppenheim and Deutsche Bank, which is in the process of buying the Luxemburgbased group’s wealth management business for 1 billion euros, may launch an auction for the investment bank A sale. Deutsche Bank has decided to integrate the business of Sal Oppenheim jr & Cie AG & Co KGaA (Sal Oppenheim) into the Group Sal Oppenheim’s Wealth Management clients will be served through Deutsche Bank’s Wealth Management division in the future, while the Asset Management business with its quantitative investment capabilities will be integrated into Deutsche Asset Management.

Bank Sal Oppenheim jr and Cie (Österreich) AG Magyarországi Fióktelepe participates in the deposit guarantee scheme of Hungary This deposit guarantee scheme applies to current accounts, savings accounts, time deposit accounts made by natural persons (Hungarian and foreign), legal entities and covers up to up to 100,000 EUR per bank per depositor. Sal Oppenheim é um banco privado alemão fundado em 17 e sediado em Colônia, Alemanha 1 Forneceu soluções de gerenciamento de ativos para clientes individuais ricos e investidores institucionais 2 O banco tornouse uma subsidiária da Deutsche Bank em 09 Em 17, Deutsche Bank decidiu descontinuar o Sal Marca Oppenheim e integrar totalmente seus negócios. Oppenheim, is primarily interested in the twocenturyold bank’s wealth management business and its BHF Bank subsidiary, said another person who is close to the talks “The investment bank at Sal.

The takeover marks the end of Sal Oppenheim's independence after more than 0 years The Luxemburgbased bank was founded in 17 The banking group said last year it had recorded losses for the. Bank Sal Oppenheim jr & Cie (Switzerland) Ltd Uraniastrasse 28 CH8022 Zurich Switzerland Phone 41 44 Fax 41 44 wwwoppenheimch History Sal Oppenheim jr & Cie SCA is a European Bank, currently headquartered in Luxembourg It manages and administers €138 billion of assets and employs around 3,800 employees in. Sal Oppenheim jr & Cie Securities Inc is a brokerdealer registered with the Securities and Exchange Commission as well as a member of the National Association of Securities Dealers and the Securities Investor Protection Corporation < New York Advisors & Consultants.

Sal Oppenheim Jr Cie Luxembourg S A And Ifsam S A Agree

Sal Oppenheim Banker Anwalte Sehen Sich Vor Falscher Richterin Welt

Prozess Um Privatbank Sal Oppenheim Christopher Sagt Aus Manager Magazin

Sal Oppenheim Bank のギャラリー

Deutsche Integrates Sal Oppenheim And Russian Units Private Banker International

Oppenheim Probe Taking On The Wealthy

Sal Oppenheim Gefangnis Und Bewahrung Fur Ex Bank Chefs Der Spiegel

184kb Sal Oppenheim

Banker Matthias Graf Von Krockow R Apperas Editorial Stock Photo Stock Image Shutterstock

Accused Dieter Pfundt Arrives District Court Cologne Editorial Stock Photo Stock Image Shutterstock

Sal Oppenheim Wikipedia

Report Deutsche Bank To Integrate Sal Oppenheim Teletrader Com

Real Estate Manager Josef Esch C Waits Editorial Stock Photo Stock Image Shutterstock

Sal Oppenheim Financial Crimes But No Punishment

Carmine Bellucci Artist And Illustrator Sal Oppenheim Bank S Poet

Court Costs Deutsche Case Closed But Battle Goes On

Sal Oppenheim Raises Taiwan News 09 08 12

Sal Oppenheim Jr Cie Cologne Financial History Review Cambridge Core

223plus Customer Magazine Of The Private Bank Sal Oppenheim Jr Cie Graphis

223plus Customer Magazine Of The Private Bank Sal Oppenheim Jr Cie Graphis

Sal Oppenheim Deutsche Bank Sagt Sich Von Josef Esch Los Manager Magazin

Http Www Midcapforums Com Milan Pdf Sawazki Pdf

Sal Oppenheim Corporate Finance Switzerland Has Been Sold To Banca Leonardo Lincoln International

Sal Oppenheim Privat Bank Graf Bader

Accused Christopher Freiherr Von Oppenheim Arrives District Editorial Stock Photo Stock Image Shutterstock

Former Sal Oppenheim Associate Christopher Von Oppenheim C Appears Stock Photo Alamy

Fund Manager Data News Analysis By Citywire

84kb Sal Oppenheim

Sal Oppenheim Anklage Bank Manager Magazin

Sal Oppenheim Fraud Another Thorn In Deutsche Bank S Side

25kb Bank Sal Oppenheim Jr Cie

223plus Customer Magazine Of The Private Bank Sal Oppenheim Jr Cie Graphis

Accused Friedrich Josef Esch Arrives District Court Editorial Stock Photo Stock Image Shutterstock

Sal Oppenheim Bank Chief Predicts Very Volatile 16

Sal Oppenheim Editorial Stock Image Image Of Germany

Money Losing Bankers Face Jail From Tough German Prosecutors Bloomberg

Sal Oppenheim Jr Cie S C A Luxembourg Linkedin

Wagen Und Wagen Sal Oppenheim Jr Cie Geschichte Einer Bank Und Einer Familie Amazon Co Uk Sturmer Michael Books

Man Enters The Private Bank Sal Oppenheim In Cologne Germany 17 Stock Photo Alamy

Sal Oppenheim Real Estate Fraud Trial Begins Business Economy And Finance News From A German Perspective Dw 27 02 13

Traditionsbank Sal Oppenheim Sucht Wege Aus Der Krise Welt

Das Letzte Kapitel Von Sal Oppenheim

Sal Oppenheim Bank Baleri Italia

Sal Oppenheim Financial Crimes But No Punishment

Germany Cologne The Asset Management Bank Sal Oppenheim In The Stock Photo Alamy

Kolner Geldhaus Bankname Sal Oppenheim Verschwindet Kolner Stadt Anzeiger

Sal Oppenheim Bank Baleri Italia

Sal Oppenheim Annual Report Communication Arts

Sal Oppenheim Bank Baleri Italia

Sal Oppenheim S Representative Christopher Alfred Freiherr Von Oppenheim Waits For The Start Of A Trial At The Regional Court In Cologne July 9 15 A German Court Sentenced Four Financiers On Thursday

Sal Oppenheim Richartz Werbung Mehr Kg

Sal Oppenheim Bank Baleri Italia

Sal Oppenheim Wikipedia

Rebranding Of A Rebrand Deutsche Changes Global Fund Offering Ahead Of Ipo

Sal Oppenheim Bank Baleri Italia

Former Sal Oppenheim Associate Matthias Graf Von Krockow Appears At The Regional Court In Cologne Stock Photo Picture And Rights Managed Image Pic Pah Agefotostock

Josef Esch Representative Of The Sal Oppenheim Private Bank Arrives News Photo Getty Images

Sal Oppenheim

Sal Oppenheim Wikipedia

Bank Sal Oppenheim Jr Cie Switzerland Ltd Linkedin

Private Bank Sal Oppenheim Strengthens Advisory Expertise For

Stammhaus Von Sal Oppenheim Wechselt Den Besitzer

223plus Customer Magazine Of The Private Bank Sal Oppenheim Jr Cie Graphis

Josef Esch Representative Of The Sal Oppenheim Private Bank Chats News Photo Getty Images

Deutsche Bank To Buy Sal Oppenheim Financial Times

Matthias Graf Von Krockow Representative Of The Sal Oppenheim News Photo Getty Images

Banker Friedrich Carl Janssen Apperas District Court Editorial Stock Photo Stock Image Shutterstock

Sal Oppenheim Klagerin Sabine Rau Du Kannst Immer Zum Einstandskurs Raus Wsj

Sal Oppenheim Extends Its Securities Lending Program Into Hong Kong

Dieter Pfundt L Representative Of The Sal Oppenheim Private Bank News Photo Getty Images

The Headquarters Of The Private Bank Sal Oppenheim Pictured In Stock Photo Alamy

Former Partner At Private Bank Sal Oppenheim Matthias Von Krockow Stock Photo Alamy

Sal Oppenheim High Resolution Stock Photography And Images Alamy

Josef Esch Representative Of The Sal Oppenheim Private Bank Chats News Photo Getty Images

Sal Oppenheim To Dissapear Following Deutsche Bank S Gradual Absorption

Private Banks And Industry In The Light Of The Archives Of Bank Sal Oppenheim Jr Cie Cologne Taylor Francis Group

Ex Sal Oppenheim Bankers Sentenced In Embezzlement Case Business Economy And Finance News From A German Perspective Dw 09 07 15

Banker Dieter Pfundt Appears District Court Cologne Editorial Stock Photo Stock Image Shutterstock

Es Geht Um Untreue Und Kreditvergehen Im Prozess Gegen Die Fuhrungsriege Der Privatbank Sal Oppenheim Wird Das Urteil Erwartet

Eu Approves Deutsche Bank Acquisition Of Sal Oppenheim Business Economy And Finance News From A German Perspective Dw 30 01 10

Sal Oppenheim Die Oppenheim Tragodie Manager Magazin

Sal Oppenheim Investment Deutsche Bank Saves Vault For The Super Rich Der Spiegel

Sal Oppenheim Bank High Resolution Stock Photography And Images Alamy

Sal Oppenheim Requiem For A Banking Tradition

Sal Oppenheim Privat Bank Graf Bader

252 Sal Oppenheim Photos And Premium High Res Pictures Getty Images

Former Sal Oppenheim Partner Christopher Freiherr Von Oppenheim Stock Photo Alamy

Deutsche Bank Buys Sal Oppenheim For 1 Billion The Local

Office Building Of The Sal Oppenheim Bank At The Kirchberg Stock Photo Alamy

Sal Oppenheim To Dissapear Following Deutsche Bank S Gradual Absorption

44kb Bankhaus Sal Oppenheim

Handout An Undated Handout Picture Of Private Bank Sal Oppenheim Stock Photo Alamy

Matthias Graf Von Krockow Representative Of The Sal Oppenheim News Photo Getty Images

Deutsche Bank Takes Over Upscale Private Bank Business Economy And Finance News From A German Perspective Dw 30 10 09

Banking Clan Oppenheim S Decline And Fall

Representatives Of The Sal Oppenheim Private Bank Sit At The State Stock Photo Alamy

Bank Sal Oppenheim Jr Cie Banks In Zurich Switzerland Money

Sal Oppenheim Jr Cie Luxembourg S A Our Customers Banking Financial Institutional

Accused Friedrich Matthias Graf Von Krockow Arrives Editorial Stock Photo Stock Image Shutterstock

Sal Oppenheim Die Oppenheim Tragodie Manager Magazin

Former Representative Of Sal Oppenheim Friedrich Carl Janssen Arrives For A Trial At The Regional Court In Cologne February 26 13 Members Of Sal Oppenheim S Former Management Are Accused Of Misusing Bank Assets