Cashback Card

You’ll earn cashback up to the full amount of your purchase (maximum reward per transaction is $1) The more you use your RoarMoney virtual card or physical MoneyLion Debit Mastercard®, the more times you’ll be able to shake your phone for cashback rewards!.

Cashback card. Save the smart way with your cashback card Did you know charity workers can now earn up to 12% cashback on every purchase at over 50 retailers?. A cashback credit card is a type of rewards credit card But where most rewards credit cards give you ‘points’ of some sort when you spend, cashback cards give you cash. How your cashback card can help make a big difference Shop as often as you like at any cashback retailer and earn every single time you shop – there’s really no limit to how often you can save!.

Earning a little every day couldn’t be easier with an American Express® Cash Back Credit Card Whether it’s buying a daily coffee from your favorite cafe, stocking up on groceries, or shopping online at major retailers, you can earn cash back on everyday purchases It’s that simple to get rewarded. The process is simple You transfer money that is already in your bank account on to the card and every time you spend at a qualifying retailer you earn cashback You can only spend what you load. Cash Back Credit Cards Browse cashback credit cards from Citi® and get details on how you can earn cash back with every purchase Read More Read More Citi makes earning cash back easy Start earning cash back twice with the Citi ® Double Cash Card or exciting cash back rewards with one of Citi’s Costco credit cards.

About Cash Back Credit Cards – Find the Best Cashback Credit Cards Cash back credit cards, as their name implies, reward you with cash back for using the card That makes them one of the most popular kinds of rewards cards because it’s like getting an extra discount on every purchase. Cash back credit cards Keep it simple with a cash back credit card!. Withdrawing your cash back is easy and you can do it in multiple ways, such as to your bank account, PayPal account or as a gift card, which can include a bonus of up to 5% Some of our most popular gift cards include Amazon, American Express Reward Card, Virtual Visa Prepaid Card, Walmart, Target and Disney among dozens of others.

About Cash Back Credit Cards – Find the Best Cashback Credit Cards Cash back credit cards, as their name implies, reward you with cash back for using the card That makes them one of the most popular kinds of rewards cards because it’s like getting an extra discount on every purchase. The cashback you earn is then paid into your account when you next load your card and will be highlighted on your online statement – smart!. The Cashback Cards are issued exclusively by Swisscard Swisscard is a leading Swiss credit card company which is owned by Credit Suisse and American Express® Swisscard is the only company in Switzerland to offer products from all the world’s leading credit card brands American Express®, Mastercard® and Visa.

Flatrate cash back card $99 2 SimplyCash from American Express No fee cash back (flat rate) $0 3 Tangerine MoneyBack No fee cash back card (bonus categories) $0 4 Rogers World Elite. You’ll earn cash back every time you use your card, which you can then put into your bank account or online investment account or redeem as a statement credit It’s that easy help me choose. The USAA CashBack Rewards Plus Card offers 5% cash back on gas and military base purchases, but only for the first $3,000 spent in those categories (total) each year Similarly, you get 2% cash back at supermarkets until your annual grocery bill crosses the $3,000 mark.

The USAA CashBack Rewards Plus Card offers 5% cash back on gas and military base purchases, but only for the first $3,000 spent in those categories (total) each year Similarly, you get 2% cash back at supermarkets until your annual grocery bill crosses the $3,000 mark. Discover it ® Cash Back is a credit card that gives you cash back rewards on every purchase, allowing you to rack up bonuses to redeem at select merchants or for cash Your Discover Cashback Bonus ® never expires, and you can redeem it in any amount, at any time By understanding how the Discover Cashback Bonus ® program works, you can earn cash back on the things you buy. The American Express Serve Cash Back Card is a prepaid debit card, meaning you have to “load” your card with money before you can use it However, this card offers generous debit card rewards.

While most flatrate cash back cards earn 1, 15 or 2 percent, the Alliant Visa Signature card rewards a whopping 25 percent on all purchases (on up to $10,000 in purchases per billing cycle). Most of the best cashback cards offer a simple, flat rate and no fees Until recently, the Chase Freedom Unlimited card gave you all of that a flat rate of 15% cash back on all purchases. Most of the debit cards on this list make you wait until the end of the month to access your cash back earnings The Amex Serve cash back prepaid card gives you access right after earning it Amex.

Withdrawing your cash back is easy and you can do it in multiple ways, such as to your bank account, PayPal account or as a gift card, which can include a bonus of up to 5% Some of our most popular gift cards include Amazon, American Express Reward Card, Virtual Visa Prepaid Card, Walmart, Target and Disney among dozens of others. The American Express True Cashback Card is the perfect credit card for people who love receiving perks and benefits Among its attractive rewards is a complimentary stay at one of the most beautiful and expensive hotels in Singapore If there’s one cashback credit card we can recommend to travellers, this would be it. Simply make your purchase with your cashback card, and you receive cashback in your credit card account at the end of the month, or in the following month This cashback will be a percentage of your transaction amount For example, if your cashback credit card offers 5% cashback on grocery spend, a $100 grocery bill earns you $5 in cashback.

5% guaranteed cash back on electronic purchases;. All retails purchases made on your Card will be eligible for the cashback Spends not qualified for cashback are Utility bill payments like telephone bills, water and electricity bills made through the Bank's payment channels like Call Center, Mashreq Online, ATM, Mobile Banking, Branches or any other Bank's payment channel. The USAA CashBack Rewards Plus Card offers 5% cash back on gas and military base purchases, but only for the first $3,000 spent in those categories (total) each year Similarly, you get 2% cash back at supermarkets until your annual grocery bill crosses the $3,000 mark.

Most of the best cashback cards offer a simple, flat rate and no fees Until recently, the Chase Freedom Unlimited card gave you all of that a flat rate of 15% cash back on all purchases. Cashback, Rebates, Airline Miles/Points Reward, Hotel Points Reward, Credit Card Points Reward Comparison for Online Shopping. The American Express Serve Cash Back Card is a prepaid debit card, meaning you have to “load” your card with money before you can use it However, this card offers generous debit card rewards.

No minimum spend criteria for earning cash back rewards. The American Express Serve Cash Back Card is a prepaid debit card, meaning you have to “load” your card with money before you can use it However, this card offers generous debit card rewards. Withdrawing your cash back is easy and you can do it in multiple ways, such as to your bank account, PayPal account or as a gift card, which can include a bonus of up to 5% Some of our most popular gift cards include Amazon, American Express Reward Card, Virtual Visa Prepaid Card, Walmart, Target and Disney among dozens of others.

Why this is one of the best cash back credit cards The US Bank Cash Visa Signature Card has no annual fee and offers cardholders a threetiered cash back rewards program You’ll earn 5% cash. Cash Back Credit Cards Cash back credit cards provide cash back rewards on your purchases Find the best cash back credit card for you based on your purchase/spend habits. Withdrawing your cash back is easy and you can do it in multiple ways, such as to your bank account, PayPal account or as a gift card, which can include a bonus of up to 5% Some of our most popular gift cards include Amazon, American Express Reward Card, Virtual Visa Prepaid Card, Walmart, Target and Disney among dozens of others.

A cashback credit card is a card that pays you back a percentage of what you spend Typically, this ranges from 1% to 2%, though it can go as high as 6% You may earn different percentages based on the types of purchases you make Despite their name, cashback credit cards don’t actually pay you in physical cash. Most of the debit cards on this list make you wait until the end of the month to access your cash back earnings The Amex Serve cash back prepaid card gives you access right after earning it Amex. American Express Cash Magnet® Card Best for Flatrate cash back Bonus offer 0% period for purchases Chase Freedom Unlimited® Best for Bonus rewards 5%/3% categories high ongoing rate.

About Cash Back Credit Cards – Find the Best Cashback Credit Cards Cash back credit cards, as their name implies, reward you with cash back for using the card That makes them one of the most popular kinds of rewards cards because it’s like getting an extra discount on every purchase. Cash back credit cards are not created equal Each cash back credit card has its own unique rewards program Out of all the credit cards we’ve discussed, the Bank of America® Cash Rewards Credit Card gives the most cash back, which offers 3% in a category of your choosing It also offers 2% back at grocery stores and 1% back on all other eligible purchases. Cash back cards are different from other types of rewards cards, like those that offer points or miles for travel purchases.

Cash back credit cards are the most straightforward type of rewards card A percentage of each eligible purchase you make with your card is given back to you You can think of cash back as a small discount on every purchase – earning 3% cash back on a $100 purchase is like paying $97, instead of $100. Flatrate cashback cards offer the same amount of cash back on all purchases Bonus rewards cashback cards offer extra rewards on select purchases, such as gas, groceries, dining and travel. Earn up to 5% cash back This card’s killer feature is 5% bonus cash back on up to $1,500 of quarterly spending in rotating bonus categories (activation required each quarter).

Earn cash back on everyday purchases, including grocery store and gas purchases Plus, some cash back credit cards give you the option to help support a special cause in addition to earning cash back for every purchase For details, explore the cash back cards on this page See less product information. Most of the best cashback cards offer a simple, flat rate and no fees Until recently, the Chase Freedom Unlimited card gave you all of that a flat rate of 15% cash back on all purchases. Cash back refers to a credit card benefit that refunds the cardholder's account a small percentage of the sum spent on purchases Cash back rewards are actual cash that can be applied to a credit.

Most of the best cashback cards offer a simple, flat rate and no fees Until recently, the Chase Freedom Unlimited card gave you all of that a flat rate of 15% cash back on all purchases. Capital One SavorOne Cash Rewards Credit Card Best Cash Back Card for Restaurant Lovers Amazon Prime Rewards Visa Signature Card Best Cash Back Card for Amazon Addicts Costco Anywhere Visa. Up to 1% guaranteed cash back on all local and international transactions;.

The American Express Serve Cash Back Card is a prepaid debit card, meaning you have to “load” your card with money before you can use it However, this card offers generous debit card rewards. Mit den Cashback Cards bleibt mehr Cash für dich 1 Für jedes Bezahlen mit deiner Cashback Kreditkarte schreiben wir dir bis zu 1% des Gesamtbetrags gut 2 Ausserdem profitierst du in den ersten 3 Monaten von einem Startbonus von bis zu 100 CHF!. A cashback credit card is a card that pays you back a percentage of what you spend Typically, this ranges from 1% to 2%, though it can go as high as 6% You may earn different percentages based on the types of purchases you make Despite their name, cashback credit cards don’t actually pay you in physical cash.

Most of the best cashback cards offer a simple, flat rate and no fees Until recently, the Chase Freedom Unlimited card gave you all of that a flat rate of 15% cash back on all purchases. A cashback credit card is one that gives you a percentage of your spending as cashback (sometimes termed as cash rebates) This cashback earned will be credited into the same credit card you spent on and can be used to offset your next credit card statement. You’ll earn cashback up to the full amount of your purchase (maximum reward per transaction is $1) The more you use your RoarMoney virtual card or physical MoneyLion Debit Mastercard®, the more times you’ll be able to shake your phone for cashback rewards!.

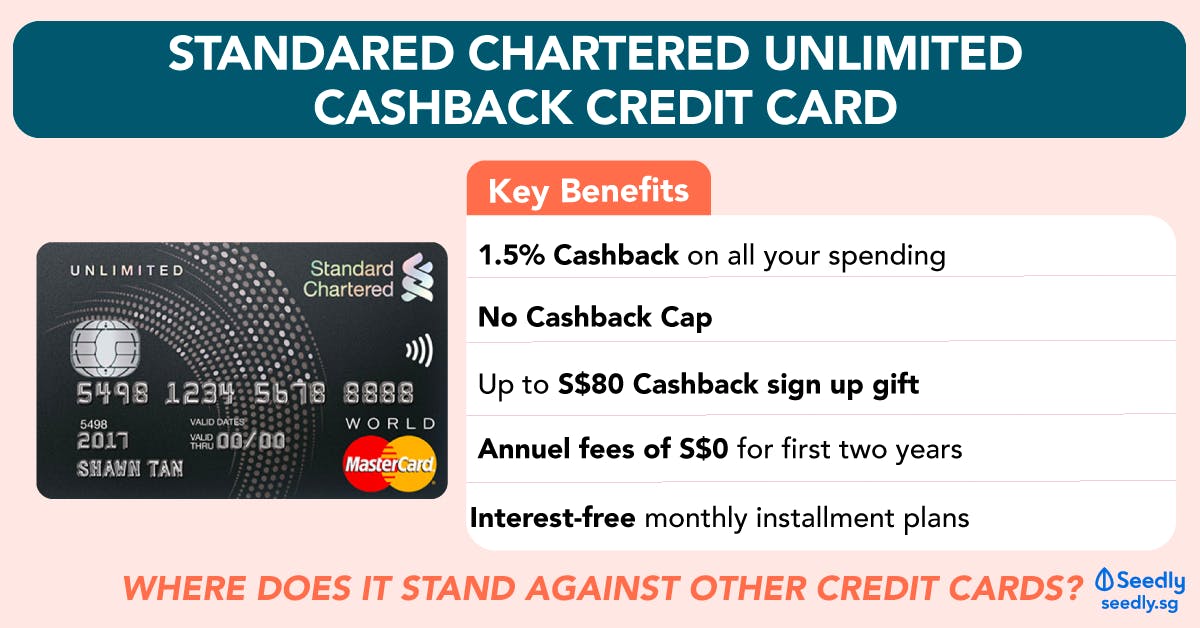

The Cashback Program (“the Program”) for Standard Chartered credit card (the ‘Card’) Customers allows eligible Standard Chartered credit cardholders (“Cardholder/s”) to accumulate Cashback (“Cashback”) on Qualifying Transactions incurred on their Standard Chartered credit card (Card/s) during the Billing Month, as per the minimum and maximum amount set by the Bank from time to time. Cash Back, Made Simple Earn 167% Cash Back on Every Purchase 1 Period Within our personal credit card options, the Fifth Third Cash/Back Card allows you to earn rewards on every purchase with no categories, caps or annual fee 2 Available exclusively for Fifth Third customers with an eligible checking or savings account. Cash back is awarded based on eligible credit card purchases excluding transactions such as cash advances of any type, balance transfers, convenience check transactions, overdraft protection transfers and quasicash transactions.

The American Express Serve Cash Back Card is a prepaid debit card, meaning you have to “load” your card with money before you can use it However, this card offers generous debit card rewards. About Cash Back Credit Cards – Find the Best Cashback Credit Cards Cash back credit cards, as their name implies, reward you with cash back for using the card That makes them one of the most popular kinds of rewards cards because it’s like getting an extra discount on every purchase. ^Cash back in the Telephone / Movies / Utility category is capped at Rs100 per month for each category Identification of Telephone / Movies categories is done basis MCC codes provided by Mastercard ® *To find a Citibank partner restaurant near you, click here Click here for Citi Cash Back Card Terms and Conditions.

Most of the debit cards on this list make you wait until the end of the month to access your cash back earnings The Amex Serve cash back prepaid card gives you access right after earning it Amex. Emirates Islamic Cashback Card brings to you the best cash back program Your Card is powered with 5% guaranteed cash back on telecom expenses;. In the traditional financial world, cashback refers to credit (and debit) card transactions that administer rewards to its users whenever they shop In a nutshell, every time a user makes a purchase, a small percentage of the amount spent is refunded to the cardholder.

The Cashback Program (“the Program”) for Standard Chartered credit card (the ‘Card’) Customers allows eligible Standard Chartered credit cardholders (“Cardholder/s”) to accumulate Cashback (“Cashback”) on Qualifying Transactions incurred on their Standard Chartered credit card (Card/s) during the Billing Month, as per the minimum and maximum amount set by the Bank from time to time. The USAA CashBack Rewards Plus Card offers 5% cash back on gas and military base purchases, but only for the first $3,000 spent in those categories (total) each year Similarly, you get 2% cash back at supermarkets until your annual grocery bill crosses the $3,000 mark. Credit Cards That Earn 2% Cash Back or More on Purchases A 2% cashback card is ideal for those who prize simplicity or who want to pair it with a bonuscategory card Gregory Karp January 6.

Cashback cards are issued exclusively by Swisscard Swisscard is a leading Swiss card company owned by Credit Suisse and American Express® Swisscard is the only company in Switzerland to offer products from all of the world’s leading credit card brands – American Express®, Mastercard® and Visa. Cash Back Credit Cards Browse cashback credit cards from Citi® and get details on how you can earn cash back with every purchase Read More Read More Citi makes earning cash back easy Start earning cash back twice with the Citi ® Double Cash Card or exciting cash back rewards with one of Citi’s Costco credit cards.

_flat.png)

Standard Chartered Liverpool Fc Cashback

The True Cashback Card American Express Singapore

The Complete Guide To The Best Cashback Credit Cards In Singapore Edition

Cashback Card のギャラリー

What Is The Best Cashback Credit Card For Online Shopping

Maximise Savings With The Best Cashback Credit Cards For Your Big Expenses

Best Cashback Credit Cards In Singapore 21 Valuechampion Singapore

Icbc S Latest Credit Card Offers Unlimited Cashback No Min Spend No Cap 1 Additional Cash Back

Credit Cards Archives The Simple Sum

Myworld Shopping In The Shopping Community

Unlimited Cashback Credit Card Standard Chartered Singapore

Introducing Standard Chartered S Unlimited Cashback Credit Card Enjoycompare

Save More Money In 19 With The Best Cashback Credit Cards

6 Cashback Credit Cards That Pay Out The Most In Singapore

A True Review Of The American Express True Cashback Card The Penny Pincher

The Entry Level Credit Card With The Most Free Lounge Visits Is A Cashback Card The Milelion

Standard Chartered Liverpool Fc Cashback Card Review Benefits

Standard Chartered Unlimited Cashback Credit Card Review January 21 Finder

1

Tandem Launches Travel Cashback Card In Uk Fintech Futures

Best Cashback Credit Cards In Singapore Updated January 21

My Singapore My Home Amex True Cashback Card Is Offering An Additional 1 Cashback On All Your Foreign Currency Spend

Best Cashback Credit Cards In Singapore 21 Valuechampion Singapore

Greater Credit Cards Savings At Shell Shell Singapore

Citibank Cash Back Visa Card Review Great Multi Purpose Card

How Does Covid 19 Change The Miles Versus Cashback Equation The Milelion

My Favourite Cashback Credit Cards

Hsbc Advance Cashback Credit Card Singapore Hsbc Sg

Best Cashback Card For One Off Lump Sum Spending Whatcard Blog Credit Cards Whatcard Community

I T Cashback Card I T Privileges More Amex Hong Kong

Earn 5 Cashback First 3 Months With American Express True Cashback Card Great Deals Singapore

Q Tbn And9gcs Znimkyce10hmbpql8idpqgfdpe7uifcvwfhsxwi 4nij3wmw39nta27c7eu42riifn2fk2ugrmi Ydqyuixsm Dfsbscz4mzrc5sapkr Usqp Cau Ec

Whatcard Of The Week Amex True Cashback Card Credit Card Reviews Whatcard Community

Q Tbn And9gcsyd Ivbxxuv Xqel10vmpzw Tw9spqmrf Jy9kcnsmmb0r8xfdqrhtlkcpzkui65hsy5jlah6ooesscxqp2kixwdb Bmnnlhf1llg9 Kxx Usqp Cau Ec

Citi Cash Back Mastercard Review 1 6 Cashback On All Spend

Best Sign Up Bonuses And Credit Cards To Apply For The Shutterwhale

Best Cashback Credit Cards Singapore January 21 Singsaver

Miles Or Cashback Which Type Of Credit Cards Should You Go For In Singapore

Choosing The Best Cashback Credit Card And Signup Promotions Fatty S Finance

The True Cashback Card American Express Singapore

Q Tbn And9gcrrl V1mcosjnqj8orop6qh4srsmhyysg Qkqv0a0fqgobltaonedysv8e9oo864xxw0xofwis4qsedadban5gixycyr6vcsvwi Gxe L7i Usqp Cau Ec

Citi Cash Back Credit Card Reviews Singapore 21

The Ultimate Cheatsheet Best Cashback Credit Cards For Working Adults 18

Citibank Cash Back Credit Card Moneysmart Review

Cimb World Mastercard Unlimited Cashback Credit Cards Cimb Sg

Get Up To S 250 Bonus Cashback With Dbs Or Posb Credit Card Apply By 05 October New Customers Only The Shutterwhale

Only For Dbs Paylah Users Get Up To S 300 Cashback Dbs Singapore

Dbs Posb Offering The Highest Ever 300 Cashback When You Apply For A Credit Card From 21 Dec 10 Jan 21 Moneydigest Sg

Unlimited Cashback Credit Card Mobile Standard Chartered Singapore

Till 10 July Upsized 2 Cashback For All New To Bank Dbs Card Applicants No Minimum Spend Required Whatcard Blog Credit Cards Whatcard Community

Promotion Preferred Credit Cards

Best Credit Cards For Online Shopping And Online Payment In Singapore

Best Cashback Credit Cards In Singapore Best Prices In Singapore

Best Cashback Credit Cards To Help You Save Money On Every Swipe

Cashback Vs Miles Vs Rewards Which Is The Best Credit Card

Credit Card Promotions November Apple Watch Se Airpods More

American Express True Cashback Card Review 21

Cashback Card Home Facebook

Key Strategies To Maximize Credit Card Cashback Fatty S Finance

Best Cashback Credit Cards With No Minimum Spend In Singapore

Bizz Solutions This Is How Mcdonald S Cashback Card Facebook

Earn 250 Cash When You Apply For The Best Cashback Credit Cards On Singsaver Heartland Boy

Standard Chartered Unlimited Cashback Credit Card Review

Standard Chartered Unlimited Cashback Credit Card Reviews And Comparison Seedly

Is Hsbc Advance Credit Card A Better Cashback Card Heartland Boy

Hong Leong Wise Review The Weekend Cashback Card

Citi Cash Back Vs Citi Cash Back Plus Card Differences Between These Cards Which You Should Choose

Enjoy Up To S 1 Cashback With Posb Everyday Card

Best Cash Back Credit Cards In Singapore Gobear Singapore

Choosing The Best Cashback Credit Card And Signup Promotions Fatty S Finance

Best Cash Back Credit Cards Singapore 21 Moneysmart Sg

Have You Already Seen Our New Cashback Cashback With Every Purchase Facebook

Dbs Credit Cards Promo Get 2 Cashback With No Minimum Spend For New Card Signups Betterspider

The Smartest Corporate Card In Singapore Aspire

Unlimited Cashback Card Faq Standard Chartered Singapore

Credit Card I Rhb Malaysia

Best Corporate Card For Advertising In Singapore Facebook Google Ads

3 Secrets On How To Maximise Amex True Cashback Card

Citi Cash Back Card January 21 Review Rates Fees Finder Singapore

Best Cashback Credit Cards In Singapore 21 Valuechampion Singapore

Unlimited Cashback Credit Card Mobile Standard Chartered Singapore

Cimb Platinum Mastercard 10 Cashback Credit Cards Cimb Sg

Review Amex True Cashback Card How To Get 3 8 Cashback On Almost Anything Or 1 17 Off Your Income Tax Sethisfy

Best Cashback Card 17

Standard Chartered Unlimited Cashback Vs Amex True Cashback

Review Of New American Express True Cashback Credit Card Cheaponana Com The Best Credit Cards In Singapore And Other Deals To Help You Save Earn And Maximise Your Money

Best Cashback Credit Card Singapore 21 Singapore Bank

The Best Unlimited Cashback Credit Cards In Singapore Her World Singapore

The 5 Best Cashback Credit Cards In Singapore 21

Standard Chartered Unlimited Vs Hsbc Advance Vs American Express True Cashback How Do You Choose A Credit Card If All 3 Cards Are Similar

Citi Cash Back Card Best Cash Back Card For Foodies Credit Card Review Valuechampion Singapore

Top Credit Cards In Singapore

6 Cashback Credit Cards That Pay Out The Most In Singapore

Cashback Credit Cards In Singapore Comparecreditcards Sg

Citi Revises Cash Back Credit Card Minimum Spending Requirement

Is Hsbc Advance Credit Card A Better Cashback Card Heartland Boy

3 Differences You Should Know Between The Amex True Cashback Card And Stanchart Unlimited Cashback Credit Card The Penny Pincher

Review Amex True Cashback Card How To Get 3 8 Cashback On Almost Anything Or 1 17 Off Your Income Tax Sethisfy

6 Cashback Credit Cards That Pay Out The Most In Singapore

First Impression Standard Chartered Unlimited Cashback Credit Card

Uob Credit Cards There S A Card For Everyone

Best Cashback Credit Card Singapore 21 Singapore Bank

The Smartest Corporate Card In Singapore Aspire

S 50 Cashback Free True Wireless Earbuds From Jabra With Standard Chartered Unlimited Cashback Card By 31 August The Shutterwhale

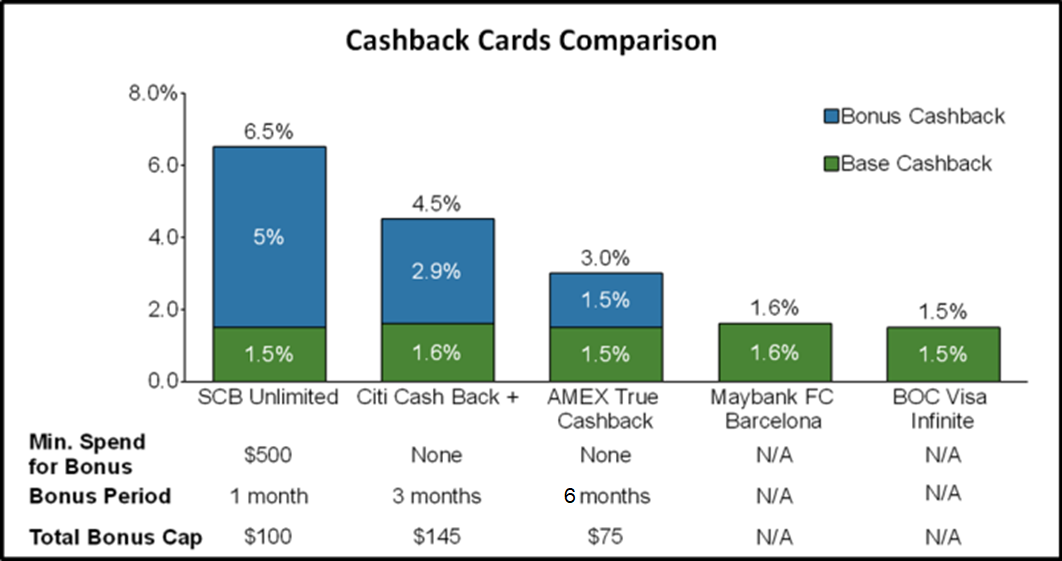

Best Cashback Credit Cards Comparison In Singapore 21