Greendot Cashback Card

Green Dot Bank is an online bank offering an unlimited cash back bank account and highyield savings account Green Dot Bank is held by Green Dot Corporation, which also owns Bonneville Bank and GoBankGreen Dot has been around since 1999, with its first prepaid debit card coming on the market in 01.

Greendot cashback card. Unlimited 3% Cash Back Bonus Every time you make an online or inapp purchase with your Unlimited Visa debit card, Green Dot Bank will add 3% of the purchase amount into the customer’s cash back bonus balance. Re Green Dot 3% Unlimited Cashback It seemed too good to be true and that was confirmed after looking into it a bit more The cash back is only available at the end of the year and yo u also only get the 3% back on online and inapp purchases. The AccountNow Green Dot Cash Back Visa Prepaid debit card allows those without a bank account to get access to services like cash checking, direct deposit and the ability to make purchases with a card rather than carrying around cash.

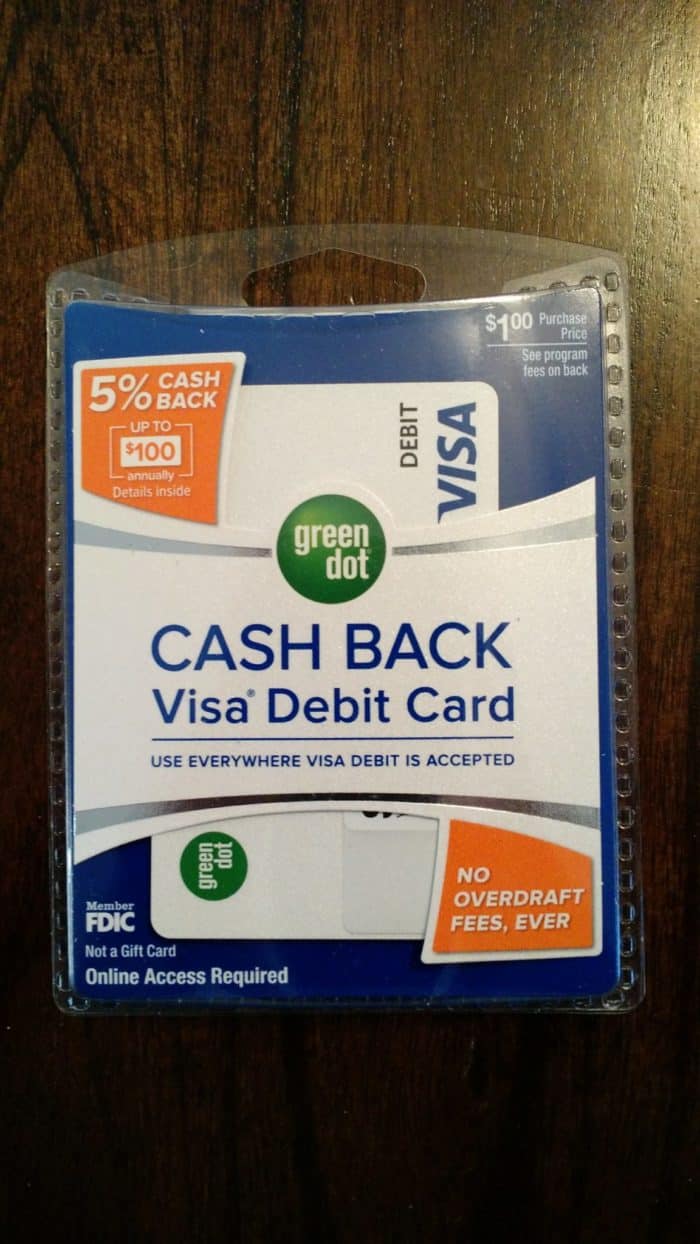

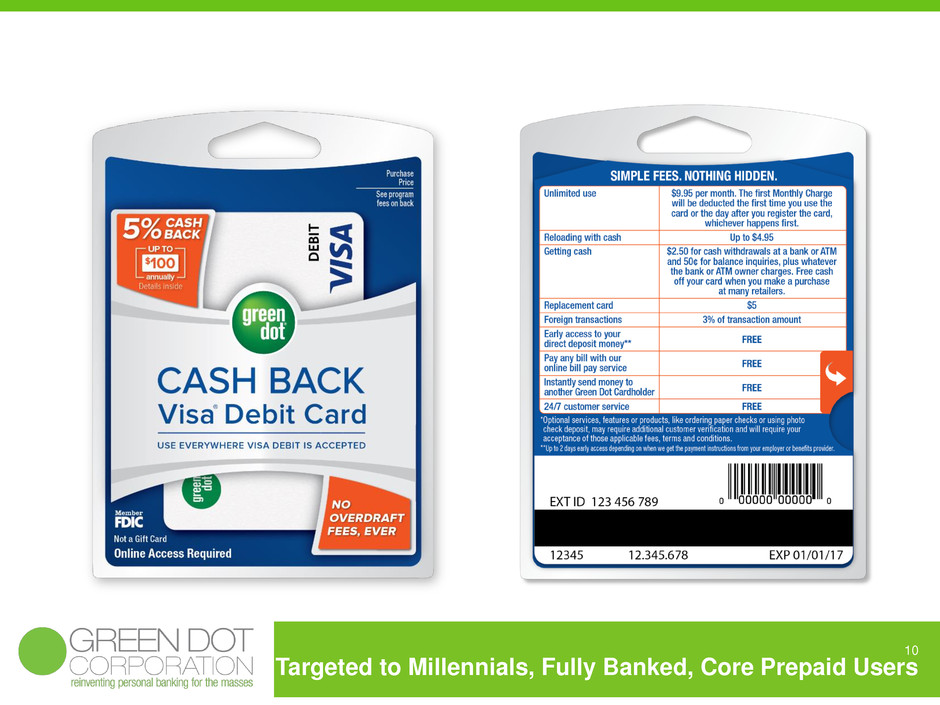

Green Dot Debit Card 5% Cash Back Shipped with USPS First Class ****$100 Activation fee at participating greendot visa debit retailers****. Green Dot Platinum card is issued by Green Dot Bank, Member FDIC Green Dot Bank also operates as GoBank and Bonneville Bank All of these trade names are used by, and refer to, a single FDICinsured bank, Green Dot Bank Deposits under any of these trade names are aggregated for deposit insurance coverage. Cards provided by Green Dot Corporation The MasterCard Card is issued by Green Dot Bank pursuant to a license from MasterCard International Incorporated The Visa Card is issued by Green Dot Bank pursuant to a license from Visa USA Inc Green Dot Corporation is a member service provider for Green Dot Bank, Member FDIC.

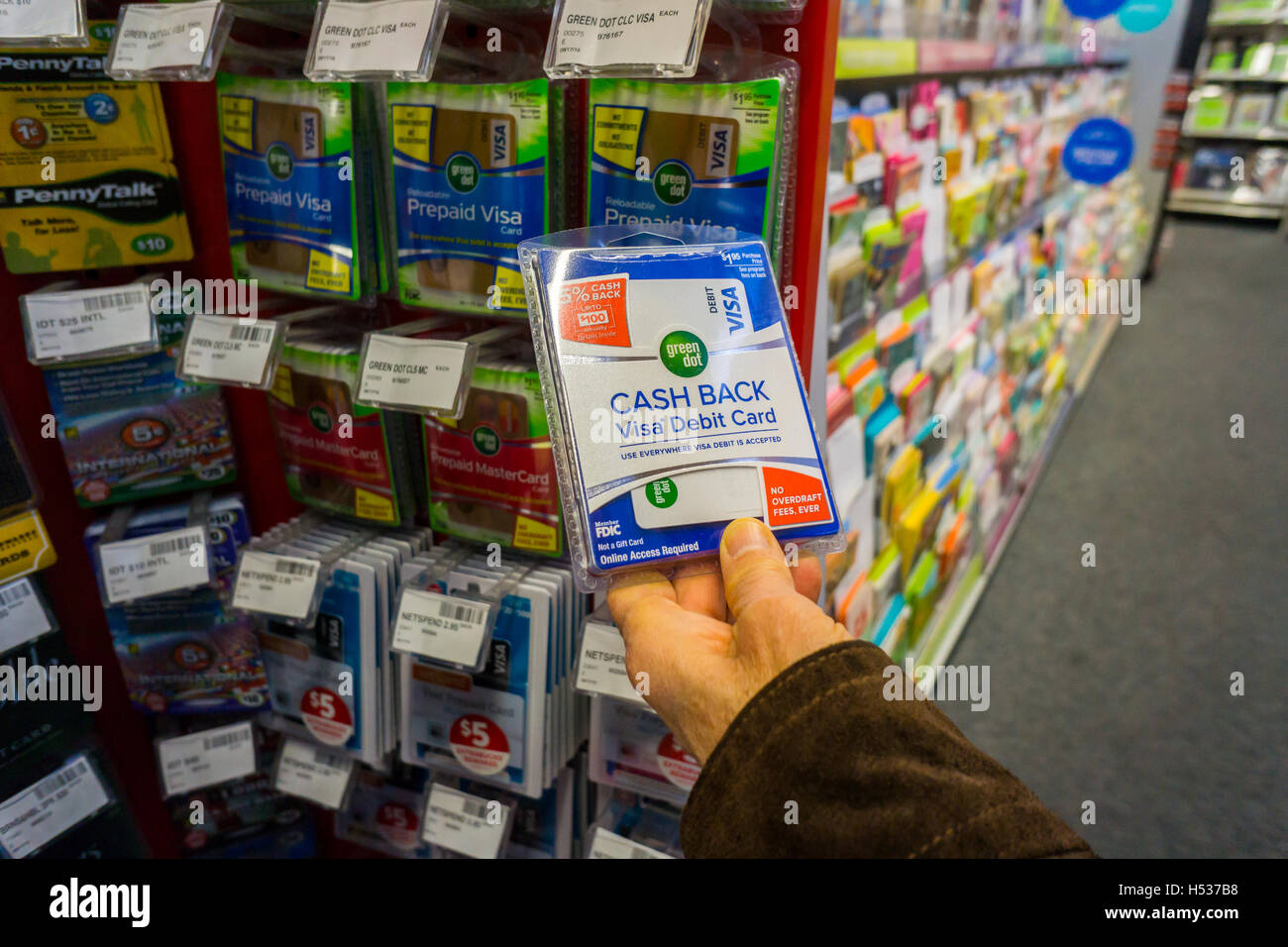

Where to Get a Green Dot Cash Rewards Visa Green Dot card applications are available online (no fee to purchase online), through their website or the Google or Apple app Store Or you can purchase a physical card for a fee of up to $195 through various retailers like Walmart, Walgreens, CVS, Rite Aid, 7Eleven and more. Short answer Most Green Dot prepaid cards have a withdrawal limit of $500 per day at an ATM or participating bank teller Some Green Dot cards, such as the Walmart MoneyCard, have higher withdrawal limits at tellers or instore financial centers Green Dot partners with MoneyPass for ATM access, meaning you can use any MoneyPass ATM to withdraw cash with no additional fees. Green Dot says electronic purchases made via retailer websites or apps (think Amazon, Target, Netflix, etc) using the card or account will count towards the $1,000 monthly spend requirement and accrue cash back But you won’t get cash back for using the Green Dot debit card for paying your regular monthly bills online.

If you want to cancel a prepaid Green Dot card completely, you first need to empty all the money off your card You can do this through regular purchases, online bill pay transactions, money transfers, paper checks or ATM transactions However, do note that any fees for various withdrawals will still apply Video of the Day. Discover Green Dot's Cash Back Bank Account which offers the richest debit card with cash back, free cash deposits, and free ATM withdrawals!. RCXZXGP https//cashapp/app/RCXZXGP__Price Check https//.

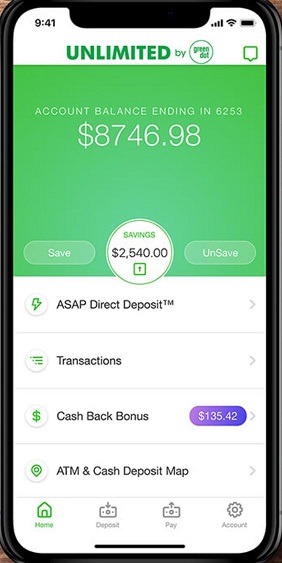

Credit Cards » Visa Credit Cards » Unlimited Cash Back Bank Account by Green Dot ADVERTISER DISCLOSURE Partner Offer Unlimited Cash Back Bank Account by Green Dot Fair to Good Credit Recommended () If you apply for a credit card, the lender may use a different credit score when considering your application for credit. Secure © 03 Green Dot Corporation. You can with the Green Dot 5% Cash Back Visa® Debit Card Earn 5% Cash Back with everyday purchases, up to $100 each year, and rack up your rewards Sold only in stores Get your pay up to 2 days before payday with ASAP Direct Deposit™ 2 Shop everywhere Visa® debit is accepted in the US.

A Green Dot Card is a reloadable debit card that can be purchased locally at places like Walmart, CVS Pharmacy and Walgreens They can also be purchased online When one of these "temporary cards. Green Dot unveiled a new bank account and debit card product called the Unlimited Cash Back Bank Account This account earns 3% cashback at year’s end on purchases made throughout the year online or inapp There’s no limit to the amount of cashback you can earn Store purchases don’t earn any cashback. Green Dot Platinum card is issued by Green Dot Bank, Member FDIC Green Dot Bank also operates as GoBank and Bonneville Bank All of these trade names are used by, and refer to, a single FDICinsured bank, Green Dot Bank Deposits under any of these trade names are aggregated for deposit insurance coverage.

Green Dot is one of the biggest players in the prepaid debit card market, and it is expanding into more traditional banking with an online account that features some eyecatching numbers A 3% interest rate, and 3% cash back on online purchases. Green Dot Debit Card 5% Cash Back Shipped with USPS First Class ****$100 Activation fee at participating greendot visa debit retailers****. More reasons to love this choice.

Make sure the name and social security number on file with your employer or benefits provider matches what’s on your Green Dot account exactly We will not be able to deposit your payment if we are unable to match recipients Claim the cash back bonus after 12 months of use and your account being in good standing. The Green Dot Bank Unlimited Cash Back Bank Account Visa debit card’s 2 percent cash back on mobile and online purchases, plus 2 percent highyield savings account APY, are a notch above competing. A Green Dot card is a prepaid debit card with no upfront fees, minimum balance, credit check requirement, or overdraft fees The card can be used just like a regular debit or credit card However, keep in mind that reload fees can be up to $595 , and monthly charges can cost up to $795.

Once you click apply for this card, you will be directed to the issuer’s website where you may review the terms and conditions of the card before applying While Creditcom always strives to present the most accurate information, we show a summary to help you choose a product, not the full legal terms and before applying you should. Green Dot Debit Cards Explore your options with debit cards designed to meet your needs Cash Back Visa® Debit Card Earn 2% cash back on qualifying online and mobile purchases and 2% interest (APY) on money in savings up to a $10,000 balance!. The Green Dot app is designed to help you manage any Green Dot debit card or bank account including the Unlimited Cash Back Bank Account with the richest debit card in America available only at.

The Green Dot Cash Back Visa ® Debit Card offers 2% cash back on qualifying online and mobile purchases and 2% interest (APY) on money in the HighYield Savings Account up to a $10,000 balance – Annual Percentage Yield accurate as of 8/1/ and may change anytime The account also offers a variety of ways to save on fees. Unlimited 3% Cash Back Bonus Every time you make an online or inapp purchase with your Unlimited Visa debit card, Green Dot Bank will add 3% of the purchase amount into the customer’s cash back bonus balance. Green Dot has launched the Unlimited Cash Back Bank Account by Green Dot Bank With what is believed to be the richest cash back Visa debit card in America, an integrated highyield savings.

Dave Ramsey most is spinning is chair today, because greendot just announce a 3% cashback plus 3% savings account Well, sort off How does GreenDot Unlimite. Re Greendot 2% Cash back is earned on qualifying online and mobile purchases Claim cash back every 12 months of use and your account being in good standing Monthly Charge $795 Waived when you spend $1,000 or more using your Card in the previous monthly period. Re Green Dot 3% Unlimited Cashback It seemed too good to be true and that was confirmed after looking into it a bit more The cash back is only available at the end of the year and yo u also only get the 3% back on online and inapp purchases I would avoid this unless you are willing to wait for the cash back and make a lot of online purchases.

Green Dot’s new offering, the Unlimited Cash Back Bank Account, gives customers a 3% savings rate on a highyield savings account, plus a high return on their spending Unlimited Cash Back debit. The Green Dot Cash Back Visa ® Debit Card lets you earn 2% cash back on online and mobile purchases with no cap 1 and earn 2% (APY) Interest on savings up to $10,000—X the national average!. Unlimited 3% Cash Back Bonus Every time you make an online or inapp purchase with your Unlimited Visa debit card, Green Dot Bank will add 3% of the purchase amount into the customer’s cash back bonus balance.

Where to Get a Green Dot Cash Rewards Visa Green Dot card applications are available online (no fee to purchase online), through their website or the Google or Apple app Store Or you can purchase a physical card for a fee of up to $195 through various retailers like Walmart, Walgreens, CVS, Rite Aid, 7Eleven and more. A woman purchases the 5 Percent Cash Back Visa Debit Card from Green Dot, which the company says has no bounced check or overdraft fees ever Green Dot urges people to "get smart" and get the card, available in stores or online. Published on Feb , 19 Adam Jusko of ProudMoneycom (https//wwwProudmoneycom) reviews the Green Dot Debit Visa that promises 5% cash back but actually gives you much less once fees are.

How To Close Green Dot Prepaid Visa Debit Card__Try Cash App using my code and we’ll each get $5!. Secure © 03 Green Dot Corporation. View all credit card offers on creditcom and find your perfect credit card today Creditcom shows you the top credit card offers online.

Go to the Green Dot website Once on the Green Dot website, hover over Register/Activate a Card and click Bought in a Store or Received in the Mail Enter your card information Enter the 16digit card number on the front of the card and the threedigit security code on the back of the card into the two gray squares that look like debit cards. Unlimited 3% Cash Back Bonus Every time you make an online or inapp purchase with your Unlimited Visa debit card, Green Dot Bank will add 3% of the purchase amount into the customer’s cash. Temporary cards can't be used at ATMs or for cash access Your first Monthly Charge will be deducted 30 days from registration OK We were not able to verify the personal information that you provided and will not be sending you a personalized card You have reached the maximum number of Green Dot Bank issued cards allowed per customer.

2 Plus, free innetwork ATMs,3 free cash deposits using the app, early direct deposit 4 and more!. Green Dot’s Cash Back Visa® Debit Card gives you 5% cash back on purchases (up to $100 annually) It also comes with great features and affordability that Green Dot is known for Get your Green Dot Cash Back Visa Debit Card right now – just fill out your name and address, and we’ll send it to your house. This Card is issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa USA Inc.

Your Green Dot 5% Cash Back Visa Debit Card has several features you can take advantage of to help offset its monthly cost Sign up for direct deposit Get the information for your account from the Green Dot site or mobile app by signing in to your account, then hand it over to your payroll team and enjoy free deposits Max out your cash back. Green Dot offers a variety of secured credit cards along with prepaid cards that you can use like you would a credit card While these cards can offer you convenience even if you have poor credit, they also come with numerous fees that might persuade you to cancel if you don't use the card enough or if you've found another option The process for canceling your Green Dot card will depend on. Greendot Cash Back/Debit Visa Card Bought greendot debit card loaded 330 dollars and can't activate the card Norwich Connecticut *Author of original report I wish *General Comment Thanks for the reply.

Green Dot’s new offering, the Unlimited Cash Back Bank Account, gives customers a 3% savings rate on a highyield savings account, plus a high return on their spending Unlimited Cash Back debit. The AccountNow Green Dot Cash Back Visa Prepaid debit card allows those without a bank account to get access to services like cash checking, direct deposit and the ability to make purchases with a card rather than carrying around cash. It is a digital world, and paper money is yesterday's news Green Dot is a debit card that's different, offering a whopping 5% cash back on purchases, as wel.

Use the Green Dot Cash Back Visa® Debit Card to deposit and spend money without a checking account Easily control your spending Apply online with no credit check at CreditCardscom. Green Dot® Cash Back Visa® Debit Card See Terms Apply Now at Green Dot's Secure Site Reward Rates N/A N/A Balance Transfers Intro APR N/A Purchases Intro APR N/A Regular APR N/A Annual Fee N/A See the online credit card applications for details about the terms and conditions of an offer Reasonable efforts are made to maintain accurate. Enrolled in the cash back program and you are immediately eligible to earn a Cash Back bonus on qualifying online and mobile purchases made with your Debit Card (“Cash Back”) Your enrollment date is the date that you successfully register and open your account You will not be enrolled in the cash back.

Temporary cards can't be used at ATMs or for cash access Your first Monthly Charge will be deducted 30 days from registration OK We were not able to verify the personal information that you provided and will not be sending you a personalized card You have reached the maximum number of Green Dot Bank issued cards allowed per customer. Credit Cards » Visa Credit Cards » Unlimited Cash Back Bank Account by Green Dot ADVERTISER DISCLOSURE Partner Offer Unlimited Cash Back Bank Account by Green Dot Fair to Good Credit Recommended () If you apply for a credit card, the lender may use a different credit score when considering your application for credit. Go to the Green Dot website Once on the Green Dot website, hover over Register/Activate a Card and click Bought in a Store or Received in the Mail Enter your card information Enter the 16digit card number on the front of the card and the threedigit security code on the back of the card into the two gray squares that look like debit cards.

Green Dot says electronic purchases made via retailer websites or apps (think Amazon, Target, Netflix, etc) using the card or account will count towards the $1,000 monthly spend requirement and accrue cash back But you won’t get cash back for using the Green Dot debit card for paying your regular monthly bills online. Enjoy a range of features across our collection of Green Dot cards including Get your pay up to 2 days early and government benefits up to 4 days early with ASAP Direct DepositTM Send money & pay bills Deposit cash using the app Enjoy no minimum balance requirement Additional features available across select Green Dot cards Access a free ATM network Earn 2% cash back on online and mobile. The Green Dot Unlimited Cash Back Bank Account’s biggest draw is the unlimited 2% cash back earned from online or inapp purchases There’s no limit to how much cash back you can earn, so long as you’re using your card for online and inapp purchases (there’s more on how Green Dot identifies those purchases in a section below).

Getting a Green Dot prepaid debit card is fast and easy After purchasing your card, register your card to access all the benefits and features You can purchase your card at one of thousands of retailers nationwide including CVS Pharmacy, Rite Aid, Kroger, 7Eleven, Walgreens, Walmart and many more Find the retailer near you. Register your Green Dot 5% Cash Back Visa Debit Card and you are instantly eligible to start earning 5% cash back (up to $100 per reward year) on qualifying purchases made with your card To be eligible to earn CashBack Rewards, your account must be in good standing. Green Dot says electronic purchases made via retailer websites or apps (think Amazon, Target, Netflix, etc) using the card or account will count towards the $1,000 monthly spend requirement and accrue cash back But you won’t get cash back for using the Green Dot debit card for paying your regular monthly bills online.

A Green Dot card is a prepaid Visa or MasterCard debit card similar to a prepaid giftcard These cards can be personalized with your name and be used for debit purchases, reloaded with money, and used at ATM machines for withdrawals Knowing the balance on your prepaid Green Dot card can keep you from being declined when making a transaction. The Unlimited Cash Back Bank Account by Green Dot offers a generous 2% cash back on purchases you make online and on your mobile device You can use the Green Dot Bank HighYield Savings account to earn 2% APY on savings up to $10, 000, which is quite high given most savings accounts offer 1% APY.

Is Green Dot Unlimited Cash Bank Account A Scam 3 Unlimited Cash Back Youtube

Earnings Preview What To Expect From Visa Today

7 Benefits Of A Green Dot Cash Back Debit Card Frugal Rules

Greendot Cashback Card のギャラリー

The New Green Dot Cash Back Visa Debit Card Visa Green Dot Card Transparent Png Download Vippng

:max_bytes(150000):strip_icc()/GreenDotVisaCardArt1-b03668cedbc24e88b8d4d4ad36facda3.png)

Green Dot Platinum Visa Credit Card Review

Green Dot Unlimited Review January 21 Finder Com

Baas Company Spotlight 2 8 Green Dot A Full Service Baas For Non Fintechs Tearsheet

Walmart And Green Dot To Jointly Establish A New Fintech Accelerator Tailfin Labs

Green Dot Cash Back Visa Debit Card Apply Online Creditcards Com

Green Dot Prepaid Card Review The Dough Roller

Www Greendot Com Cashback Apply For Green Dot Cash Back Visa Debit Card Plugthe Net

Partners In The Driver S Seat How Green Dot Is Differentiating Its Platform Offerings Bank Automation News

How To Deposit Cash To Your Unlimited Cash Back Bank Account For Free With The Green Dot App Youtube

Greendot We Will Be Open During The Chinese New Year Period 27 Jan 31 Jan 17 To Provide A Meat Free Bq Sg Bargainqueen

Our Products Banking Debit Cards Prepaid Credit Cards Green Dot

Green Dot Reloadable Prepaid Cards Dollartree Com

Q Tbn And9gcs1kq6nouvvjgk79luhxochxuarlzp2ynp2hp55wcotyidg9kun Usqp Cau

Www Greendot Com Cashback Apply For Green Dot Cash Back Visa Debit Card Plugthe Net

Can I Withdraw Money From My Temporary Green Dot Card Credit Card

How To Get Free Money On My Green Dot Card

Green Dot 5 Cash Back Visa Debit Card Review 21 Finder Com

Green Dot Launches The Unlimited Cash Back Bank Account To Help Americans Build Savings While They Spend Business Wire

Green Dot 5 Cash Back Debit Card Review Youtube

:max_bytes(150000):strip_icc()/Green-Dot-Embraces-New-Pre-Pad-Regs-5aa6eafc18ba0100374fa06c.jpg)

Five Best Low Fee Prepaid Cards

7 Benefits Of A Green Dot Cash Back Debit Card Frugal Rules

Green Dot Earnings Top Estimates Revenues Fall Short Los Angeles Business Journal

Green Dot Stock Is Down 63 This Year Enough One Bull Says Barron S

Green Dot Go2bank Appeals To Underbanked Challenges Fintechs

Unlimited By Green Dot Review High Interest Savings And Cash Back

5 Cash Back Visa Debit Card Green Dot

Green Dot Hires Former Netspend Boss Dan Henry As New Ceo Paymentssource

5 Things To Know About Green Dot Credit Cards Nerdwallet

Green Dot 5 Cash Back Visa Debit Card Review 21 Finder Com

Walmart Moneycard Adds 2 High Yield Savings Account Free Cash Deposits And Family Accounts Business Wire

Blank Credit Card Png Green Dot 5 Cash Back Visa Debit Card Green Dot Corporation Vippng

Get Cash Back When You Shop With The Green Dot Debit Card

Consumers Don T Need A Bank Account To Harness The Spending Credit Building Power Of The Green Dot Platinum Visa Cardrates Com

A Package Containing A Green Dot Corp Visa Inc Debit Card Is News Photo Getty Images

Moneypak Where To Buy Locations How To Use Green Dot

7 Benefits Of A Green Dot Cash Back Debit Card Frugal Rules

Green Dot Prepaid Card Review The Dough Roller

Green Dot 5 Percent Cash Back Visa Debit Card Tv Commercial A New Kind Of Bank Ispot Tv

How To Close Moneypak Account

/cdn.vox-cdn.com/uploads/chorus_asset/file/19325898/UVC_White_1.png)

Uber Money Is The Company S Latest Attempt To Expand Into Financial Services The Verge

Green Dot Cash Back Mobile Account Debit Cards

Download Green Dot Card Opus Line 25 Oz Tritan Sports Bottle Quantity 48 Png Image With No Background Pngkey Com

Moshims Green Dot Cash Back Visa Debit Card Customer Service Number

Moneypaks Used For Fraud Business Insider

Green Dot Reloadable Prepaid Mastercard Amazon Com Credit Cards

Green Dot Reloadable Debit Visa Cash Back Card No Value 2 25 Picclick

Debit Cards Sold In Stores Green Dot

4 Ways To Check A Balance On Green Dot Card Wikihow

Prepaid Debit Card Trailblazer Steve Streit Retires As Ceo Of Green Dot Atm Marketplace

Green Dot Launches The Unlimited Cash Back Bank Account To Help Americans Build Savings While They Spend Business Wire

How To Get Free Money On My Green Dot Card

How To Get Free Money On My Green Dot Card

Reloadable Prepaid Cards Walgreens

Green Dot Readies Go2bank To Take On New Generation Of Challengers Paymentssource

When It S Time To Pay Are You Quick Thoughtful Or Eager With The Unlimited Cash Back Bank Account By Green Do How To Get Money Online Banking What Is Green

Packages Containing A Green Dot Corp Visa Inc Debit Card And A News Photo Getty Images

Green Dot Prepaid Card Review 21 Finder Com

Green Dot Corporation Debit Card Stored Value Card Credit Card Visa Storedvalue Card Bank Debit Card American Express Png Klipartz

Green Dot Launches The Unlimited Cash Back Bank Account To Help Americans Build Savings While They Spend Business Wire

Green Dot Logo High Resolution Stock Photography And Images Alamy

5 Cash Back On All Debit Card Purchases Am I Missing Something Or Is This Crazy Personalfinance

Green Dot Launches The Unlimited Cash Back Bank Account

Green Dot Reviews 190 Reviews Of Greendot Com Sitejabber

7 Benefits Of A Green Dot Cash Back Debit Card Debit Card Debit Green Dot

Movo Free To Register Activate

Debit Card Money Green Dot Corporation Saving Credit Card Saving Text Png Pngegg

Green Dot Paymentssource

Green Dot Reviews 190 Reviews Of Greendot Com Sitejabber

/green-dot_inv-4090251867f0457eb7df58c55c29635d.png)

Green Dot Bank Review 21

Green Dot Launches The Unlimited Cash Back Bank Account Karla Sullivan

Green Dot Launches High Yield Mobile Banking App With Cash Back Mobile Payments Today

Debit Card Offering Big Money Back 5 13 16 Youtube

Green Dot And The Future Of Banking As A Service

Green Dot Review Top Ten Reviews

2 Green Dot Unlimited Prepaid Visa Card 50 Complaints Customer Ratings

.jpg)

Moshims Green Dot Cash Back Visa Debit Card Customer Service Number

Pin On 购物

Download Green Dot Mobile Banking Free Updated 21

Green Dot Cash Back Mobile Account Debit Cards

/green-dot-visa-secured-credit-card_background1-abd6da4f1e7349e4b6c5d3050d40731d.jpg)

Green Dot Platinum Visa Review

/green-dot-logo-9a02f7592b5d4a64a632dac2b5e50265.png)

Green Dot Bank Review 21

Green Dot Card

Form 8 K Green Dot Corp For Dec 01

Greendot Care Club Rewards Program Membership

Green Dot Corporation Credit Card Debit Card Stored Value Card Mastercard Bank Card Transparent Background Png Clipart Hiclipart

1

Cash Envelopes Alternative With Green Dot Planning Inspired

Green Dot Stock Is Down 63 This Year Enough One Bull Says Barron S

Green Dot 3 Unlimited Cashback Myfico Forums

4 Reasons To Use A Prepaid Card When Traveling

How To Fit Self Care Into Your Budget Everyday Eyecandy

The New Green Dot Cash Back Visa Debit Card Green Dot Visa Debit Card Png Image With Transparent Background Toppng

How To Manage Your Money In A Simpler Way

Moshims Green Dot Cash Back Visa Debit Card Customer Service Number

Q Tbn And9gcqmbqzlhpsgrn5zv9zluefvu4wcjbjj2zhyryurwf3wtq Iyacg Usqp Cau

Pin On Unlimited Why Green Dot

%2C445%2C291%2C400%2C400%2Carial%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_.jpg)

Moshims Green Dot Cash Back Visa Debit Card Customer Service Number

Green Dot Launches 3 Cash Back And Savings Account Nerdwallet

Q Tbn And9gcrett73rt6zqcj0zxd5v3aeot8surruhnrb5boax25fn Onbrv Usqp Cau