Eiopa Solvency Ii

EIOPA's Opinion on the Solvency II directive is part of the process to review the directive The measures proposed aim at keeping the regime fit for purpose by introducing a balanced update of the regulatory framework, reflecting better the economic situation and completing the missing.

Eiopa solvency ii. EIOPA’s Solvency II review opinion fails to offer improvements to help EU economy, consumers and green transformation Following the publication of the European Insurance and Occupational Pensions Authority’s (EIOPA) opinion to the European Commission on the review of Solvency II, deputy director general of Insurance Europe, Olav Jones, said. EIOPA’s Solvency II review opinion fails to offer improvements to help EU economy, consumers and green transformation Following the publication of the European Insurance and Occupational Pensions Authority’s (EIOPA) opinion to the European Commission on the review of Solvency II, deputy director general of Insurance Europe, Olav Jones, said. EIOPA’s published opinion as part of its review of Solvency II includes suggestions of how more proportionality can be applied, however, including limitations of the extent of reporting on areas including investments and derivatives, assets and liabilities by currency and variation analysis It also recommends the own risk and solvency.

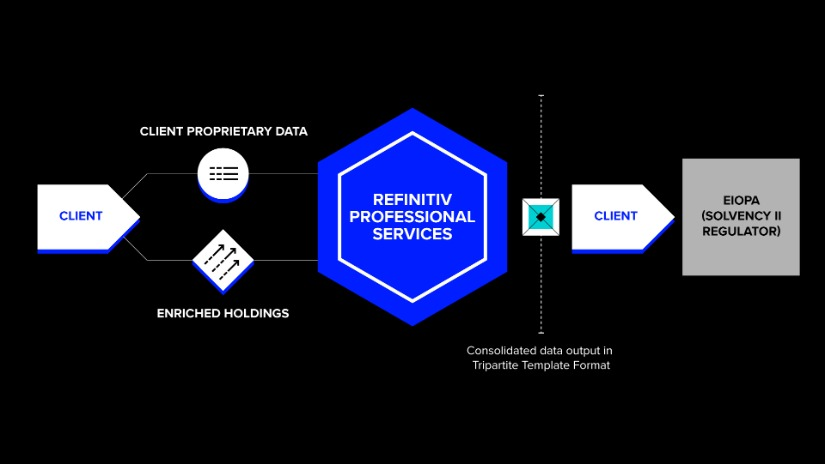

EIOPA's Opinion on the Solvency II directive is part of the process to review the directive The measures proposed aim at keeping the regime fit for purpose by introducing a balanced update of the regulatory framework, reflecting better the economic situation and completing the missing. Solvency II reporting increases the regulatory burden on insurance companies significantly Effective system solutions are essential to avoid what can be an extremely timeconsuming exercise Identifying and solving data quality issues at an early stage helps prevent problems later. DIRECTIVE 138/09/EC (SOLVENCY II DIRECTIVE) TITLE I GENERAL RULES ON THE TAKINGUP AND PURSUIT OF DIRECT INSURANCE AND REINSURANCE ACTIVITIES CHAPTER I Subject matter, scope and definitions SECTION 1 Subject matter and scope.

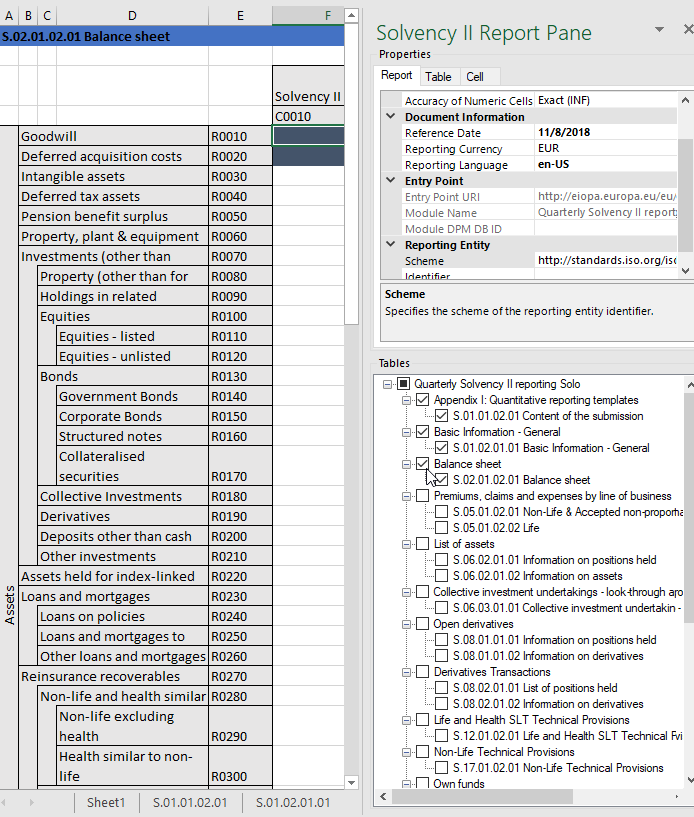

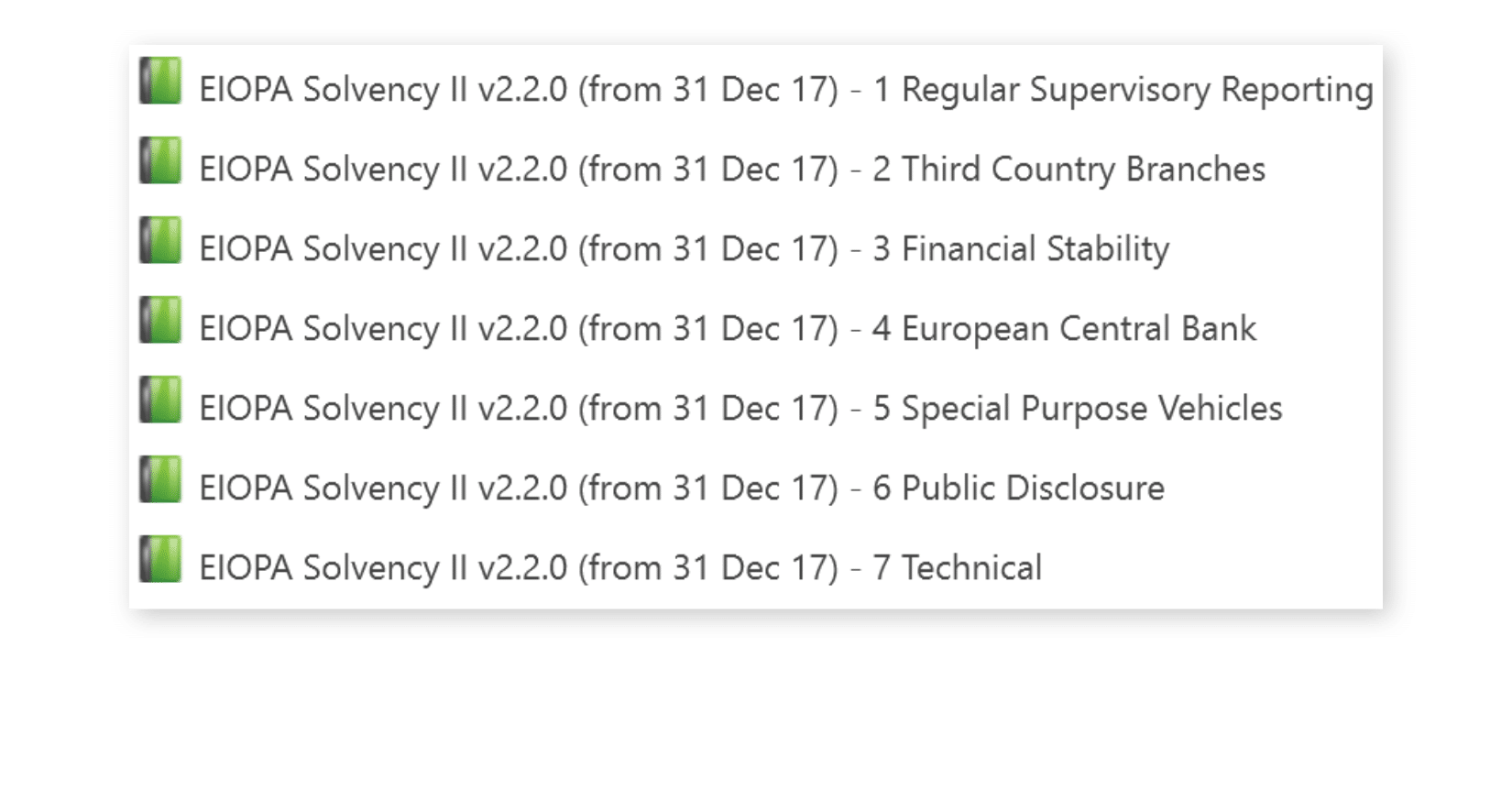

EIOPA answer EIOPA indeed published basic statistics on Standard Formula and Internal Models users by country You can find the file (tab ‘Method of SCR calculation’) under the following link. This EIOPA Solvency II DPM and XBRL taxonomy package release 250 is provided to be used from the 31/12/ reference date until a new version is announced in line with the Governance of Taxonomy Releases It covers both the definition of reporting requirements and the underlying regulations for. The Workiva cloud platform simplifies Solvency II reporting by empowering your team to deliver consistent and accurate narrative, charts and tables across documentation and reports Data reliability With Workiva, qualitative and quantitative information can be aggregated and managed in one location.

This EIOPA Solvency II DPM and XBRL taxonomy package release 250 is provided to be used from the 31/12/ reference date until a new version is announced in line with the Governance of Taxonomy Releases It covers both the definition of reporting requirements and the underlying regulations for. EIOPA's Solvency II review opinion fails to offer improvements to help EU economy, consumers and green transformation Following the publication of the European Insurance and Occupational Pensions Authority's (EIOPA) opinion to the European Commission on the review of Solvency II, deputy director general of Insurance Europe, Olav Jones, said. EIOPA's Solvency II review opinion fails to offer improvements to help EU economy, consumers and green transformation Following the publication of the European Insurance and Occupational Pensions Authority's (EIOPA) opinion to the European Commission on the review of Solvency II, deputy director general of Insurance Europe, Olav Jones, said.

A Background to Solvency II and the fifth quantitative impact study Solvency II is a regulatory project that provides a riskbased, economicbased and principlebased framework for the supervision of (re)insurance undertakings It acknowledges the main characteristics of the (re)insurance sector by building upon them. The Commission has asked EIOPA to determine whether Solvency 2 contains incentives or obstacles to sustainable investment, particularly investments in nonrated bonds and loans, private equity and real estate Keep in mind that national supervisory authorities, including ACPR in France, will also be compiling information independently and non. Protocols, Decisions and Memoranda;.

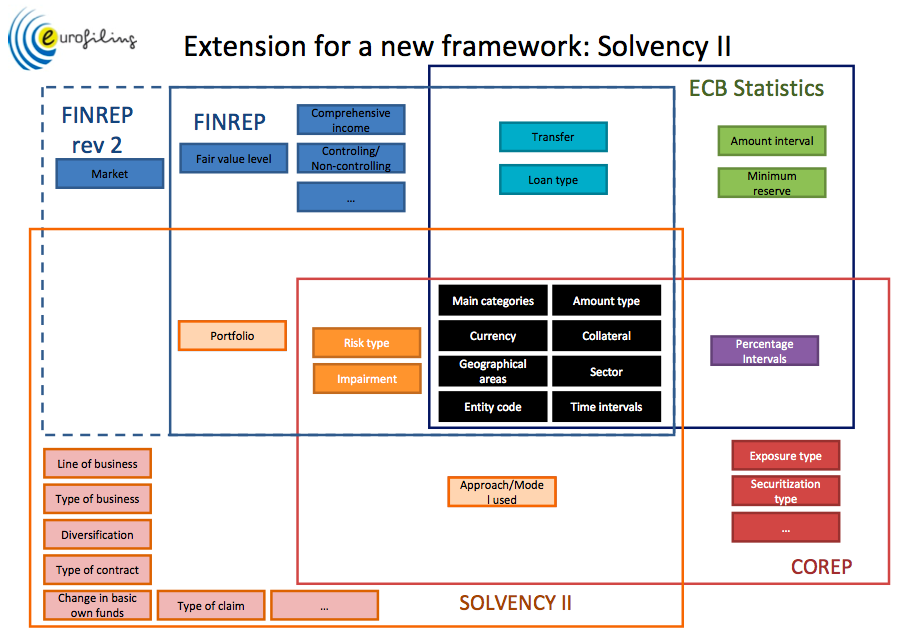

EIOPA contributes to the establishment of highquality common regulatory and supervisory standards and practices Regulation Development of a single rule book for insurance and pensions in the EU. The European Insurance and Occupational Pensions Authority (EIOPA) issued today a onepage guide targeted for consumers that have a life insurance policy or pension from the United Kingdom (UK) and living in the European Union or considering moving residence from the UK to the EU. The rules and guidelines defined in this document apply primarily to the Solvency II and Pension Funds XBRL Taxonomies information Level 2 (NCAs to EIOPA) submission process NCAs may implement them as part of their Level 1 (Insurance, Reinsurance Undertakings, IORPS/Pension Funds to NCAs) data remittance.

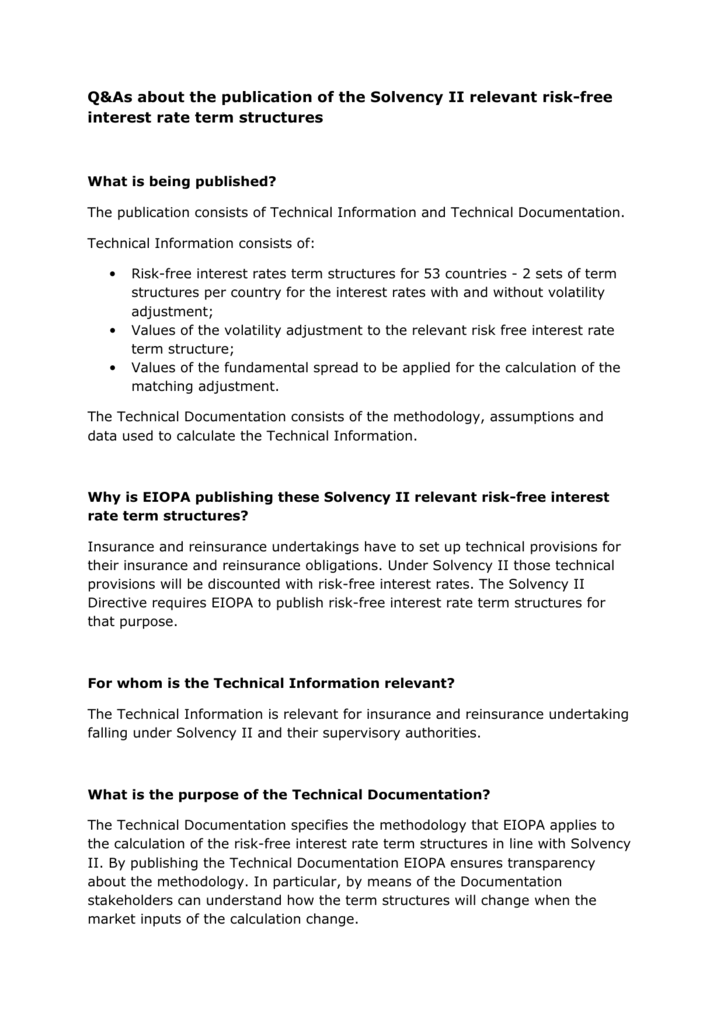

Extraordinary RFR calculations Due to COVID19 outbreak, as of 24 March , EIOPA carries out extraordinary calculations to monitor the evolution of the relevant riskfree interest rate term structures (RFR) in order to support insurance and reinsurance undertakings in the monitoring of their solvency and financial position. EIOPA supports the expost evaluation of the regulatory regime as an important element of better regulation by contributing to a rigorous, evidencebased and transparent review of Solvency II In an early first phase, the Commission adapted the Solvency II Delegated Regulation to review the treatment of infrastructure investments and the treatment of simple, transparent and standardised (STS) securitisation. See Article 45(4) of the Solvency II Directive as well as EIOPA Guideline 2 on own risk and solvency assessment 4 These are the overall solvency needs, the compliance, on a continuous basis, with the capital requirements and the significance with which the risk profile of the undertaking concerned deviates from the assumptions underlying the.

Solvency II Solvency II is the prudential regime for insurance and reinsurance undertakings in the EU Solvency II sets out requirements applicable to insurance and reinsurance companies in the EU with the aim to ensure the adequate protection of policyholders and beneficiaries. EIOPA's Opinion on the Solvency II directive is part of the process to review the directive The measures proposed aim at keeping the regime fit for purpose by introducing a balanced update of the regulatory framework, reflecting better the economic situation and completing the missing elements from the regulatory toolbox. July 19 EIOPA Consultation on Solvency II Remuneration The EU Insurance and Occupational Pensions Authority (EIOPA), the European Supervisory Authority responsible for the regulation of the EU insurance sector, has published a consultation paper on its draft opinion (Opinion) on the supervision of remuneration in the insurance and.

O n 2 March, the European Insurance and Occupational Pensions Authority (EIOPA) published its call for evidence as part of its holistic impact assessment of Solvency 2 This is the latest step as EIOPA develops its thinking in advance of publishing its final advice to the European Commission. Solvency II is the most sophisticated in the world Europe’s insurers truly appreciate its high standards of governance, risk management, reporting, and the consumer protection it provides However, there is a limited, yet significant, number of problems that need to be addressed. On the takingup and pursuit of the business of Insurance and Reinsurance (Solvency II) (recast) (Text with EEA relevance) THE EUROPEAN PARLIAMENT AND THE COUNCIL OF THE EUROPEAN UNION, Having regard to the Treaty establishing the European Community, and in particular Article 47(2) and Article 55 thereof,.

Please subscribe to this RSS feed to receive updates when the content of this page is updated Solvency II introduced supervisory reporting requirements and harmonised European Unionwide reporting and disclosure formats to ensure a consistent implementation of European regulatory and supervisory frameworks and to support EIOPA's goal to improve the efficiency and consistency of the. This EIOPA Solvency II DPM and XBRL taxonomy package release 240 is provided to be used from the 31/12/19 reference date until a new version is announced in line with the Governance of Taxonomy Releases It covers both the definition of reporting requirements and the underlying regulations for. Solvency II EIOPA is consulting on a supervisory statement on the use of risk mitigation techniques by insurance and reinsurance undertakings Supervisory authorities are recommended to also apply this Supervisory Statement to insurance and reinsurance undertakings that make use of an internal model to calculate the Solvency Capital Requirement.

EIOPA has today published its opinion on the upcoming review of the European insurance rules called Solvency II The European Commission is planning to propose amendments to the current regime in summer 21 and had asked EIOPA for a broad assessment of the current framework. The rules and guidelines defined in this document apply primarily to the Solvency II and Pension Funds XBRL Taxonomies information Level 2 (NCAs to EIOPA) submission process NCAs may implement them as part of their Level 1 (Insurance, Reinsurance Undertakings,. Companies European Insurance and Occupational Pensions Authority, Eiopa The chair of the European Insurance and Occupational Pensions Authority (Eiopa) talks to Christopher Cundy about the main proposals to amend Solvency II and what they hope to achieve Eiopa published its final recommendations for Solvency II on 17 December, proposing a package of measures designed to tackle a range of issues with the EU’s prudential framework and help prepare the insurance sector for an increasingly.

Directive 09/138/EC of the European Parliament and of the Council of 25 November 09 on the takingup and pursuit of the business of Insurance and Reinsurance (Solvency II) (recast) (Text with EEA relevance). How many EU insurers use the Solvency II Standard Formula to derive their capital requirements in terms of SCR?. Solvency II is a Directive in European Union law that codifies and harmonises the EU insurance regulation Primarily this concerns the amount of capital that EU insurance companies must hold to reduce the risk of insolvency.

The EU Insurance and Occupational Pensions Authority (EIOPA), the European Supervisory Authority responsible for the regulation of the EU insurance sector, has published a consultation paper on its draft opinion (Opinion) on the supervision of remuneration in the insurance and reinsurance sector The consultation ends on 30 September 19 The remuneration rules that apply to insurance and reinsurance firms are found in the Solvency II Delegated Regulation (EU) 15/35 (Solvency II). EIOPA’s published opinion as part of its review of Solvency II includes suggestions of how more proportionality can be applied, however, including limitations of the extent of reporting on areas including investments and derivatives, assets and liabilities by currency and variation analysis It also recommends the own risk and solvency. EIOPA answer EIOPA indeed published basic statistics on Standard Formula and Internal Models users by country You can find the file (tab ‘Method of SCR calculation’) under the following link.

25 Valuation of technical provisions and the solvency position of an insurer or reinsurer shall not be heavily distorted by strong fluctuations in the shortterm interest rate This is particularly important for currencies where liquid reference rates are only available for short term maturities and simple. Submissions to the EC;. Solvency II presents compliance teams with a unique set of challenges, but the right data, technology and insights can empower industry players to meet their obligations with accuracy and efficacy Compliance with Solvency II presents the insurance industry with a complex set of challenges that center on being able to manage Big Data at speed.

EIOPA Explanatory notes on reporting templates Variation Analysis templates (18 rev) Public Disclosure requirements under Solvency II Directive The following public disclosure requirements are applicable to all undertakings subject to Solvency II Directive. A pilot Rulebook for Solvency II is being published, comprising Directive 138/09/EC, Delegated Regulation (EC) 15/35, Delegated Regulation (EC) 16/467, Delegated Regulation (EC) 18/1221, Implementing Technical Standards adopted by the European Commission, as well as EIOPA’s Guidelines, Opinions, Supervisory Statements and Questions and Answers. EIOPA’s published opinion as part of its review of Solvency II includes suggestions of how more proportionality can be applied, however, including limitations of the extent of reporting on areas including investments and derivatives, assets and liabilities by currency and variation analysis It also recommends the own risk and solvency.

Solvency II Final L2 Advice;. Register of Insurance Intermediaries. EIOPA published the opinion on the review of the Solvency II regime Overall, EIOPA notes that the Solvency II framework is working well from the prudential perspective and no fundamental changes are needed, rather a number of adjustments are required to ensure that the regulatory framework continues as a wellfunctioning riskbased regime.

EIOPA answer EIOPA indeed published basic statistics on Standard Formula and Internal Models users by country You can find the file (tab ‘Method of SCR calculation’) under the following link. Commission Delegated Regulation (EU) 15/35 of 10 October 14 supplementing Directive 09/138/EC of the European Parliament and of the Council on the takingup and pursuit of the business of Insurance and Reinsurance (Solvency II) Text with EEA relevance. EIOPA’s published opinion as part of its review of Solvency II includes suggestions of how more proportionality can be applied, however, including limitations of the extent of reporting on areas including investments and derivatives, assets and liabilities by currency and variation analysis It also recommends the own risk and solvency.

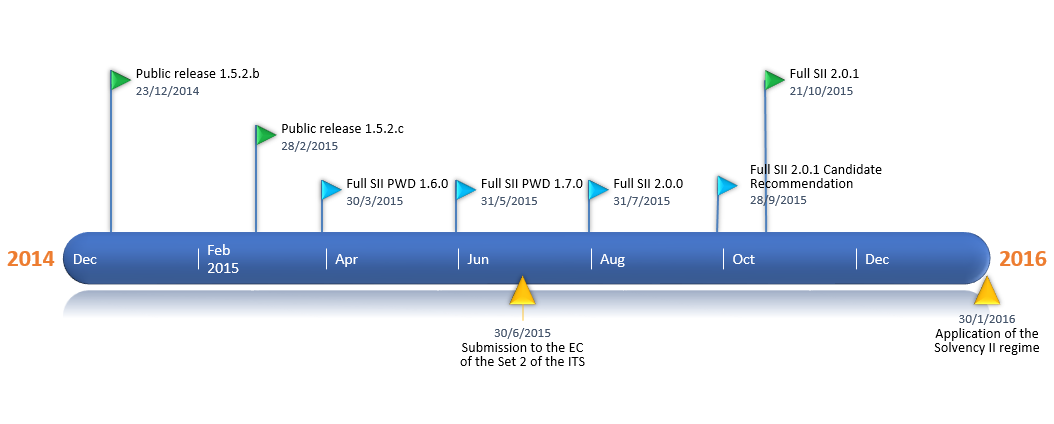

EIOPA investigates how ESG and climate risks will be included in Solvency 2 In March 18, the European Commission adopted an action plan to integrate sustainable finance within the financial system For this purpose it asked EIOPA and ESMA to submit proposals on how to take ESG and climate risks into account under Solvency 2 and the Insurance Distribution Directive. Solvency II harmonised the prudential framework for insurers and reinsurers in the EU with its entry into application on 1 January 16 It has defined a single rule book for risk based capital requirements and advanced risk management In , the Commission is conducting a review of the Solvency II Directive in line with the legal mandate. Solvency II Directive Own Funds EIOPA conducted a comprehensive review of own funds under Solvency II, as the tiering structure differs from the prudential requirements applicable to the banking industry (Directive 13/36/EU and Regulation (EU) No 575/13) In addition, EIOPA was asked to assess whether the items.

The EU is reviewing its Solvency II capital requirements for insurers in the bloc like Generali, Allianz and Axa that were introduced in 16 “EIOPA proposes changes in several areas but with. Under the Solvency II Review, EIOPA proposes to keep deadlines for quarterly reporting but extend the deadline of annual reporting by 2 weeks David Gray , Consultant Actuary, c omment s “ With the submission deadline for the 31 December reference date shown as 1 day earlier than that published in the PRA’s reporting schedule, we. Solvency II Final L2 Advice Page Content In its letter of 12 June 09, the European Commission requested CEIOPS to provide final, fully consulted advice on the vast majority of Solvency II Level 2 implementing measures for October 09 and agreed on a third set to be finalized by January 10 on other areas where changes had been made to the.

This EIOPA Solvency II DPM and XBRL taxonomy package release 240 hotfix is provided to be used from the 31/12/19 reference date until a new version is announced in line with the Governance of Taxonomy Releases It covers both the definition of reporting requirements and the underlying regulations for this release. Solvency II 28 August On 31 July , EIOPA launched its " Solvency II Single Rulebook " to " enable the navigation across different legal acts such as the Directive, Delegated and Implementing Regulation, as well as EIOPA Guidelines, Recommendations, Opinions and Supervisory Standards". Solvency II reporting increases the regulatory burden on insurance companies significantly Effective system solutions are essential to avoid what can be an extremely timeconsuming exercise Identifying and solving data quality issues at an early stage helps prevent problems later.

EIOPA’s published opinion as part of its review of Solvency II includes suggestions of how more proportionality can be applied, however, including limitations of the extent of reporting on areas including investments and derivatives, assets and liabilities by currency and variation analysis It also recommends the own risk and solvency. Eiopa's Solvency II reforms balance restored 17 December Published in Risk, Regulation, Solvency II, Rest of Europe Companies European Insurance and Occupational Pensions Authority, Eiopa The European Insurance and Occupational Pensions Authority (Eiopa) has published its final thoughts on how Solvency II should be reformed Christopher Cundy guides you through the proposals. Solvency II and other EU directives into UK law as part of Brexit preparations, but the extent to which it adopts or mirrors proposals after Brexit is unclear Highlight EIOPA is consulting on its Opinion on the review of Solvency II The proposals are wide ranging and build on earlier recommendations and advice provided by EIOPA on key.

This EIOPA Solvency II DPM and XBRL taxonomy package release 240 is provided to be used from the 31/12/19 reference date until a new version is announced in line with the Governance of Taxonomy Releases It covers both the definition of reporting requirements and the underlying regulations for. How many EU insurers use the Solvency II Standard Formula to derive their capital requirements in terms of SCR?. Solvency II harmonised the prudential framework for insurers and reinsurers in the EU with its entry into application on 1 January 16 It has defined a single rule book for risk based capital requirements and advanced risk management In , the Commission is conducting a review of the Solvency II Directive in line with the legal mandate.

NN Group has taken note of EIOPA’s Opinion to the European Commission on the Solvency II review published on 17 December The Opinion, which consists of a proposed package of measures, will be used as input for the European Commission to draft a legislative proposal which will be discussed with the European Council and European Parliament in the coming years. Register of Institutions for Occupational Retirement Provision;. How many EU insurers use the Solvency II Standard Formula to derive their capital requirements in terms of SCR?.

Solvency Ii Requirements Refinitiv

Solvency Ii Review Set To Improve Proportionality For Captives Eiopa Commercial Risk

Solvency Ii Tier 1 Take Off Bank Insurance Hybrid Capital

Eiopa Solvency Ii のギャラリー

Eiopa Outlines Solvency Ii Rules For Covid 19 Reinsurance Schemes Reinsurance News

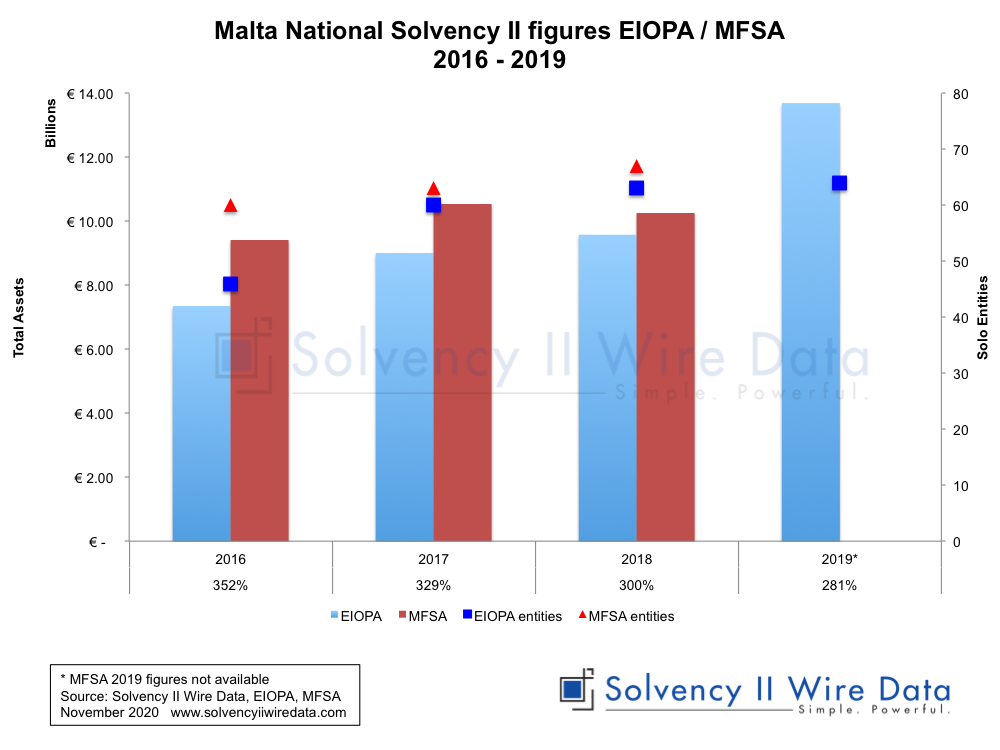

Insurance Market Coverage In Malta Solvency Ii Wire

Gabriel Bernardino On Four Important Solvency Ii Reforms Eiopa

Eiopa Proposes Changes To Solvency Ii And The Idd On Climate Change And Sustainability For Life And Non Life Insurers Society Of Actuaries In Ireland

Concerns Over Solvency Ii Effect On Pensions Ftadviser Com

A Technical Specification For The Preparatory Phase Part I

Solvency Ii Review Could Disrupt Insurers Solvency Ratios S P Global Ratings

Eiopa Publishes Information Request For Solvency Ii Review The Business Of Risk

Solvency Ii Software Eiopa Solvency Ii Directive Workiva

Www Pwc Com Gx En Insurance Solvency Ii Countdown Pdf Reporting Requirements Under Solvency Ii Move Forward Pdf

Solvency Ii Xbrl Without The Headache Altova Blog

Regulatory Eiopa Publishes Climate Change Enhanced Solvency Ii Guidelines Insurance Edge

Rklgkbxwt01pjm

Consultation Paper On An Opinion On Sustainability Within Solvency Ii Eiopa Bos 19 241 Better Regulation

2

Www Actuaries Org Uk Documents Plenary 3 Solvency Ii And Eiopa Difference Makers Or More Same

Eiopa Publishes Information On The Use Of Limitations And Exemptions From Reporting Under Solvency Ii Eiopa

Eiopa Launches Solvency Ii Field Test Xbrl

Eiopa Publishes Information Request For Solvency Ii Review The Business Of Risk

Register Eiopa Europa Eu Publications Opinions 19 09 30 opinionsustainabilitywithinsolvencyii Pdf

Eiopa Draft Solvency Ii Review Advice Would Hinder Not Help Ec Ambitions For Europe Insurance Europe

Www Eiopa Europa Eu Sites Default Files Solvency Ii Eiopa Bos 749 Opinion Review Solvency Ii Pdf

Solvency Ii Insuranceerm

Eiopa Guidelines Preparing For Solvency Ii Thursday 2 May Pwc

Eiopa S Risk Dashboard European Insurers Remain Exposed To High Risks Since The Outbreak Of Covid 19 Eiopa

Www Im Natixis Com En Institutional Resources Solvency Ii Review

Darko Popovic Archives Fti Consulting

Eiopa Finalises Solvency Ii Reporting Package

Solvency Ii Is Good For You Amazon Co Uk Van Hulle Karel Books

Overview On Eiopa Consultation Paper On The Opinion On The Review Of Solvency Ii

Eiopa Not Careless But Complacent The Actuary

Rklgkbxwt01pjm

Eiopa Deconstructingrisk

Milliman Cdn Azureedge Net Media Milliman Importedfiles Ektron Solvency Ii Review Briefing Note Nl Ashx

Service Betterregulation Com Sites Default Files Eiopa 18 075 Eiopa Second Set Of Advice On Sii Dr Review Pdf

Eiopa Publishes First Set Of Solvency Ii Statistics On The European Insurance Sector

Risk Free Interest Rate Term Structures Eiopa

Home Kpmg Com Content Dam Kpmg Pdf 14 10 Eiopa Draft Guidelines On Solvency Ii Fs Pdf

Www Eca Europa Eu Lists Ecadocuments Sr18 29 Sr Eiopa En Pdf

Solvency Ii Background Eiopa

Eiopa Xbrl Filing Rules For Solvency Ii Reporting Eiopa Xbrl Filing Rules For Solvency Ii Reporting

Eiopa Quarterly Risk Assessment Of The European Union Insurance Industry Eciia

Reporting Toolkit An Alternative To Eiopa S T4u For Solvency Ii Reporting By Business Reporting Advisory Group Medium

Register Eiopa Europa Eu Publications Consultations Eiopa Bos 19 465 Cp Opinion Review Pdf

Solvency Ii Taxonomy Xbrl

13 03 27 Solvency Ii Guidelines Eiopa Europa

Solvency Ii Preparation Guidelines Eiopa Is Not For Turning Blog Barnett Waddingham

Captive Insurance Latest News Eiopa Delays Solvency Ii Review Holistic Impact Assessment To June

Captive Insurance Regulation News Eiopa Solvency Ii Needs A Number Of Adjustments

Fitch New Eiopa Proposals Will Not Settle Solvency Ii Disputes Latest News Insurance Times

Gabriel Bernardino On Four Important Solvency Ii Reforms Insuranceerm

Eigenvalues Of Correlation Matrices In Solvency Ii Regulation The Download Scientific Diagram

Bafin Discussion Topic One Year Of Solvency Ii In Practice

Www Efrag Org Assets Download Asseturl 2fsites 2fwebpublishing 2fmeeting documents 2f 2f06 01 eiopa analysis ifrs 17 Efrag teg 13 02 19 Pdf

Eiopa S Risk Dashboard European Insurers Remain Exposed To High Risks Since The Outbreak Of Covid 19 Eciia

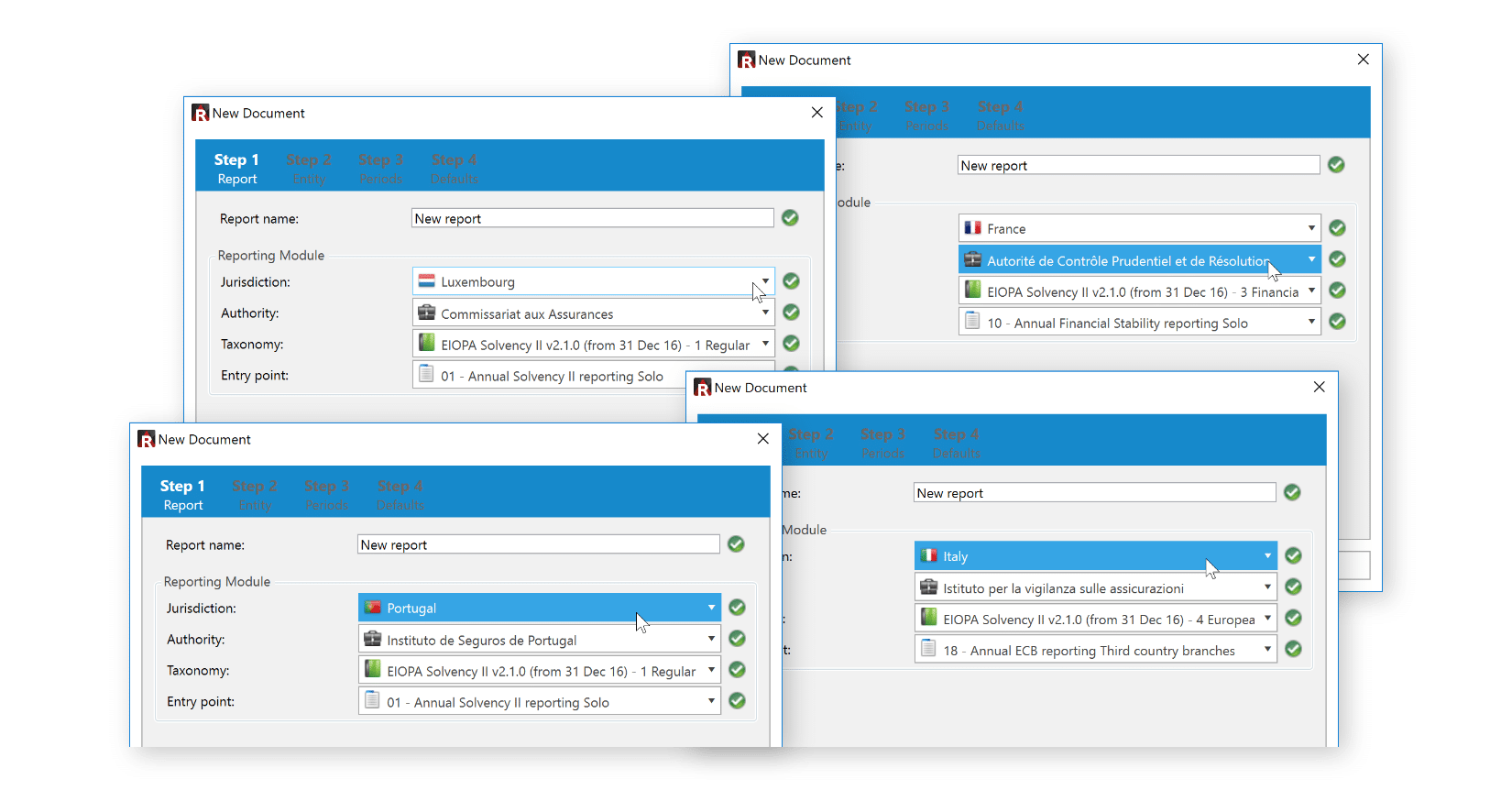

Solvency Ii Pillar 3 Qrts Dpm Authority Authority Software

Solvency Ii Pillar 3 Qrts Dpm Authority Authority Software

Eiopa Publishes First Set Of Solvency Ii Statistics On The European Insurance Sector

Supervisory Reporting Dpm And Xbrl Eiopa

Risk Dashboard Eiopa

Eiopa Solvency Ii Updates Clearwater Analytics

Solvency Ii Review A Balanced Update For Challenging Times Eiopa

Captive Insurance Latest News Insurance Europe Responds To Eiopa Solvency Ii Opinion Paper

Succeeding Under Solvency Ii Corporate Governance Pillar Two And Disclosure Pillar Three Preparation Gc Capital Ideas

Supervisory Reporting Dpm And Xbrl Eiopa

Fillable Online Eiopa Solvency Ii Validations Fax Email Print Pdffiller

Eiopa

Eiopa Updated Technical Methodology Documentation For Rfr Term Structures For Solvency Ii Actuarial Association Of Europe

Www Esrb Europa Eu Pub Pdf Other Esrb Letter0117 Responsetotheeiopaconsultationpaperonthereviewofsolvencyii 505c08ff78 En Pdf

Eiopa Launches Its Solvency Ii Single Rulebook Eiopa

Replay Solvency Ii Review Challenges And Opportunities Federation Francaise De L Assurance

Eiopa Sixth Consumer Trends Report

Eiopa Hints At Pragmatic Changes To Solvency Ii Lloyd S List

Solvency Ii Eiopa Delves Into Sustainability Risks Insurance Business

Monthly Update Of The Symmetric Adjustment Of The Equity Capital Charge For Solvency Ii End January Eiopa

Eiopa Solvency Ii Software And Service For Insurers Alternative For T4u

Eiopa Propose Solvency Ii Amendments Xbrl

Eiopa Report Could Hold Up Solvency Ii Kpmg Warns Latest News Insurance Times

Review Of Solvency Ii Eiopa

Technical Specifications For The Solvency Ii Eiopa Europa

Eiopa Is Planning To Align Solvency Ii Xbrl Taxonomy With Eba Solvency Ii Wire

Eiopa Publishes Thoughts On Fine Tuning Solvency Ii Insurance Edge

Eiopa Statement On Solvency Ii Supervisory Reporting In The Context Of Covid 19 Eiopa

Http Assets Milliman Com Ektron Solvency Ii Review Scr Standard Formula Pdf

Eiopa Says Solvency Ii Needs Adjustments Teletrader Com

Solvency Ii Review Proportionality And Supervisory Convergence Eiopa

Insurers Respond To Eiopa Proposals On Solvency Ii Supervisory Reporting And Public Disclosure Insurance Europe

Eiopa Reporting Format Dpm And Xbrl

Esbg Response To Eiopa Consultation

Www Debevoise Com Media Files Insights Publications 19 10 Eiopa Reveals Proposed Solvency Pdf

Solvency Ii Make The Rules More Proportionate

Q As About The Publication Of The Solvency Ii Relevant Risk

Eiopa Solvency Ii

Technical Specifications For The Solvency Ii Eiopa Europa

The Impact Of Market Volatility On European Insurers J P Morgan Asset Management

Response Provided To Eiopa Solvency Ii Review Discussion Paper Insurance Europe

Solvency Ii Interim Reporting Requirements Were Too Ambitious Eiopa Risk Net