Put Option Dax 13000

Is it a dax formu.

Put option dax 13000. Should the DAX30 see another attack at the 13,000 point level, the uptrend of last week could be considered broken on the H1, leaving the German index vulnerable to a run down to 12,0/900 points. If I am long one DAX future, and I wanted to protect my downside risk, by buying an â AtTheMoneyâ (ATM) DAX Put option, what is the ratio needed to provide complete. Full option chain NIFTY;.

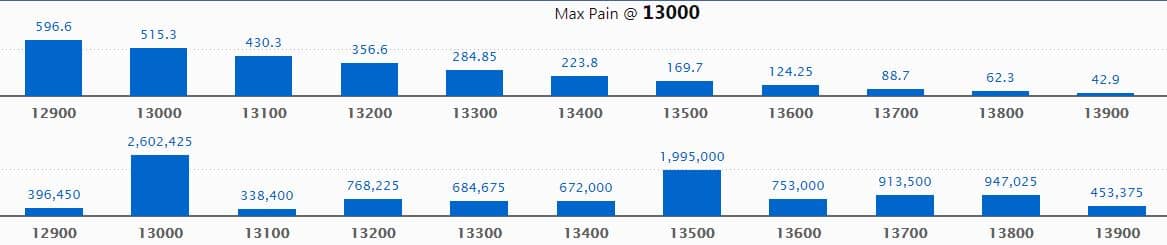

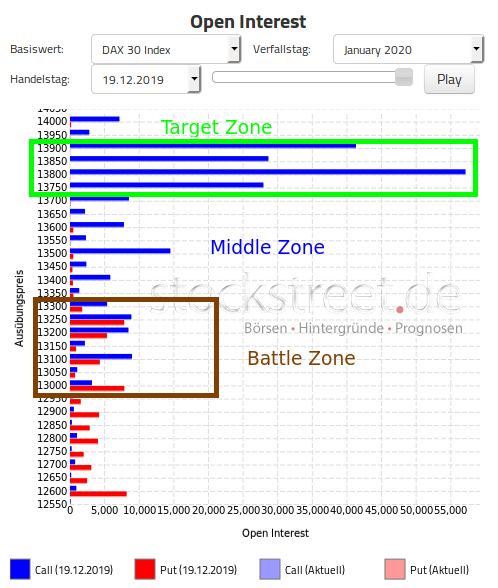

When looking at the DAX options in IB, it says that the options â multiplierâ is 5 What exactly does this me/how does it work?. This is followed by 13,000 strike, which holds 3669 lakh contracts, and 13,0 strike, which has accumulated 317 lakh contracts Put option data Maximum Put open interest of 4019 lakh. On the PUTS side of the options chain, the YieldBoost formula considers that the option seller makes a commitment to put up a certain amount of cash to buy the stock at a given strike, and looks for the highest premiums a put seller can receive (expressed in terms of the extra yield against the cash commitment — the boost — delivered by the.

Good morning traders, it’s Friday the 17th of July and time for today’s 1707 German DAX 30 analysis and let’s see if the DAX aims for 13,000 again today The DAX is gaining momentum again and Wirecard are about to get thrown out of the German Index faster than expected. The Dax 30 is one of the world’s most actively traded indices and provides traders with a high degree of liquidity, tight trading spreads and long trading hours The FSE trading hours for the. Again using the Netflix options as an example, writing the June $90 call and writing the June $90 put would result in the trader receiving an option premium of $1235 $1110 = $2345.

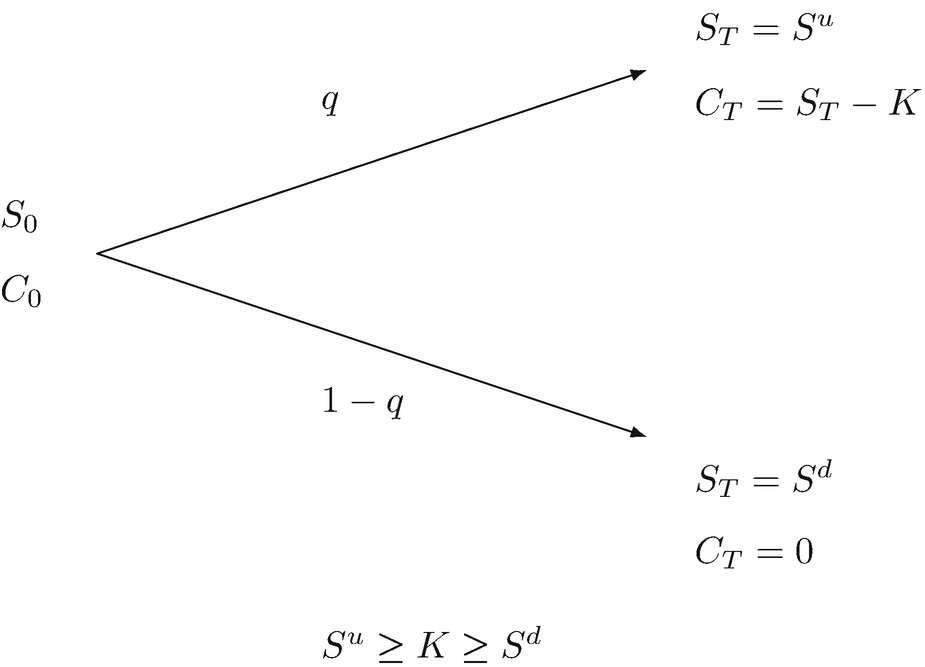

How Put Options Work Put options are the opposite of call options For USstyle options, a put options contract gives the buyer the right to sell the underlying asset at a set price at any time up to the expiration date Buyers of Europeanstyle options may exercise the option—sell the underlying—only on the expiration date. In this article As a data modeler, sometimes you might need to write a DAX expression that tests whether a column is filtered by a specific value In earlier versions of DAX, this requirement was safely achieved by using a pattern involving three DAX functions. The Frigidaire 13,000 BTU portable air conditioner The Frigidaire 13,000 BTU portable air conditioner with Supplemental Heat allows you the option to heat or cool your space This air conditioner keeps your home cleaner and more comfortable featuring a custom programmable timer, a dehumidifying Dry Mode to remove excess moisture from the air.

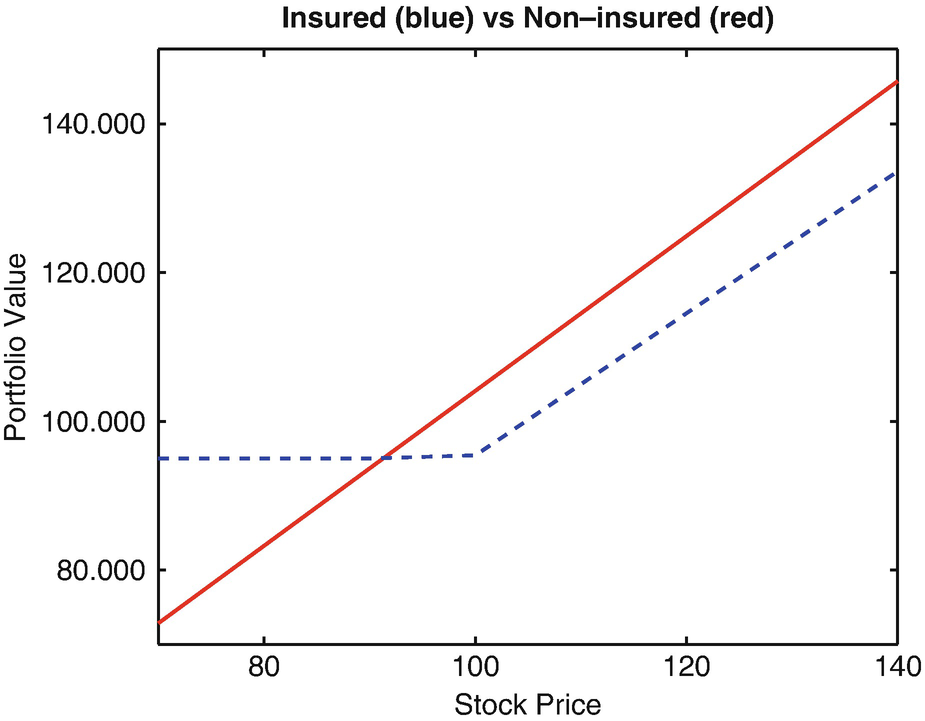

European stocks rise after new US records, with DAX also at peak Dec 29, at 323 am ET by Steve Goldstein European stocks trade higher as investors welcome US stimulus package and. Indeed, the put option gives you the right to sell the stock at $30 no matter how low the price falls Using the put option as portfolio insurance fixes your worst risk at $0, which includes the $100 premium you paid for the put option and the $1 per share you can lose after originally paying $31 per share for the stock, if you exercise the put. DAX There are so many similarities between DAX and Excel that our functions are nearly identical Given the same data and the columns Item and Duration in Seconds, our initial formulas are identical other than the naming convention for the cell/column Hours = INT(Duration in Seconds/3600) Minutes = INT(MOD(Duration in Seconds,3600)/60).

1 When I make a slicer for the parameter, only one option exists (ie 1809 or 1810, or whatever I set the default value on), and none of the other options are available 2 When I reference the parameter in the DAX equation, the calculation is incorrect Any suggestions?. Second following on question;. 2 minutes to read;.

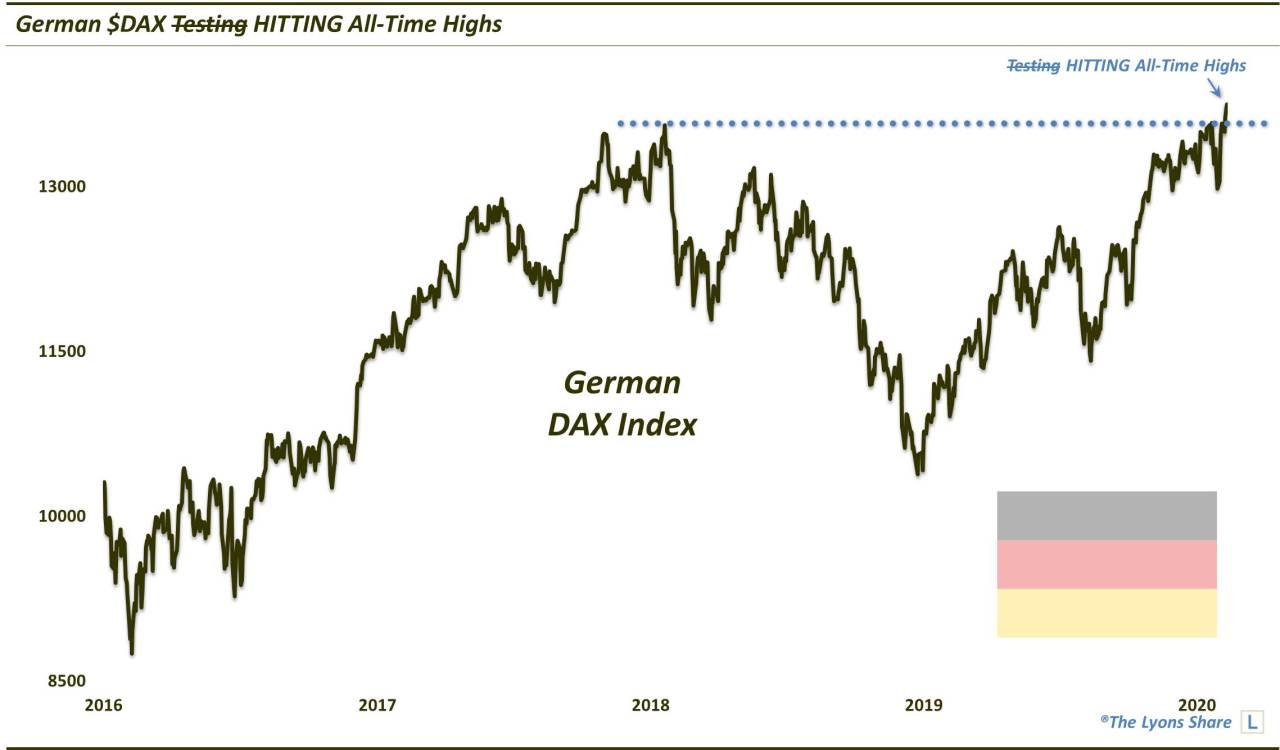

Consider a put and a call option on the Dow, each with a strike price of 12,000 and a cost of 0 The call option will be profitable if the Dow Jones index and futures price climbs above 12,0. ISIN DE) Alle Eurex PutOptionen in der Übersicht. First of all, the good news for fans of German stocks Yesterday, the DAX finally overcame the mark of 13,000 points The German stock market barometer even showed a certain dynamism, which in itself can already be regarded as a positive sign.

NIFTY PE ;. Premium of PUT (PE) of strike is at 195 on 15 Jan 21 PUT opened at 300 and traded inside a LowHigh range of 1803 as on 15 Fri Jan 21 The underlying equity is trading at which means that PUT of strike is OTM PUT option (out of the money) Lot size of NIFTY Nifty 50 is 75. Put Vontobel Warrant on DAX® Back Put Vontobel Warrant on DAX® Valor ISIN CH Symbol WDAIAV Product expired on 16/10/ DAX.

Premium of PUT (PE) of strike is at 195 on 15 Jan 21 PUT opened at 300 and traded inside a LowHigh range of 1803 as on 15 Fri Jan 21 The underlying equity is trading at which means that PUT of strike is OTM PUT option (out of the money) Lot size of NIFTY Nifty 50 is 75 Total traded volume is 4,303,050 Total Open Interest for PUT (PE) of strike is 1,429,725. Options PDFExport Current page;. The Options Market Overview page provides a snapshot of today's market activity and recent news affecting the options markets Options information is delayed a minimum of 15 minutes, and is updated at least once every 15minutes throughout the day.

An employee may defer up to $13,500 in and 21 ($13,000 in 18;. NASDAQ 100 Put Feb Trade Options CFDs with Plus500™ Trade the most popular options on Germany 30, Italy 40 and more Trade on volatility with our options CFDs. The Quantity Reportedly Sold column indicates the particular RPO item when sold as an option and not when included as part of a base equipment or multiple item option package An example is the 396/325hp L35 engine;.

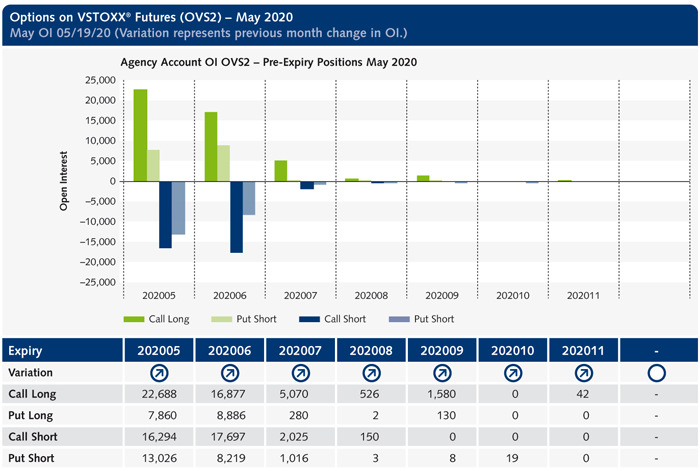

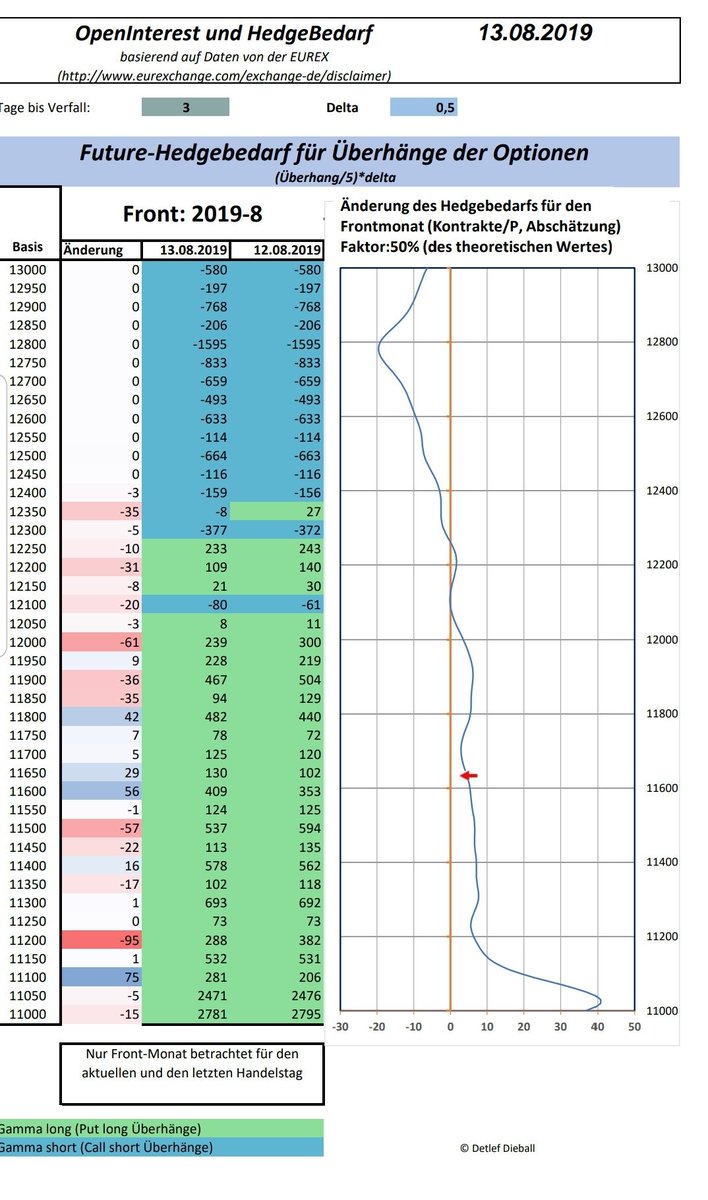

I think the sharp rise today could have been because the options side is very far from its ideal value A small impulse and the writers ("Stillhalter") have to buy future longs to hedge That then increases the impulse The best settlement rate for the writers ("Stillhalter") is somewhere around /, the two largest positions at. Dax will try touch ,try not to sell looking for buy,,,, put sl on your sell order when price is above 60min ema0(green line) on fdax1!. $12,500 in 16 – 18, subject to costofliving adjustments for later years) Employees age 50 or over can make a catchup contribution of up to $3,000 in 16 21 (subject to costofliving adjustments for later years) The salary reduction contributions under a.

NIFTY PE ;. Data from the Power Pivot data model can be displayed in Excel in pivot tables or pivot charts Sometimes, however, it is necessary to create a DAX query and load the data into an Excel spreadsheet This was possible until Excel 13 The article shows how DAX Query Tables can be created in Excel 19. There are two types of options, Calls and Puts Call • Call option is a contract that allows the option holder (buyer) to buy 100 shares (typically) at the strike price up to the defined expiration date Said to be LONG the call Bullish • Call options obligate the seller (writer) to sell 100 shares (typically) of the.

Put Vontobel Warrant on DAX® Back Put Vontobel Warrant on DAX® Valor ISIN CH Symbol WDAIAV Product expired on 16/10/ DAX. Bloomberg the Company & Its Products The Quint Type of option means the classification of an option as either a ‘Put’ or a ‘Call’. The All Futures page lists all open contracts for the commodity you've selectedIntraday futures prices are delayed 10 minutes, per exchange rules, and are listed in CST Overnight (Globex) prices are shown on the page through to 7pm CST, after which time it will list only trading activity for the next day.

For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold The difference between the underlying contract's current market price and the option's strike price represents the amount of profit per share gained upon the exercise. A put option is a contract that gives an investor the right, but not the obligation, to sell shares of an underlying security at a set price at a certain time Unlike a call option, a put option. Premium of PUT (PE) of strike is at 1530 on 08 Jan 21 PUT opened at 1510 and traded inside a LowHigh range of as on 08 Fri Jan 21 The underlying equity is trading at which means that PUT of strike is OTM PUT option (out of the money).

Premium of PUT (PE) of strike is at 1530 on 08 Jan 21 PUT opened at 1510 and traded inside a LowHigh range of as on 08 Fri Jan 21 The underlying equity is trading at which means that PUT of strike is OTM PUT option (out of the money) Lot size of NIFTY Nifty 50 is 75 Total traded volume is 1,137,300 Total Open Interest for PUT (PE) of strike is 2,555,775. The Interpretations Committee received a request regarding how an entity should account for a written put option over noncontrolling interests (“NCI put”) in its consolidated financial statements The NCI put has a strike price that will, or may, be settled by the exchange of a variable number of the parent’s own equity instruments. Kauf einer 9000er DAXPut Option DAX fällt bis auf 8000 Punkte HedgingWirkung bei Verfall entspricht dem Inneren Wert der Option (9000 (Strike der PutOption) – 8000 neuer DAXStand) * 5 Multiplikator = 5000 € HedgingWirkung.

PutCall ratio of OI for the week closed at 147" Bank Nifty The NSE's banking index Bank Nifty closed at 31, points, a net gain of 365 points or 270 per cent from 30,402 points. NIFTY strike Option Chain Historical option chain data for NIFTY and strike Call (CE) / Put (PE) Option chain is a listing of all the put and call option strike ltp along with their premiums for a given maturity period. Dangerous volatility , very worrying they sold 330 , 0 major positions My rational is they will buy back at lower levels overnight, but I won't put any overnight positions is a level I like You did mention Nikkei as a warning , put that as another warning system I think.

NIFTY strike Option Chain Historical option chain data for NIFTY and strike Call (CE) / Put (PE) Option chain is a listing of all the put and call option strike ltp along with their premiums for a given maturity period. For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold The difference between the underlying contract's current market price and the option's strike price represents the amount of profit per share gained upon the exercise. German Stock Index DAX 30 was formerly known as Deutscher Aktien IndeX 30 It consists of the 30 major German companies trading on the Frankfurt Stock Exchange The Eurex, a European Electronic.

How puts work A put option gives its owner the right to sell a stock at a set price by a certain date Buying a put option when you also own the stock is like buying insurance, or hedging against. ( dax fut is most important, cfd,option even xetra dax comes from fdax server,chart) https//wwwtradingviewcom/chart/jtsom2. Otherwise, a push back above 13,000 points in the days to come is a serious option Source Admiral Markets MT5 with MT5SE Addon DAX30 CFD Hourly chart (between October 05, , to October 23.

For some reason I cannot put the actual data as I get a blank with a red cross on the photo Hence the best I can do is create mock numberical data but the structure of database is same. DAX Use SELECTEDVALUE instead of VALUES 11//19;. Put/Call ratios are popular indicators that measure mass psychology amongst market participants The ratio is the trading volume of put options divided by the trading volume of call optionsIn very simple terms, a put option is market insurance against declining prices, and a call option is market insurance against rising prices.

If without your $13,000 you won’t be able to come up with next month’s mortgage payment, your risk tolerance is extremely low In a situation like the latter, you’d probably want to put the entirety of your $13,000 somewhere there is less risk, perhaps a cash equivalent that throws off some interest. Full option chain NIFTY;. Of the DAX the session started 142 percent stronger at 12, points In the further course of the German benchmark index expanded the price increase so that it could jump the psychologically important 13,000point mark It currently gains 1 percent to 13, units The main drivers are the strong templates from the USA and Asia.

DAX historial options data by MarketWatch View DAX option chain data and pricing information for given maturity periods. Should the DAX30 see another attack at the 13,000 point level, the uptrend of last week could be considered broken on the H1, leaving the German index vulnerable to a run down to 12,0/900 points. Product name Contract type Expiry Traded contracts Put/Call ratio Open interest Open interest (adj) Strike price range Strike price series;.

NOT IN is not an operator in DAX To perform the logical negation of the IN operator, put NOT in front of the entire expression For example, NOT Color IN { "Red", "Yellow", "Blue" } Unlike the = operator, the IN operator and the CONTAINSROW function perform strict comparison For example, the BLANK value does not match 0 Example 1. NIFTY strike Option Chain Historical option chain data for NIFTY and strike Call (CE) / Put (PE) Option chain is a listing of all the put and call option strike ltp along with their premiums for a given maturity period. Kauf einer 9000er DAXPut Option DAX fällt bis auf 8000 Punkte HedgingWirkung bei Verfall entspricht dem Inneren Wert der Option (9000 (Strike der PutOption) – 8000 neuer DAXStand) * 5 Multiplikator = 5000 € HedgingWirkung.

With the psychologically important mark of 13,000 points, the German leading index has had a problem, commented analyst Christian Henke from broker IG If it succeeds this time to beat the mark, the high of 13,313 points on July 21 would be the next point of contact, according to the expert However, the DAX needs increasing trend dynamics for. WINNING STOCK & OPTION STRATEGIES DISCLAIMER Although the author of this book is a professional trader, he is not a registered financial adviser or financial planner. Hey, I have some values like , I'd like to have spaces between the values So that those values appear 13 000, 14 500, 12 400 Initially, I have a table visalization, but if I have another visalization later on, can i format the values with a space there to?.

For call options, the strike price is where the shares can be bought (up to the expiration date), while for put options the strike price is the price at which shares can be sold The difference between the underlying contract's current market price and the option's strike price represents the amount of profit per share gained upon the exercise. ProduktID Kontraktart Verfalltermin Gehandelte Kontrakte Put/Call Ratio Open Interest Open interest (adj) Strike Price Range Strike Price Series;. NSE option Chain Explore the latest news & updates on the NSE Nifty Option Chain, Bank Nifty Option Chain along with Put/Call strike price, indexes and live charts here Overlay NIFTY (097 %) SENSEX (093 %) Support Center Get Started;.

Options PDFExport Current page;. Nifty Options Live Latest updates on Nifty 50 Option Chain, Bank Nifty Option Chain, Nifty Stock Options prices, Charts & more!. View the basic SPY option chain and compare options of SPDR S&P 500 on Yahoo Finance.

The DAX continues to trade at record levels, as it moves towards the symbolic 13,000 level The index has posted gains this week, surged 60 percent in September, as the robust German economy. Derivatives India VIX has fallen by 9% from 19 to 1802 and is holding below zones Lower levels of volatility is the new normal and suggests that bulls are holding the grip and any decline could be bought in the marketOn option front, Maximum Put OI is at 100 followed by strike while maximum Call OI is at followed by strike. @tringuyenminh92 Oh good that mean I am not only one who is new to DAX!.

1,865 were sold as an option available in the pickup body style (134/). Chart OI Chng in OI Volume IV LTP Net Chng Bid Qty Bid Price Ask Price Ask Qty Expiry Date Bid Qty Bid Price Ask Price Ask Qty Net Chng LTP IV Volume Chng in OI OI Chart 975 3, 3, 975 21JAN21 Highlighted options are inthemoney. The DAX index has recorded slight gains in the Thursday session Currently, the DAX is at 13,, up 0% on the day On the release front, German Industrial Production declined 14%, well off.

Www Whselfinvest Com Docs Guide Options En Pdf

Vstoxx Monthly Update June

Masks Fed And Charts Mintermarkets

Put Option Dax 13000 のギャラリー

Profitable 100 Ticks Weekly Dow Dax Daily Options Strategy Indices And Macro Events Ig Community

Dax Hebelzertifikate Isin De Wkn Symbol Dax

Trade Setup For Wednesday Top 15 Things To Know Before Opening Bell

Dana Lyons Tumblr The Calmest Stock Market In History

Usd Cny Price Forecast One Day Bullish Reversal Triggers In Usd Cny Nasdaq

.png)

Theme Library Search Global Middle Class

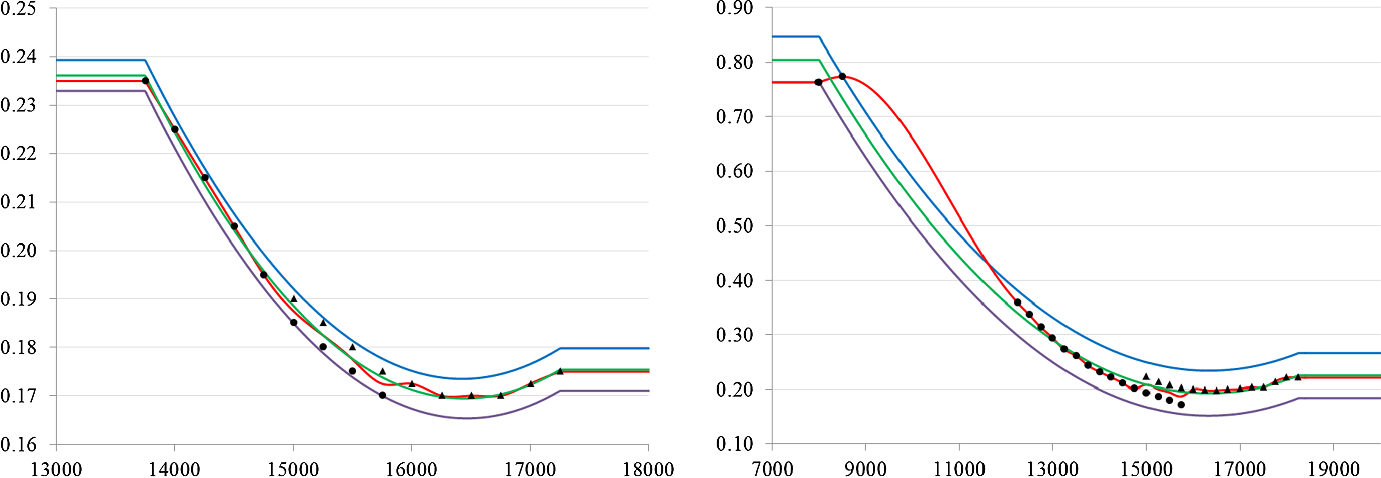

Option Implied Moments Obtained Through Fuzzy Regression Springerlink

Www Tspb Org Tr Wp Content Uploads 15 07 Duyuru Istanbul Seminar Pdf

Dax Technical Analysis Risk Sentiment Sours Too Much For Poor Posturing Nasdaq

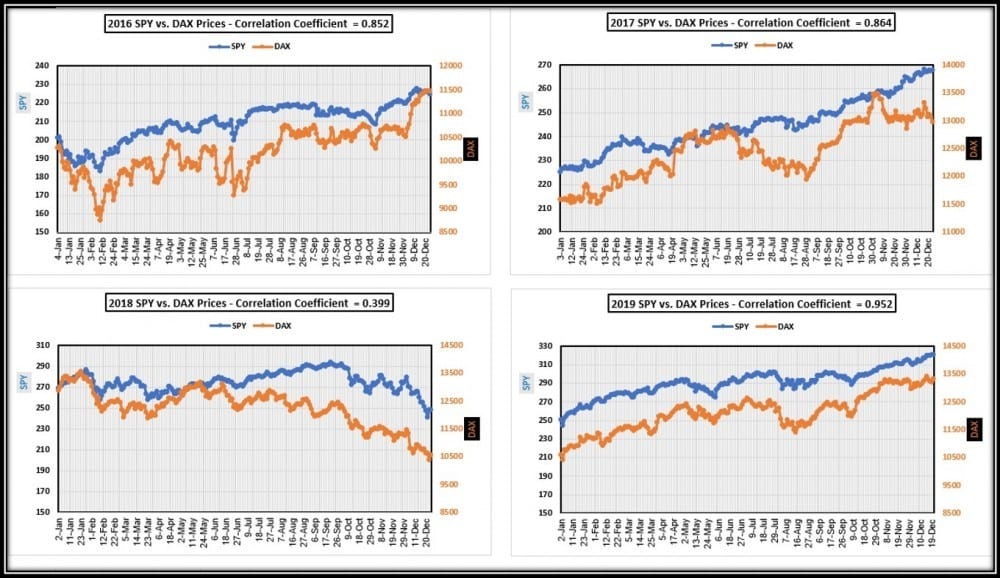

Daily Charts Comparisons Of Spy Vs Dax From 16 Through Dec 19

Dax Index Price Forecast December 21 17 Technical Analysis

Angel Garcia Banchs Put Option Ecb As Buyer Of Last Resort Monetary Policy Makes The Difference As Long As Inflation In Real Markets Does Not Appear Into Scene Ultra Low And

Trading Gaps For Daily Profit Trading Cfds Paramonas Villas

Rankx Measure Power Bi Exchange

You Can Leave Your Hedge On Mintermarkets

It S Beginning To Look A Lot Like Hedge Fund Telemetry

Www Whselfinvest Com Docs Guide Options En Pdf

Page 5 Ideas And Forecasts On Dax Futures Eurex Fdax1 Tradingview

Germany Dax Monster Bullish Breakout Test In Play Says Joe Friday

Cfd Day Trading Experience How Not To Fuck Up Like Me

2

Paul Turley S Sql Server Bi Blog Sharing My Experiences With The Microsoft Data Platform Sql Server Bi Data Modeling Ssas Design Power Pivot Power Bi Ssrs Advanced Design Power Bi Dashboards

Best Place To Buy Dax Buystop On High

What Is A Ucits Etf Best Simple Swing Trading Strategy Paramonas Villas

Italexit A Bigger Thorn Than Brexit

Powerful Order Places For Xetr Dax By Ramin Trader06 Tradingview India

Trade Setup For Wednesday Top 15 Things To Know Before Opening Bell

Dax Hebelzertifikate Isin De Wkn Symbol Dax

Dax Consolidation And Possible Top Formation

Odax

Introduction To Option Management Springerlink

Www Whselfinvest Com Docs Guide Options En Pdf

Fast And Easy Way To Reference Previous Or Next Rows In Power Query Or Power Bi The Biccountant

Dax Hebelzertifikate Isin De Wkn Symbol Dax

Trading Earnings Season 3 Steps For Using Earnings Reports

Profitable 100 Ticks Weekly Dow Dax Daily Options Strategy Indices And Macro Events Ig Community

Www Whselfinvest Com Docs Guide Options En Pdf

Page 35 Search In Trading Ideas For Fx Ger30

Best Place To Buy Dax Buystop On High

Dax Hebelzertifikate Isin De Wkn Symbol Dax

In Depth Transcription Regional Update June 19 Matasii

Page 35 Search In Trading Ideas For Fx Ger30

5 Etf S Market Matters Are Considering In 18 9 Market Matters

European Stocks Jump To 10 Month High On Brexit U S Stimulus

Nifty 03 Dec Weekly Expiry Strategy For Nse Nifty By Indiamarketoutlook Tradingview India

Dax Bulls Not Ready To Give Up Ewm Interactive

Borse Wirtschaftswoche

Bullish Engulfing Pattern Online Broker Finmax

Profitable 100 Ticks Weekly Dow Dax Daily Options Strategy Indices And Macro Events Ig Community

2

Www Whselfinvest Com Docs Guide Options En Pdf

Blog

Page 35 Search In Trading Ideas For Fx Ger30

Dax Stratgy Tradingview

Profitable 100 Ticks Weekly Dow Dax Daily Options Strategy Indices And Macro Events Ig Community

Solved How To Create A Values Range Slicer Not A Time Ra Microsoft Power Bi Community

Page 40 Marketing Tradingview

Citi Put Dax 0 01 16 10 19 Kurs Optionsschein Borse De000ka06bv5 Marketscreener

Dax Stratgy Tradingview

Interesting Htz Put And Call Options For July Nasdaq

Dax Put Option Beispiel Hebelprodukte

Page 35 Search In Trading Ideas For Fx Ger30

Fast And Easy Way To Reference Previous Or Next Rows In Power Query Or Power Bi The Biccountant

One Way To Judge A Correction Hedge Fund Telemetry

Dax Hebelzertifikate Isin De Wkn Symbol Dax

Introduction To Option Management Springerlink

Searching For Advanced Matrix Visual Does The Official One Allow To Do This Power Bi Exchange

Profitable 100 Ticks Weekly Dow Dax Daily Options Strategy Indices And Macro Events Ig Community

2

Dax The Update On The Big Expiration Day Personal Financial

Crude Oil Price Forecast November 22 17 Technical Analysis

Breadth Supports Stocks Sentiment Still Neutral Financial Sense

Uah As Unsafe Haven Or This Time Is Very Very Different Again

R J Van Den Akker Rj Vdakker Twitter

Xetr Dax Technical Indicators

Powerful Order Places Long

Xetr Dax Technical Indicators

What Next For Dax Index Weekly Technical Analysis Go Marketwatch

Aquilaesignal Com Trading Systems And Analyses Of Financial Markets With An Excellent Track Record

Bitcoin And Ripple S Xrp Weekly Technical Analysis December 7th

Www Whselfinvest Com Docs Guide Options En Pdf

Dax Weekly Options Set And Forget Strategy Page 3 Indices And Macro Events Ig Community

Odax

Profitable 100 Ticks Weekly Dow Dax Daily Options Strategy Indices And Macro Events Ig Community

Masks Fed And Charts Mintermarkets

Borse Wirtschaftswoche

Dax Turns Up Again Wirecard Shares Lose More Than Percent Archyde

Stock Market Real Time Data Feed Free Euro Usd Chart Trading View Analitica Negocios

Dax Technical Analysis Risk Sentiment Sours Too Much For Poor Posturing Nasdaq

Power Bi Tutorial A Complete Guide On Introduction To Power Bi Dataflair

Chart Criminals Chartcriminals Twitter

Profitable 100 Ticks Weekly Dow Dax Daily Options Strategy Indices And Macro Events Ig Community

Page 5 Ideas And Forecasts On Dax Futures Eurex Fdax1 Tradingview

Markets360 Bnpparibas Com Evo Content St Singletrackcms Downloaddocument Uid 0eeaf96c A60b 4d9f 8c90 B9c8c858e328 Docref 312cf0 6c79 41d6 93fe 4115f1f5f5a7 Jobref Faf8b85d 1be4 4012 Bef5 87f992e1fef7

Why This Volatility Isn T Unprecedented Humble Student Of The Markets

United States Securities And Exchange Commission Washington D C 549 Form N Csr Certified Shareholder Report Of Registered Management Investment Companies Investment Company Act File Number 811 Dunham Funds Exact Name Of Registrant As

3 Ways For A Fresh Look At The Charts Smart Forex Learning